Currency Market Trend Analysis: May 7, 2018

By The Numbers: Your FX Week In Review

Currency Calendar

| Date | Releases / Holiday | |

|---|---|---|

| May 7, 2018 | Sentix Investor Confidence | EUR |

| May 7, 2018 | BoC Gov Council Member Lane Speech | CAD |

| May 8, 2018 | Housing Starts | CAD |

| May 9, 2018 | RIC Housing Price Balance | GBP |

| May 10, 2018 | Manufacturing Production MoM/YoY | GBP |

| May 10, 2018 | Total Trade Balance | GBP |

| May 10, 2018 | BoE Interest Rate Decision | GBP |

| May 10, 2018 | New Housing Price Index MoM/YoY | CAD |

| May 10, 2018 | BoC Review | CAD |

| May 11, 2018 | Consumer Price Index MoM/YoY | EUR |

| May 11, 2018 | Unemployment Rate | CAD |

Upcoming bank holidays and impactful report releases for select countries.

Market Analysis

Canadian Dollar

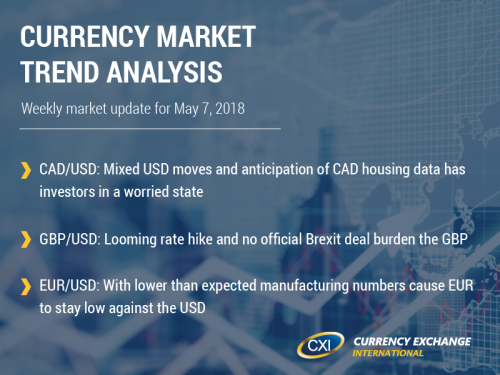

CAD/USD opened last week at 0.7798 and closed at 0.7785 – depreciating by 0.17% due to mixed USD data and anticipations rising for housing data and employment rates in Canada.

First thing on officials and traders mind is the NAFTA agreement. There still hasn’t been enough progress to sign a deal. With Mexico’s elections underway we may see some headway after. But for now, a break seems more likely until they the election is final.

In Canada the housing sector has been getting more and more attention especially with how Toronto’s market has been. Housing starts are expected to decline while building permits are expected to increase and help the recovery of the housing market. On Thursday a better picture will be painted on how this is going to affect the CAD.

All eyes and ears will be on Lane’s speech on Monday. This speech should give insight on the rest of the data to be coming out of Canada this week.

1. BoC Gov Council Member Lane Speech: Monday, May 7th

2. Housing Starts: Tuesday, May 8th

3. New Housing Price Index MoM/YoY: Thursday, May 10th

4. BoC Review: Thursday, May 10th

5. Unemployment Rate: Friday, May 11th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

British Pound

GBP/USD opened last week at 1.3775 and closed at 1.3530 – depreciating by 1.78% due to looming rate hike in the horizon.

With disappointing UK macroeconomic indicators, it has brought the GBP down along with the looming possibility of a rate hike on Thursday by the Bank of England. Also on the other side of the pond the US Federal Reserve has confirmed that inflation indices are nearing their targeted levels and their monetary policy are normalizing.

Also in the UK Home Secretary Rudd stepped down in light of the immigration scandal. Also with him stepping down, Sajid Javid replaced him. This has shifted the IK government and now there is another Brexit hardliner in the midst.

1. RIC Housing Price Balance: Wednesday, May 9th

2. Manufacturing Production MoM/YoY: Thursday, May 10th

3. Total Trade Balance: Thursday, May 10th

4. BoE Interest Rate Decision: Thursday, May 10th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

European Central Bank Euro

EUR/USD opened last week at 1.2132 and closed at 1.1965 – depreciating by 1.38% due to falling manufacturing numbers.

With negative news coming out of the EU has caused the EUR to decline against the USD. The Ireland boarder is still a big topic for the Brexit negotiations. No outcome has been made in that front and with a shift in the UK government might cause a longer Brexit probational period. This has caused investors to remain cautious with the EUR.

News coming out of the EU this week a quite but the investor confidence report coming out on Monday and more data coming from Germany, and the CPI on Friday, will guide the direction of the EUR.

1. Sentix Investor Confidence: Monday, May 7rd

2. Consumer Price Index MoM/YoY: Friday, May 11th

Forex Charts powered by Investing.com

Forex Charts powered by Investing.com

Get more Currency Market Trend Analysis >>

Sign up to get CXI's Currency Market Trend Analysis sent to your inbox weekly >>

FX Market Pro

Corporations & Financial Institutions: Want to get ahead of the curve for the upcoming week? Get CXI's currency market trend analysis sent directly to your inbox weekly.

Sign UpAbout the Author

Remon Shehata - Data Analyst

Remon educates corporate clients on foreign currency markets lending industry best practices that enhance client knowledge and create specialized solutions that fit each business. Interested in having a custom international payments strategy or foreign exchange risk plan? Request A Call

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com