Caixan Manufacturing PMI lifts sentiment overnight, but markets now bracing for potentially negative US NFP

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

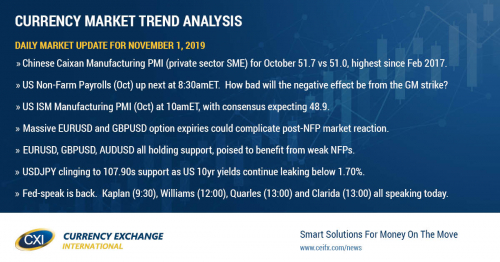

- Chinese Caixan Manufacturing PMI (private sector SME) for October 51.7 vs 51.0, highest since Feb 2017.

- US Non-Farm Payrolls (Oct) up next at 8:30amET. How bad will the negative effect be from the GM strike?

- US ISM Manufacturing PMI (Oct) at 10amET, with consensus expecting 48.9.

- Massive EURUSD and GBPUSD option expiries could complicate post-NFP market reaction.

- EURUSD, GBPUSD, AUDUSD all holding support, poised to benefit from weak NFPs.

- USDJPY clinging to 107.90s support as US 10yr yields continue leaking below 1.70%.

- Fed-speak is back. Kaplan (9:30), Williams (12:00), Quarles (13:00) and Clarida (13:00) all speaking today.

ANALYSIS

USDCAD

Dollar/CAD closed above 1.3160 yesterday after US yields stablished in afternoon trade. A stronger than expected Caixan Manufacturing PMI for October out of China spurred some broad, “risk-on”, USD selling in Asian markets last night, which then saw USDCAD probe back towards the 1.3140s. This optimism is being dialed back a bit now as traders await the US Non-Farm Payrolls report for October, which could be bad due to the GM strike. The consensus estimate is for +89k new jobs, wage growth of +0.3% MoM / +3.0% YoY, and an unemployment rate of 3.6%. Key chart support today lies in the 1.3130s, then the 1.3100 level. The upside levels to watch are the 1.3180s and then the 1.3220-30s (should we get a better than expected report).

USDCAD DAILY

USDCAD HOURLY

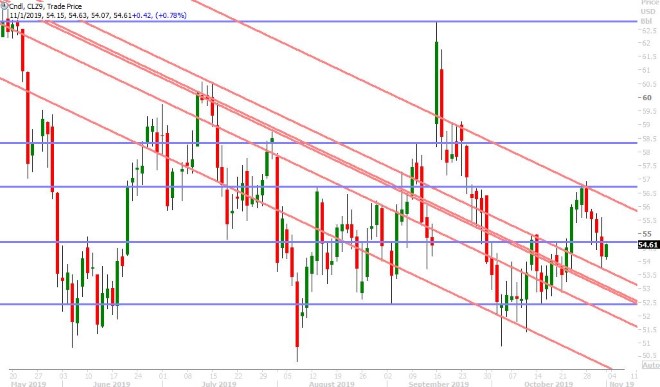

DEC CRUDE OIL DAILY

EURUSD

The EUR bulls are not giving up hope yet, despite yesterday’s failed breakout attempt above the 1.1160s. The 1.1140s held into the NY close yesterday and we saw buyers emerge at this level yet again in London trade today. We think weaker than expected US NFP numbers could be the catalyst for a clean break to the upside for EURUSD, however today’s raft of massive option expiries could complicate the post report market reaction. Over 3blnEUR rolls off at the 1.1150 strike and over 5blnEUR is set to expire at 1.1200, all at 10amET.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling didn’t have a great NY close by virtue of GBPUSD slipping below the 1.2950 level, but the “risk-on” move from the beat on the Chinese Caixan Manufacturing PMI did the trick and got the market back above it. Buyers then emerged on the dip in London trade, and we now have a GBPUSD market poised to benefit from a weak US NFP report. Similar to EURUSD however, there are massive option expiries today to consider for GBPUSD today, likely Brexit-day hedges (recall Oct 31st was supposed to be the day the UK left the EU). Over 1blnGBP rolls off at the 1.2950 strike and over 2.4blnGBP is set to expire at the 1.2900 level.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie has displayed a very similar chart pattern to both EURUSD and GBPUSD in overnight trade, with the saving grace for bulls being the market’s continued ability to hold the 0.6890s. The Chinese Caixan Manufacturing PMI for October was reported at 51.7 vs 51.0, which was the strongest showing of private, SME manufacturing sentiment since February 2017. Over 1.4blnAUD in options expire at the 0.6900 strike at 10amET this morning.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen continues to flounder around chart support in the 107.90s this morning as the broader markets brace for a potentially disappointing US Non-Farm Payrolls report. US 10yr yields remain below the 1.70%, which is not great technically speaking. Yesterday’s daily candle for the S&P 500 futures (which was not technically a bearish outside side) doesn’t look all that pretty as well. The US reports its October ISM Manufacturing PMI at 10amET this morning and the consensus expectation here is for 48.9.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com