Australian dollar plunges off overnight highs

Summary

-

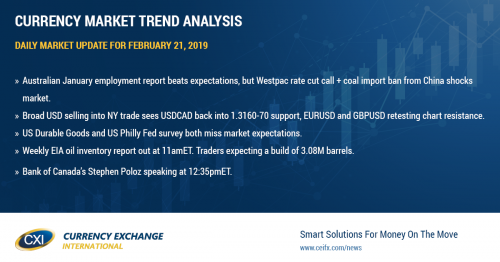

USDCAD: Dollar/CAD couldn’t muster a bounce during the early part of NY trade yesterday as oil prices continued their rally. Talk of production cuts from Nigeria appeared to be the catalyst; taking the April contract comfortably above trend-line resistance at the $57 level. The FOMC Minutes came to the rescue for the broader USD and USDCAD during afternoon trade however, as the tone of the Fed member commentary behind closed doors wasn’t as dovish as the FOMC’s most recent press conference. Two swift selloffs for AUDUSD during Asian trade then helped USDCAD recover back above trend-line support in the 1.3170s, but some EURUSD dip buying in Europe so far today is erasing that progress. A bunch of economic figures have just been reported:

US Philly Fed (February) : -4 vs +14 exp. BIG MISS.

US Durable Goods (December) : +1.2% MoM vs +1.7% exp. Ex. Defense/Air -0.7% MoM vs +0.2% with negative revision to Nov. NOT A GREAT REPORT, BUT OLD DATA NOW.

Canadian Wholesale Sales (December) : +0.3% MoM vs -0.2% exp. NOT BAD.

The weekly EIA oil inventory report comes out at 11amET, and finally we’ll get Bank of Canada governor Stephen Poloz speaking at the Montreal Chamber of Commerce at 12:35pmET. We think the sellers remain in charge here for USDCAD so long as we stay below the 1.3170s. A break back above could inspire some short covering into the low 1.32s, but continue to stay below and we could be looking at further selling into the 1.3090-1.3120 level.

-

EURUSD: Euro/dollar is trading range-bound this morning after yesterday’s breakout attempt above the 1.1350s failed when the “less dovish than expected” FOMC Minutes were released. This saw the market pull back down below this key trend-line resistance level into the NY close, and it is this price level which has capped overnight price action as well. Buyers have been nibbling at chart support in the 1.1320s however, but on the whole we’ve had a relatively narrow range. The German and Italian CPI figures for January were both reported in-line with expectations today (+1.4% MoM and +0.1% MoM respectively). The Markit PMI data out of France, Germany and the broader Eurozone was arguably mixed (stronger than expected in Services but weaker than expected in Manufacturing). EURUSD is now attempting to break back above the 1.1350s following the weak US Philly Fed/Durable Goods data points. We think this now puts the buyers back in charge following Tuesday’s bullish daily reversal.

-

GBPUSD: Sterling is trading amazingly bid this morning as yesterday’s touted meeting between Theresa May and Jean Claude Juncker failed to produce anything of substance for markets. More here on the meeting. The FOMC Minutes saw GBPUSD pull back below the 1.3070s (the level the market broke above into the London close). A Reuters headline, citing a UK government source, crossed around the 6amET hour this morning saying it’s unlikely we will have a Brexit deal by next week, but buyers swooped in at the lows anyways. Traders are now digesting headlines from the EU’s Timmermans, as he gives his opinion on the Brexit situation, and the latest negative economic headlines out of the US. Chart resistance in the 1.3070-80s is being challenged yet again.

-

AUDUSD: The Aussie is grabbing all the headlines today as a crazy overnight session saw the market trade in a 100pt+ range. Tuesday’s bullish daily reversal and yesterday’s decent NY close above 0.7160 set the market up for further upside movement. We then got a pretty swift move up to trend-line resistance in the 0.7210s when Australia reported a blockbuster employment report for January (+39.1k jobs vs +15k expected). What followed however was a double-whammy of surprises for the market. Westpac, one of a Australia’s major banks, slashed its GDP growth forecast for the nation and made a bold call that the RBA will be forced to cut interest rates twice this year. These headlines crossed shortly after the Aussie jobs report and send the market sharply back lower in the 0.7150-60s (the NY range). Then came the shock headline out of China that its Dalian port is now banning Australian coal imports indefinitely (leading many market participants to speculate that this is Chinese retaliation to Australia deciding last year to bar Huawei from enhancing the nation’s 5G wireless network). AUDUSD collapsed lower on the headlines and smashed through support in the 0.7120s. Some buyers have stepped at trend-line support in the 0.7080s, but the daily chart technicals have taken a turn for the worse here we’d argue. We think we could see continued selling should the 0.7120-50 range not be regained in short order.

-

USDJPY: Dollar/yen is trading steady this morning; tracking the overnight ebbs and flows of the S&P futures, but with barely any volatility. Japan reported it February Manufacturing PMI below 50 again (signaling contraction), but it had no effect on the market. Chart support in the 110.50s continues to hold, which is a positive for USDJPY. The S&Ps have now given up all their overnight gains though, which could spur further selling (pressure on USDJPY) into NY trade this morning.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

April Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com