Dollar trading mixed to start holiday shortened week

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- AUD and CAD outperforming as equity investors cheer silver lining in Spanish & Italian coronavirus death statistics.

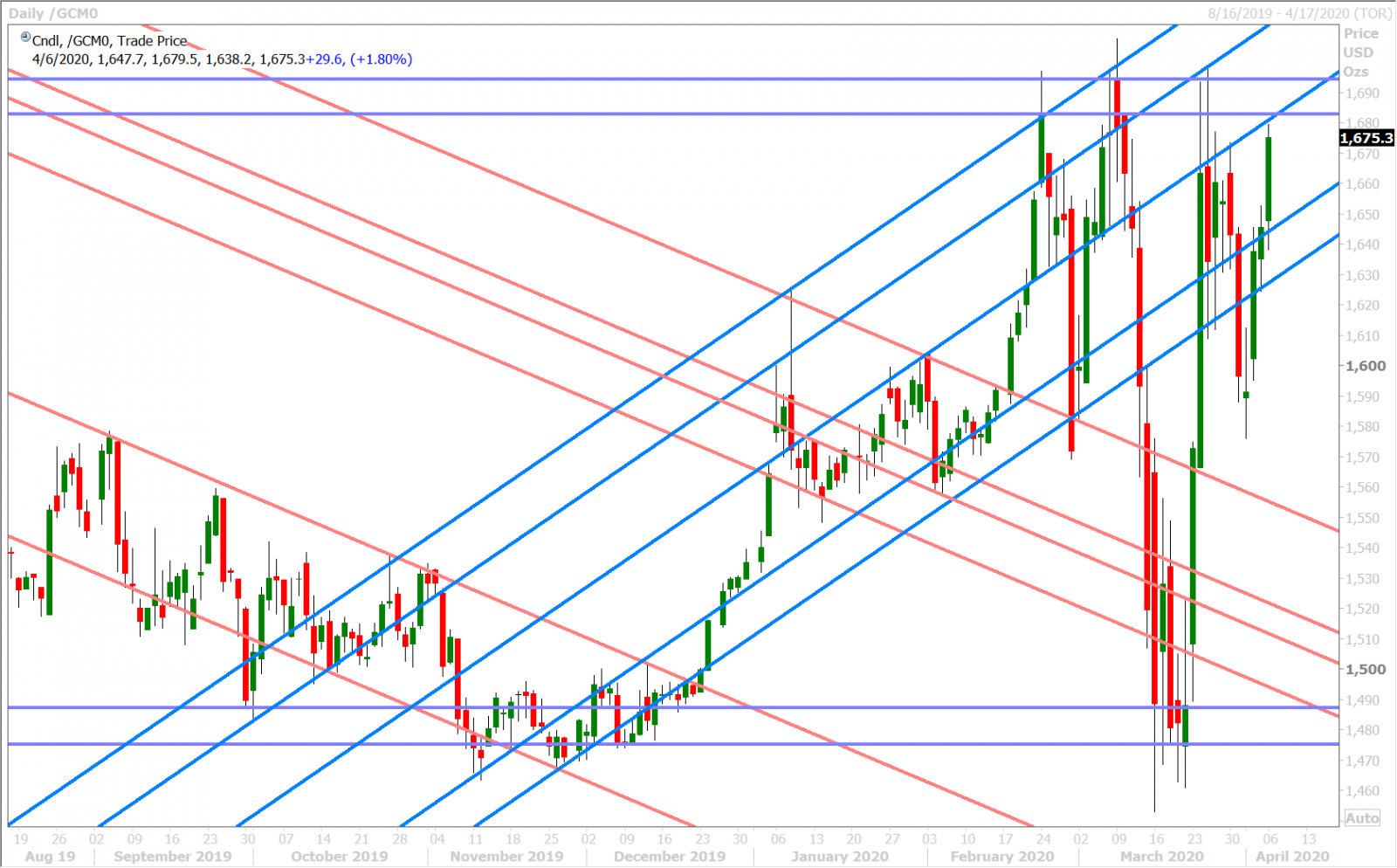

- Oil opens 10% lower after Saudi Arabia/Russia spat pushes today’s OPEC+ meeting to Thursday, but S&P rally helps it recover.

- EURUSD traders focused on the negatives: deadliest week ahead expected for US, widening CCBS, increase in fund long position.

- GBPUSD lagging on 1.2290 support break from Friday + UK PM Boris Johnson being admitted to hospital.

- USDJPY breaks above 108.60s as Japan set to declare state of emergency in seven prefectures. PM Abe expected to confirm tomorrow.

- Bank of Canada to release Q1 2020 Business Outlook Survey at 10:30amET. RBA meets at 12:30amET tonight.

- Canada to report its March Employment Report on Thursday. North American markets to be closed for Good Friday on April 10.

ANALYSIS

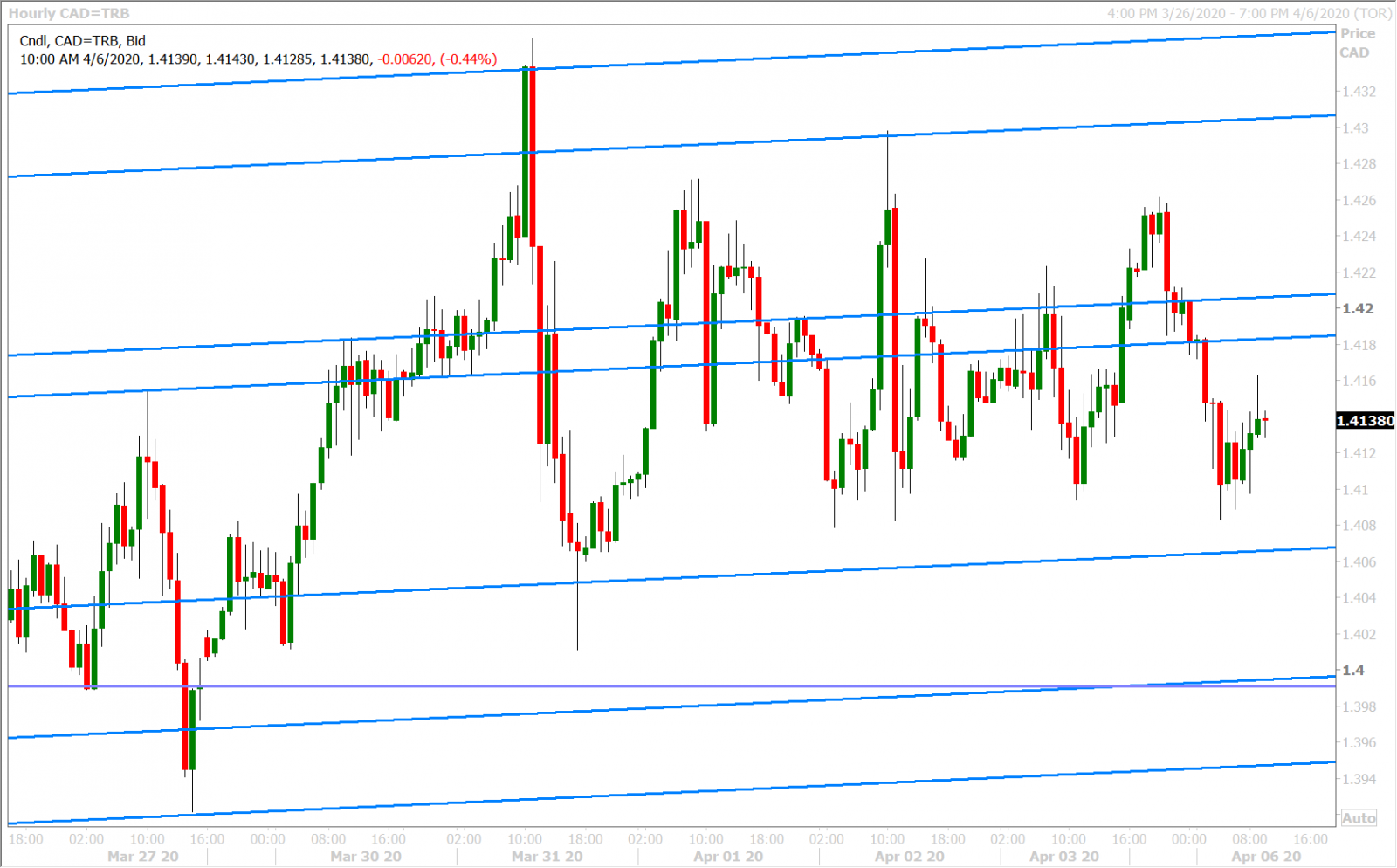

USDCAD

Dollar/CAD gapped higher at the Sunday open after a war of words over the weekend between Saudi Arabia and Russia forced a delay of today’s planned OPEC+ meeting and led to a 10% drop in May WTI crude prices last night. More here from Bloomberg.

The negativity was short lived however as the S&P futures opened higher, and market chatter suggested this was because of a reduced pace of coronavirus deaths over the weekend in Spain and Italy. Traders are clinging to the slightest of silver linings here in our opinion, but it was enough to spur the Nikkei over 4% higher last night and lead European equities higher this morning as well. This broad improvement is risk sentiment has also allowed May WTI to recoup most of its losses (now down just 4%) and it has also brought about another slump for USDCAD back below the pivotal 1.4185-1.4205 zone (formally 1.1480-1.4200 because of the upward sloping nature of the trend lines that created it).

Odds are the market’s week-long battle with the 1.4200 figure will rage on today as traders prepare for a potentially negative Q1 2020 Business Outlook Survey to come out from the Bank of Canada at 10:30amET.

The latest Commitment of Traders report released by the CFTC late Friday showed patient long positions liquidating during the week ending March 31, which we find noteworthy given USDCAD’s now more neutral chart structure. This week’s holiday-shortened economic calendar features the Canadian Housing Starts and Building Permits data tomorrow, the FOMC Minutes on Wednesday, and the Canadian Employment Report on Thursday. North American markets will be closed for the Good Friday holiday on April 10.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

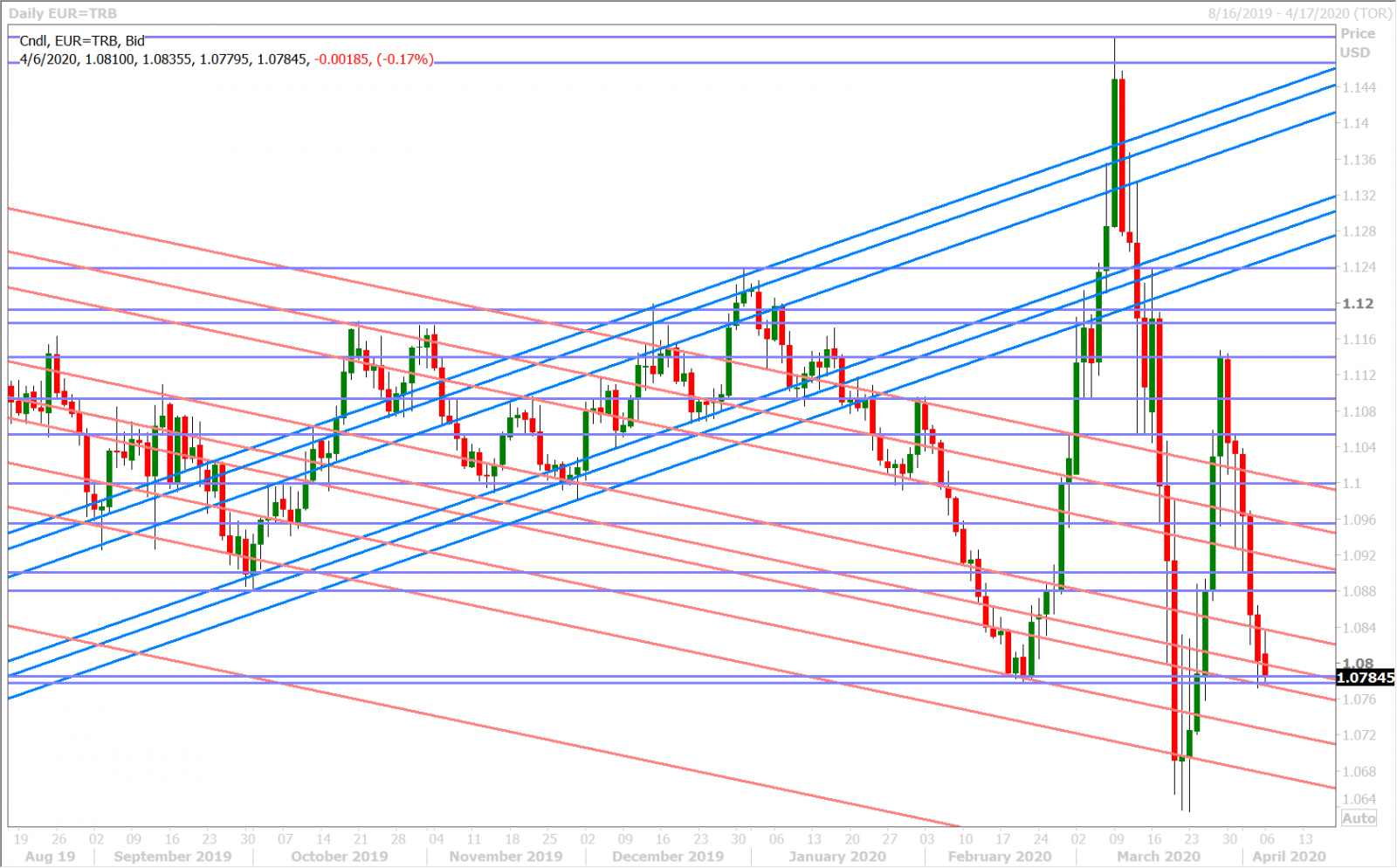

EURUSD

Euro traders are not drinking the same Kool-Aid that global equity investors are downing today. They seem to be more focused on the following three negatives in our opinion:

- fears that this could be the deadliest week so far in the US’s battle against the coronavirus

- a widening in the 3-month EURUSD cross currency basis swap to +52bp (first widening in two weeks)

- an increase in the fund net long EURUSD position during the week ending March 31 (three week high)

We think all this is keeping EURUSD on the defensive this morning and we still believe that a NY close below the 1.0770s would be very bearish for the market. Germany reported a smaller than expected contraction in Industrial Orders for February this morning (-1.4% MoM vs -2.4%), which once again went ignored by market participants because it’s stale data.

EURUSD DAILY

EURUSD HOURLY

JUNE GOLD DAILY

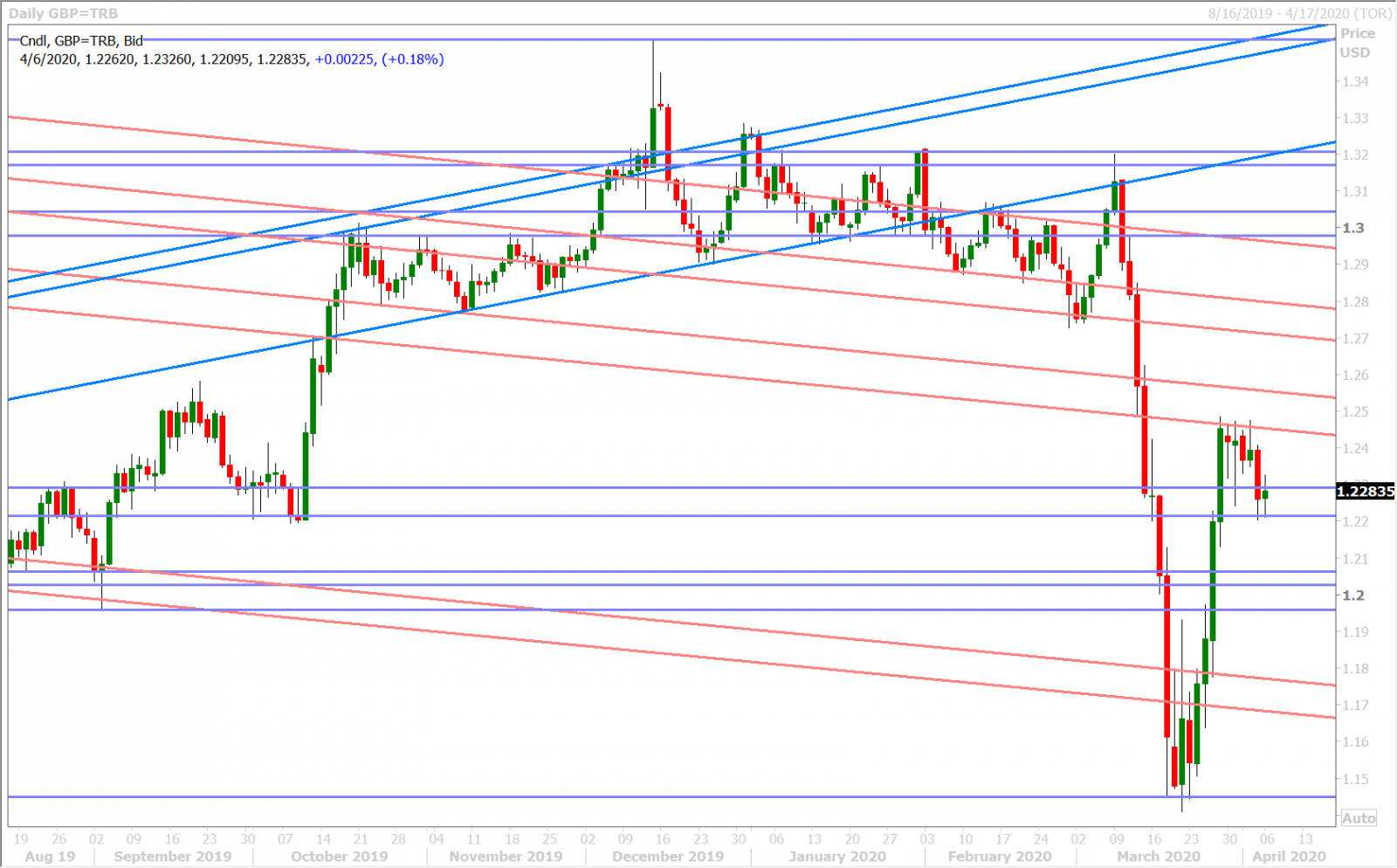

GBPUSD

Sterling opened lower last night after news broke about UK PM Boris Johnson getting admitted to hospital with worsening coronavirus symptoms. GBPUSD was already trading in a weakened technical state given Friday’s NY close below the 1.2290s, and so we weren’t surprised to see some mild selling. The market respected Friday’s session lows in the 1.2210s however, and we have since seen it bounce back following comments from UK minister Robert Jenrick that Johnson would return “shortly”. GBPUSD is now pivoting around the familiar 1.2290 level once again.

The week’s UK economic calendar features a raft of old data on Thursday (February reads for GDP, Industrial Production, Manufacturing Output and Trade). Today’s Construction PMI for March missed expectations (39.3 vs 44.0).

The latest Commitment of Traders report released by the CFTC late Friday showed the fund net long GBPUSD position declining for the 4th week in a row during the week ending March 31. We think the market’s swift recovery during this period granted these traders a gift and we would not be surprised to see further long liquidation on rallies from here.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

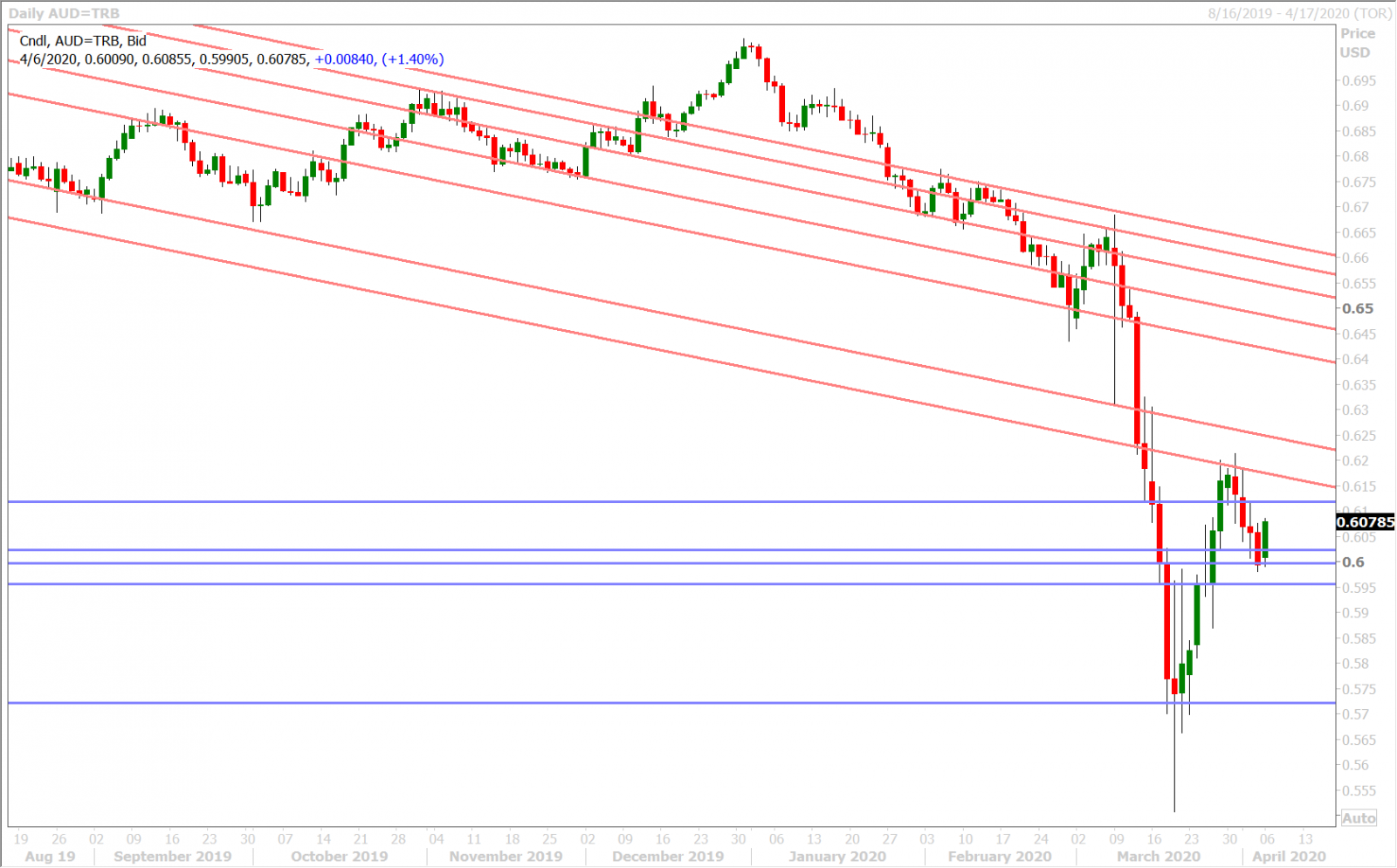

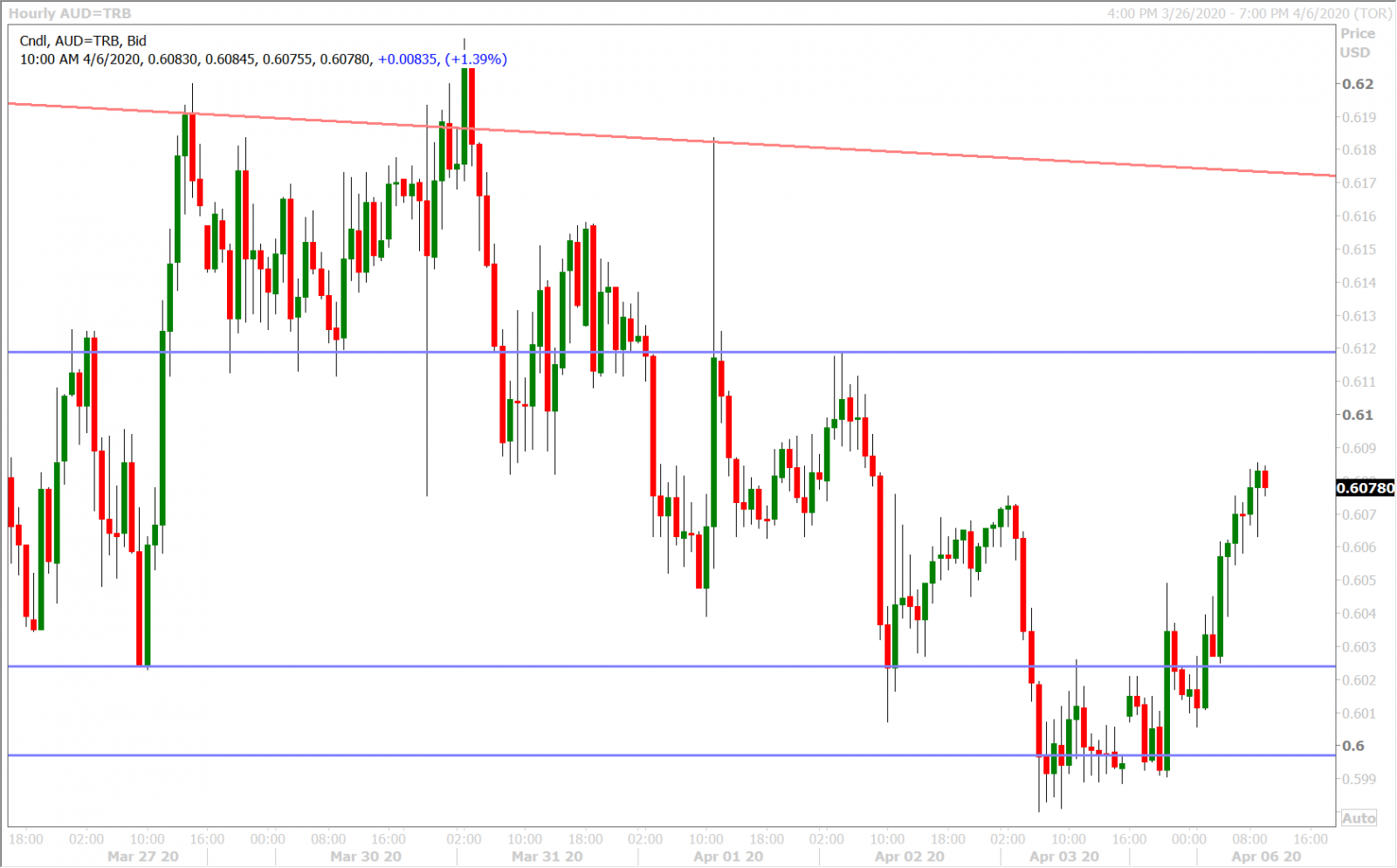

AUDUSD

The Australian dollar is outperforming its G7 peers this morning on the back of the global equity rally we’re seeing this morning. This reasoning may seem counterintuitive given some of the concerns we think EUR traders are worried about, but fighting this trend has proven costly in overnight trade. AUDUSD has confidently regained the 0.6020 level it lost in NY trade on Friday and it now looks set to re-challenge the 0.6120s resistance level.

We also think some short covering could be in play today ahead of tonight’s RBA meeting at 12:30amET because so much bad news (dovish monetary policy) has already been priced into the market. We wouldn’t be surprised to see traders latch onto any positive soundbites that come out tonight's press release from the Reserve Bank of Australia.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

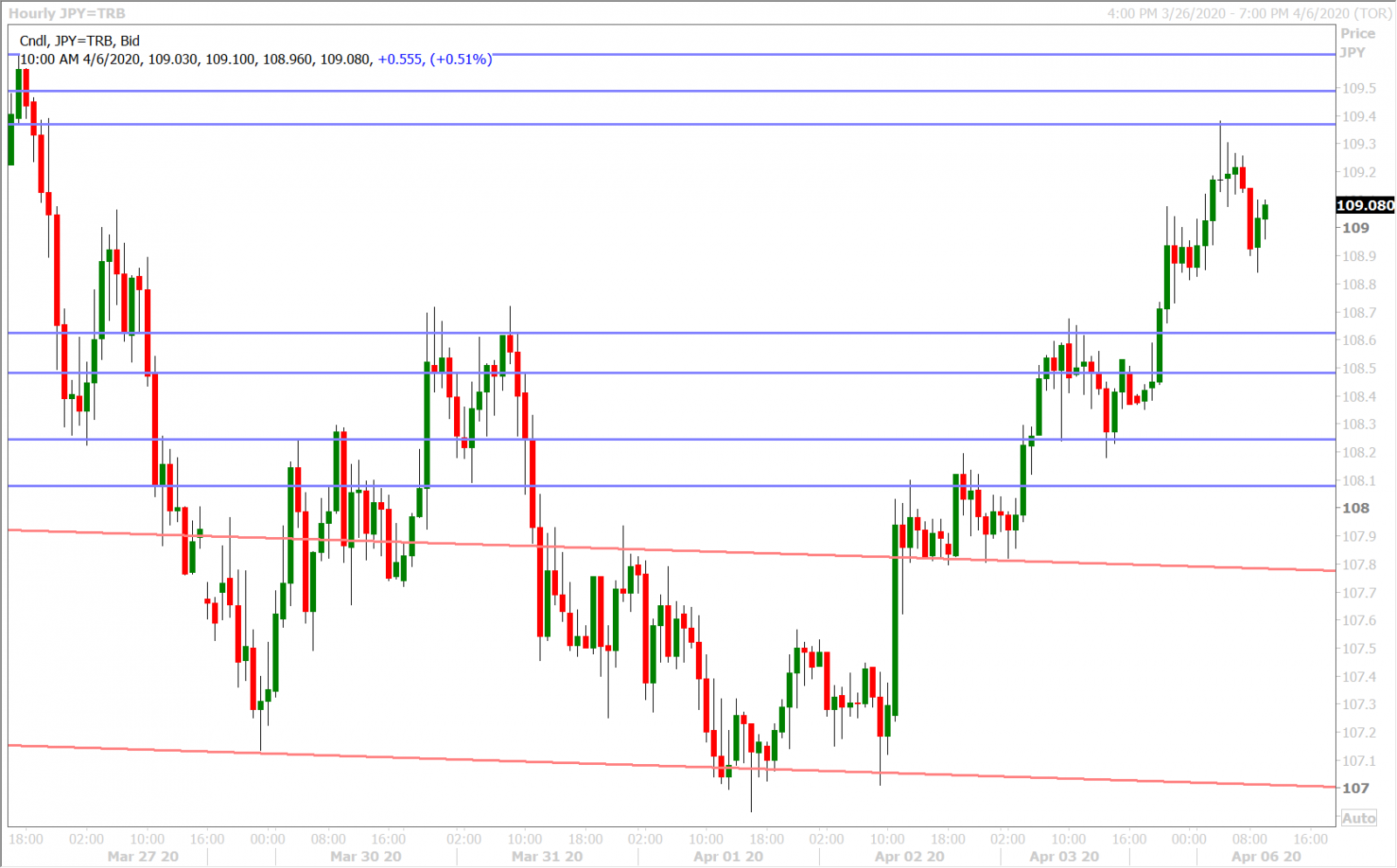

USDJPY

The yen is under-performing today as Japanese PM Shinzo Abe effectively signaled that a state of emergency declaration would be coming for seven prefectures. While he didn’t make the declaration official this morning (said he wanted to issue it as early as tomorrow), the FX markets have already taken the lead and are selling JPY across the board. Friday’s chart resistance level in the 108.60s gave way very easily last night and we saw a quick move to the 109.30s in early London trade this morning.

Some USDJPY selling has come in after the NY open but we think the market will give dip buyers a chance now so long as “Japan-specific” coronavirus fears continue to mount. We also think the fact that the funds are still net short USDJPY (as of March 31) helps the bull thesis a little bit. What could potentially hurt USDJPY this week? Relatively worse US coronavirus headlines versus Japan (which could bring back traditional risk-off flows), plus the prospects of Abe not declaring a full Japanese lock-down tomorrow.

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.