Positive trade headlines boost risk sentiment, but broader USD tone more guarded

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

The broader USD is beginning the week with a guarded, bid tone; choosing to ignore the “risk-on” flows we're seeing in global equities, bond yields and commodities this morning. The broader market optimism appears to be coming from some positive trade headlines out of US Commerce Secretary Wilber Ross over the weekend and from the final October Manufacturing PMIs out of Germany and the Eurozone, which both come in a little higher than the flash readings from a week ago. However, FX traders appear to be skeptical and we see this reflected in both the AUD and the CAD as they trade to session lows ahead of the NY open.

This week’s North American calendar features the US Non-Manufacturing PMI on Tuesday, the Canadian Employment Report on Friday, and a fair bit of Fed-speak along the way.

Monday: US Factory Orders (Sep) at 10amET. Fed’s Daily at 5pmET

Tuesday: US Non-Manufacturing PMI (Oct). Fed’s Barkin, Kaplan, Kashkari.

Wednesday: Fed’s Evans, Williams, Harker

Thursday: Fed’s Kaplan, Bostic

Friday: Canadian Housing Starts (Oct), Canadian Employment Report (Oct), US UofM survey (Nov), BOC’s Beaudry.

The leveraged funds at CME added sizably to their net short USDCAD position, during the week ending Oct 29, by adding new short positions. While we’d agree they’re starting to look a little vulnerable in light of the Bank of Canada’s surprisingly dovish hold to interest rates last week, we think they’ll hang in there so long as USDCAD does not trade back above the 1.3190s.

USDCAD DAILY

USDCAD HOURLY

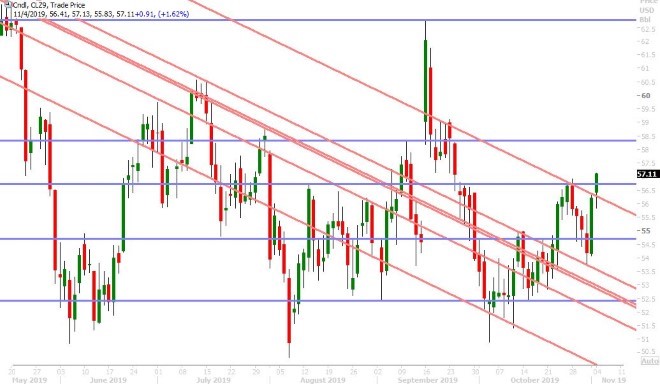

DEC CRUDE OIL DAILY

EURUSD

The euro/dollar bulls did not get the negative US Non-Farm Payrolls report we think they were hoping for on Friday, but we think the weaker than expected US ISM Manufacturing PMI for October did enough to prevent the chart technicals from breaking down. The market starts the week however with a lack of upside momentum, perhaps due to Japan being out on holiday and perhaps because over 1.2blnEUR in options expire between the 1.1150-1.1170 strikes this morning at 10amET. Christine Lagarde, the new ECB President as of Friday, is also expected to make her first speech at an event in Berlin today at 2:30pmET, which could also be adding to a bit of EUR anxiety.

Traders clearly brushed off this morning’s slightly better than expected final October reads for both the German and Eurozone Manufacturing PMIs (42.1 vs 41.9 flash and 45.9 vs 45.7 flash). We think some fresh German data this week could get more attention:

Wednesday: German Industrial Orders (Sep), German Services PMI (Oct)

Thursday: German Industrial Output (Sep)

Friday: Speech from new EU President Ursula von der Leyen titled “The Situation in Europe”

The leveraged funds at CME marginally trimmed long positions during the week ending Oct 29, but still remain net-short to the tune of 54k contracts (about where the net position stood during July/August).

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is slumping to start the week, despite a slightly better than expected UK October Construction PMI out earlier this morning (44.2 vs 44.0) and despite Boris Johnson’s Tories extending their lead in the pre-election polls. See here for the Guardian’s Election 2019 poll tracker. Perhaps some of the GBPUSD weakness is part in parcel due to Barclays making a bold call to short GBPUSD in its “Trade of the Week”. From a technical perspective, we think Friday’s NY close below the 1.2940-50 was an invitation for the sellers to come back in.

This week’s UK calendar will feature the Bank of England’s policy meeting on Thursday morning, but the central bank is widely expected to keep interest rates and its upbeat, post-Brexit, outlook on hold. The leveraged funds at CME reduced their net short GBPUSD position sizably during the week ending Oct 29, by covering shorts and adding to longs. This is understandable given the 700pt rally in sterling over the month of October. The funds are now the least net-short they’ve been since May.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

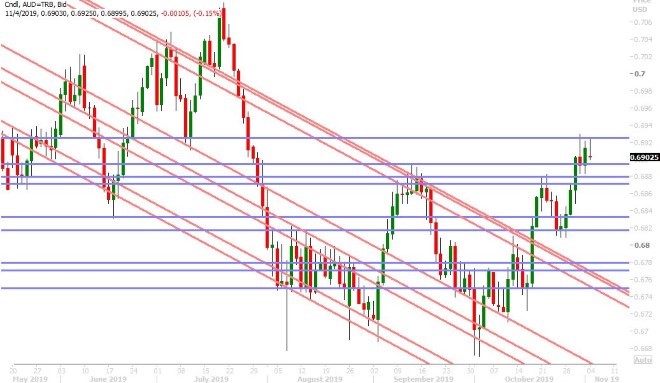

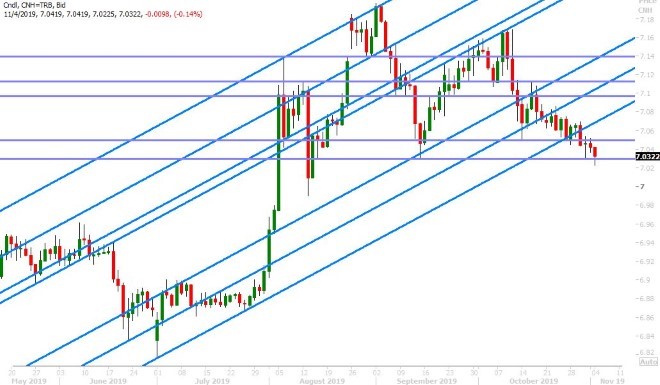

The Australian dollar is struggling to start the week, despite today’s “risk-on” tone to equities and commodity prices. Some weaker than expected Australian Retail Sales data for the month of September appeared to be the culprit in quiet Asian trade (+0.2% MoM vs +0.4%), and dollar/yuan’s ability to regain the 7.0300 support level in London trade today seemed to weigh on AUD sentiment as well. The Reserve Bank of Australia meets tonight at 10:30pmET to announce its latest decision on interest rates. Traders are expecting no change, in light of recent hawkish comments from RBA Governor Lowe. The funds trimmed their net short AUDUSD position to 40k contracts during the week ending Oct 29. We think AUDUSD may be susceptible to a pull back here given its inability to benefit from today’s positive trade headlines.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

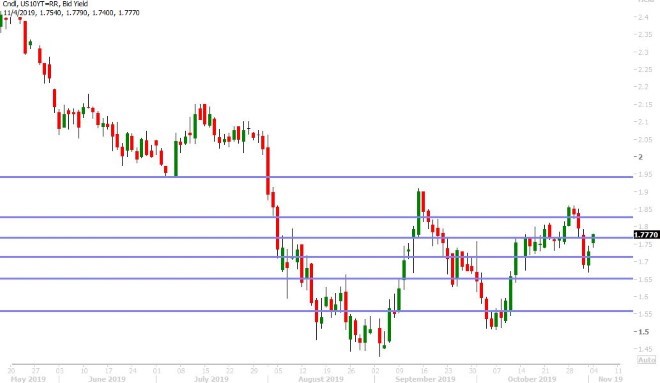

Dollar/yen started the week very quietly as Japanese markets were closed for the Culture Day holiday, but the market then got a boost this morning from a headline reporting that “a White House official tells Politico a deal with China is almost there”. This feels like another recycled US/China trade headline but the trading algorithms are buying it for the time being. The S&P 500 futures have extended +0.60% this morning to another new record high, US 10yr yields are now threatening a break above the 1.77% level after reversing back above 1.70% on Friday’s NFP beat. The funds at CME added ever so slightly to their new, net-long USDJPY position during the week ending Oct 29. We think they’ll need a strong NY close above the 108.50s in order to arrest the technical chart damage caused by the Fed meeting last week.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com