USDCAD continues higher ahead of Bank of Canada meeting

Summary

-

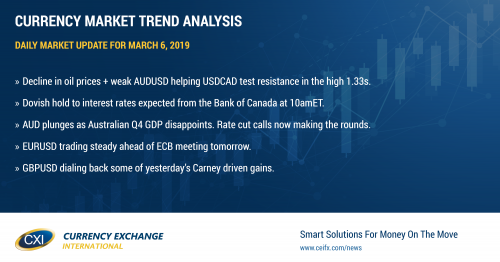

USDCAD: Dollar/CAD continues higher this morning as crude oil prices pull back again and the Aussie plunges lower. April crude rejected the $57 handle yesterday and it’s been a slippery slope downward for the commodity ever since. We think today’s OECD downgrade of 2019 global growth forecasts from 3.5% to 3.3%, a massive 7M barrel build in last night’s weekly API oil inventory figures, and memories of Friday’s bearish engulfing candle pattern on the oil chart are all not helping here. The Australian dollar is getting smacked lower following a triple whammy of negative developments (more on this below). Combine this with some broad USD buying witnessed elsewhere overnight and we’re looking at a USDCAD market that continues to trend higher. The US has just reported +183k jobs gained in its February ADP employment report, which narrowly missed expectations of +189k. Up next is the Bank of Canada interest rate decision at 10amET, where traders are expecting a dovish hold on interest rates. We’ll be paying close attention to see if the following wording in January’s statement is revised: “…the policy interest rate will need to rise over time…”. Option traders are expecting a 60-70pt intra-day range for today’s trade, if we look at overnight at-the-money straddle pricing. We think USDCAD could continue higher into the 1.34s should the Bank of Canada deliver an even more cautious outlook. Expect a meaningful pullback to the low 1.33s should they sound optimistic for some reason (market is not positioned for this). The latest COT data from the CFTC (futures positioning as of Feb 26th) shows a fund community that continues to bet on a higher US dollar. The EIA reports its weekly oil inventory report at 10:30amET, with traders looking for a build of 1.4M barrels.

-

EURUSD: Euro/dollar is dribbling lower this morning after yesterday’s better than expected US Non-Manufacturing ISM figures inspired broad based USD buying and knocked the market below trend-line support in the 1.1310s. The selloff in AUDUSD overnight and the rally in USDCNH back above the 6.71 mark is not helping the EURUSD vibe here in our opinion either. The slightly weaker than expected US ADP jobs report has now seen selling down into trend-line support at the 1.1280s, but buyers have swooped in quickly. We think the 1.1285-1.1310 range becomes the pivot for price action heading into the ECB meeting tomorrow morning. Expect some short covering should we trade above and further selling should we trade below. The latest COT data from the CFTC shows the funds remain net short EUR since September 2018.

-

GBPUSD: Sterling is consolidating yesterday’s bounce off the 1.3100 level this morning, which is not too surprising considering the broad USD buying theme today and the GBPUSD’s hourly downtrend since Feb 27th. Bank of England (BOE) governor Mark Carney breathed some life into the pound yesterday when he commented that the “market path of BOE rates may not be high enough”. We think the BOE’s steadfast optimism on the UK economy (post a successful Brexit resolution) and the persistent fund short position in GBP futures could continue to support GBPUSD on dips. The EU’s chief Brexit negotiator Michel Barnier confirmed today the rumors from yesterday that “no solution” has been found to break the deadlock over Brexit. More here.

-

AUDUSD: The Australian dollar is suffering from a deluge of negative headlines this morning. While yesterday afternoon’s bounce back above the 0.7070s inspired some optimism heading into the NY close, the RBA’s Lowe was quick to douse this out by commenting that it’s hard to think of a scenario where rates rise this year. Then came the miserable Q4 GDP figures out of Australia, which on the surface didn’t look that bad (+0.2% vs +0.3% expected), but upon further review showed slowing consumption from households and reduced investment from businesses. Finally, to add insult to injury, more and more sell-side financial institutions are coming out today with calls for RBA rate cuts this year; with some predicting this could occur as early as July. Traders broke AUDUSD below chart support in the 0.7070s amidst all the headlines and are now attacking the next major support level in the 0.7020-30 area. We think this level will become today’s pivot for price action. Trade back above and we might see some short covering, but break below and we could see another flood of selling down to the 0.6940s.

-

USDJPY: The dollar/yen chart is not looking so hot this morning after buyers failed to push the market above trend-line resistance in the low 112s yesterday. This failure occurred despite a stronger than expected US Non-Manufacturing ISM figure for February, which is also a little disconcerting. The S&P futures and US 10yr yields are trading moderately lower this morning. We think USDJPY may move lower again now in search of buyers.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

April Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com