Canadian Retail Sales on deck

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

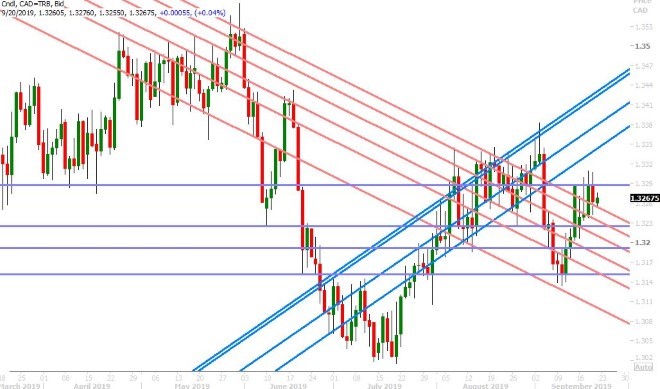

USDCAD

Dollar/CAD regained the top of the 1.3230-50 trend-line support zone at the close of NY trade yesterday as oil markets ultimately didn’t fall for Pompeo’s war mongering against Iran. This has helped stem the post-Fed selling in USDCAD, but traders have one more headline to deal with before they can call it quits for what’s been a busy week of headlines. Canadian Retail Sales for July will be reported shortly at 8:30amET and the market consensus is for a gain of 0.6% MoM, +0.3% ex. Autos.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar continues to struggle at trend-line chart resistance in the 1.1060s this morning, and the more the market keeps failing here (5th time already this week), the more we’re loosing confidence in the market’s attempt at a bottoming pattern. Last Thursday’s bullish outside day recorded post ECB was positive, as was Tuesday’s strong bounce off trend-line support in the 1.0980s, but EURUSD’s repeated inability to close above the 1.1060s is concerning in our opinion. Today’s slump since the start of European trade seems to be GBPUSD driven, as sterling traders have second thoughts on yesterday’s breakout above 1.2500. Germany reported weaker than expected PPI figures for the month of August earlier today (-0.5% MoM vs -0.2%), but the numbers we’re market moving.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling looks set to completely reverse yesterday’s upside breakout above the 1.2500 level this morning. The sense we’re getting from market chatter is that Sky News cherry picked positive sounding headlines from its interview with Jean Claude Juncker yesterday, and that the sad reality of the current Brexit stalemate will come to light once again when the full interview airs on Sunday. GBPUSD has smashed back down through the 1.2500 level as we type, and is now testing a horizontal support level in the 1.2470s. We think a NY close below the 1.2500 will be super disappointing for the bulls and could lead to more GBP selling to start next week.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

Boy, what a difference a dovish sounding RBA Minutes, a Fed disappointment, and a 0.1% rise in the Australian unemployment made for the AUDUSD market this week. We started the week with decent, albeit not great, chart technicals…but things really fell apart when these negative fundamental developments put repeated pressure on trend-line support in the 0.6840s. With this level now broken and RBA rate cut odds surging once again for October 1st (78% now vs 25% at the start of the week), we think AUDUSD will continue to struggle here into next week. The next major chart support level comes at the 0.6750 level.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is struggling this morning as well, after traders failed to reverse the post-Fed negative reversal and close NY trade above the 108.10 level yesterday. US 10yr yields are providing some support though as they have yet to take out their pre-Fed lows of 1.7430%. All eyes are on the repo and effective fed funds markets again this morning as traders await the results of the NY Fed’s next emergency repo operation ($75blnUSD being offered up again today). Today will also feature what’s known as “quad” witching in the stock market, where once a quarter we’ll get the simultaneous expiration of contracts for stock index futures, index options, stock options and single stock futures. With over 8blnUSD notional expiring at the S&P 3000 strike today at the market currently at 3010, expect perhaps a slightly negative drag on USDJPY at some point today.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com