Canadian April employment report in focus. Tariffs raised on China overnight, but US/China talks set to continue.

Summary

-

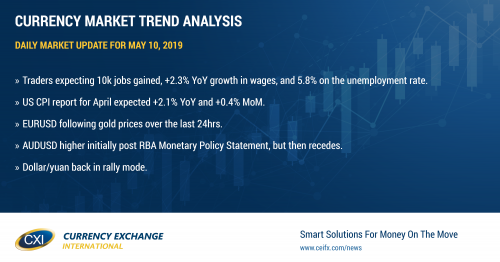

USDCAD: Dollar/CAD is trading with a bid tone this morning as traders await the April Canadian employment figures at 8:30amET. The consensus estimate is for 10k jobs gained, +2.3% YoY growth in wages, and 5.8% on the unemployment rate. The US CPI numbers for April will be coming out at the same time, and the expectation here is +2.1% YoY and +0.4% MoM on the headline, and +2.1% YoY and +0.2% MoM on the core read. US/China trade talks concluded yesterday without a deal, and so tariffs formally increased to 25% on $200bln worth of Chinese imports overnight. Chinese stocks and the yuan moved higher initially in Asia funny enough, as it was reported by Bloomberg that Chinese state funds were behind the sudden bid in stocks. However, all this is reversing now as negativity starts to creep back in ahead of continued trade talks in Washington today. China has vowed to retaliate against the increase in tariffs, but they are not saying much else yet other than clearly saying they will not weaponize the yuan. USDCAD sits above trend-line support in the 1.3450s, which is still technically positive. We think a weaker than expected Canadian employment report could be the catalyst that sees the USDCAD rally continue into the 1.35s.

-

EURUSD: Euro/dollar has inched above trend-line resistance in the 1.1220s this morning, and this continues yesterday’s gold driven spike higher we feel. June gold prices came to life when the S&Ps traded down 50 handles at one point and we saw EURUSD spike higher at the same time. The S&P futures are on the defensive again this morning after hitting resistance at the 2886 level overnight, gold is mildly bid again, and so is the Euro. The Italian Industrial Output and Retail Sales reports for March both missed expectations this morning, but this negative data was largely brushed aside. With EURUSD clearly showing its ability to withstand broad, risk-off, USD buying flows this week, we think there’s a risk of a short covering rally here should the S&Ps break below 2836 and should June gold prices break above 1292.

-

GBPUSD: Sterling is doing a whole lot of nothing this morning, as traders are stuck in a mess of chart support/resistance in the 1.3000-1.3030 zone. The UK reported better than expected Manufacturing and Industrial Production figures for the month of March this morning, but the GDP figures for the same month missed expectations. EURGBP traders look content to keep the market glued to upcoming option expiries in the 0.8630s. We think GBPUSD needs to get back above the 1.3030s before the selling pressure will abate.

-

AUDUSD: The Aussie spiked a little higher last night following the RBA’s quarterly Monetary Policy Statement, but quickly receded after the Australian central bank cut its growth/inflation forecasts and said “forecasts made on "technical assumption" rates follow market pricing of two cuts to 1 pct. Full text here. We think AUDUSD stays on the defensive here, especially if USDCNH continues to rally.

-

USDJPY: Dollar/yen has had a choppy overnight session, and is now treading water head of the US CPI report for April. We think the market technicals remain weak here and we wouldn’t be surprised to see yesterday’s lows (109.40s) tested once again. The next major chart support level comes in at the 109.05-15 area.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

June Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

July Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

S&P 500 Daily Chart

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com