Dismal US ISM report invigorates Fed rate cut trade

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

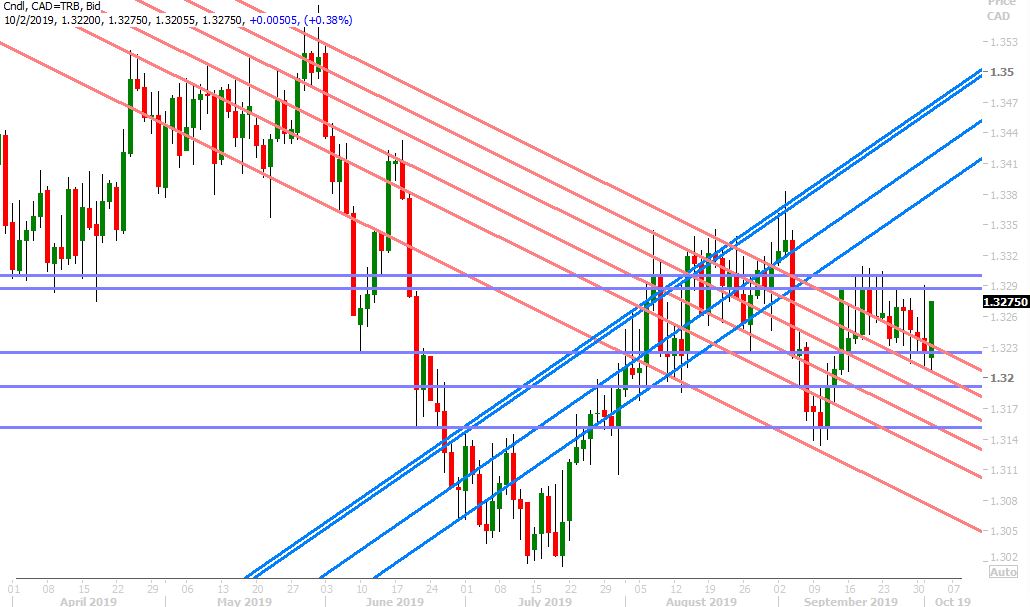

USDCAD

Dollar/CAD fell apart yesterday after the US ISM Manufacturing figures for September were reported at their worst level since June 2009. The selling continued in quiet Asian trade overnight after the market could not regain the 1.3225 support level into the NY close, but we saw some broad USD buying come in during early European trade today following IFO’s downgrade of 2019 German GDP growth to just 0.5% from 0.8% in the spring. More here from CNBC. Some vigorous EURCAD buying has since taken the lead though into the NY session, which has us searching for a CAD-negative headline. The US reported its ADP Employment Report for the month of September and the numbers missed expectations (+135k vs +140k), plus showed a negative 38k revision to August’s job gains. The initial reaction for the broader USD appeared to be one of mild relief that the numbers weren’t worse following yesterday’s weaker than expected Employment Index component to the US ISM report (US yields and USD slightly higher) but this knee jerk move higher has now faded (with the exception of USDCAD). We think USDCAD could be very choppy today within the familiar 1.3220-1.3280s range.

USDCAD DAILY

USDCAD HOURLY

NOV CRUDE OIL DAILY

EURUSD

The awful US ISM Manufacturing numbers caused the EURUSD shorts to quickly cover into chart resistance at the 1.0930s yesterday, but today’s downgrade of German GDP growth from the IFO Institute gave another gut shot to the market. Sellers took over at the European open, driving EURUSD back down to yesterday’s chart resistance (now turned support) at the 1.0905 area, and funny enough some buyers returned at that level. The weak US ADP Employment Report saw EURUSD dip initially, but it appears reality is sinking in. We think chart resistance at the 1.0930s might get challenged again today.

EURUSD DAILY

EURUSD HOURLY

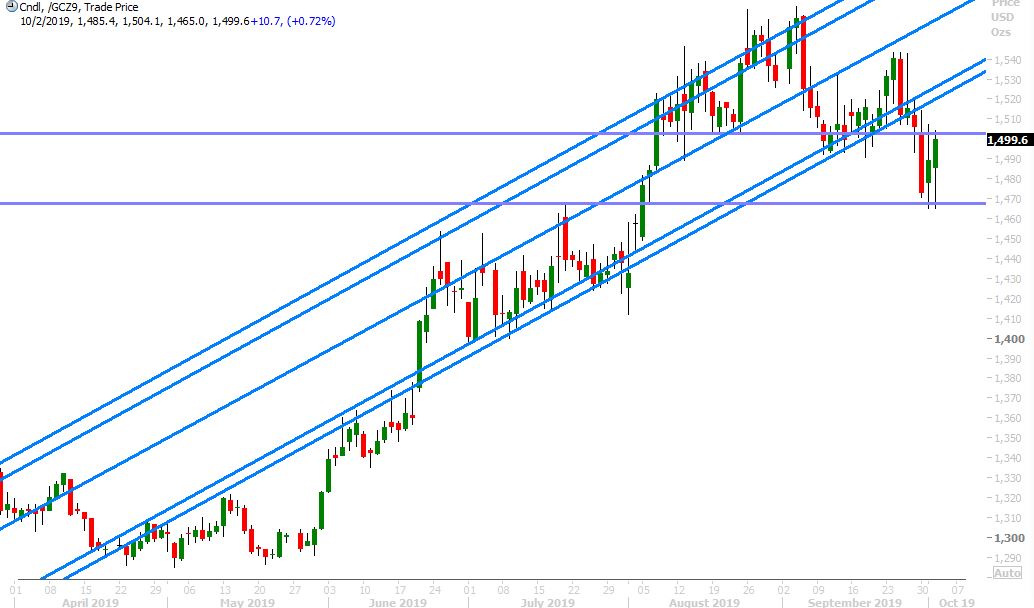

DEC GOLD DAILY

GBPUSD

Sterling enjoyed a swift bounce yesterday following a Bloomberg report that suggested some EU governments have discussed offering the UK a time-limit on the contentious Irish border backstop. However, the response from the Irish and other EU officials hasn’t been positive since this story broke, and so angst is rising again today as Boris Johnson is set to present his new Irish backstop plan to the EU. More here from the Guardian. The UK reported a weaker than expected Construction PMI for September this morning (43.3 vs 45.0) and while this was arguably the impetus for the further drop in GBPUSD to chart support in the 1.2220s, we’ve since seen some buyers return here as well.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie found some relief following the dismal US ISM numbers reported yesterday, but it appears today’s EURUSD selling in Europe gave traders an excuse to sell rallies in this renewed down-trend for the market post the RBA meeting. We think the 0.6680s will be pivotal for AUDUSD today. A move back above this trend-line could stem the selling temporarily.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

It’s gone from bad to worse for USDJPY today as the “Fed rate cut trade” gets some renewed vigor following yesterday’s awful US ISM report. US 10yr yields have shaken off yesterday’s JGB drama and are now trading firmly back below chart support at the 1.65% level; the December Eurodollar futures are now trading comfortably back below a 2% implied fed funds rate for year's end; and gold prices continue to rally this morning. With yesterday’s bearish daily reversal on the USDJPY chart and with the market now falling back below chart support at 107.50, we think the sellers have the upper hand at the moment.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com