Broad "risk-off" flows kick in after Trump's speech.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Trump doesn’t deliver the “constructive statement on China” that traders were expecting.

- USD broadly higher with “risk-off” flows, ignoring US yield slump. USDCAD breaks above 1.3250.

- US reports mixed CPI number for October. Headline measure beats but core measure misses.

- Jerome Powell speaks at 11amET before congressional Joint Economic Committee.

- Fed’s Barkin speaks at 12:30pmET. Kashkari at 1:30pmET. Harker at 6:30pmET.

- AUDUSD slips below 0.6830s. Australia Employment Report out at 7:30pmET tonight.

- EURUSD funk continues, ignores fall in US yields. Auto-tariff delay or German GDP angst?

- GBPUSD rangebound despite softer headline UK CPI. Tories leading by 10pts in the polls.

ANALYSIS

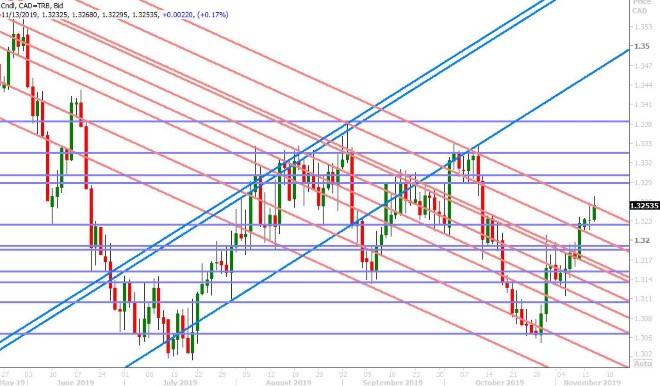

USDCAD

The markets are displaying broad “risk-off” type flows this morning; with the S&P futures, Chinese yuan, oil and copper all trading lower while bonds, Eurodollar futures, the yen and the broader USD trades higher. We think this is follow-through disappointment from President Trump’s address to the Economic Club of New York yesterday; a speech where we feel he didn’t deliver the “constructive statement on China” that traders were expecting. USDCAD has broken above the 1.3250 resistance level on an intra-day basis, which we think is technically significant because (should it close NY trade above here) it would end the market’s volatile downtrend we’ve witnessed since September and set the course for the 1.33 handle once again.

The US just reported its CPI data for October and the numbers came in mixed (+1.8% YoY vs +1.7% on the headline but +2.3% YoY vs +2.4% on the core measure). Today’s main event will be Jerome Powell’s annual testimony to the congressional Joint Economic Committee at 11amET. Market chatter suggests the Fed chairman won’t deviate from his most recent press conference at the end of October, but traders will be glued to this event anyways because of how sensitive trading algorithms are nowadays to the way wire headlines are written. We’ll also hear from Fed members Barkin, Kashkari and Harker in the NY afternoon.

USDCAD DAILY

USDCAD HOURLY

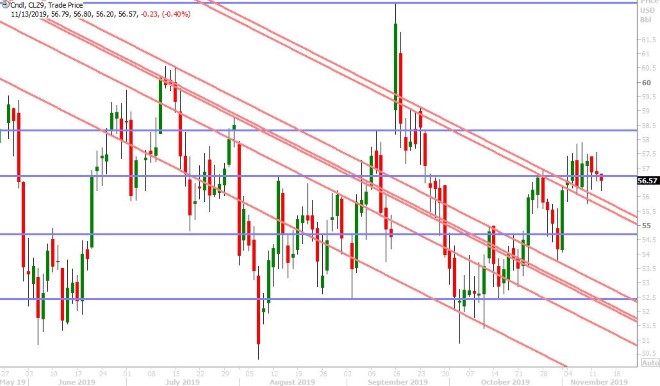

DEC CRUDE OIL DAILY

EURUSD

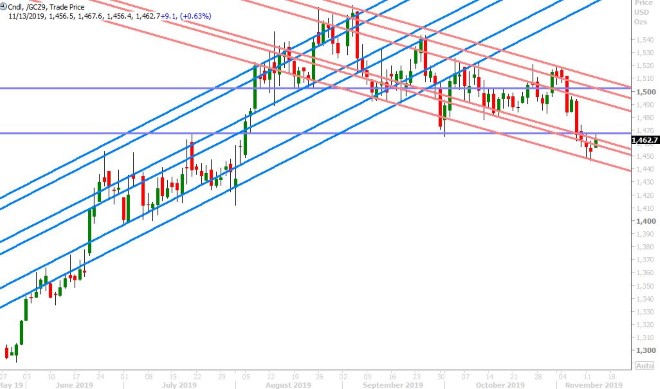

The funk that has plagued EURUSD for the last two week continues this morning, despite the fall-off in US yields we’ve witnessed since Trump’s speech yesterday and despite December gold’s “risk-off” rally so far today. So what gives? We noted yesterday to clients that President Trump spoke quite negatively about Europe in his speech, saying “Europe has set up terrible barriers for the US on trade, in some ways worse than China”. Perhaps this is causing some anxiety ahead of the delay of European auto tariffs for another six months, which Trump is expected to grant this week? Perhaps this is also angst ahead of tomorrow’s flash Q3 GDP print out of Germany, where traders are expecting a -0.1% negative print (aka recession)? All this being said, EURUSD continues to hold the psychological 1.1000 support level as NY trade gets underway today. We think the market could rebound a bit if Jerome Powell eases up on his optimistic tone of late.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Bank of England “rate cut” market chatter has ticked up a notch this morning after the UK reported softer than expected headline CPI figures for the month of October (+1.5% YoY vs +1.6%). Sterling traders don’t seem all that concerned for the moment however as the core (ex food/energy) measure matched expectations of +1.7% YoY. GBPUSD remains stuck within a range (1.2820s to 1.2870s). Ditto for the EURGBP cross (0.8560-0.8600). The BBC’s latest General Election Poll Tracker show the Tories 10pts ahead of the Labour party. See here for more detail.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie spiked 20pts higher after the Reserve Bank of New Zealand (RBNZ) unexpectedly kept interest rates on hold last night, but this move in AUDUSD fizzed out pretty fast as focus returned to a negative sounding US/China trade article released from the WSJ (see here), some dovish RBA calls from National Australia Bank and BIS Oxford Economics, and a ho-hum Q3 Wage Price Index report out of Australia (+2.2% YoY vs +2.3% expected). We found it interesting that RBNZ Governor Orr noted there was no need to play catch-up to Australia on rate cuts, which sort of implied that the Kiwis are ahead of the curve on monetary policy vis a vis the Aussies (the AUDNZD cross plunged lower). This morning’s broad “risk-off” move in European trade then saw AUDUSD slip below the 0.6830s support level, which doesn’t bode well for the market’s technical picture in our opinion. Australia will report its October Employment Report at 7:30pmET tonight, and the expectations here are for +15k jobs (vs 14.7k last month) and for the unemployment rate to tick slightly higher to 5.3%.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is falling with US yields this morning as the rest of the world catches up with how disappointing Trump’s speech was yesterday in our opinion. We don’t think this morning’s mixed US CPI release helps the cause for US yields and we view the 108.60s as the next major support level for USDJPY. Next up is Jerome Powell at 11amET. Japan will report its Q3 GDP figures at 6:50pmET tonight (+0.2% expected QoQ).

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com