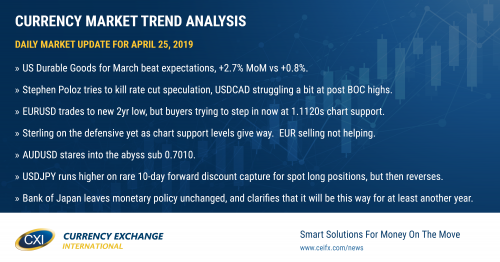

Bank of Canada delivers more dovish than expected hold to interest rates. Broad USD buying continues today

Summary

-

USDCAD: Dollar/CAD is drifting higher this morning in an attempt to retest the post Bank of Canada highs at 1.3520, and broad USD buying is leading the way so far today. Dollar/yuan has finally broken above the 6.73 level and has rallied quickly to the next trend-line resistance level in the high 6.75s. Euro/dollar continues its decline after breaking below chart support in the 1.1180s yesterday. Sterling has given up both the 1.2920s and the 1.2890s. Finally, the Aussie is staring into the abyss this morning as the market inches below the 0.7010 level into the Jan 3rd flash crash range. The Bank of Canada indeed delivered a more dovish than expected hold to interest rates yesterday. More specifically, it talked about a global economy that is slowing more than forecast, ongoing uncertainty about trade conflicts and how this is undermining business sentiment, and its decision to formally remove the need for rates to return into a neutral range (which it downgraded in the process). The financial media is running with the headline that the Bank of Canada abandoned its rate hiking bias, but we would argue this largely occurred last month. We didn’t think the press conference was a good one for Stephen Poloz as some reporters focused on the Bank of Canada’s forecasting errors, and we found it rather comical towards the end when the governor said that rates were still more likely to go up than down given their current forecasts. We think this last comment was an attempt to kill rate cut speculation, and we think this is one of the reasons why USDCAD has yet to take out the post press release highs in the 1.3520s. The OIS swaps curve nudged up marginally yesterday, but is still showing a roughly 60% chance that the Bank of Canada cuts rates by 25bp by year’s end. The US Durable Goods numbers for March were just reported and they beat expectations (+2.7% MoM vs +0.8%). We think USDCAD retains its upward bias here, but we’d like to see the market break above the 1.3520s sooner rather than later, otherwise we could see some profit takers enter.

-

EURUSD: It’s been a rough 24hrs of trade for Euro/dollar after the market broke below trend-line support in the 1.1180s yesterday. We can’t say there was a headline that drove the downside break yesterday specifically, but the negative technical development on the charts was noteworthy. We also think dollar/yuan’s foray above the 6.73 level added fuel to the fire, along with the fact that German 10yr bund yields moved back below 0%. The EURUSD market now sits a new 2-year low this morning, with traders attempting to buy trend-line support in the 1.1120s, but the better than expected Durable Goods numbers just released now might make it difficult.

-

GBPUSD: Sterling continues to fall here after yesterday’s EURUSD selling killed the bounce and dragged the market back below chart support in the 1.2920s. While the 1.2890s stemmed the selling into afternoon NY trade yesterday, this level has now given way after the EUR resumed lower at the start of European trade today. The lack of meaningful Brexit headlines over the last week now appears to be hurting the market, whereas quiet days over the last couple of months tended to help the market. We think traders are finally realizing that the EU-granted Brexit delay to Oct 31st will simply kick the proverbial can down the road. We also think the poor timing of the flip to a marginal net long GBPUSD position for the funds, as of April 16th, is exacerbating this move lower (as we think these funds are now being forced to put short positions back on). The next support level for GBPUSD comes in at the 1.2850s, then the 1.2780s. Talk made the rounds yesterday and early today about Theresa May tabling a key Brexit vote for next week, but sources close to the BBC are now denying these rumors.

-

AUDUSD: The Aussie is staring into an abyss this morning, and we say this because we’re now trading below key support at 0.7010 and within the January 3rd, flash crash price range (which has very little chart support within it). May copper prices have fallen swiftly back below the 2.90 support level today amid the broad USD buying we’re seeing today. We think the selling in AUDUSD could snowball pretty quickly here should there be no attempt to quickly regain the 0.7010-20s.

-

USDJPY: Dollar/yen traders have done some technical damage to the charts over the past 24hrs, and we think part of that has to do with a runup to capture a rare 10pts in forward discount that was rewarded to speculative spot USDJPY longs at the close of NY trade yesterday. The speculative FX community uses the very liquid spot market to express their intentions and these positions are swapped or rolled over every day at 5pmET. Overnight interest rate differentials between the US and Japan usually creates a small discount for long USDJPY positions that are swapped over, but any positions held into the close yesterday in particular were rewarded a rare 10 days-worth of forward discount (because spot USDJPY trades value April 26 would now have to be valued May 6th – or the next business day in Japan because of the unprecedented length of the Golden Week holidays this year). Yes, the USD traded broadly higher yesterday, but we think this one time roll-over effect on the market played a part in the quick move up to the 112.40s late yesterday. Unfortunately though, this move quickly evaporated in early Asia trade overnight and put the pressure on these new USDJPY longs to seek more dovish than expected news out of the Bank of Japan later in the session. That news never materialized, with the BOJ keeping to the status quo as usual, when it announced its latest update on monetary policy last night. Governor Kuroda thought that is was now important to clarify the BOJ’s forward guidance in an effort to improve the central bank’s credibility. With that, we got that following statement: The Bank of Japan will be “keeping interest rates very low for an extended period of time at least through around spring 2020”. We think the more entrenched USDJPY longs (from lower levels) might look at today’s price action as an excuse to trim exposure here.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com