Markets want rate cuts now

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

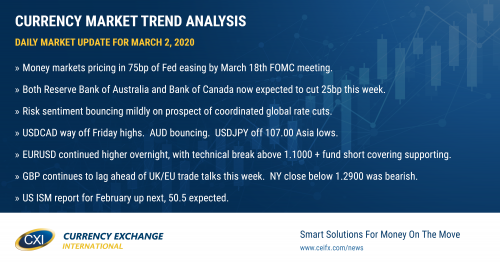

• Both Reserve Bank of Australia and Bank of Canada now expected to cut 25bp this week.

• Risk sentiment bouncing mildly on prospect of coordinated global rate cuts.

• USDCAD way off Friday highs. AUD bouncing. USDJPY off 107.00 Asia lows.

• EURUSD continued higher overnight, with technical break above 1.1000 + fund short covering supporting.

• GBP continues to lag ahead of UK/EU trade talks this week. NY close below 1.2900 was bearish.

• US ISM report for February up next, 50.5 expected.

ANALYSIS

USDCAD

Global bond markets want central banks to cut interest rates now. This is the overarching theme to start the week as traders fret about China’s horrible February PMI numbers and the anticipated spread of the coronavirus into the United States. The Fed funds futures curve is now expecting the Fed to capitulate and cut rates by a whopping 75bp when they meet next on March 18. This week’s Reserve Bank of Australia and Bank of Canada policy meetings now each have at least 25bp of rate cuts baked into them. The Bank of England is now expected to cut rates 25bp when it meets next on March 26th. Even the ECB is feeling the pressure to cut rates if you can believe that, with the 5y5y inflation swap trading at new record low of 1.1044% and with EONIA curve showing 10bp of additional easing to come on the March 12th meeting date.

The plunge in global interest rates has been so intense over the last three trading sessions that rumors are now flying around that global central banks will coordinate an emergency, inter-meeting, rate cut...perhaps on Wednesday morning ET (based on the timing of big coordinated actions taken in December 2007, October 2008 and November 2011). All three occurred on a Wednesday morning about an hour before the US stock market opened.

We think the anticipation of a global monetary policy bazooka being unleashed this week is the reason why broad risk sentiment has recovered off its lows from the Asian trading session last night, but we can’t say the momentum has swung meaningfully higher…we’ve just stopped going down for the moment. FX markets are taking US rate cuts very seriously today this morning and we see this in form of broad USD selling (after Friday’s risk-off driven broad USD buying). USDCAD, in particular, has retreated from trend-line extension resistance in the 1.3460s (hit on Friday) and is now bouncing off chart support in the 1.3320-40s (last Wednesday’s range).

This week will be an eventful one because for starters – we’ve never seen central banks in modern times go against rate cuts that have been fully priced into their respective bond markets. This means the Bank of Canada will cut by 25bp on Wednesday. We’ll also have a barrage of important North American economic data points to digest as well (see below), plus the OPEC meeting on Friday (where there’s a possibility that the existing production cuts could been deepened by 600k to 1mln bpd). What is more, we’ll likely get more US-focused coronavirus angst because it appears US health authorities are not conducting anywhere near of the number of tests when comparted to what we’re seeing in Europe and Asia.

The coronavirus case count is now quickly approaching 100k worldwide (80,026 in China). South Korea has 4,335 cases and 26 deaths. Italy has 1,696 cases and 34 deaths. Iran has 1,501 cases and 66 deaths. See here, from BNO News, for the latest statistics from China and the rest of the world.

Monday: US ISM (February) – 50.5 expected

Wednesday: Final US Services PMI (February), US Non-Manufacturing ISM (February), Bank of Canada Rate Decision

Thursday: US Factory Orders (January)

Friday: OPEC meeting, US & Canadian employment reports (February)

USDCAD DAILY

USDCAD HOURLY

APR CRUDE OIL DAILY

EURUSD

Euro/dollar surged higher to chart resistance in the 1.1150s overnight as global bond markets now demand immediate rate cuts from the Fed. Friday’s intra-day hesitation at the 1.1000 level proved short lived after the market closed NY trade firmly above it, and with that traders had another positive technical development to latch on to at the start of Asian trade last night. We’ve rallied over 250pts now however since EURUSD ended its downtrend with a break above the 1.0880-1.0900s last week, and we feel as if the market has now probably flushed out all the new fund shorts that entered during the first three weeks of February (Friday’s COT report showed the fund net short EURUSD positioning extending to a new 3-year high as of February 25th). With that, we think the market could be rip for a short term pullback, the result of which would create a new trading range now…albeit higher now...let’s call it 1.1000-1.1160.

The final Manufacturing February PMIs for Germany and the Eurozone were reported this morning slightly higher than their flash estimates (48.0 vs 47.8 and 49.2 vs 49.1 respectively). This week’s European calendar features the German Retail Sales report for January on Wednesday, followed by the final Services February PMIs for Germany and the Eurozone. Friday’s session will bring the release of Germany’s Industrial Orders data for January.

EURUSD DAILY

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

The bears are in control of sterling to start the week as traders continue to angst over upcoming UK/EU trade talks. More here from the BBC. We think Friday’s very poor NY close below the 1.2900 handle is adding to the market’s woes here as the negative technical development now exposes chart support levels from late last year (1.26-1.27). We think traders are also watching the OIS market and how it has quickly priced in a BOE rate cut for March 26th. The leveraged fund net long position in GBPUSD remained largely unchanged during the week ending February 25; a development that we think doesn’t help the market here as these positions are now surely losing money.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is bouncing this morning as the markets now speculate about a globally synchronized series of rate cuts. The first one is expected from the Bank of Australia tonight at 10:30pmET, with traders expecting a 100% chance of a 25bp reduction in the cash rate to 0.50%. This should be bearish news for the Aussie, but because we’re seeing rate cut expectations explode even more for the Fed today, we think this the reason AUDUSD is staging a mild recovery. While we believe the trend for AUDUSD is still down, we think a NY close above back above the 0.6550-60s could invite some short covering.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen imploded on Friday as global equities and US yields plunged further. Friday afternoon’s statement from Jerome Powell did little to comfort markets in our opinion, and while the Bank of Japan attempted something similar overnight we’d argue this is not working either. Markets want rate cuts now and we’re at an incredible juncture where we’ll soon see if central banks conform to the tradition of doing whatever their money markets want them to do. We wouldn’t be surprised if traders try to re-test the Asia session lows at 107.00 one more time.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com