Big Tory lead over Labour helps risk early on, but negative CNBC trade tweet sours mood.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

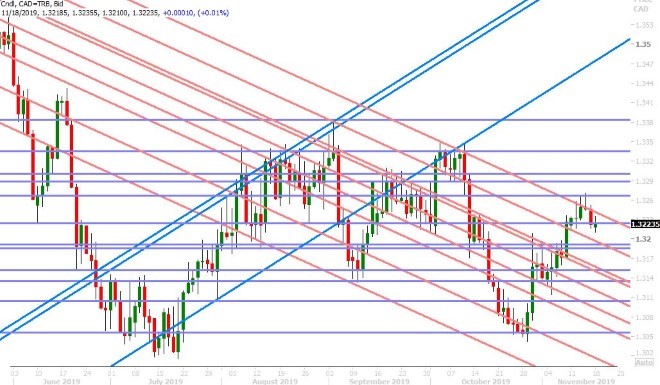

USDCAD

There’s was a “risk-on” tone to global markets this morning after five election polls in the UK today showed the Tories taking an even wider lead over the Labour Party. Sterling/dollar broke above the 1.2930s during the 3amET hour on this, and this appeared to lift all boats. The S&P futures, US yields, and USDJPY all moved higher in European trade while gold and the broader USD came under pressure. USDCAD, in particular, floundered just below the 1.3220s with not much downward momentum, perhaps because Friday’s NY close right at the pivotal 1.3220 support level (not below it) wasn’t an overt show of negative technical force. We’ve seen a “risk-off” USD bid come in to start NY trade following a negative US/China trade tweet from CNBC Asia (more on this below).

This week’s North American calendar features October CPI and September Retail Sales data out of Canada. We’ll also be getting some more central bank speak out of the Fed and the Bank of Canada.

Monday: Fed’s Mester at 12pmET

Tuesday: US Housing Starts (Oct), Fed’s Williams, BOC’s Wilkins

Wednesday: Canadian CPI (Oct), FOMC Minutes from Oct 31 meeting

Thursday: US Philly Fed (Nov), Fed’s Mester, BOC’s Poloz

Friday: Canadian Retail Sales (Sep)

The leveraged funds at CME predictably trimmed their net short USDCAD position during the week ending Nov 12th. We think they’re breathing a sigh of relief that USDCAD failed to break to a new uptrend last week, but we don’t they’ll rest easy until we see a strong NY close below 1.3200. All it would take is one surprisingly negative Canadian or “risk-off” headline and we could be talking about the USDCAD upside breakout once again. How the market then responds to the 1.3240-60 resistance zone will be key.

USDCAD DAILY

USDCAD HOURLY

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar has seen a very choppy start to the week, despite the early morning rally in GBPUSD, and we think we could see more of this given the slew of mid 1.10 option expiries on deck for this week. According to Reuters, we have 1.3blnEUR in options going off the board at 1.1055 today, then the same amount at the same strike for tomorrow, and then 2blnEUR+ between 1.1020 and 1.1050 for Thursday.

This week’s European calendar features the release of the flash Manufacturing PMIs out of Germany and the Eurozone for November, and a keynote speech from the ECB’s Christine Lagarde at the Frankfurt European Banking Congress (all on Friday). The ECB will also release the minutes of the meeting from its October 24th policy announcement, on Thursday. The funds trimmed their net short EURUSD position during the week ending Nov 12th by primarily adding to long positions.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is galloping higher this morning after a number of weekend election polls showed the Tories increase their lead to at least 14pts over the Labour Party. GBPUSD got some help early on in Asia when buyers stepped in to defend Friday’s NY highs in the 1.2910s, and the rally really picked up steam when the 1.2930s gave way to the upside. The October highs in the 1.2980s capped the rally and we’ve seen since the market pull back to test how strong the buyers really are. This week’s UK calendar doesn’t feature any notable economic releases. The funds trimmed their net short GBPUSD position ever so slightly during the week ending Nov 12th.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar used Friday’s “risk-on” tone, combined with mixed to weak US data, to extend its bounce into the 0.6810s but this was all the market could muster. We’re now seeing AUDUSD retreat a bit as USDCAD bounces and EURUSD clings to a large option expiry in the 1.1050s. Off-shore dollar/yuan has shot back up to the 7.0300 level over the last hour, apparently on the back of this negative US/China trade tweet out of CNBC Asia’s Eunice Yoon:

“Mood in Beijing about #trade deal is pessimistic, government source tells me. #China troubled after Trump said no tariff rollback. (China thought both had agreed in principle.) Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.”

This could also explain the commodity currency underperformance over the last hour. The PBOC unexpectedly cut its reverse repo rate today, but this monetary easing measure now seems like a distant memory in light of CNBC’s tweet. The RBA will release the minutes of its Nov 5th policy meeting tonight at 7:30pmET. Assistant RBA governor Kent will be making a speech at 5pmET. Rate cut odds for December 3rd have slipped back to 20% to start the week (according to the OIS market). The leveraged funds at CME have piled back into their net short AUDUSD position during the week ending Nov 12th.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen and US yields benefited earlier this morning from the positive polling news for the Tories in the UK, but both markets are giving back all these gains and then some after the negative CNBC US/China tweet unleashes a wave of “risk-off” across markets. The US 10yr yield is now re-attacking the 1.80% handle, we’re now seeing USDJPY fall precipitously back to Friday’s lows. With the funds extending their net long USDJPY position yet again during the week ending Nov 12th, we think there’s a risk the market could fall apart with another “risk-off” move below the 108.50s.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com