Two-day USDCAD rally pauses ahead of Canadian jobs report

Summary

-

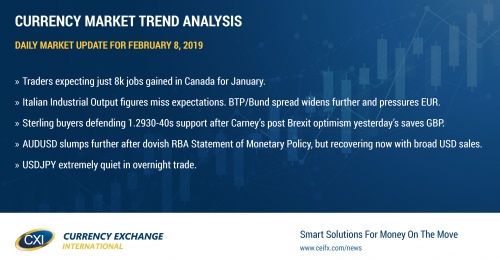

USDCAD: Dollar/CAD is marking time this morning ahead of the Canadian employment report for January, but this comes after yet another strong rally for the market yesterday following some negative developments on the US/China trade front. Trump is now supposedly NOT going to meet with China’s President Xi before the March 1st deadline, after which tariffs of 25% will be applied on over 200bln USD of Chinese imports. This surprising news sent US stocks into sell mode, knocked crude oil prices all the way down by $52, and consequently led USDCAD past chart resistance in the 1.3270s. Traders are expecting just 8k jobs gained in Canada for the month of January, +1.6% YoY gains in wages, and 5.7% for the unemployment rate. Expect some quick profit taking from longs should the numbers beat expectations. Conversely, expect chart resistance in the 1.3320s to be taken out should we get weaker than expected numbers. Such a result could open up further gains to the 1.3370s (the next major resistance level).

-

EURUSD: Euro/dollar traders are trying desperately to hold chart support in the 1.1340s this morning, but it’s been difficult to do because of the inundation of negative European economic data this week. Today it was Italy’s turn again; reporting January Industrial Output at -0.8% MoM vs expectations of +0.4%. The focus is once more on the BTP/Bund spread, which has blown out further to +285bp as Italian bonds sell off on the news and investors flock to the security of German paper (bonds). All this being said, the market has regained the 1.1340s as we write and so we think some fund shorts might finally take a little bit off the table here.

-

GBPUSD: There’s not a whole lot going on in sterling this morning, but traders have stanchly defended the 1.2930-40s after it appears some stop orders were triggered in early European trade. Governor Carney’s post Brexit optimism appeared to save the market yesterday. With now just 50 days remaining until the UK must leave Europe, here’s a nice summary of the deadlines and events coming up.

-

AUDUSD: The Aussie had a rough overnight session, following the release of the RBA’s quarterly Statement on Monetary Policy. The Australian central bank lowered its 2019 GDP forecasts substantially (from 3.25% to 2.5%), and reiterated governor Lowe’s comments the other day about the probability of a rate rise or a rate cut being “more evenly balanced”. Full text here. This was enough to send AUDUSD through chart support in the 0.7090s, but surprisingly the market is recovering back above the level as we enter NY trading this morning. Perhaps a little bit of “sell the rumor, buy the fact”? With EURUSD and GBPUSD continuing to uptick at this hour, we think AUDUSD can follow along. Chart resistance today is 0.7125. Note that Chinese markets re-open on Monday and so we’d be on guard for some potential “catch-up” volatility in USDCNH.

-

USDJPY: Dollar/yen traders are looking rather sleepy as the weekend approaches. We’ve had an extremely narrow overnight range of just 25pts as the market remains confined to the center of a 109.50-110.00 range.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com