Markets take a breather after yesterday's Brexit angst

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- S&Ps bounce +0.5%, EUR edges higher on ECB speak, GBP finds floor.

- EURUSD techs noticeably weaker now after 1.1910s fail / 1.1880s give-up.

- This week’s very negative Brexit headlines destroy GBPUSD’s recent uptrend.

- USDCAD stuck in 60pt range. AUDUSD still pivoting 0.7280s. USDJPY asleep.

- Traders ignore mixed UK econ data for July + slight beat to US August CPI.

- Suga expected to win Japan’s LDP race on Monday. Fed/BOJ meet next week.

ANALYSIS

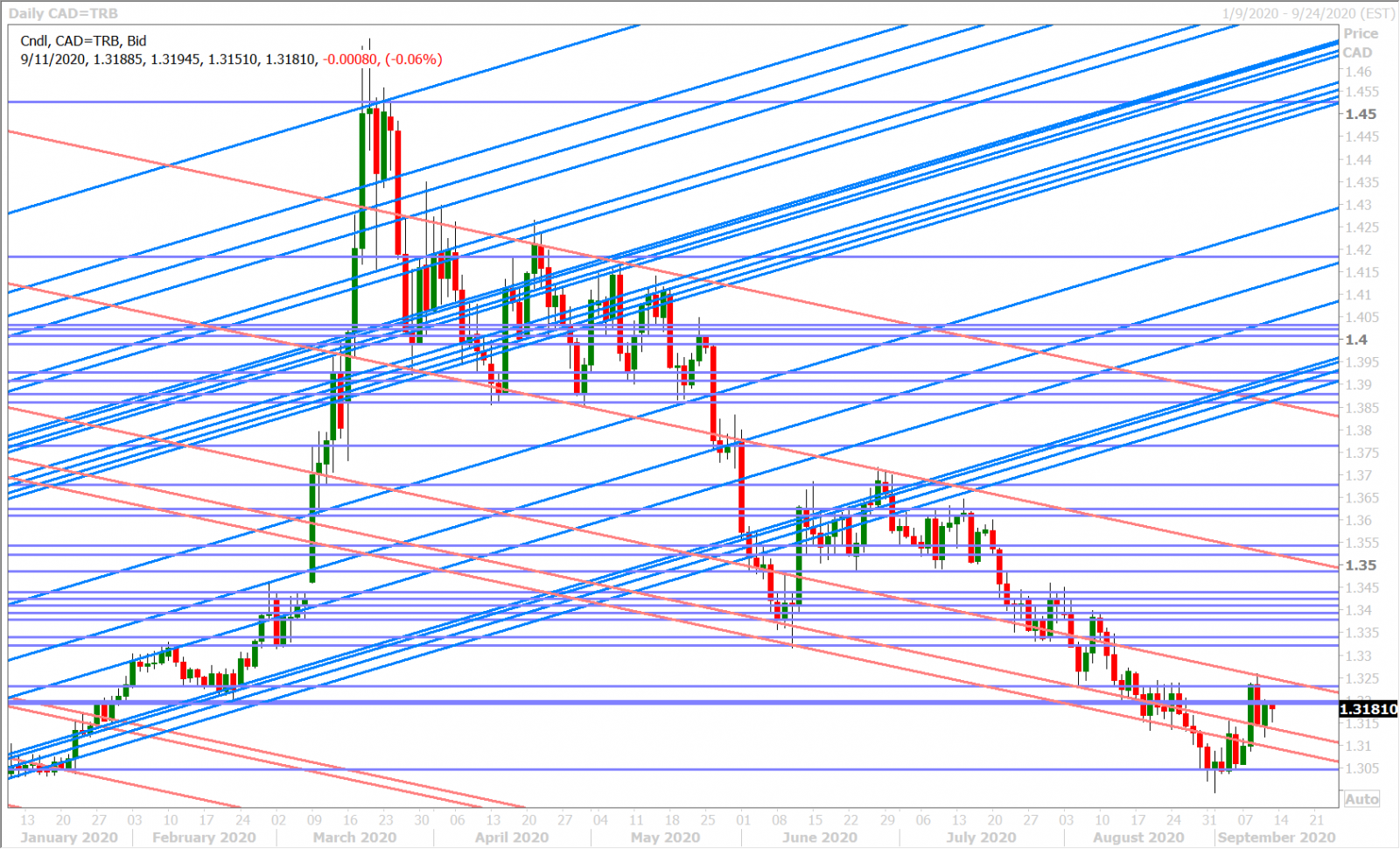

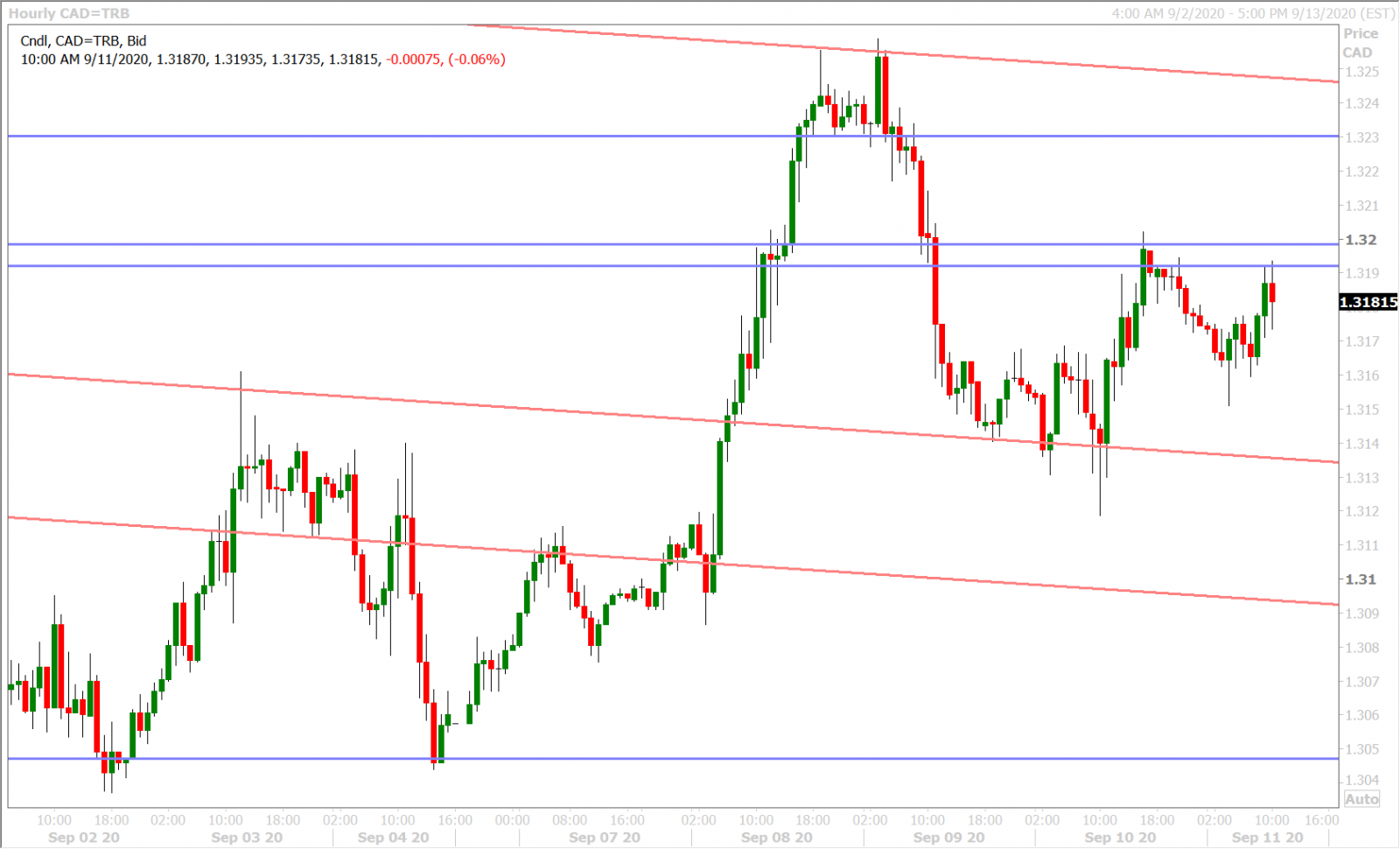

USDCAD

Dollar/CAD couldn’t get much going from a directional perspective yesterday as early EUR-rally-driven USD selling was offset by GBP/S&P sale-inspired USD buying later in the session, and it looks like the market could be in store for more range-bound price action today as the 1.3130s support and as the 1.3190-1.3200 level resists. We think Tiff Macklem frustrated many yesterday when he said the Bank of Canada's "QE buying could be more or less going forward". The S&P futures are bouncing 0.5% higher this morning and the latest US CPI report for August slightly beat expectations (+1.7% YoY vs +1.6% on the headline and +1.3% YoY vs +1.2% for the core measure). Over 1.2BLN in USDCAD options expire around the 1.3225 strike this morning, which could help the market into 10amET.

USDCAD DAILY

USDCAD HOURLY

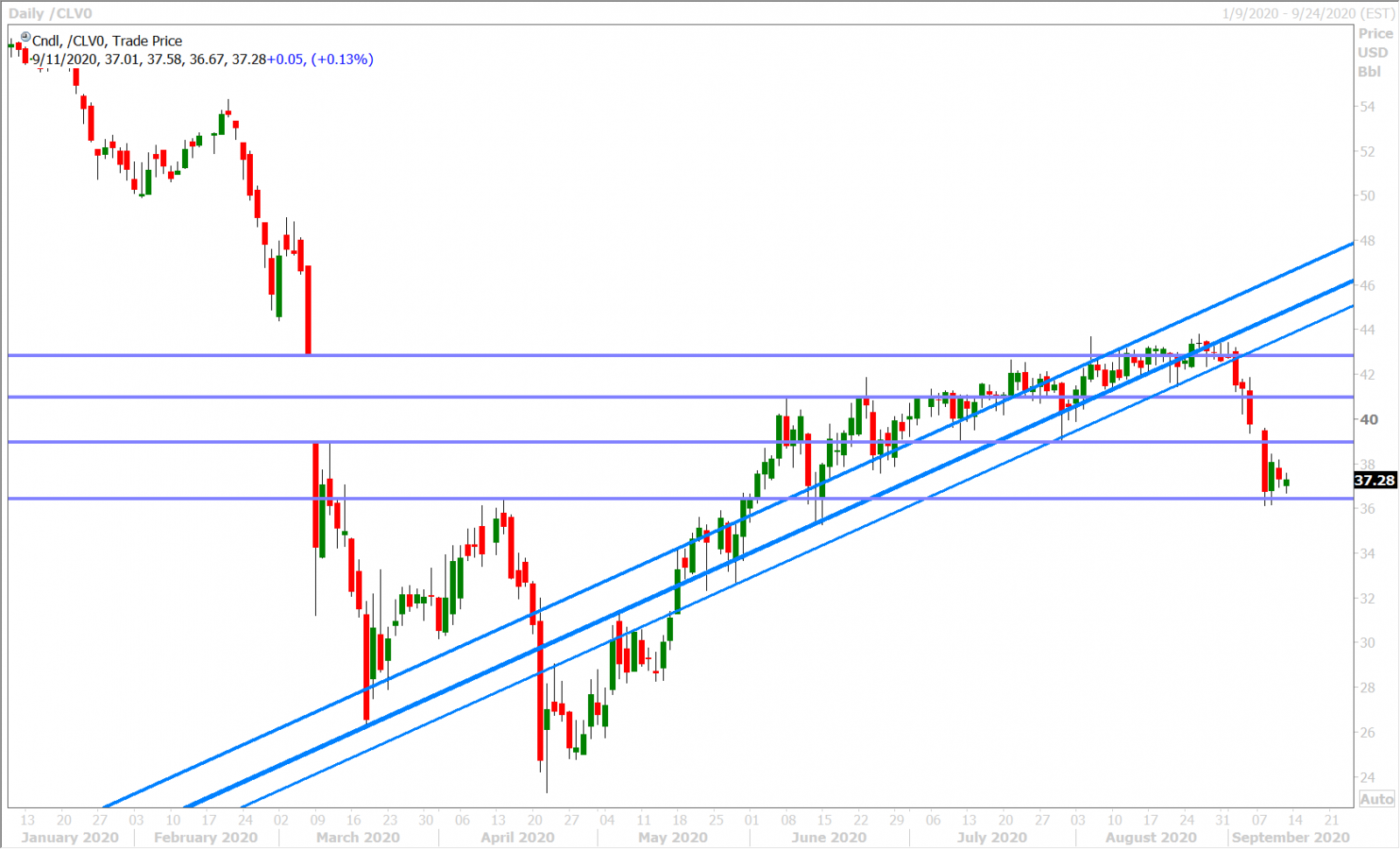

OCT CRUDE OIL DAILY

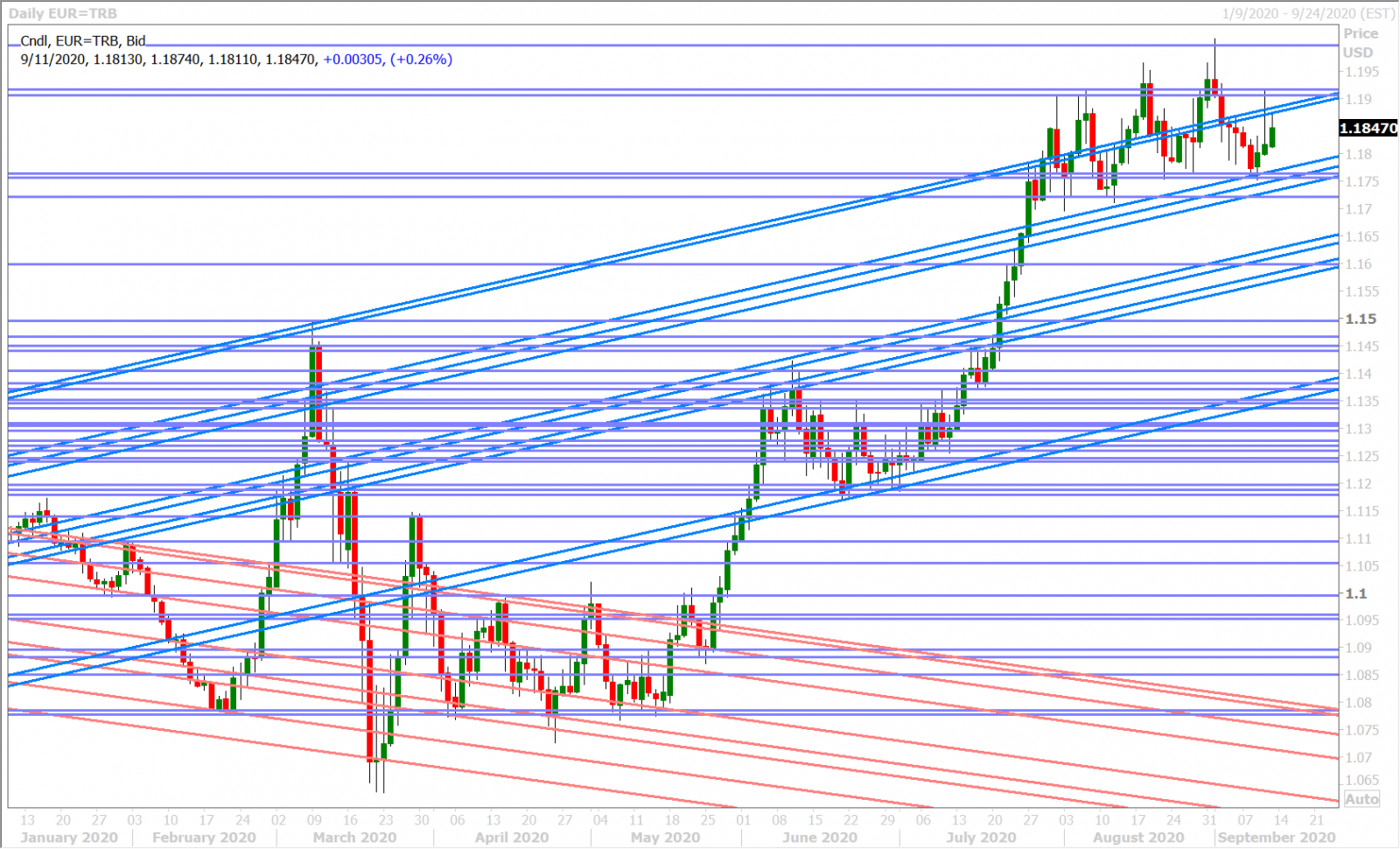

EURUSD

A rollercoaster ride for euro/dollar over the last 24hs now sees spot prices pretty much back to where they were before yesterday’s ECB meeting, but we must say the chart technicals now look noticeably weaker. The market’s swift rejection of the 1.1910s resistance level was the first warning shot as short covering, on the back of Christine Lagarde’s lack of concern for the dis-inflationary effects of the euro’s rise, ran its course into the London close. A Brexit-headline-driven plunge for GBPUSD was then the next shoe to drop for EURUSD as it dragged the market back below the 1.1880s it had just broken above a couple hours earlier. A rough afternoon for US stocks added insult to injury for the euro going into the NY close, and while some party-line comments from the ECB’s Villeroy and Vasiliauskas helped the market recover this morning, it’s still struggling to get back above the 1.1880s level it lost yesterday.

This morning’s 10amET option expiries are pretty evenly spread out in terms of size at the 1.1800, 1.1850 and 1.1900 strikes (about 1BLN each) and so we don’t think this event will have much influence. We think the entrenched EURUSD fund longs could get nervous going into the weekend if the market can't find some reason to quickly re-test yesterday’s highs.

EURUSD DAILY

EURUSD HOURLY

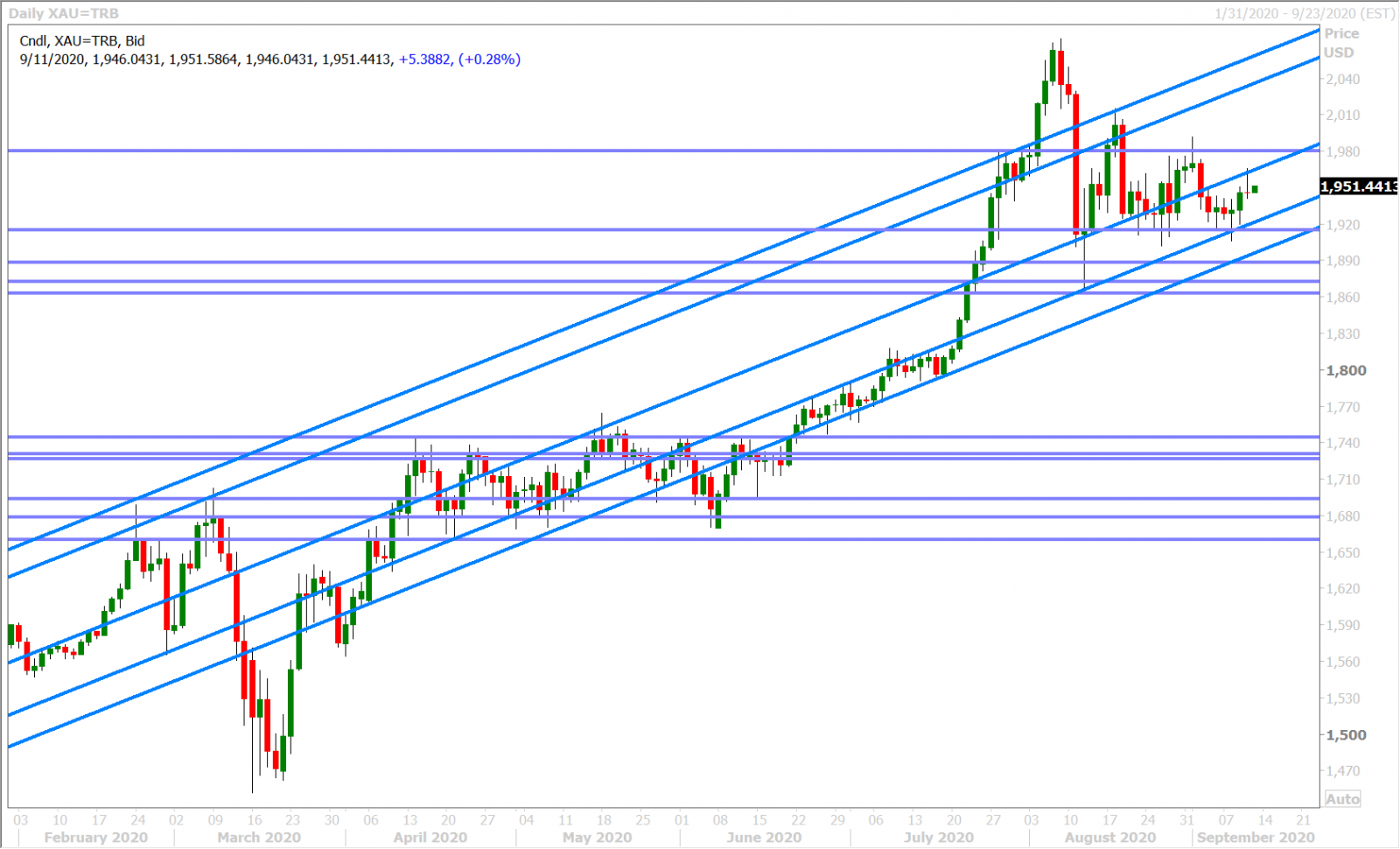

SPOT GOLD DAILY

GBPUSD

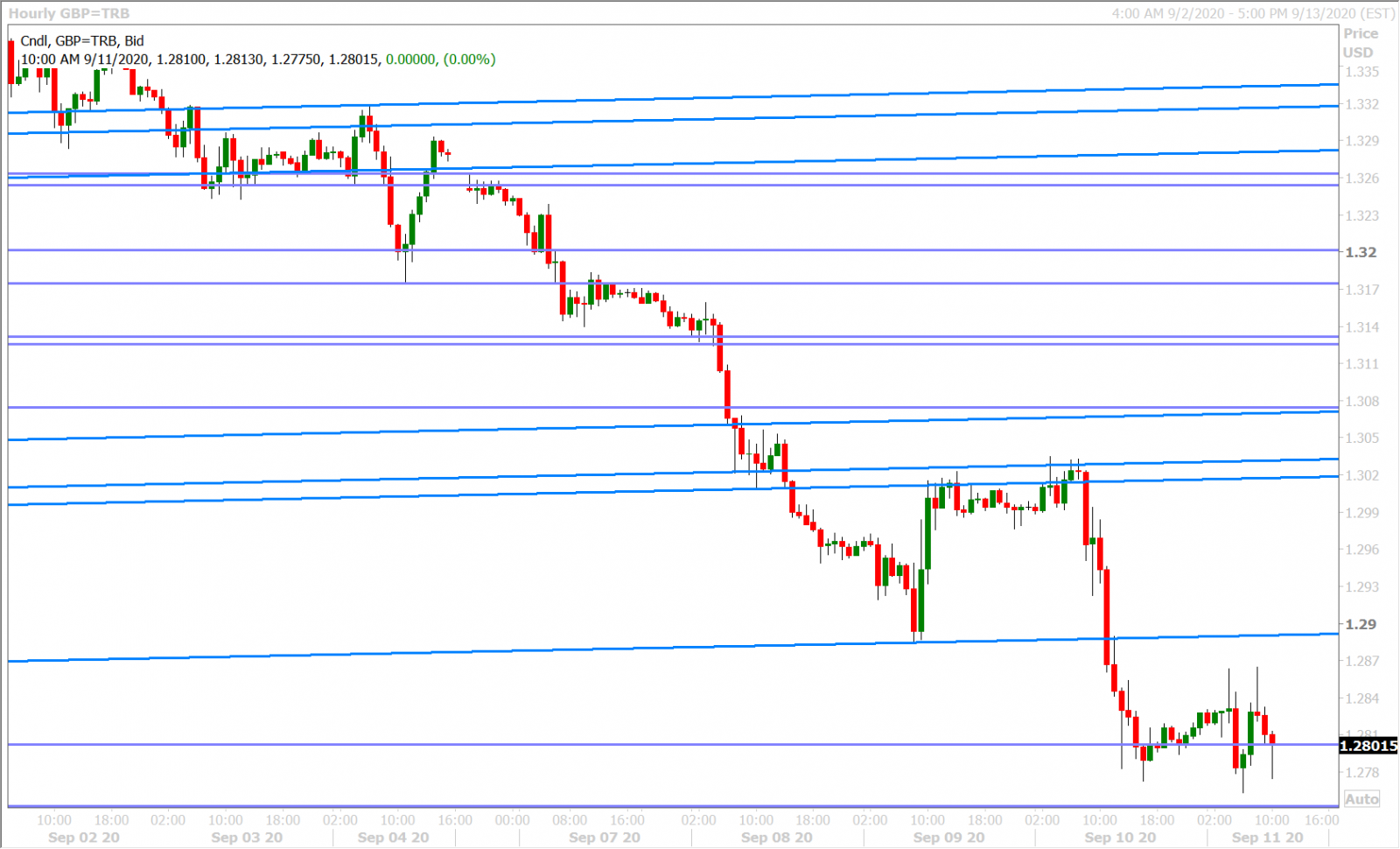

Sterling continued its collapse after the London close yesterday after the European Commission gave the UK until the end of September to amend it’s new Internal Market Bill. Full statement here. Chief EU Brexit negotiator Michael Barnier added to the Brexit negativity with his latest statement shortly thereafter (see here), but it appeared as though David Frost’s “we have agreed to meet again” comment (see here), and a strong US 30yr bond auction, helped to stem the GBPUSD selling into day’s end. This morning’s UK economic data dump for July was a non-event for the market.

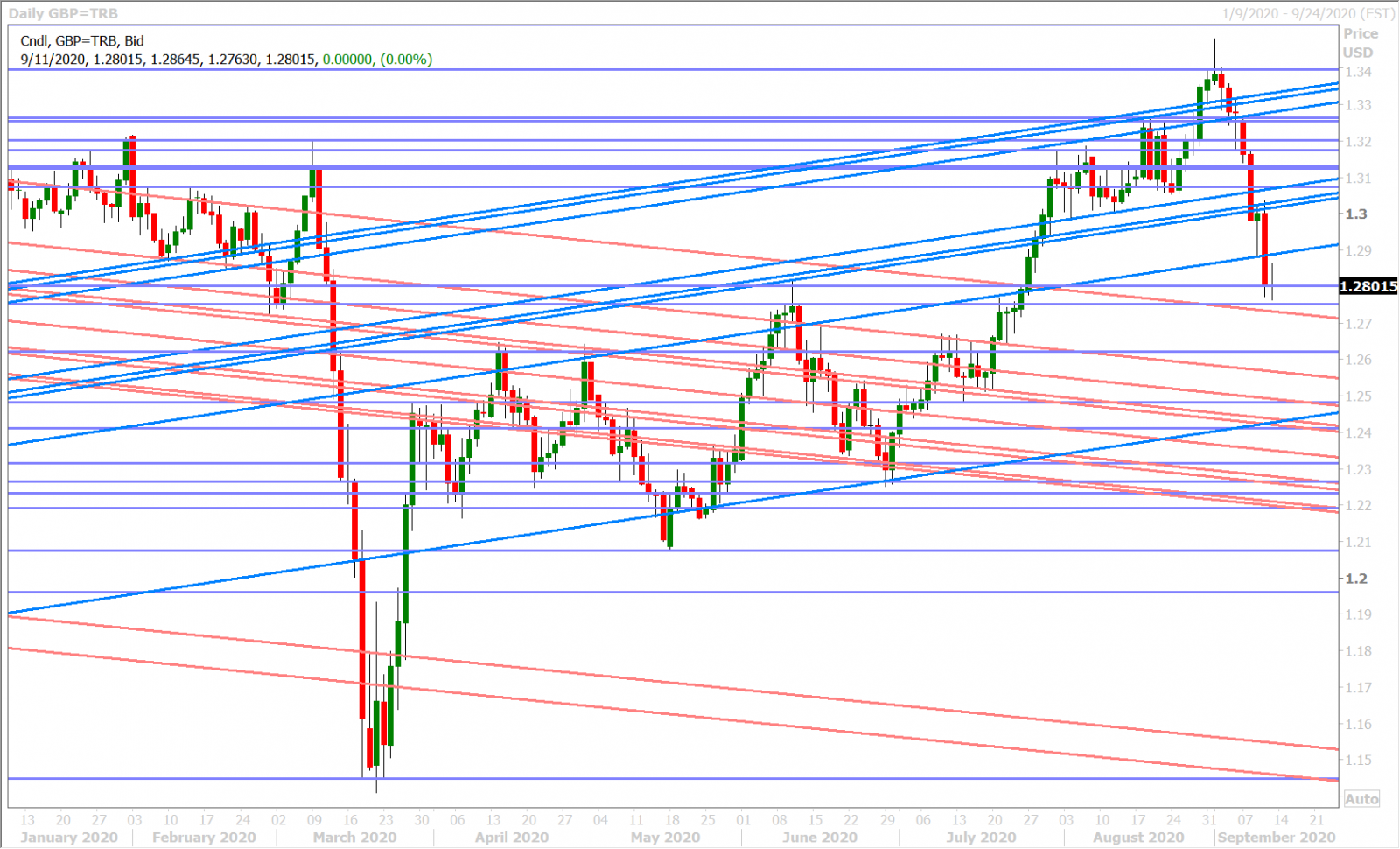

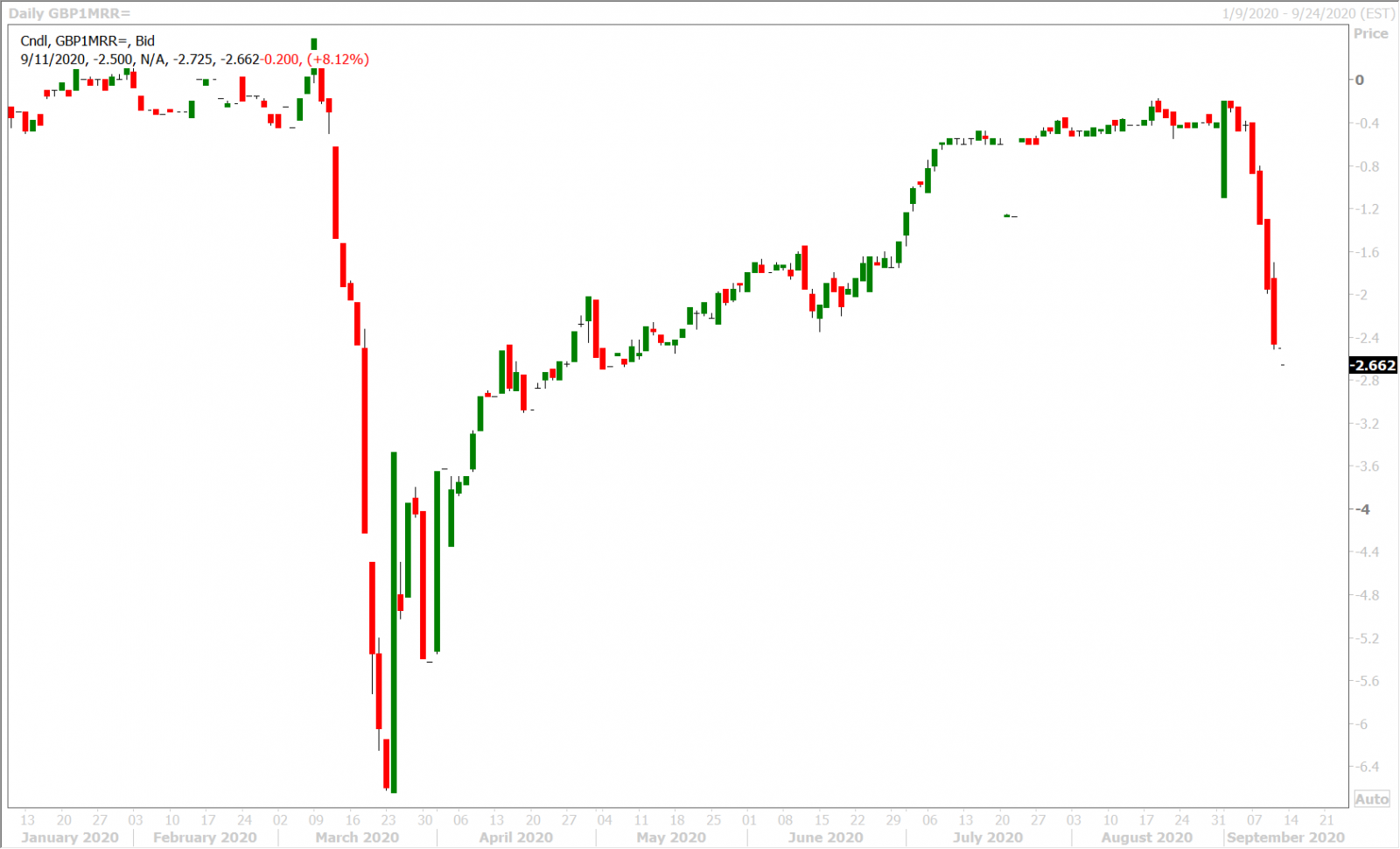

Sterling/dollar’s daily chart technicals have deteriorated so quickly this week that we now firmly believe that the market’s uptrend is over. We said last Friday that the market would get more directional with a break out of the 1.3250-1.3320 range, but we have to admit we’ve been a bit surprised with just how directional it has been and how major chart support levels have been dropping like flies since Brexit developments took a turn for the worse on Monday. The marketplace is now clearly worried that the EU and UK won’t reach a trade agreement by the end of the year. The benchmark 1-month GBPUSD risk reversal is dramatically reflecting this now too by plunging to -2.58 this week; a level not seen since June. We think sterling/dollar now likely adopts a 1.2700-1.3050 trading range going into October.

• GB Jul GDP Estimate YY, -11.7%, -11.3% f'cast, -16.8% prev

• GB Jul GDP Estimate MM, 6.6%, 6.7% f'cast, 8.7% prev

• GB Jul GDP Estimate 3M/3M, -7.6%, -7.5% f'cast,-20.4% prev

• GB Jul Industrial Output YY, -7.8%, -8.9% f'cast, -12.5% prev

• GB Jul Industrial Output MM, 5.2%, 4.0% f'cast, 9.3% prev

• GB Jul Manufacturing Output MM, 6.3%, 5.0% f'cast, 11.0% prev

• GB Jul Goods Trade Balance GBP, -8.635 bln, -6.900 bln f'cast,

GBPUSD DAILY

GBPUSD HOURLY

GBPUSD 1-MONTH RISK REVERSAL DAILY

AUDUSD

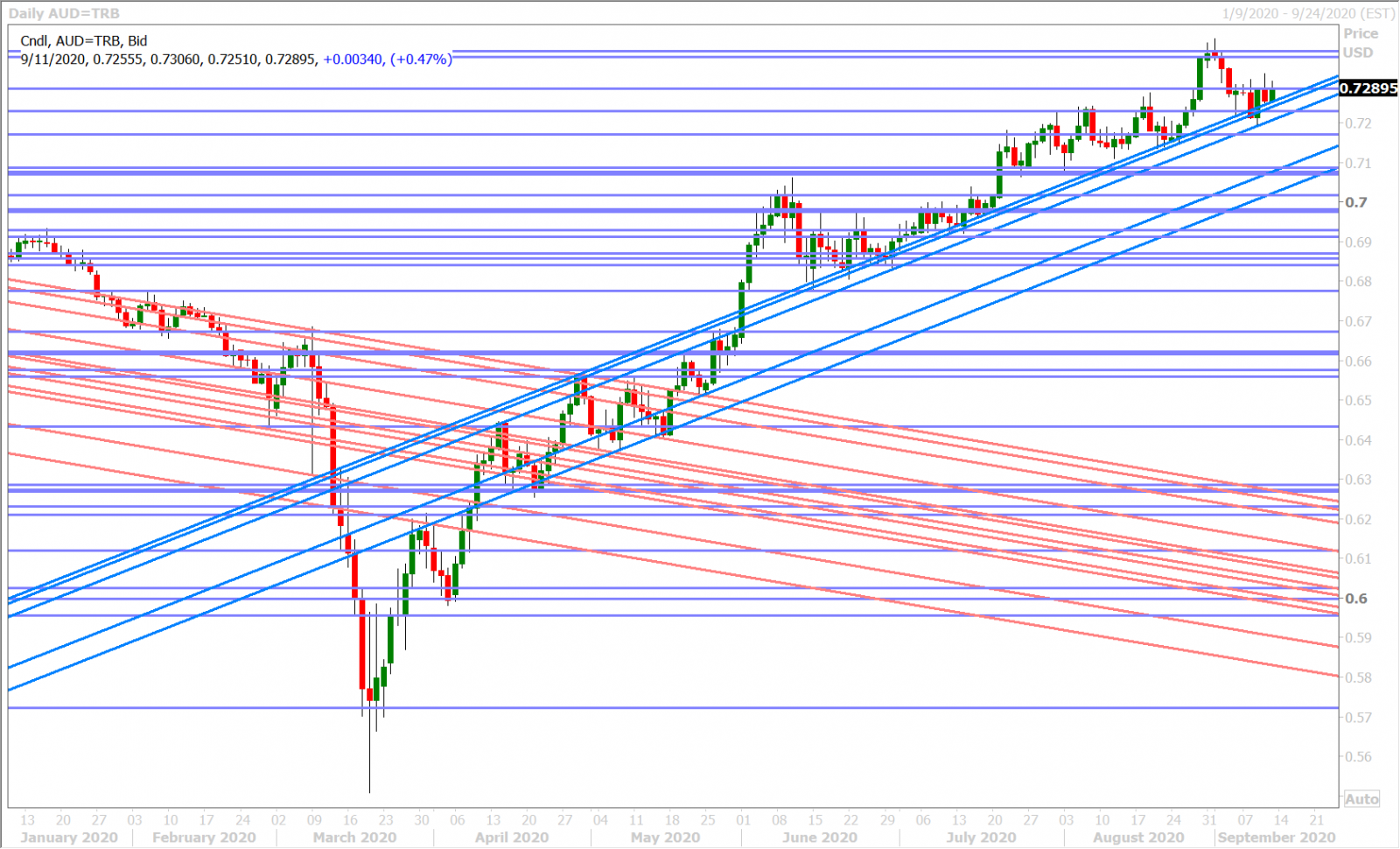

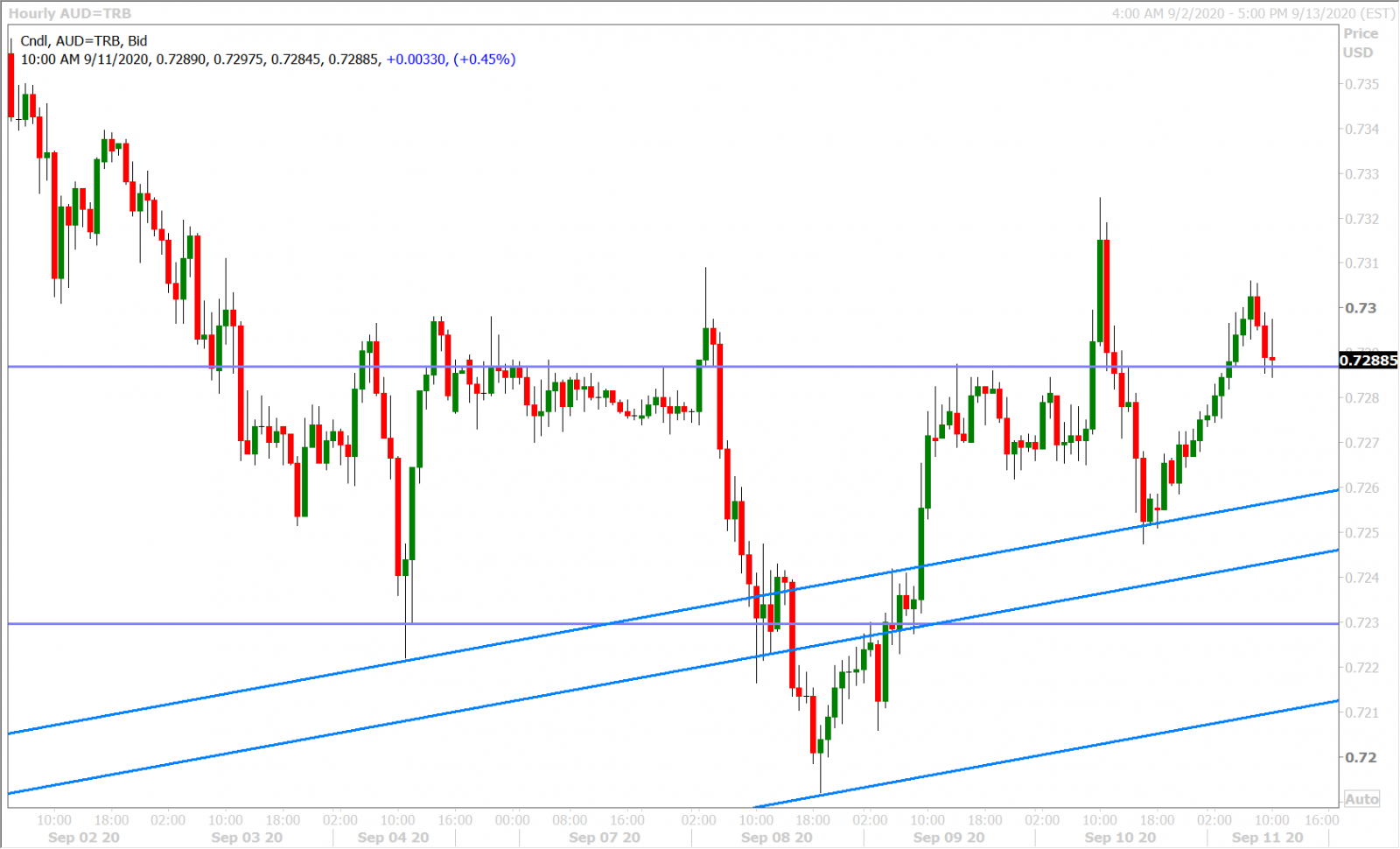

Yesterday’s negative Brexit headlines really derailed the Aussie’s early ECB-inspired, break above the 0.7280s resistance level. The market’s swift move back below this level after the London close, failure to regain it after a strong US 30yr bond auction, and late-day S&P selling added to the woes for AUDUSD going into the NY close, but strong buying off the 0.7250s support level in early Asia has helped the market recover. One could argue that what we’re seeing today is merely a calming down of yesterday’s excessive Brexit pessimism. We feel the 0.7280s will once again be pivotal for price action heading into the weekend.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen showed relative strength in the face of broad USD selling early yesterday and while we initially thought this was a noteworthy sign of possible market strength going into the rest of NY trading session, this idea was put to bed after it was apparent that GBP-plunge-driven USD buying flows were not helping the market. Instead, dollar/yen seemed to track US yields exclusively; edging higher with them to make room for $23bln worth of new 30yr paper…only to fall back with them when the auction showed strong demand.

Chief Cabinet secretary Yoshihide Suga is still expected to win Monday’s LDP leadership vote (which would make him japan's next prime minister), and so near-term volatility gauges/option expiry sizes over the Monday/Tuesday trading session suggest this will be a non-event for the markets. Next week’s main features will be the Fed meeting on Wednesday and the BOJ meeting on Wednesday night/Thursday morning, however the mammoth amount of USDJPY options expiring between the 105.50 and 106.75 strikes next Thursday morning suggests this market is going nowhere fast.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International, CXI, is the leading provider of comprehensive foreign exchange services, risk management solutions and integrated international payments processing technology in North America. CXI’s relationship-driven approach ensures clients receive tailored solutions and world-class customer service. Through innovative and trusted FX software platforms, CXI delivers versatile foreign exchange services to our clients, so that they can efficiently manage and streamline their foreign currency and global payment needs. CXI is a trusted partner among financial institutions, corporations and retail markets around the world. To learn more, visit: www.ceifx.com