Sterling goes on a Brexit roller-coaster ride

Summary

-

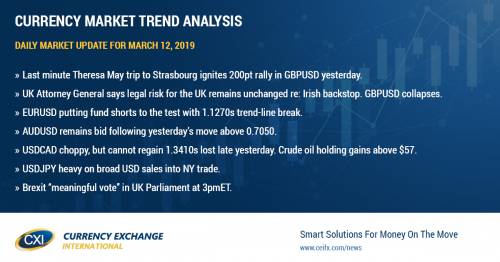

USDCAD: Dollar/CAD is trading bid this morning, but this comes after the market lost trend-line support at the 1.3410 level in late NY trade yesterday. The broader USD couldn’t make much headway during Asian trade overnight but some buying entered in Europe following some disappointing headlines on Brexit. The US CPI figures for February were just reported and they missed expectations on the YoY headline and core readings. April crude oil is trading higher this morning after it was reported that Russian oil companies will adhere to agreed OPEC cuts until July 2019. We think USDCAD trades with a choppy, but slightly more offered tone today. Chart support comes in at the 1.3375-80 level, while resistance is 1.3410, 1.3425, then 1.3450.

-

EURUSD: The euro/dollar market has been putting the entrenched fund short position to the test this morning by tripping buy stop orders above the 1.1270s. There really wasn’t much driving the early European move through this level, but the gains have quickly evaporated and we’re now looking at a market that appears content to follow GBPUSD lower amid more Brexit misery. The BTP/Bund spread continues to knock on the door of +250bp to the upside. USDCNH is holding the 6.71 level and the S&P futures are dialing back some of yesterday’s gains this morning. The slightly weaker than expected US CPI figures for February are now inviting some buying back into the 1.1270s. We think the shorts may have to be on guard again here.

-

GBPUSD: It’s been a crazy 24hrs for sterling as the Brexit headlines go on overdrive. It all started with reports shortly after the NY open yesterday morning about Theresa May making a last minute trip to meet Jean Claude Juncker in Strasbourg. Rumors then started to swirl that she had hammered out some sort of deal that would finally resolve the heated Irish backstop issue. GBPUSD traders didn’t wait around for details and instead scrambled to buy the market. Three chart resistance levels (1.3070s, 1.3140-50, and 1.3210-30) ultimately all gave way over the NY session and into Asian trade, and the market finally took at break when we hit horizontal resistance in the 1.3280s. Theresa May confirmed the rumors this morning, by announcing new legally binding changes to the Irish backstop (which on the surface is very positive news), however the UK Attorney General, Geoffrey Cox, has just thrown cold water over all this by saying that the legal risk for the UK remains unchanged. In his words, “the UK would have no internationally lawful means of exiting the protocol’s arrangements” should the UK and the EU not be able to figure out a solution for the Irish border before the end of the Brexit transition period. These headlines, released around the 7am hour, have now sent GBPUSD careening lower into the 1.3010 support level. Some buyers are trying to emerge again and are trying to regain the 1.3050-70s at this hour, but all this volatility has turned the chart technicals into a bit of a mess here. It turns out that a “meaningful vote” will still occur today in UK Parliament at today at 3pmET, where Theresa May is now almost certainly expected to lose.

-

AUDUSD: The Aussie is trading with a neutral tone this morning as traders digest the overnight whipsaw in EURUSD prices. May copper is trading higher to the tune of 1%. The slightly softer US inflation figures for February (just reported) are inviting some buyers back in now. We think AUDUSD can continue higher here.

-

USDJPY: Dollar/yen made some headway to the upside late yesterday after holding the 111.00 mark, and those gains extended into overnight trade, but the market appears to be struggling with broad USD selling since the NY open. The softer CPI figures out of the US, and over 1.2blnUSD in options expiring at the 111.00 strike this morning, don’t appear to be helping here. We think traders may need to quickly prepare for the downside, should the 111.10s give way.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

April Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com