China backtracked on nearly all aspects of US trade deal, according to Reuters

Summary

-

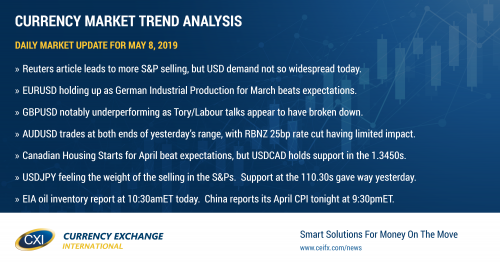

USDCAD: Dollar/CAD is trading close to yesterday’s closing levels this morning, but with an offered tone as June crude oil prices bounce 30 cents from their London lows. Market chatter overnight has been focused on an exclusive article from Reuters titled: China backtracked on nearly all aspects of US trade deal. See here. This has seen the S&P futures fall back below chart support at the 2886 level, after a late day bounce yesterday saw the market close above it, and this is causing some demand for the safe haven USD once again (although the buying is not as strong and as widespread as it was yesterday). The Canadian Housing Starts data for April has just been released and it beat expectations (+235.5k vs +195.5k). The weekly EIA oil inventory data comes out next at 10:30amET, with traders expecting a build of 1.21M barrels (which would be the 3rd week in a row of inventory accumulation). We think USDCAD may need to consolidate further here before traders attempt another move higher.

-

EURUSD: Euro/dollar continues to shrug off global risk off flows this morning as traders appear more focused on European data points. While yesterday’s data wasn’t good, today’s data has been somewhat better as Germany reported better than expected Industrial Production data for the month of March (+0.5% MoM vs -0.5% expected). With that, EURUSD has reclaimed the 1.12 handle and is currently holding the level as ECB President Mario Draghi speaks at the Generation Euro Student’s Awards. About 1blnEUR in options expire at the 1.1225 strike this morning, which could be supportive to the market in the early goings here, but we think the continued fall in the German 10yr bund yield (now -0.05%) and a third day in a row of gains in the BTP/Bund spread (now at +271bp) could pressure EURUSD.

-

GBPUSD: Sterling has been the notable loser in overnight trade as Brexit talks between the Tory and Labour parties appear to be going nowhere. More on this here from ITV News. GBPUSD traders made a few feeble attempts to get the market back above chart support (turned resistance) in the 1.3070s during Asian and early European trading today, but this has failed and it’s been a downhill slide lower ever since. Support at the 1.3010s is now under attack, and the EURGBP has exploded back above the 0.8560 level today (which is bearish GBP more broadly we feel). Theresa May also continues to face pressure from the 1922 Committee this week about setting a firm end date for her tenure as prime minister.

-

AUDUSD: Australian dollar traders have unfortunately been stuck with choppy trading conditions over the last 24hrs, but the market continues to hold up well despite the waves of risk-off flows we’re seeing in the S&P and copper futures. The surprise 25bp cut to interest rates in New Zealand last night saw AUDUSD whipsaw lower and then higher, but we continue to hold yesterday’s support/resistance range of 0.6995-0.7025. China reports its CPI data for April tonight at 9:30pmET, and the expectation is for +2.5% YoY.

-

USDJPY: Dollar/yen continues to feel the weight of the global equity risk off trade. Chart support at the 110.30s gave way in NY trade yesterday, and the psychological 110.00 level is now being put to the test as the S&P futures fall another 18pts this morning. Yen futures traders added over 2k contracts in new positions yesterday, which would suggest new USDJPY shorts are entering. We think USDJPY risks trading into the mid to low 109s should the S&P futures take out 2862 to the downside today.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

July Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com