Coronavirus outbreak may reach its peak in one week or about 10 day

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- China’s Xinhua out with the headline, citing respiratory scientist Zhong Nanshan.

- Broader risk sentiment improves with global equities, yields, yuan all bouncing.

- OPEC trying to stem oil market decline with talk of extending & deepening production cuts.

- Hong Kong set to put curbs on individual travel from mainland China.

- China confirms 4,515 cases of coronavirus and 106 deaths as of end of day January 27th.

- Human-to-human transmission (with no travel link to Wuhan) now recorded in Canada, Japan, Germany.

- US Durable Goods (Dec) come in mixed, headline +2.4% MoM vs +0.4% but core -0.1% MoM vs +0.2%.

- Australia reports Q4 CPI tonight at 7:30pmET, with traders expecting +0.6% QoQ and +1.7% YoY.

ANALYSIS

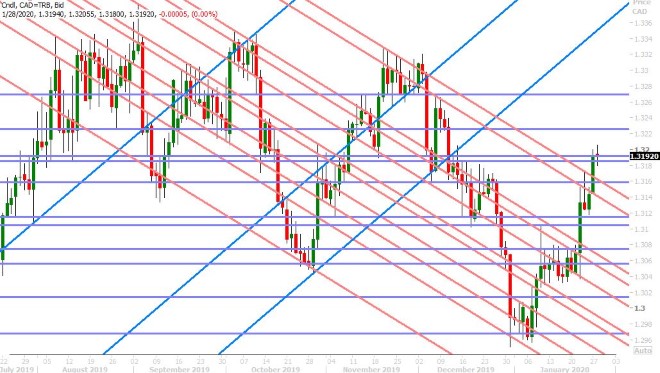

USDCAD

Dollar/CAD attempted to break higher into a new uptrend this morning following some more discouraging news on the coronavirus front. The number of cases in China has officially increased to 4,515 and the death toll has risen to 106. We now have cases of human-to-human transmission of the virus, (infecting people who had not been to Wuhan) in Canada, Japan and Germany. What is more, Hong Kong is set to close some of its border checkpoints with mainland China while Beijing will stop issuing travel permits for people travelling to the territory. This last point brought in another wave of “risk-off” USD buying at the start of European trade today.

The World Health Organization is still not sounding any alarm bells however; with director General Tedros Adhanom Gherbreyesus instead echoing President Xi’s confidence today that China will be able to contain the virus. OPEC officials are trying to calm the oil markets down by hinting at an extension, and even a deepening, of production cuts should demand fall due to the spread of the coronavirus. We also now have a report circulating from Xinhua news agency, citing a Chinese respiratory scientist who believes the coronavirus may reach its peak in one week or about 10 days. More here.

This report is now seeing risk sentiment broadly recover into NY trade. Global equities, oil futures, the Chinese yuan and commodity currencies are bouncing while bonds, gold and the JPY give back their overnight gains. It’s hard to know what to believe at this point given China’s history of massaging official data and communications, but for the time being we think traders need to be on guard for potential “buyer failure” today above the 1.3190 level.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

Euro/dollar is dribbling lower this morning as traders seem content to gravitate to this week’s looming option expiries around the 1.1000 strike. We’ve also seen US yields bounce on the back of the relatively less negative coronavirus report from Xinhua, which is mildly EURUSD negative.

The US just reported its Durable Goods figures for the month of December and while the headline beat expectations (+2.4% MoM vs +0.4%), the ex-transportation numbers missed consensus (-0.1% MoM vs +0.2%). On the surface, this appears to be a rather mixed report and so we don’t think the market will react much to this.

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling fell lower in the overnight session; a move which was very much in line with yesterday’s negative momentum following Friday’s bearish reversal back below 1.3100. Some broad USD buying was the key drag on the market in early European trade, led by USDCNH and the Hong Kong headlines, and then we got the weaker than expected CBI Retail Sales survey (flat vs +3 expected), which pulled GBPUSD back below the 1.3020 support level ahead of NY trade.

Traders are now trying to get the market back above this leve as market chatter begins to pick apart everything that is wrong with this morning’s US Durable Goods report...but they're struggling. Where we’re trading now is also a key level to watch heading into Thursday’s Bank of England meeting. The OIS market is still not hinting one way or another what will happen (53% rate cut odds) but a NY close below the 1.3010s would be an increasingly bearish signal.

In other UK news, Boris Johnson’s government has allowed China’s Huawei limited access to build Britain’s 5G network, but as expected this is already not going over well in Washington. More here from CNBC.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

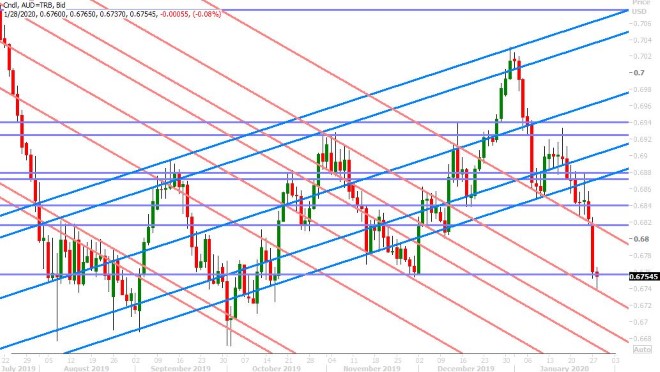

AUDUSD

The Aussie fell further to the mid-0.67s in overnight trade today on the back of the Hong Kong travel curb headlines, but it’s finally trying to stage a bounce now. We’d say the this morning’s Xinhua headline and chart support in the 0.6740-50 region is helping with that. We wouldn’t be surprised to see some of recent shorts lighten up too ahead of tonight’s Q4 CPI out of Australia (7:30pmET). Traders are expecting +0.6% QoQ and +1.7% YoY, which would be a slight increase in inflation versus Q3 2019. OIS market rate cut odds are now literally 50/50 for next Tuesday’s RBA meeting.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

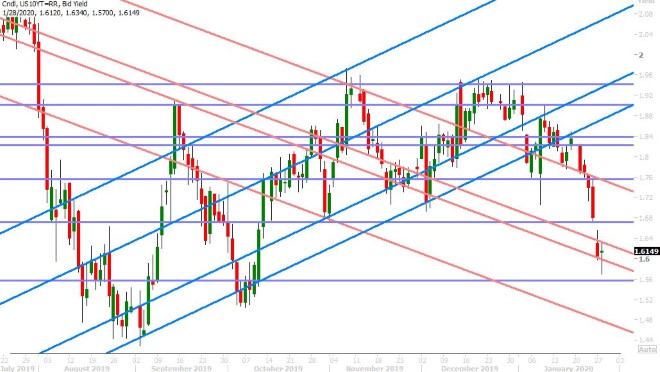

USDJPY

Dollar/yen continues to hold the 109 level this morning, despite a poor NY close below this level yesterday and some more “risk-off” headlines out of Hong Kong earlier today. The Xinhua report has very much been the catalyst for the latest bounce higher, and with USDCNH now giving up on another attempt at breaking above the 6.99 resistance level, we think USDJPY could finally go ahead and fill its Sunday opening gap in the 109.10-25 area.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

Currency Exchange International, CXI, is the leading provider of comprehensive foreign exchange services, risk management solutions and integrated international payments processing technology in North America. CXI’s relationship-driven approach ensures clients receive tailored solutions and world-class customer service. Through innovative and trusted FX software platforms, CXI delivers versatile foreign exchange services to our clients, so that they can efficiently manage and streamline their foreign currency and global payment needs. CXI is a trusted partner among financial institutions, corporations and retail markets around the world. To learn more, visit: www.ceifx.com