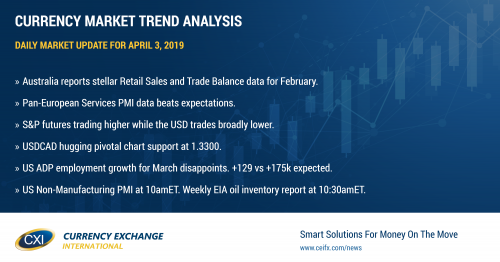

Better than expected Australia and European data propels risk sentiment higher today

Summary

-

USDCAD: Dollar/CAD is trading on the defensive again this morning after yesterday’s oil and AUD driven bounce fizzled out at Fibonacci chart resistance in the 1.3370s. There’s a broad improvement in risk appetite today following better than expected Retail Sales and Trade Balance data out of Australia last night, stronger than expected Services PMI data out of Europe today, and a report out of the Financial Times this morning claiming that the US and China are 90% of the way there on a trade deal. One could argue the FT’s article is known news and it’s really the final 10% which is of utmost importance now, namely the enforcement mechanisms and the removal of current tariffs. The US ADP Employment Report for March was just released and the numbers MISSED expectations (+129k jobs gained vs +175k). Next up is the US Non-Manufacturing PMI at 10amET, where traders are expecting a read of 58.0 for March. Finally, we’ll get the weekly EIA oil inventory report at 10:30amET, and the consensus estimate here is for a draw of 0.9M barrels. Last night’s API oil inventory report disappointed the bulls a little bit, as it showed a larger than expected increase in oil stocks over the last week. We continue to believe that the 1.3300 level is now pivotal support for USDCAD. A break below could invite swift selling into the low 1.32s.

-

EURUSD: Euro/dollar is seeing a bounce this morning for a change, and we have some better Australian and European data to thank for that. The market followed AUDUSD higher in Asia, broke chart resistance in the 1.1220s ahead of European trading today, and then continued rallying after Germany, France, Italy and Spain all reported better than expected Services PMI numbers for the month of March. Trend-line chart resistance in the 1.1250s is capping prices now however and we think the market might go on the hunt for buyers once again here.

-

GBPUSD: Sterling is following EURUSD higher this morning, as traders now await what Labour leader Jeremy Corbyn will do after Theresa May extended another olive branch to her political opponent yesterday. The NY close was half decent, with GBPUSD extending past chart resistance in the 1.3120s and the market is now testing chart support (formally resistance) in the 1.3160s. We think the market could drift higher here should this level hold.

-

AUDUSD: The Aussie is roaring back today after Australia reported much better than expected Retail Sales data (+0.8% MoM vs +0.2%) and a record trade surplus (4.801blnAUD) for the month of February. The AUDUSD chart has now erased all of yesterday’s bearish price action following the neutral hold on interest rates from the RBA. The fact that over 1.3blnAUD in options expire at the 0.7100 strike this morning appears to be holding the market back a little bit here as NY trading gets underway, but we think a close above the 0.7110s will encourage further buying.

-

USDJPY: Dollar/yen tried to break out overnight amidst the broad risk-on bid that followed the very positive Australia data, but overhead chart resistance in the 111.50-60 area has proved formidable for the market so far today. We’re now seeing some moderate selling as the US ADP Employment report for March disappoints. Over 2.3blnUSD in options expire at the 111.15 strike this morning, which could act as a weight heading into 10amET. We’re paying close attention today to how the S&P futures respond to chart resistance at 2886, as we think this level could be pivotal for the direction of near term risk sentiment more broadly.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com