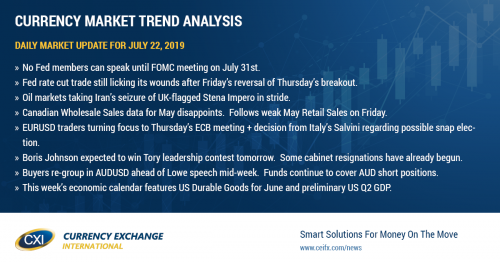

Fed enters blackout period ahead of next week's meeting

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD is starting the week with a quiet bid tone as the broader USD still digests last week’s dramatic turnaround in 50bp rate cut expectations for next week’s Fed meeting. The odds surged to 70% following comments from Fed member Williams on Thursday, but then plunged all the way back down to 20% when the NY Fed came out afterwards and said Williams comments were merely “academic” and “not about potential policy actions at the upcoming FOMC meeting”. The inability for the “Fed rate cut trade” to recover later on Friday and into this week tells us traders may need to be on guard for a reversal here ahead of the meeting (ie. bonds, gold, Eurodollars lower while USD higher). USDCAD, in particular, didn’t quite achieve the bullish outside pattern we talked about on Friday, but it continues to hold trend-line support in the 1.3030s that was surpassed when Canada reported weaker than expected Retail Sales growth for May on Friday, and this is mildly positive for the market in our opinion. The leveraged funds at CME continued to add to short positions during the week ending July 16, extending their new net short position to 21k contracts (if we look at the latest Commitment of Traders report released by the CFTC). What is interesting to note too is how the commercials (dealers and corporate hedgers) have been buying the dip big time here in USDCAD. This week’s economic calendar will be on the relatively lighter side, with the only real features being US June Durable Goods on Thursday and the preliminary read on US Q2 GDP on Friday. We won’t have any Fed-speak as the FOMC enters its traditional blackout period ahead of its meeting on July 31. Canada just reported its Wholesale Sales data for the month of May on the data missed expectations big time: -1.8% MoM vs +0.5%. September crude, while bid to start the week following Iran’s seizure of a UK-flagged tanker called Stena Impero that violated international maritime borders late Friday, is now retreating as physical oil traders don’t seem all that concerned about political escalations.

USDCAD DAILY

USDCAD HOURLY

AUG CRUDE OIL DAILY

EURUSD

With the “Fed rate cut trade” now looking a little shaky and with Fed members now in a blackout period ahead of next week’s FOMC meeting, EUR traders appear to now be focusing on this week’s ECB meeting on Thursday. To say that expectations are dovish for this ECB meeting would be an understatement in our opinion, as the OIS market continues to price in a 30-40% chance of a 10bp cut to the deposit rate. The charts have turned decidedly negative for EURUSD following the Thursday/Friday swift rejection of chart resistance in the 1.1280s and the market’s inability to recover since then. Traders are also eyeing a decision from Italian deputy PM Salvini on whether or not he wants to force a snap election, as the League and 5-Star Movement continue to be at each other’s throats. The leveraged funds at CME added to both long and short positions in EURUSD during the week ending July 16, leaving their net short position slightly smaller than where it was the week before. We think this reduced net short position helps the bear thesis here (will allow room for position accumulation) should traders want to take out chart support at the 1.1200 level. Prior to ECB meeting on Thursday, we’ll get the flash July PMI data out of Germany, France and the broader Eurozone (Wednesday) and the German IFO survey for July (3hrs before the ECB on Thursday).

EURUSD DAILY

EURUSD HOURLY

AUG GOLD DAILY

GBPUSD

Sterling is lagging the rest of the bunch to start the week as some cabinet resignations begin ahead of tomorrow’s final vote on the Tory leadership contest, when it is expected Boris Johnson will succeed Theresa May as UK prime minister. We can’t say these resignations are all that surprising, but they're giving GBPUSD traders something to trade off this morning as the broader USD trades quietly. Trend-line chart support in the 1.2460s (tested briefly late Friday) is being tested once again to the downside, and so far buyers are emerging once again. The funds at CME increased their net short GBPUSD position even further during the week ending July 16, which we said on Friday could now make the market vulnerable to a short squeeze because price has not followed suit to new lows.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie was forced to completely retrace its post-Williams rally on Friday, as the “Fed rate cut trade” never really recovered, but chart support at the 0.7040 level held into the NY close (which was a positive technical development). Buyers are back in control this morning, after a brief dip below this level occurred in early European trade, and we think the market now has some momentum to continue higher into RBA Lowe’s speech on Wednesday night ET. The funds at CME reduced their net short AUDUSD position for the 3rd week in a row, during the week ending July 16. A Reuters survey of economists, released today, overwhelmingly expects the Reserve Bank of Australia to keep its benchmark interest rate on hold at 1.00% when it meets next on August 6th.

AUDUSD DAILY

AUDUSD HOURLY

SEP COPPER DAILY

USDJPY

Dollar/yen is starting the week quietly bid as the wounded “Fed rate cut trade” decides what do as the Fed now enters its blackout period. Friday’s swift reversal of Thursday’s move higher in bonds, gold, and Eurodollars was damaging, from a technical perspective, and so it’s not surprising to see a lack of upside momentum here in all these markets, but we wouldn’t consider these rallies over just yet. US 10yr yields are still trading below last week’s highs of 2.14%, August gold prices continue to hold their breakout level in the 1420s, and the December Eurodollar interest rate futures have not yet taken out last week’s lows. All this means that USDJPY will not have sustainable upside momentum either in our opinion, and we’re sort of seeing this today already with three rejects of chart resistance at the 108.00 level. BOJ governor Kuroda is expected to make a speech this morning at the IMF in Washington at 11amET. This week’s Japanese economic calendar features the Nikkei Manufacturing PMI for July tomorrow night at 8:30pmET and the Tokyo CPI data for July at 7:30pmET on Thursday night. The funds at CME started rebuilding their net long USDJPY position during the week ending July 16 by liquidating shorts and putting on new longs, but the overall position is still minor when compared to what it was at the end of April.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com