FX traders pause for US holiday. Next week's calendar in focus.

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- USD downtrends defended against CAD and AUD this week. USDCNH lower.

- Dollar recovers vs EUR & GBP following yesterday’s negative COVID/Brexit headlines.

- Monday/Tuesday features ISM Non-Manufacturing PMI, latest COT report, RBA meeting.

- UK/Canadian finance ministers speaking next Wed + potential for pre-EU Summit headlines.

- More large topside EURUSD option expiries (1.1250-1.1350) could attract brief upside interest.

- USDJPY wants to range trade. Canada reports official Employment Report for June next Friday.

ANALYSIS

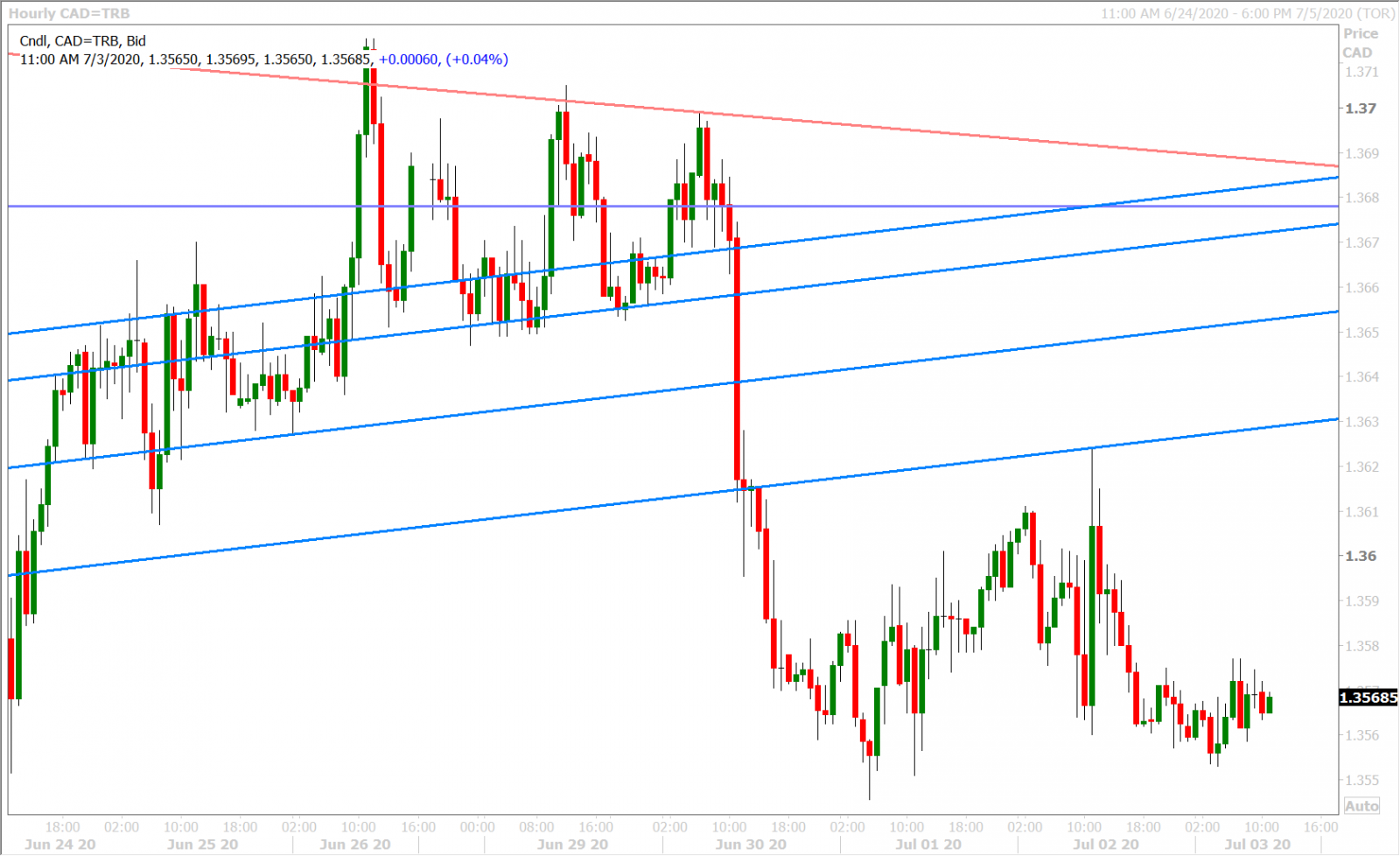

USDCAD

Another record day of new coronavirus infections in Florida spoiled a brief bout of optimism for markets yesterday following the better than expected US Non-Farm Payrolls report; however traders ultimately faded this COVID negativity once again and sold the dollar into the NY close. China’s strong Caixan PMI survey for June and Australia’s higher than expected Retail Sales numbers for May were cited as reasons for the buoyant risk tone in Asia last night, but European traders have adopted a more cautious tone following Merkel’s comments about EU recovery fund negotiations being “rocky” and Johnson’s comments about there being “other very good options” for the UK in the event if a good EU trade agreement can’t be reached. This follows yesterday’s announcement that a key EU-UK Brexit meeting, scheduled for today, had been cancelled. Sterling/dollar swiftly gave up its attempt to get back above the 1.2480s following these headlines this morning, and the downside pressure it’s now putting on the 1.2440s is helping to keep the USD moderately bid as liquidity evaporates into the American long weekend. US stock and bond markets are closed today in observance of the Independence Day holiday.

Next week’s calendar kicks off with the US Markit PMIs and the ISM Non-Manufacturing PMI (June figures) on Monday. The latest Commitment of Traders of Report (showing speculative fund positioning as of June 30) will also be released late Monday afternoon because of today’s US holiday. Tuesday’s session won’t have much on the North American data front, which could leave traders focused on the broader USD’s reaction to the RBA meeting, the German Industrial orders data for May, and some Fed-speak from Bostic and Quarles. Some fiscal updates could come out of the UK and Canada next Wednesday when Rishi Sunik and Bill Morneau speak; the usual weekly US jobless claims report will features for Thursday, and the Canadian Employment Report for June will be the headliner economic update for next Friday.

This week’s month/quarter-end dollar selling very much helped to keep dollar/CAD's daily downtrend intact (below the 1.3700-1.3710s), but we don’t foresee serious downward momentum returning until the 1.3490-1.3510 support level gets taken out. USDCAD is now very much trading with the same range-bound tone it adopted after Jerome Powell short term bottomed the market in early June.

USDCAD DAILY

USDCAD HOURLY

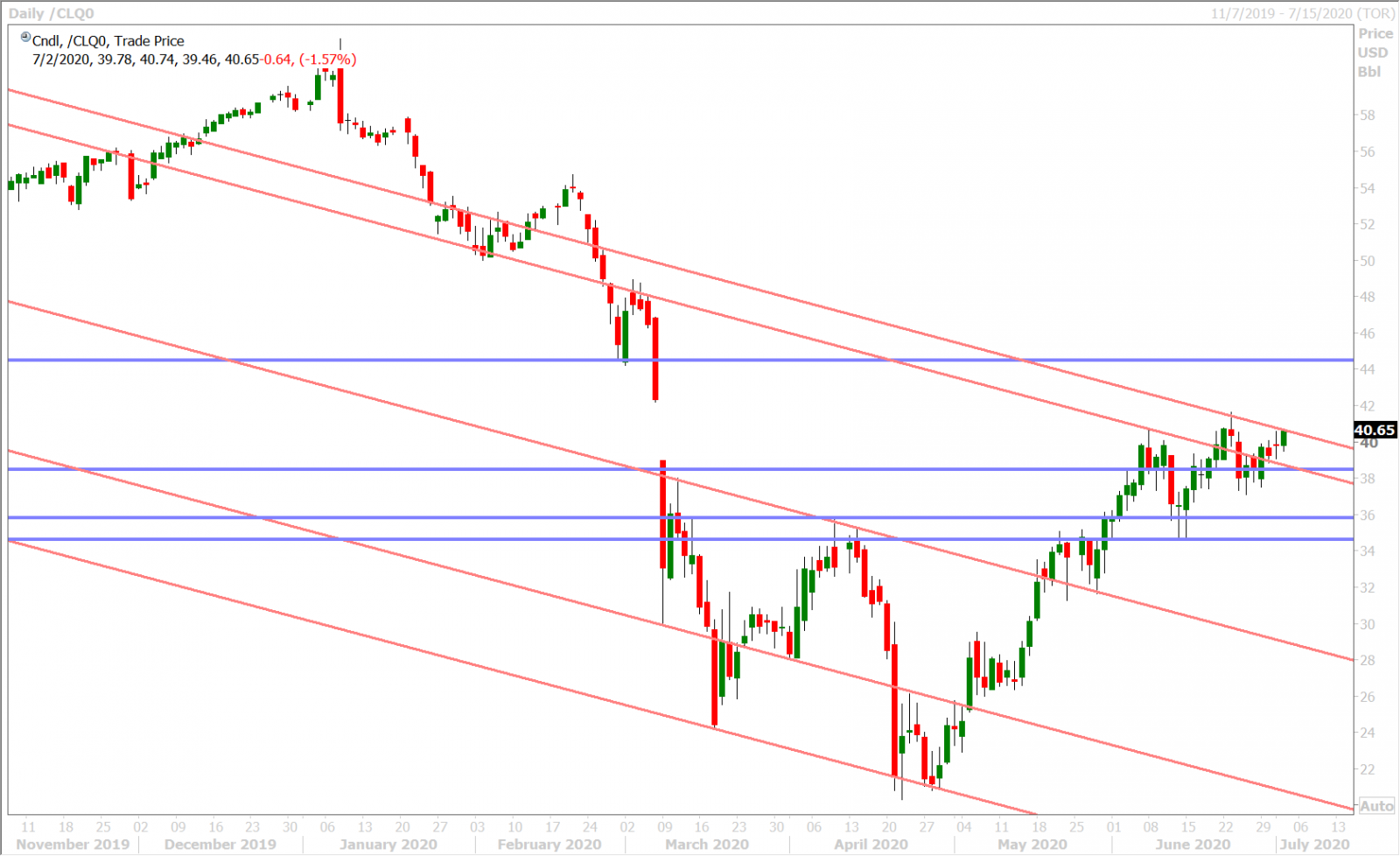

AUGUST CRUDE OIL DAILY

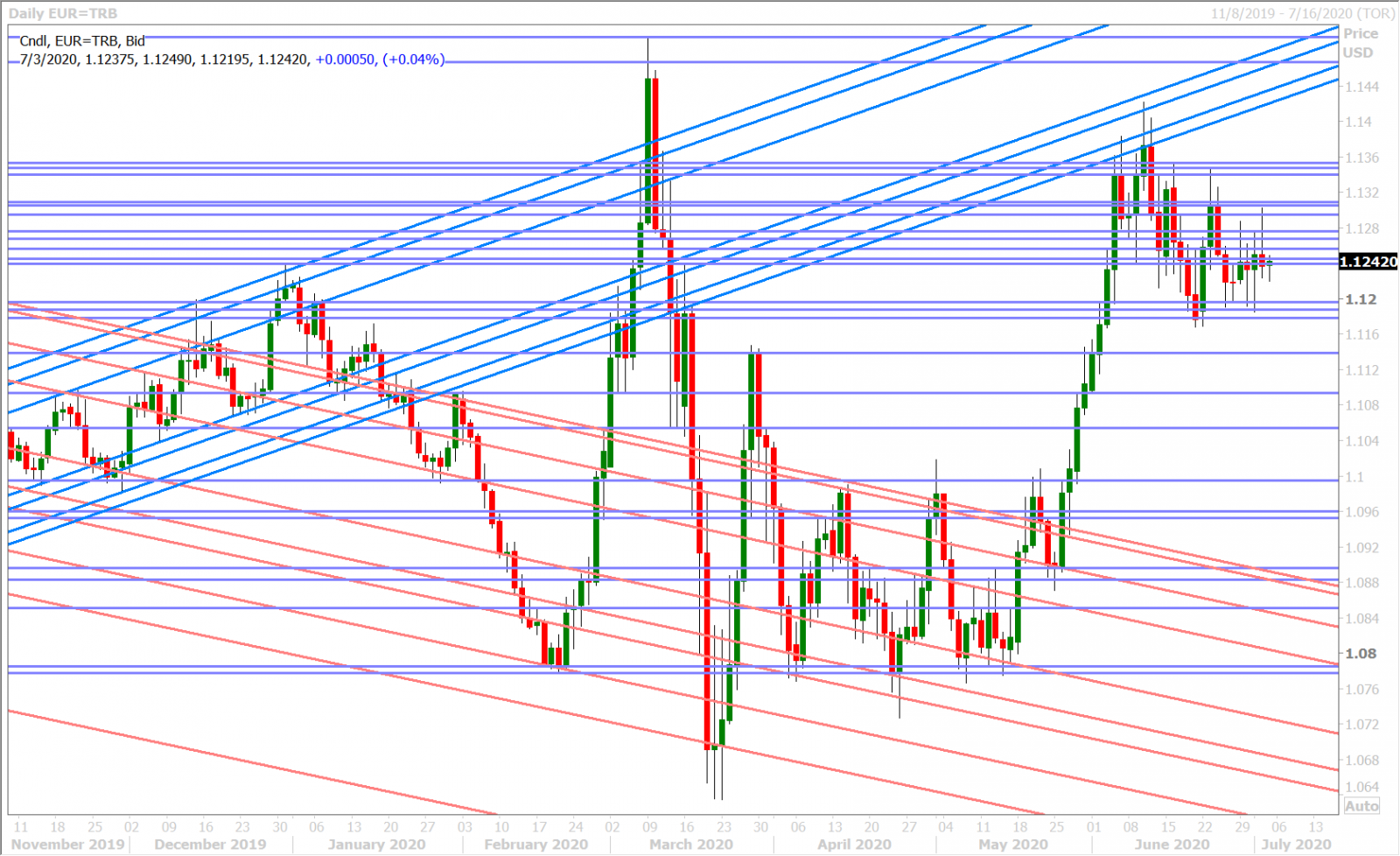

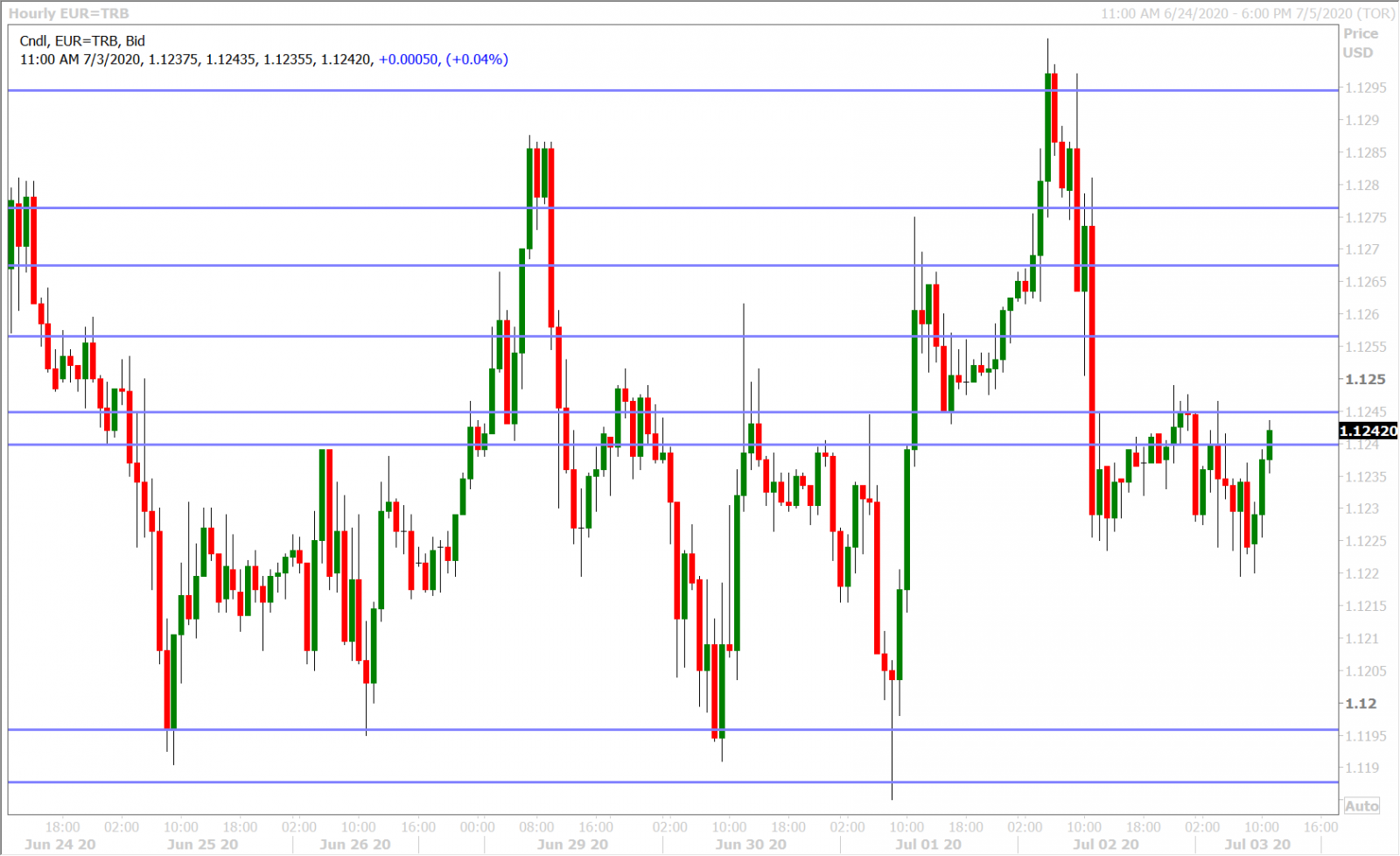

EURUSD

Yesterday’s record rise of new COVID cases across Florida really took the wind of the sails for the euro/dollar market. After grazing chart resistance in the 1.1290s following the good NFP numbers, the risk mood went sour after the sunshine state reported 10,109 new infections for the previous day; which was a 6.4% rise versus the 7-day average of +5.6%. Familiar chart support in the 1.1240s then quickly gave way and this level has proved as stubborn resistance for the EURUSD market ever since. We wouldn’t be surprised to see the market slip lower here amid a lack of chart support until the 1.1190s, but we’re also cognizant of the technical strength we’re seeing in the Canadian and Australian dollars today, which could ultimately halt the euro’s decline. Today’s better than expected final June Composite PMI figures out of Germany and the Eurozone were non-events (details below).

Next week’s European calendar features some German economic numbers for the month of May (Industrial Orders on Monday and Industrial Output on Tuesday), but we think this old data could get easily overshadowed by pre-EU Summit headlines ahead of the July 17-18 meeting. Germany’s Angela Merkel will be holding high level talks with EU officials on Wednesday. There are also a litany of topside option expiries positioned above the market next week (1.1250-1.1350), which could attract brief spikes higher for spot EURUSD prices. However, we still think that Powell’s dire post-Fed meeting press conference, June 16th’s bearish head & shoulders pattern, unresolved EU recovery fund discussions, and the overextended nature of the fund net long EURUSD position (latest COT report) continues to cast a negative shadow over this market.

Eurozone Jun Markit Services Final PMI, 48.3, 47.3 f'cast, 47.3 prev

Eurozone Jun Markit Composite Final PMI, 48.5, 47.5 f'cast, 47.5 prev

German Jun Markit Services PMI, 47.3, 45.8 f'cast, 45.8 prev

German Jun Markit Composite Final PMI, 47.0, 45.8 f'cast, 45.8 prev

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

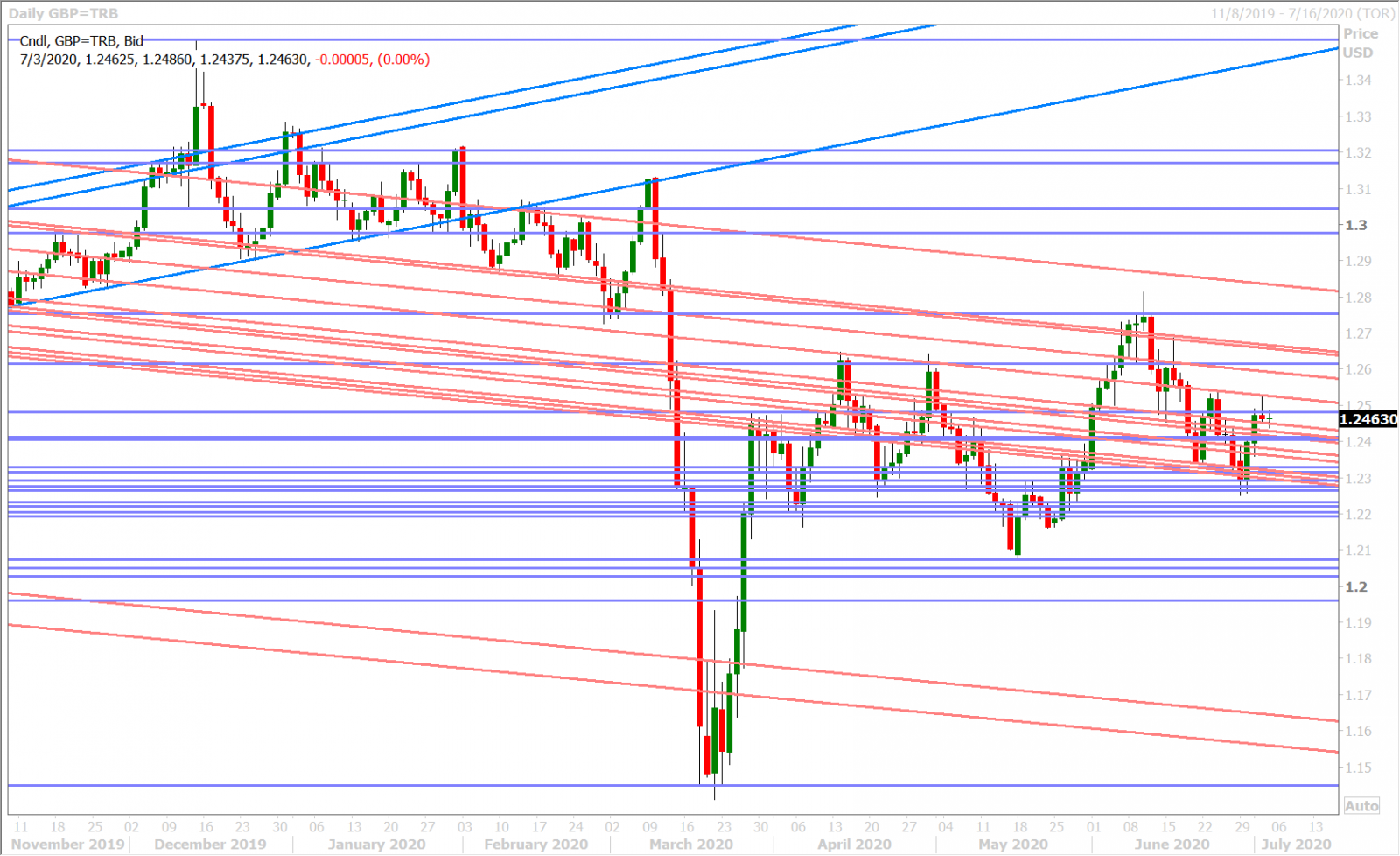

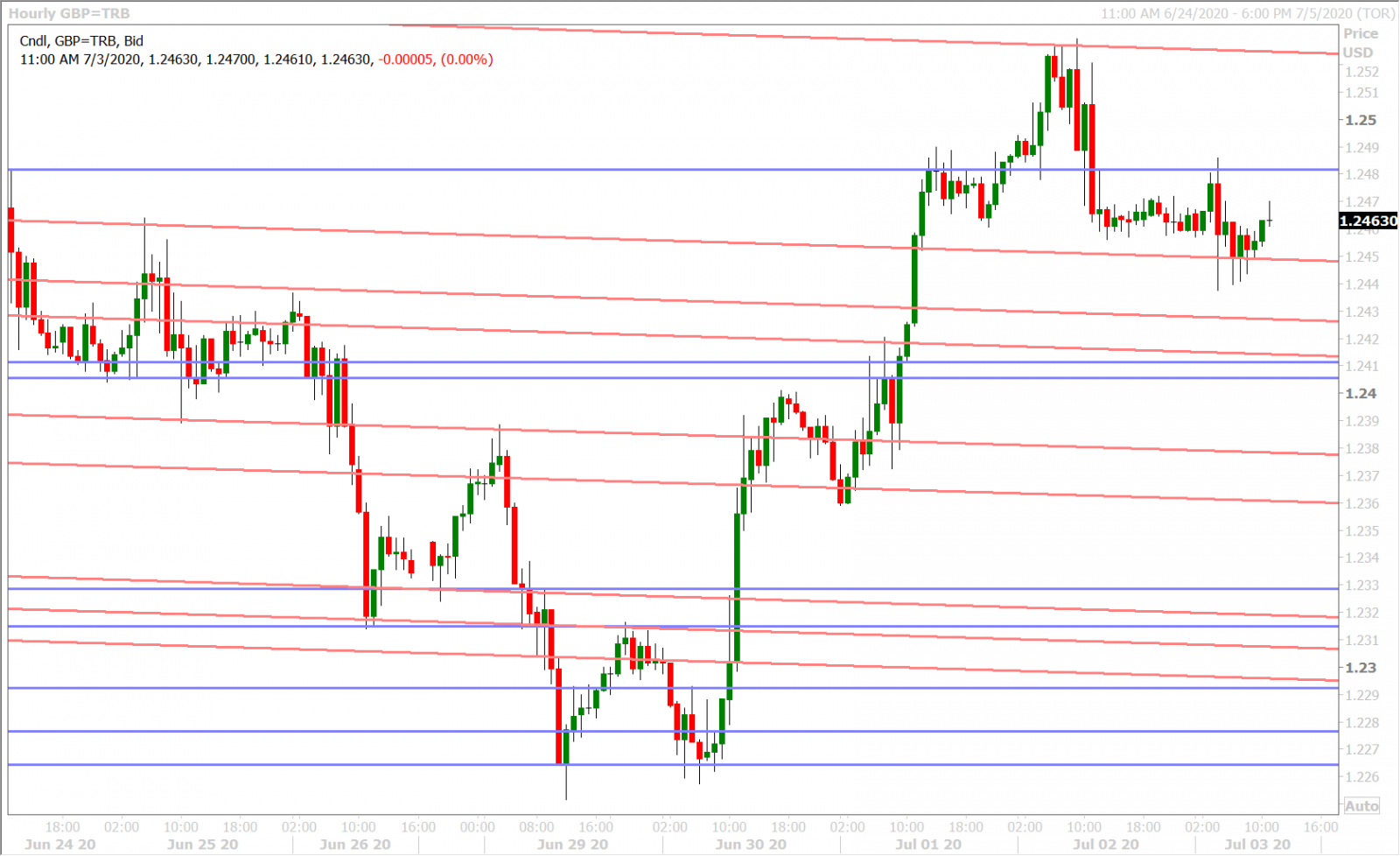

GBPUSD

Sterling traders have been reminded over the last 24hrs that all is still not well on the Brexit front. The EU’s Michel Barnier said yesterday that “serious divergences” remained between the EU and UK positions and, while Boris Johnson said he’s more optimistic than Barnier when it comes to getting a good deal, the UK PM said that an “Australia-style” arrangement would be a “very good option” in the event that both sides can’t come to an agreement. GBPUSD has been on the defensive ever since yesterday’s announcement about a key EU/UK negotiation getting cancelled for today.

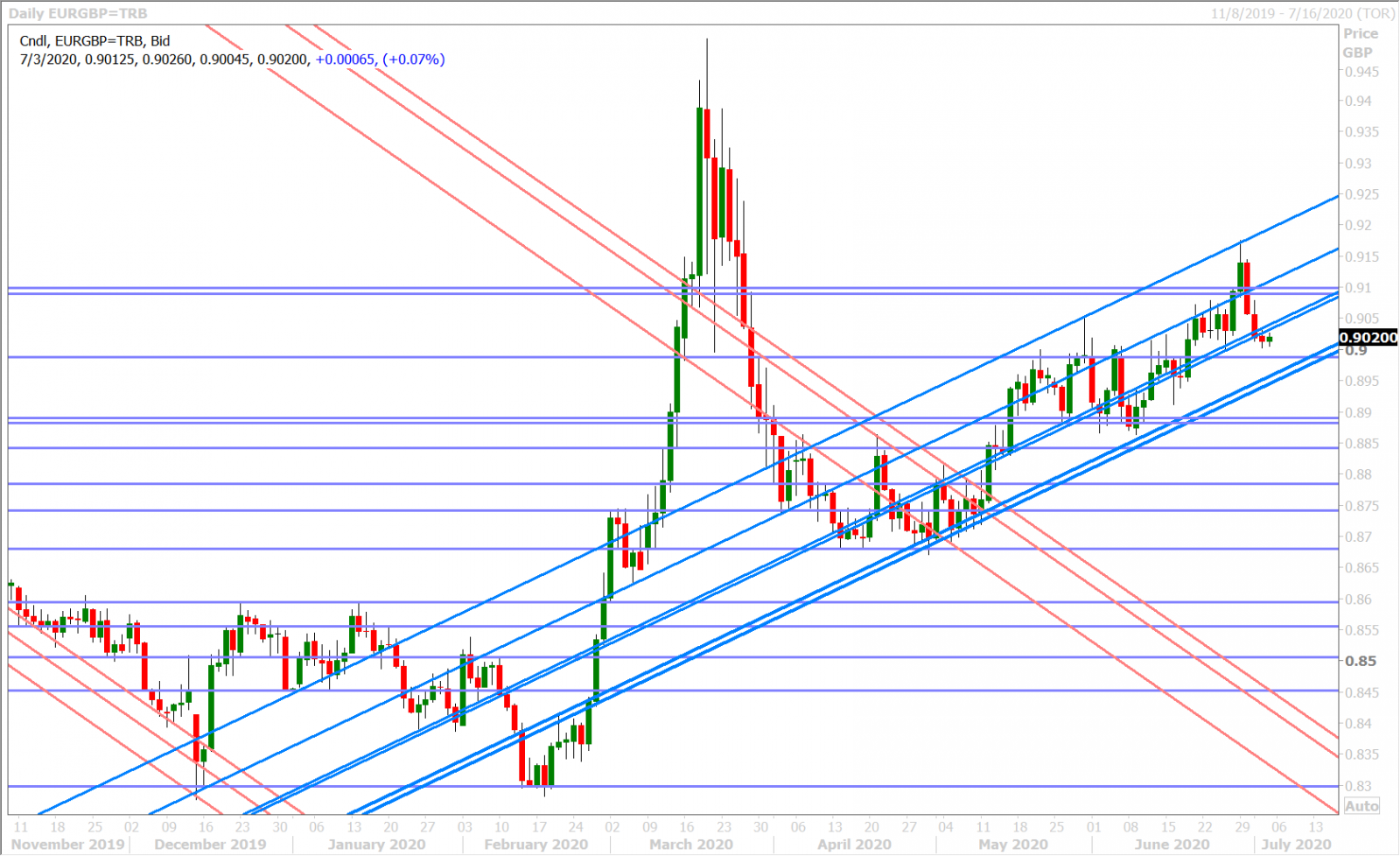

Next week’s UK economic calendar will be relatively uneventful (just the June Construction PMI out on Monday), which should leave traders focused on the broader market risk tone and Brexit-related headlines as usual. The chart technicals for GBPUSD have very much turned more neutral after Tuesday/Wednesday’s bounce. The EURGBP cross is looking decidedly more bearish on the daily chart now however, which will have us on the look-out for positive Brexit headlines next week and perhaps some more encouraging tones out of UK finance minister Rishi Sunik when he speaks on Wednesday about his latest plans for steering the economy through the COVID crisis.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

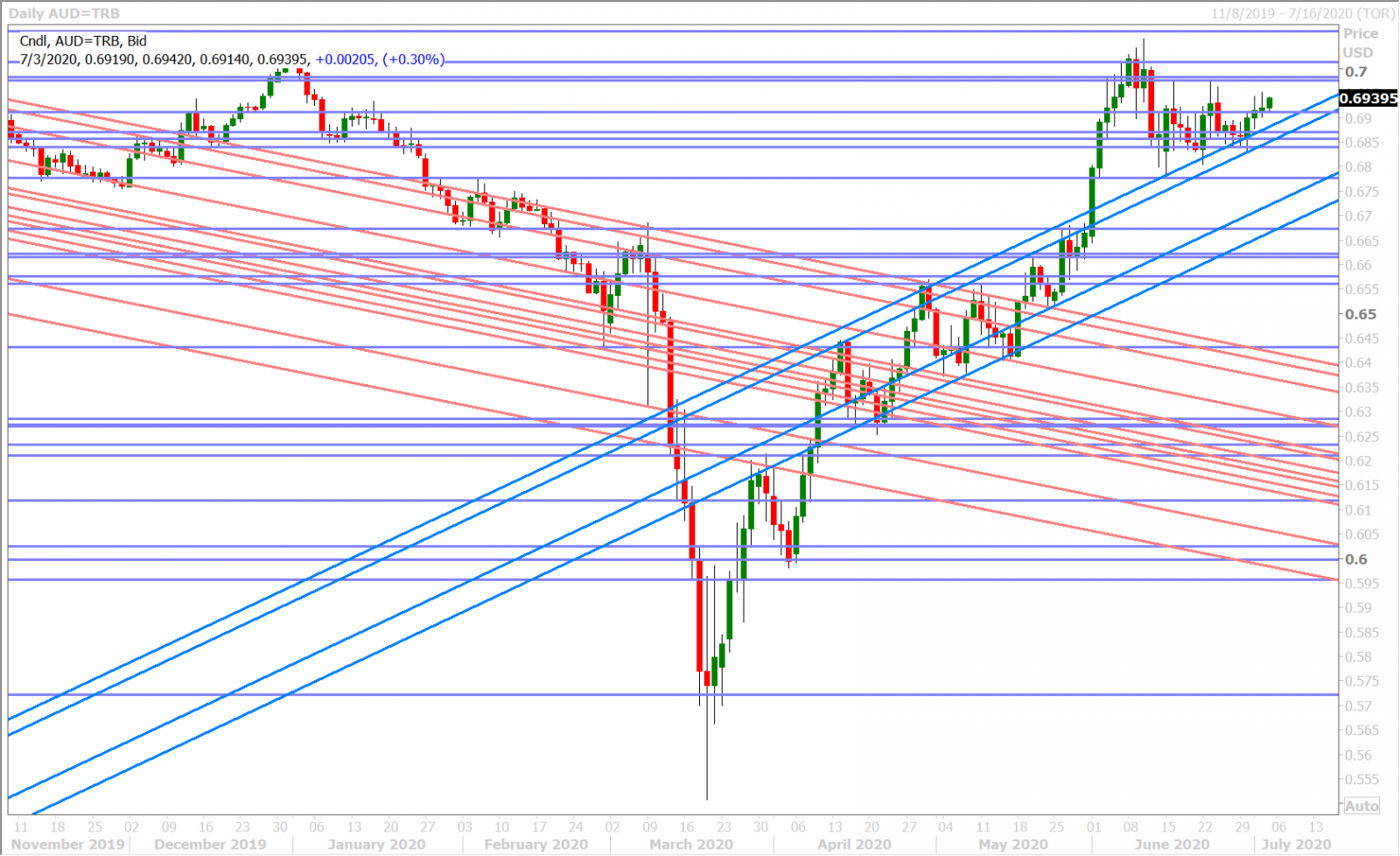

AUDUSD

Month/quarter-end dollar selling, generally better than expected global economic data, large topside option expiries and the marketplace’s ongoing desire to shrug off negative US COVID headlines has very much saved the Australian dollar this week. All these factors helped the AUDUSD market defend its daily uptrend at key chart support in the 0.6840s and we wouldn’t be surprised if the leveraged funds, who’ve dramatically reduced bearish AUD bets over the last two weeks, try to take a stab at the 0.70 handle again should the 0.6910s hold today. The technically more constructive outlooks for the Canadian dollar and the Chinese yuan (weaker looking USDCAD and USDCNH charts) add some merit to this idea in our opinion, but we don’t want to overanalyze (give credence to) price action on a holiday trading session.

The Reserve Bank of Australia is expected to keep all its monetary measures on hold when it meets again early next Tuesday, and we think Guy Debelle’s speech this week was a nice summary of the RBA’s less dire economic, but still very accommodative monetary policy outlook. Full speech here. We’ll be paying attention to any negative commentary regarding the recent strength of the Australian dollar and the re-imposition of COVID lockdowns in parts of Melbourne.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

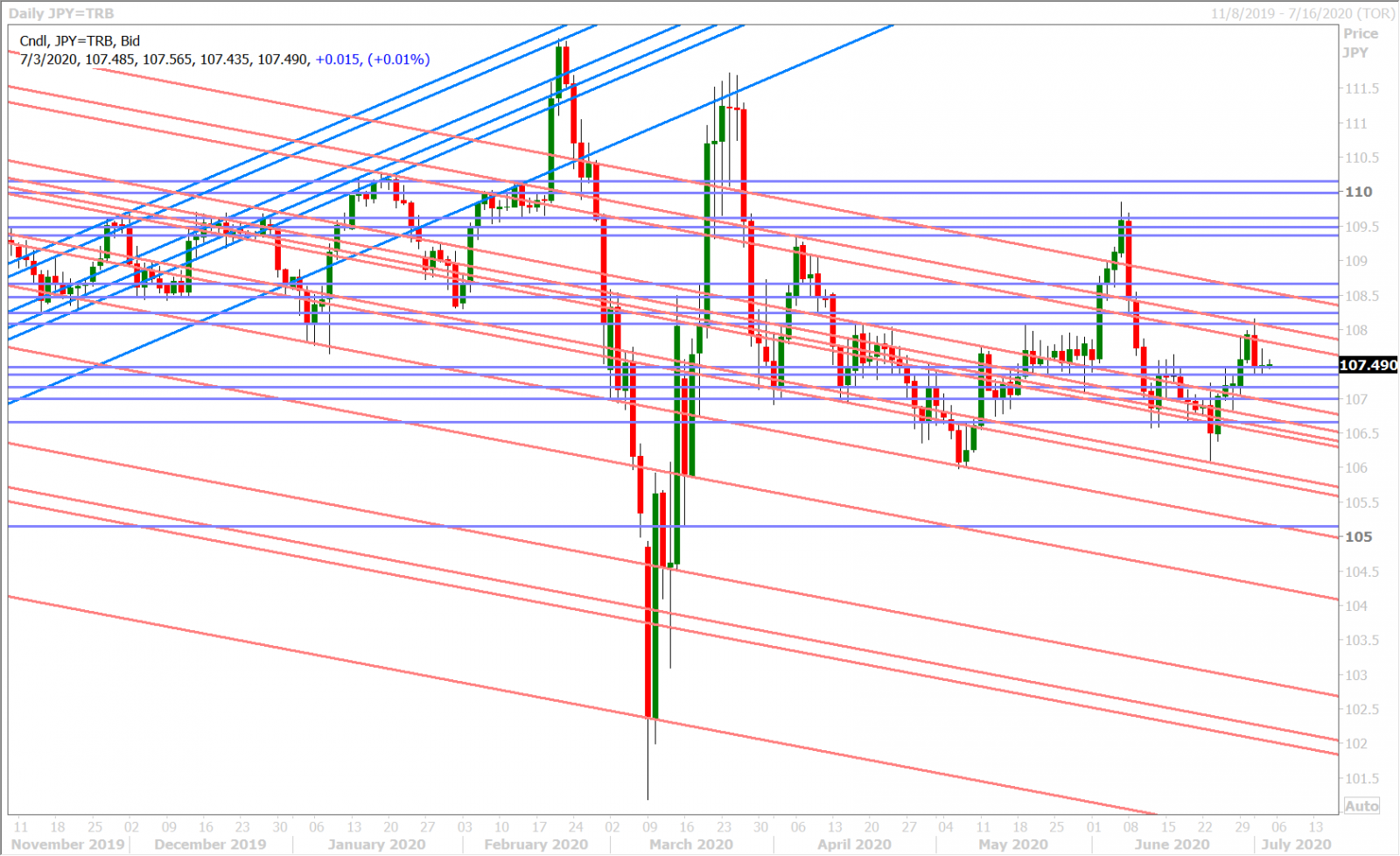

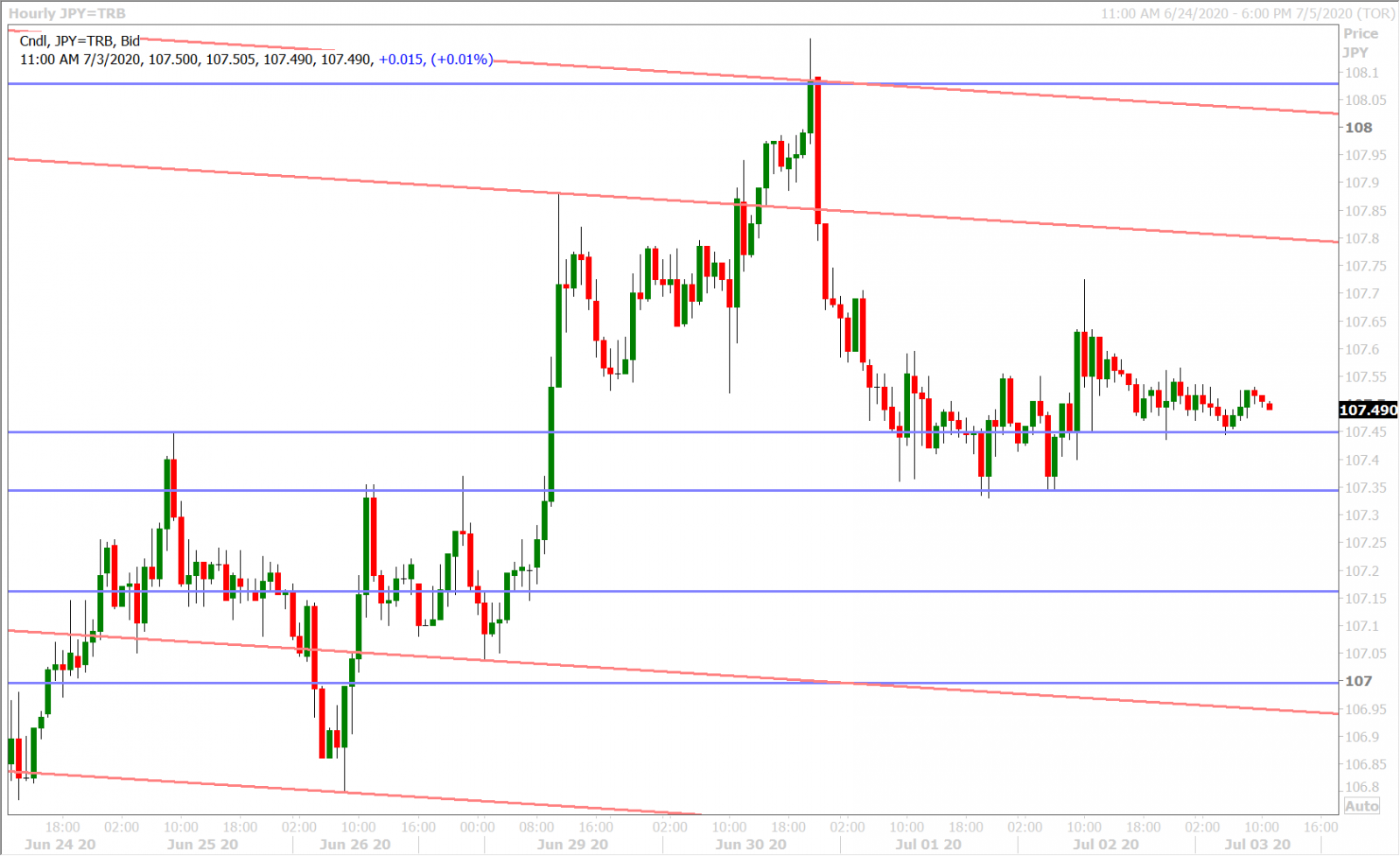

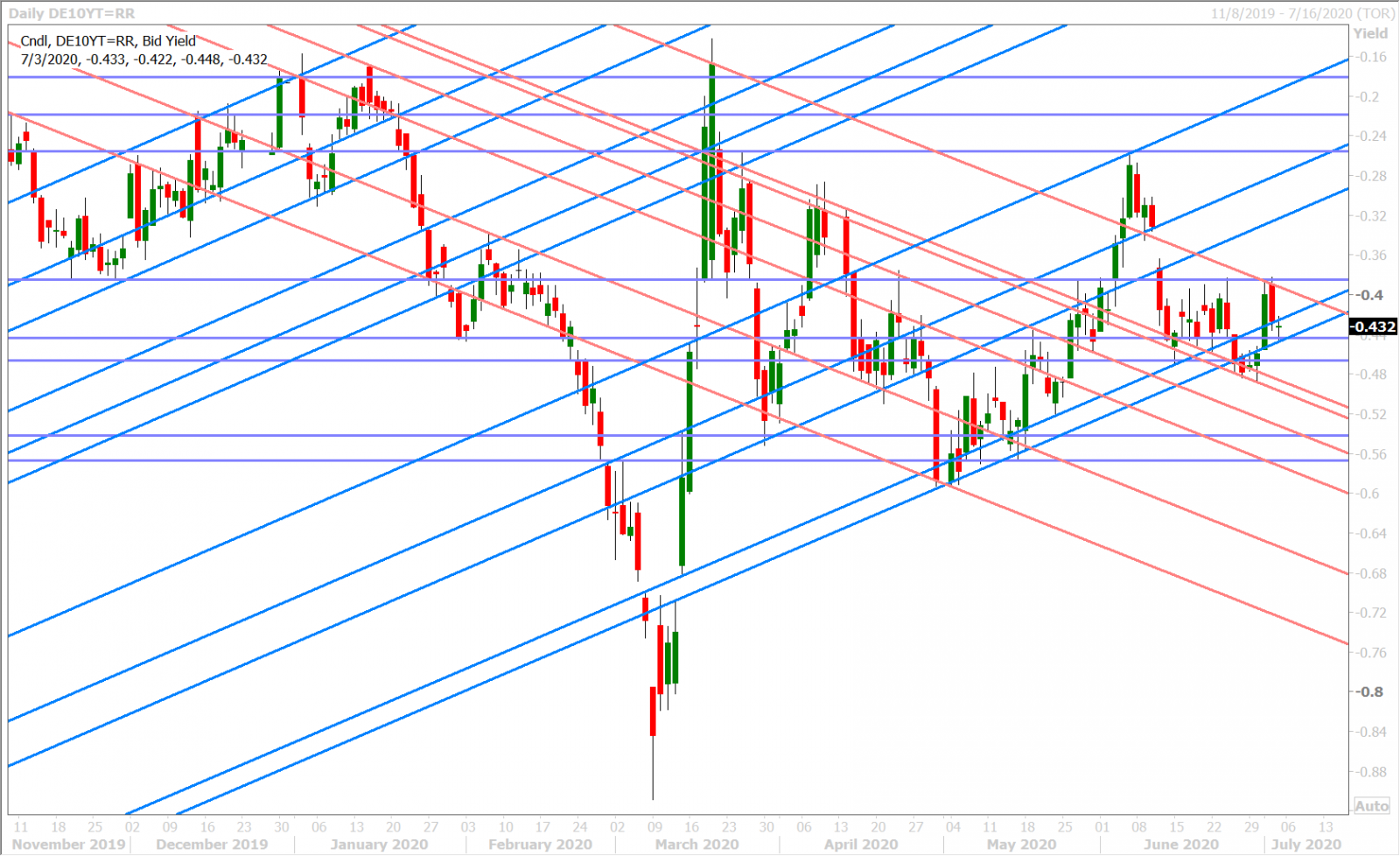

They may as well shut the quoting machines down for dollar/yen today as the market barely moved in quiet overnight trade and has no reason to move today with US bond markets being closed. German bund yields are trading a couple basis points lower on the session and a $600mln worth of options just expired at the 107.50 strike.

Two large option expiries at the 107.50 strikes should be the “unexciting” features for USDJPY next week ($1.2bln on Wednesday and just under $1bln on Thursday), as the market looks poised to regress back into its all too familiar 106.50-107.50 trading range.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10-YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com