EU agrees to Brexit extension to January 31, 2020

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- EU grants UK request for Article 50 extension. Sterling unphased as this was expected.

- S&P 500 trades to new all time high, propelled by US/China Phase 1 deal optimism.

- US 10yr yields continue rally after Friday break above 1.77%. USDJPY eyeing break above 108.80s.

- Broad “risk-on” tone helps AUDUSD and depresses USDCAD, albeit mildly.

- EURUSD continues to find sellers on rallies after Thursday’s bearish outside day.

- Eventful calendar this week features the Bank of Canada and FOMC rate decisions on Wednesday.

- Funds trim USD longs across the board during week ending Oct 22.

ANALYSIS

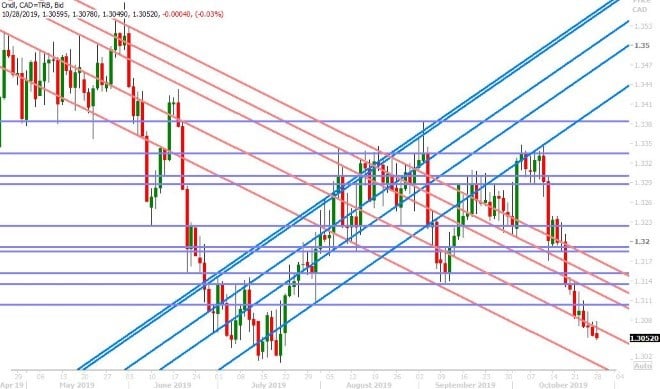

USDCAD

Global markets are trading with a mild “risk-on” tone this morning after the EU granted the UK a Brexit extension to January 2020 and after reports circulated about the US and China being “close to finalizing” part of the Phase 1 trade deal. Dollar/CAD has slipped back below Friday’s trend-line support level in the 1.3060s as a result, but there’s not much downside momentum at this hour (perhaps due to the over 500mlnUSD in options expiring at 10amET in the 1.3050s).

This week’s calendar should be eventful, with the key features being the FOMC and Bank of Canada rate decisions on Wednesday. Another 25bp rate cut is pretty much baked in for the Fed whereas no changes are expected from the Canadian central bank. We think Jerome Powell disappoints the rate cutting doves again by talking up a slowing US economy, by downplaying liquidity issues in the funding markets and by being non-committal on further rate cuts. We think Stephen Poloz will speak positively about the Canadian economy as well, but with better arguments to support his thesis if we look at the recent trend of solid Canadian data, the better Q3 Business Outlook Survey and the slight improvement in US/China trade talks. Any deviations from these expected narratives would surprise markets otherwise.

We’ll also get the US ADP Employment Report for October (Wednesday), Canadian GDP for August and the Chicago PMI for October (Thursday), and then the US Non-Farm Payrolls report for October and the US ISM Manufacturing PMI for October (both on Friday). The leveraged funds at CME added big-time to their net short USDCAD position during the week ending Oct 22 by liquidating longs and adding new shorts. We continue to believe the trend is in their favor, but we’d be on guard for some volatility this week due to all the event risk ahead.

USDCAD DAILY

USDCAD HOURLY

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar saw a mild bounce off trend-line chart support in the 1.1070s to start the week (perhaps because over 1.8blnEUR in options expire between 1.1085-1.1100 this morning), but the sellers are once again coming in as Thursday’s, ECB-driven, bearish outside day on the charts casts a shadow over price momentum. We think this could be the case until the FOMC decision on Wednesday, and we think the aforementioned support level in the 1.1070s could give way should Jerome Powell go into denial mode again. We also think the fund net short EURUSD position, which got trimmed significantly by the Brexit-driven runup to the high 1.11s, allows much room for the shorts to re-enter and chase the market lower if need be without making the overall position appear stretched. This week’s European calendar features the German Unemployment and CPI data for October (Wednesday), the Eurozone flash Q3 GDP numbers (Thursday) and the Markit Manufacturing PMIs for October from across Europe (Friday).

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

The EU has agreed to granting the UK a Brexit extension to January 31, 2020. More here from BBC News. None of this has come as a surprise to market participants this morning however as the EU telegraphed this decision late last week and let’s be honest…they didn’t have much of a choice. GBPUSD is trading quietly between chart support at 1.2810 and chart resistance at 1.2870 and EURGBP continues to mark time after bouncing off the 0.8600 support level last week. All eyes will now turn to PM Johnson’s election motion, which is expected to be voted on after 2pmET today. Will the Labour party finally agree to an election seeing as “no-Brexit” risk has been formally taken off the table for 3 months? The UK Manufacturing PMI for October will be released on Friday, along with all the other European PMIs. The leveraged funds at CME reduced their net short GBPUSD position to its lowest level since June during the week ending Oct 22, on a combination of short covering and long accumulation.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie buyers continue to hang on here, but they have yet to see the firm move back above the 0.6830s which we think will give them comfort. Today’s positive sounding US/China trade headlines helped the market hold the 0.6810s, but that move is fading as EURUSD pulls off its session highs. The focus will now probably turn to RBA’s Lowe, who is expected to make a speech at 2:45amET tomorrow morning. We think some further hawkish tones from the Australian central bank governor could be enough to propel the market higher once again. Australia reports its Q3 CPI data on Tuesday night at 8:30pmET. The leveraged funds at CME trimmed their net short AUDUSD position back down to 44k contracts, which is close to where it was the last time the market rallied significantly in early September.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen traders are thinking about an upside breakout above the 108.80s this morning, after Friday’s and today’s positive US/China trade headlines propel the S&P 500 to new all time highs. US 10yr yields are going along for the ride too, and have maintained their upside momentum since getting back above the 1.77% level on Friday. We also think the market is bracing for more disappointment from the Fed on Wednesday (we’ll get the 25bp rate cut as expected, but perhaps nothing else?). The leveraged funds at CME have come to the realization that the trend is changing more positively for the USDJPY market as well. During the week ending Oct 22, they covered shorts and added to longs; extending their new net long USDJPY position for the second week in a row. The Bank of Japan meets this Wednesday night/early Thursday morning (right after the Fed meeting) and while they are expected to trim their growth/inflation outlooks, most market participants expect no changes to rates, forward rate guidance or their asset purchase program.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com