FX markets quiet as Christmas holiday approaches

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

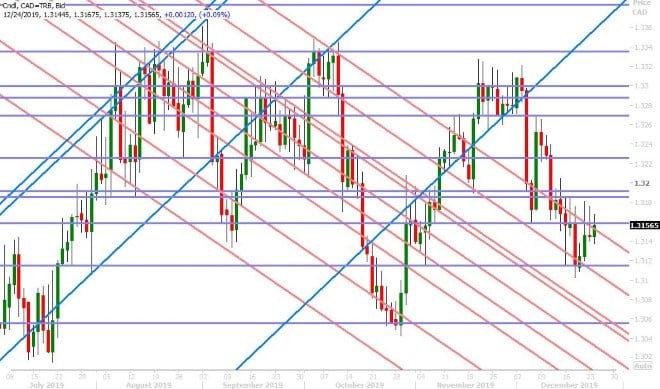

USDCAD

Dollar/CAD is toying with the fund short position this morning as the Christmas and Box Day holiday approaches. After two consecutive NY closes below the 1.3150-60 level (which technically kept December’s downtrend alive), we find the market once again trying to get above it. The broader USD traded mildly higher with US yields in Europe this morning but this move has already started to reverse as NY trade gets underway today. There should be a whole lot of nothing to markets today, with liquidity getting progressively worse as the day goes on. The CME’s equity, interest rate and FX futures markets are closing early at 1:15pmET.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar is trying to bounce off familiar trend-line support at the 1.1070s this morning as the Christmas holidays approach. US 10yr yields bounced confidently off the 1.90% support level yesterday, which seems to be encouraging traders to buy the dip today, and so we don’t think EURUSD will be able to bounce that far. We’d note an interesting mini-breakout on the February gold futures chart this morning however, with last night’s move above the 1490 level. Perhaps we’re just seeing a few buy stop orders trip amidst today’s, pre-holiday, lack of liquidity, but the wheels in our heads are already spinning about a possible “risk-off” headline that could shock markets over the holidays. What could make gold rally here?

US markets will re-open on December 26th while the Europeans will take an extra day off for Boxing Day. The only major scheduled economic releases on the docket until the new year are German Retail Sales for November and the Chicago PMI for December, both of which will be reported on Monday morning Dec 30th.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling traders are trying to prevent seven days in a row of losses this morning by bouncing the market once again off the 1.2920s support level. We’d call this a mild USD-driven move at most though because the thought of another “no-deal” Brexit deadline (at the end of next year’s transition period) continues to sour the mood in the UK. More here from the WSJ. UK markets will re-open on Friday following the Christmas and Box Day holidays. There are no scheduled economic releases on the UK calendar until late next week.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

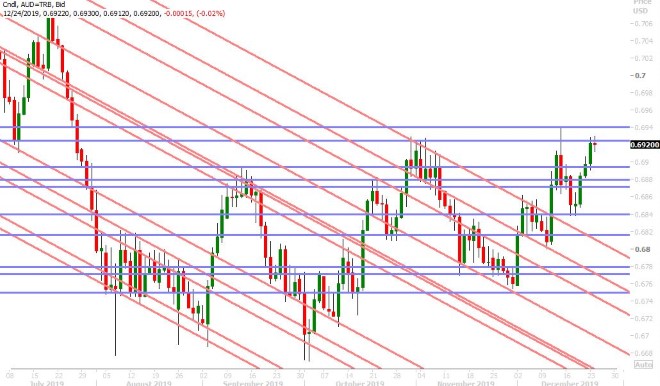

AUDUSD

The Aussie continues to struggle against chart resistance in the 0.6920s today as traders are lacking a news catalyst to break the market to new swing highs. The net short AUD position from the funds at CME, and the fact it has remained more or less the same for three weeks in a row now while the market moves higher, could be contributing to the upside pressure in AUDUSD here following last week’s stellar Australian employment report. A break above the 0.6920s would set trader sights on the December 13th high of 0.6940, but after that there’s not much resistance on the charts to hold back a market rally until at least the 0.7070s in our opinion.

AUDUSD DAILY

AUDUSD HOURLY

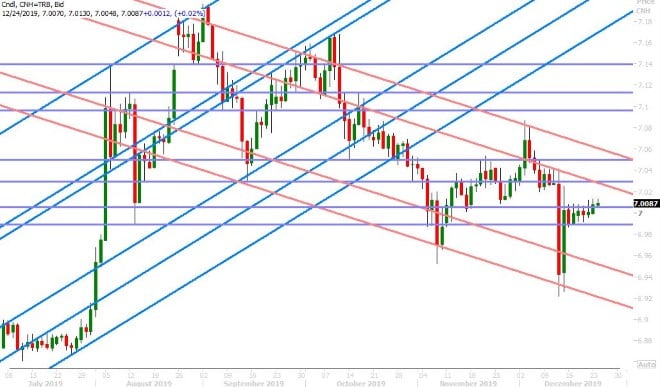

USDCNH DAILY

USDJPY

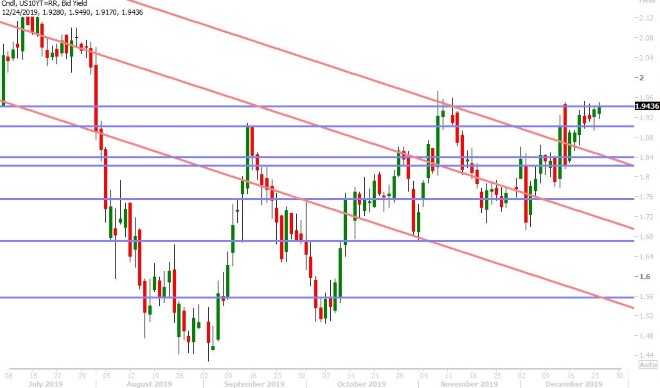

Dollar/yen traders seem as if they’ve already left the office for the Christmas holiday. The overnight range has been an incredibly tight 7pts, from high to low!!! US 10yr yields continue to push higher this morning and now look poised to re-challenge the 1.95% level, which is a very important technical development in our opinion. The market has failed on numerous occasions to get above this level whenever US/China trade deal hype died down, but here we are again threatening a break to the upside. We think a break-out above the 1.95% level (on a NY closing basis) would be meaningfully positive for the broader USD, and therefore we think traders need to be on guard for some sort of "risk-on" headline over the holidays.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com