Gold prices and Eurodollar interest rate futures race higher to start week

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

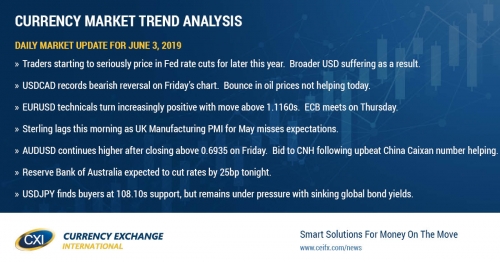

SUMMARY

- Traders starting to seriously price in Fed rate hikes for later this year. Broader USD suffering as a result.

- USDCAD records bearish reversal on Friday’s chart. Bounce in oil prices not helping today.

- EURUSD technicals turn increasingly positive with move above 1.1160s. ECB meets on Thursday.

- Sterling lags this morning as UK Manufacturing PMI for May misses expectations.

- AUDUSD continues higher after closing above 0.6935 on Friday. Bid to CNH following upbeat China Caixan number helping.

- Reserve Bank of Australia expected to cut rates by 25bp tonight.

- USDJPY finds buyers at 108.10s support, but remains under pressure with sinking global bond yields.

ANALYSIS

USDCAD

Dollar/CAD is trading lower this morning as the familiar risk-off themes from Friday spill over into this week. The weekend didn’t produce any positive news on the US/China trade front, and if anything, China’s tone has become a little more combative after the Chinese Vice Minister of Commerce Wang Shouwen said the US is “solely to blame” for the collapse of trade talks. The Chinese Global Times is now reporting that China will issue a warning to students about the risks of studying in the US. We’ve also got tough talk over the weekend from China’s defense minister Wei Fenghe, who warned the US not to meddle over territorially matters in the South China Sea. With all this, we’re seeing global stocks and bond yields under pressure to start the week. The Japanese yen is in demand. What is more, gold prices continue to shine as the new safe haven and December Eurodollar futures are screaming higher to price in Fed rate cuts; and this has ruined the upward momentum for the broader USD since late last week. Dollar/CAD, in particular, has given up the pivotal 1.3510s and one attempt so far today to regain it. July crude oil prices are rebounding 1.7% this morning after Saudi oil minister Al-Falih said he was confident we’ll see a OPEC+ production cut extension beyond June. We think’s Friday’s bearish reversal in USDCAD and a frustrated fund long position will now leave the market vulnerable to further downside here as we begin the month of June. Today’s support levels come in at 1.3490, 1.3475, then the 1.3440s. The US reports its May ISM Manufacturing survey at 10amET this morning, and the expectation is for 53.0 on the headline.

USDCAD DAILY

USDCAD HOURLY

JUL CRUDE OIL DAILY

EURUSD

Euro/dollar continues to hit session highs this morning as August gold prices extend another $12 higher today. Friday’s trend-line resistance level in the 1.1160s has given way to the upside and has survived one successful retest in early European trade. The charts are now free and clear for prices gains until the 1.1220s in our opinion. Today’s pan-European Markit Manufacturing PMIs for May came in largely in-line with expectations (which we think saw EUR investors breathe a sigh of relief) and we actually got a better number out of Italy (49.7 vs 48.6 expected), which seems to be calming nerves and Italian BTP yields following last week’s budget provocations from deputy PM Salvini. The leveraged funds at CME remain net short EURUSD as of May 28 however, and it will be interesting to see if a market move towards the 1.1220s forces them to square positions ahead of the ECB meeting on Thursday.

EURUSD DAILY

EURUSD HOURLY

AUG GOLD DAILY

GBPUSD

Sterling as been lagging the rest of the pack this morning after its Manufacturing PMI for May missed expectations by a long shot (49.4 vs 52.0). Attempts to breach trend-line chart resistance in the 1.2650s have failed on three occasions so far today, and so it’s not surprising to see GBPUSD slump back into Friday’s price range. The funds added to short positions yet again during the week ending May 28, bringing their net short position back up to the levels we saw in March. The EURGBP cross begins the month of June attacking chart resistance in the 0.8860s once again like Friday. We think sterling will continue to attract sellers on rallies as the campaign to replace Theresa May kicks into high gear next week.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar scored a bullish closing pattern on Friday, by virtue of the market closing above the 0.6935 level. We continue to believe AUD traders have rising gold prices to thank for that, as well as the offshore dollar/yuan’s inability to seriously challenge the 6.9500 level despite growing US/China trade tension. Today’s slightly better than expected Caixan Manufacturing PMI out of China for May appears to be a bit of icing on the cake, coming in at 50.2 vs 50.0 expected. The funds remained net short over 66k contracts of AUDUSD as of May 28, and we continue to think that this entrenched positioning (which is no longer working) may feel the pressure to cover here (buy). The Reserve Bank of Australia meets tonight and it is widely expected that they’ll cut interest rates by 25bp.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen saw some pressure to start the week as investors in Asia and Europe continued to sell equities and bid up bond prices, but the market appears to have found some buyers at trend-line chart support in the 108.10s. There are also 1.3blnUSD in options expiring at the 108.50 strike at 10amET this morning and we think this event is having a bit of a magnetic effect on prices. Collapsing global bond yields, the rise in gold prices, and a surge in December 2019 Eurodollar pricing to 2% today continue to steal the airwaves however, as traders start to seriously price in Fed rate cuts for later this year. The leveraged funds at CME remained long USDJPY as of May 28 (which doesn’t help the prospects for USDJPY here we feel), but we’d imagine this position is somewhat lighter now after Friday’s sell-off. The key support levels for USDJPY this week come in at 108.10, then the 107.70s.

USDJPY DAILY

USDJPY HOURLY

DEC 3-MONTH EURODOLLARS DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com