USD trading quietly bid ahead of busy week

Summary

-

USDCAD: Dollar/CAD is trading with a quiet bid tone this morning as the broader USD sees some light buying heading into NY trade. This week’s economic calendar (see below) will be action packed, with the highlight coming on Wednesday as the Federal Reserve will announce its latest update on the US monetary policy outlook.

Monday: US Personal Consumption Expenditure Index (March)

Tuesday: Canadian Raw Material Prices (March), Canadian GDP (February), US Chicago PMI (April), Bank of Canada’s Poloz speech before House of Commons

Wednesday: US ADP Employment Report (April), US ISM (April), Weekly EIA Oil Inventory Report, FOMC Decision, Bank of Canada’s Poloz speech before Senate

Thursday: US Factory Orders (April)

Friday: US Employment Report (April), US Non-Manufacturing ISM (April)

The leveraged funds at CME added to both long and short positions in USDCAD during the week ending April 23, leaving them slightly less long the market than they were the week before. We think the longs will remain in charge here so long as the 1.3430-40s hold to the downside.

-

EURUSD: Euro/dollar has had a quiet, choppy start to the week as traders fade an uptick to Italian bonds at the European open today. The uptick came as S&P affirmed Italy’s BBB credit rating late Friday. “While current economic and fiscal settings have put public debt on an upward path, we continue to believe that Italy benefits from credit features that underpin the BBB rating," S&P said in a statement. “We expect the Italian economy to stagnate this year, with GDP increasing around 1 percent in nominal terms.” The lift in Italian bond prices saw EURUSD trade higher as well, but the move is reversing now as EURUSD meets familiar trend-line resistance in the 1.1160s once again. This week’s European calendar will be less eventful, in part due to the May Day holiday on Wednesday, but we think the pan-European PMIs on Thursday will get some attention.

Tuesday: German Employment Report (April), Italian CPI (April), Eurozone and Italian GDP (Q1 preliminary), Italian 10-yr bond auction, SOMA Day

Wednesday: May Day holiday across Europe

Thursday: German Retail Sales (March), Markit Manufacturing PMIs (April)

Friday: Eurozone CPI (April)

The funds were busy adding to both long and short positions during the week ending April 23, but added more shorts and therefore extended their net EURUSD short position to a new 2yr high (~105k contracts). We think the market may see some pressure to start the week as the EURUSD chart technicals remain weak and we have over 28bln USD of liquidity that will be coming out of the credit markets tomorrow due to Fed SOMA operations. After that though, we would not be surprised to see some of these EUR shorts square up ahead of the Fed meeting on Wednesday.

-

GBPUSD: Sterling, like EURUSD, is having a choppy start to the week; higher initially on the European open but now back to unchanged on the session as NY trading gets underway. Brexit headlines continue to be few and far between, with a UK government spokesperson saying earlier that progress with the Labour party has yet to be found. This week’s UK calendar will likely prove uneventful as there are no scheduled Brexit discussions to take place in parliament and the Bank of England will likely stay the course when it provides its monetary policy update on Thursday:

Wednesday: Markit Manufacturing PMIs (April)

Thursday: Bank of England meeting

Friday: Markit Services PMIs (April)

The funds slipped to marginally net short GBPUSD again during the week ending April 23, after flipping to a net long position during the week prior. We think their short covering in early April was ill-timed, and it looks like they’ve been forced to re-enter ever since the market fell back below chart support in the 1.3020s. EURGBP is trading bid this morning, and is holding trend-line support in the 0.8620s, as traders likely anticipate the month-end demand that we typically see in this cross. We think GBPUSD will likely pressure chart support in the 1.2880s early this week.

-

AUDUSD: The Australian dollar is showing a similar pattern to EURUSD and GBPUSD so far this week, but with even less volatility. It’s been a very quiet start to the week, with AUDUSD largely hugging both sides of Friday’s trend-line chart resistance level in the 0.7050s. That being said, we expect tonight’s activity to be a bit more eventful as China will be reporting its widely following PMIs (both Manufacturing and Services, for the month of April). We think that any surprise uptick (like what we witnessed last month) will invigorate a global "risk-on" trade heading into the Fed decision on Wednesday. Such a result would likely also see AUDUSD surpass chart resistance in the 0.7070s. The Australian economic calendar will be relatively uneventful this week, with just the March Building Permits data out on Thursday night. This will likely leave the focus squarely on the broader USD’s reaction to the China PMIs and the Fed this week.

-

USDJPY: Dollar/yen is understandably trading very quietly to start the Golden Week holidays in Japan. The nation will be on holiday until May 7, which will now leave the markets with much less liquidity than normal during the Asian time zone. A prominent FX analyst commented comically overnight: “ Day 1 of Japanese Golden Week market holiday passes without a flash crash. 5 to go”. The leveraged funds at CME extended their net long USDJPY position during the week ending April 23 by trimming shorts and adding longs. It will be interesting to see this Friday how they’ve shifted their positions after last week’s bearish reversal off the 112.40 area. We think the market will attempt a move to the upside early this week if the USD continues its broad-based bid, however we think how US yields respond to the Fed on Wednesday will be the more important driver of price action later this week. We would note that Europe will also be out on Wednesday due to the May Day holidays, which could make liquidity around the Fed decision quite poor.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

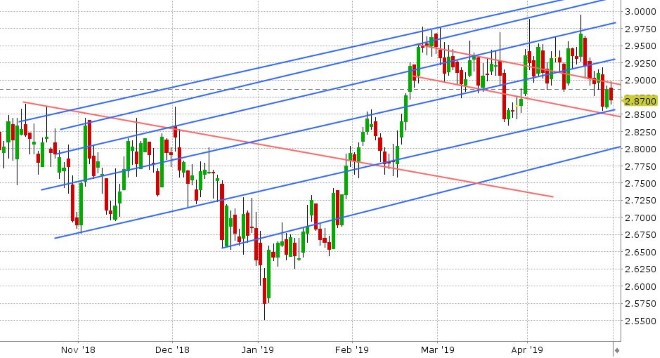

S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com