Bank of England keeps rates on hold with 7-2 vote

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

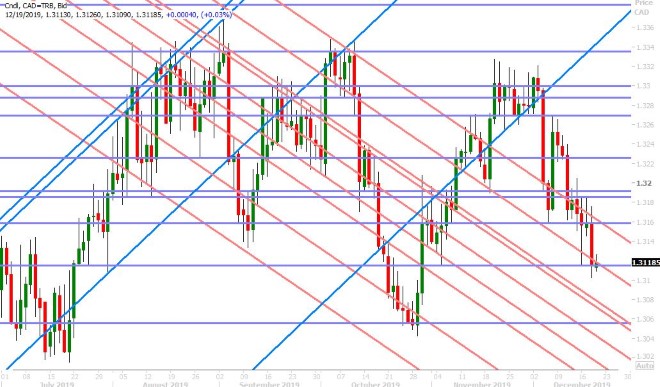

USDCAD

Dollar/CAD broke down to begin a new downtrend yesterday. While we felt the market’s 40pt move lower (on the back of the 10yr high for Canadian median core CPI) was a bit of an overreaction, it was hard to argue to with USDCAD’s deteriorating technical outlook heading into the report. The market had already given up 1.3150-60 chart support and so the subsequent fall to the 1.3110s was the path of least resistance in our opinion. Traders have now stalled the market at this level, and it’s been this way since the NY close yesterday. The overnight news flow has been dominated by Trump impeachment headlines and while we’d argue markets don’t care one bit about this political charade going on in Washington, we think at the very least it’s distracting traders a little bit this morning.

USDCAD DAILY

USDCAD HOURLY

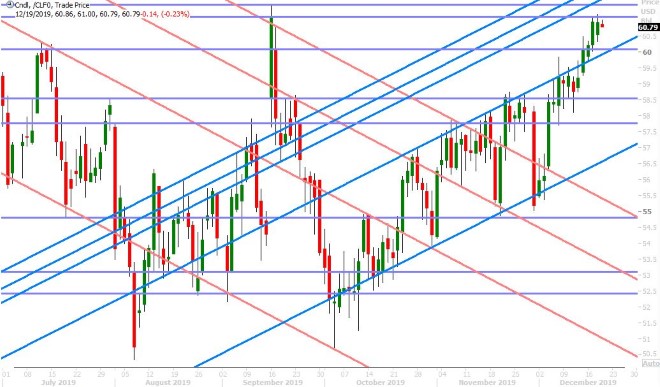

JAN CRUDE OIL DAILY

EURUSD

Euro/dollar bounced marginally in Asian and early European trade today as US 10yr yields dialed back some of yesterday’s gains, but the market has reversed back down to the low 1.11s as yields gun for the 1.95% level. To be quite honest, we don’t know what global bond traders are cheering about over the last 24hrs. Both the German bund yield and the US 10yr yield are on the cusp of major upside breakouts (above 1.95% and -0.22% respectively) and so we have to ask ourselves…is some big “risk-on” headline coming? This could be big trouble for EURUSD.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

The Bank of England kept interest rates on hold at 0.75% this morning with a 7-2 vote. This was the market expectation and the two dissenting votes came once again from Michael Sounders and Jonathan Haskel. What’s been a little challenging to digest however is the BOE’s forward guidance, which sounds all over the place this morning. Take these two, seemingly divergent, almost wishy-washy, takes on what may happen next:

- IF GLOBAL GROWTH FAILS TO STABILISE OR BREXIT UNCERTAINTIES REMAIN ENTRENCHED, MONETARY POLICY MAY NEED TO REINFORCE EXPECTED UK RECOVERY

- IF RISKS DO NOT MATERIALISE AND ECONOMY RECOVERS BROADLY AS EXPECTED, SOME MODEST TIGHTENING OF POLICY, AT GRADUAL PACE AND TO LIMITED EXTENT, MAY BE NEEDED

Here are some examples of what sounds like a rather balanced outlook going forward. These two headlines don’t sound great…

- CAN'T TELL YET HOW MUCH POLICY UNCERTAINTIES FOR COMPANIES AND HOUSEHOLDS HAVE DECLINED SINCE ELECTION

- BOE STAFF CUT FORECAST FOR UK GDP GROWTH IN Q4 TO +0.1% QQ (NOV FORECAST +0.2% QQ)

…but these two sound relatively more positive.

- GLOBAL GROWTH HAS SHOWN TENTATIVE SIGNS OF RECOVERY SINCE MPC'S NOVEMBER MEETING

- PARTIAL DE-ESCALATION OF U.S.-CHINA TRADE WAR GIVES SOME ADDITIONAL SUPPORT TO OUTLOOK

So naturally, sterling has been all over the place since 7amET as well; lower initially, then higher, and now lower again. We would sum up the market’s reaction so far as a “ok, thanks for nothing Mark Carney…let’s stick with the current downtrend” sort of move. The market lost chart support in the 1.3110s yesterday and it failed three times since then to regain it; one attempt of which came after this morning’s BOE announcement. We think this negative technical development alone (what we call repeated buyer failure) is enough to explain why GBPUSD is now trading in the 1.3040s.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

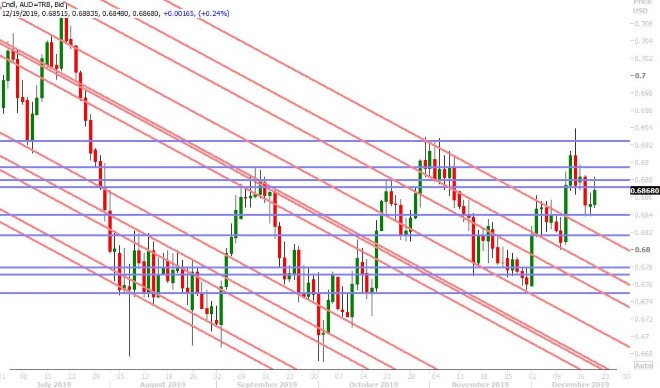

AUDUSD

The Aussie got a nice boost in the Asian session last night after Australia reported a better than expected November employment report. The headline job gain of 39.9k beat estimates of +14k, and the unemployment rate ticked down unexpectedly from 5.3% to 5.2%. This bit of economic news, plus a looming 1.1blnAUD option expiry at 0.6875, was enough to send AUDUSD higher to the 0.6870s in our opinion (Friday and Monday’s chart support level), but the market has been struggling ever since (as this level is now chart resistance). We’ve also seen selling pressure come in once again for EUR and CNH this morning, which are AUD negatives.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

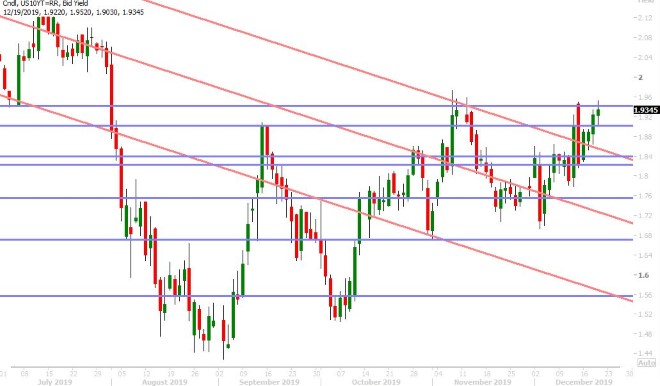

The US 10yr yield and USDJPY have taken a bit of a hit here following the release of a weaker than expected US Philly Fed survey for the month of December (0.3 vs 8.0). While this is just one negative data point, and comes after a barrage of risk-on headlines over the last week, we think it could be enough to derail a potential upside breakout in global bond yields. The USDJPY daily chart, in particular, is now poised to form a bearish outside reversal…given last night’s head-fake above 109.60 and where we’re trading right now. The Bank of Japan meeting was a non-event as usual last night as governor Kuroda reiterated his resolve to keep monetary policy extremely accommodative. More here from Reuters.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com