China intervenes to calm its capital markets

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- PBOC injects 1.2 trillion yuan, cuts 7 & 14 day reverse repo rates.

- Chinese regulators halt night trading in A50 China futures + ban short selling of stocks.

- Intervention halts further selling after Shanghai Composite gaps down 7%, lifts risk sentiment.

- S&P futures, US yields, USDJPY now higher as gold prices slide.

- US ISM Manufacturing PMI for January beats expectations, 50.9 vs 48.5.

- Reserve Bank of Australia rate decision tonight at 10:30pmET. No change expected.

- GBP collapses as tough talk from Boris Johnson and Michel Barnier reignite "no-deal" Brexit fears.

- Over 24 Chinese provinces (accounting for 80% of GDP) to stay shut until February 10th.

ANALYSIS

USDCAD

Dollar/CAD struggled to maintain its upward momentum earlier today after Chinese authorities intervened in their capital markets with a raft of measures to calm local traders returning from the Lunar New Year holiday. The PBOC injected 1.2 trillion yuan in liquidity into its money markets (its largest ever single-day reverse repo operation), cut the 7 and 14 day reverse repo rate by 10bp to 2.4% and 2.55%, and issued multiple statements saying that it will lower lending rates to support firms affected by the coronavirus outbreak. What is more, China’s Securities Regulatory Commission suspended night trading of the A50 futures in Singapore and issued a verbal directive to Chinese stock brokerages to bar short selling. All this had the effect of stemming further losses in the Shanghai Composite (after it gapped down 7%) and lifting risk sentiment across the board in Asian trade last night.

US stock futures traded higher along with US bond yields and USDJPY. April gold futures immediately moved lower. USDCNH seemed like it had to trade higher with USDCNY initially as the on-shore market shot way higher than the PBOC’s fix of 6.9249 (which we think moderately helped USDCAD out of the gates last night), but the fact that this market is now struggling too did not bode well for USDCAD in European trade today. Reports are circulating today that OPEC+ may call an emergency meeting on Feb 8-9 or Feb 14-15 to discuss measures to deal with the 20% drop off in Chinese oil demand since the start of the coronavirus outbreak. We’re hearing rumors of another production cut to the tune of 500k-1M barrels per day, and we think this is also contributing to this morning’s uptick in risk sentiment.

All this intervention-driven, risk-on sentiment comes despite another weekend of negative coronavirus headlines out of China. Over 17k infections and 362 deaths are now confirmed in China. Over 24 Chinese provinces (accounting for over 80% of GDP) have now told businesses not to re-open until February 10th. While the rate of new coronavirus cases in other countries seemed to have slowed over the weekend, the situation on the ground in China still appears grim.

Today’s NY calendar is showcasing some more good news so far in the form of a better than expected US ISM Manufacturing PMI for January (50.9 vs 48.5), and with that USDCAD is once again challenging the pivotal 1.3250s resistance area. This comes after last week’s dismal Chicago PMI and so it’s not surprising to see US yields and the USD knee jerk a little higher now. This weeks calendar features the RBA rate decision tonight, the ISM Services PMI on Wednesday, some central bank speak on Wed/Thurs and then the January employment reports out of both the US and Canada on Friday.

Tuesday: US Factory Orders (Dec)

Wednesday: US ADP Employment Report (Jan), US ISM Services PMI (Jan), BOC’s Wilkins, Fed’s Brainard & Quarles

Thursday: Fed’s Kaplan

Friday: US Non-Farm Payrolls report (Jan), Canadian Employment Report (Jan)

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

Euro-dollar is breaking below the bottom end of its new 1.1050-80 price range this morning as global risk-on sentiment and a solid US ISM report pushes US yields higher and gold prices lower. Today’s final January PMI prints out of Germany and the Eurozone both marginally beat their flash estimates (45.3 vs 45.2 and 47.9 vs 47.8 respectively). The leveraged funds at CME added to their net EURUSD short position during the week ending January 28.

We think the market now risks retracing all the way back down to its 1.1010-20 pre-rally base, if it cannot regain the 1.1050s by the NY close. The rest of the European calendar this week features the final January Services and Composite PMIs out of Germany and the Eurozone (Wednesday), German Industrial Orders (Thursday) and German Industrial Output (Friday).

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

The pound is getting absolutely hammered this morning after the UK Prime Minister Boris Johnson and the EU chief Brexit negotiator Michel Barnier both released tough-sounding gambits to start their Brexit transition period campaigns. More here from the Financial Times.

Whatever positive sentiment the charts were foretelling on Friday have now been completely flipped upside down as “no-deal” Brexit fears resurface. Perhaps what Johnson and Barnier said today was all for show as both sides flex their muscles ahead of negotiations, but sterling traders are not waiting around. They’re selling with a vengeance today, taking GBPUSD all the way down to the 1.3030 level that it reversed back above following the Bank of England meeting last week. The pace of the decline is rather concerning in our opinion and has us eyeing the potential for a technically negative NY close, which could portend further losses for sterling.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie is sitting quietly above Friday’s chart support in the 0.6670s this morning as broad risk-on sentiment gets moderately cancelled out by Chinese yuan weakness. The better than expected US ISM report is not having the kind of negative effect on AUDUSD as one might expect (potential seller failure here?). The Reserve Bank of Australia will announce its latest decision on interest rates tonight at 10:30pmET. While traders are expecting no change, we think it will be interesting to see how the Australian central bank describes the coronavirus situation. We think there’s a possibility that the Australian dollar could bounce if they don’t raise any alarm bells.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is bouncing with the broader risk tone this morning as traders cheer China’s interventionist measures and this morning’s solid US ISM Manufacturing PMI report for January. We think the market’s downward momentum has now been halted somewhat and we foresee a 108.60-109.00 range going into mid-week should broader risk sentiment hold up. The leveraged funds at CME reduced their net long USDJPY position during the week ending January 28, which is not too surprising given the swift coronavirus-driven move off the 110 handle.

USDJPY DAILY

USDJPY HOURLY

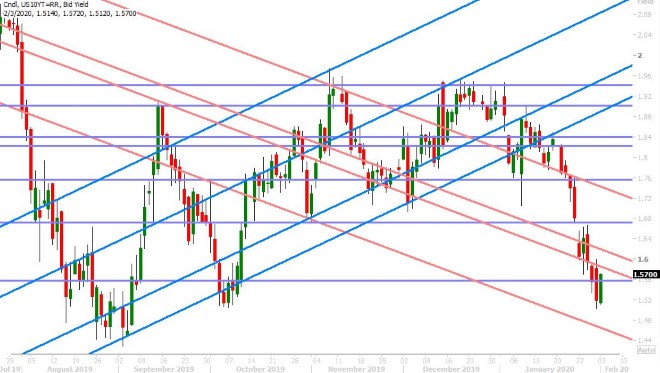

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com