Month-end flows in focus. Bank of Canada surprises with rate cut + QE

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Dealers reporting month end demand for USD and JPY into 10amET London fix. Liquidity is thin.

- Over 1.7blnEUR in EURUSD options expiring around 1.1000 strike into 10amET NY options cut as well.

- USD rallying broadly into NY trade, but lots of technical damage done after yesterday’s “risk-on” moves.

- Sterling continues to display higher relative volatility (beta). Aussie lagging its G7 peers over last 48hrs.

- UK PM Boris Johnson tests positive for the coronavirus. Spain reports deadliest day so far with 769 deaths.

- BANK OF CANADA cuts 50bp, launches $5blnCAD/week in QE + Commercial Paper Purchase Program.

- Bank of Canada governor Stephen Poloz to speak at 9:30amET. USDCAD quickly back above 1.41000.

ANALYSIS

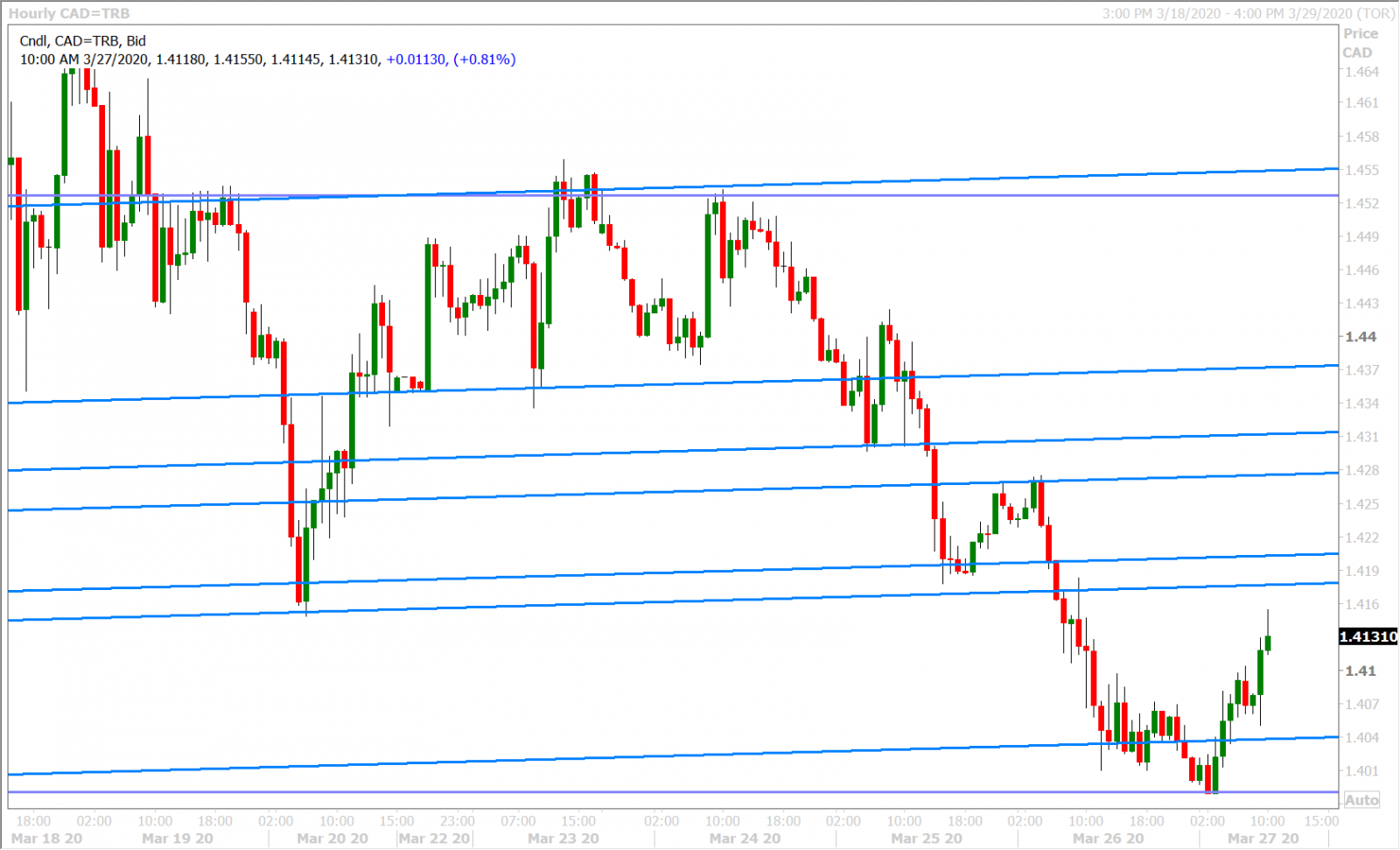

USDCAD

There’s lot of chatter this morning about what FX flows will look like going into today’s month-end London fix, and NY options cut, at 10amET. Dealers are reporting the predictable demand for JPY ahead of the Japanese fiscal year-end on March 31. They’re also reporting otherwise broad demand for USD from global fund manages that need to re-balance their portfolios for month end…portfolios that have likely been slammed by US asset under performance. Liquidity is thin though, so we hear, and so these flows could lead to exacerbated volatility in NY trade today. Over 1.7blnEUR in EURUSD options also expire this morning, between the 1.1000 and 1.1025 strikes, and so hedging flows around these will likely add some complexity to month-end as well.

Dollar/CAD has managed to find a bid against the 1.3990-1.4030 chart support zone amidst the broad USD buying flows we’re seeing in London, but we’re not so sure how long this lasts given yesterday’s technically destructive breakdown for the USD against all the major currencies. The market failed to get back above the 1.4310s (Wednesday’s lows) and it gave up the 1.4170-90s (last Friday’s lows) in the process…which is not great and now signals an end to the market’s recent uptrend if we close NY trade here. Last Friday’s intra-day head & shoulders pattern signaled the short term top and this Friday’s trade (if we close below the 1.4170-90s) will likely usher in a new, choppy, 1.3900-1.4200, trading range heading into April.

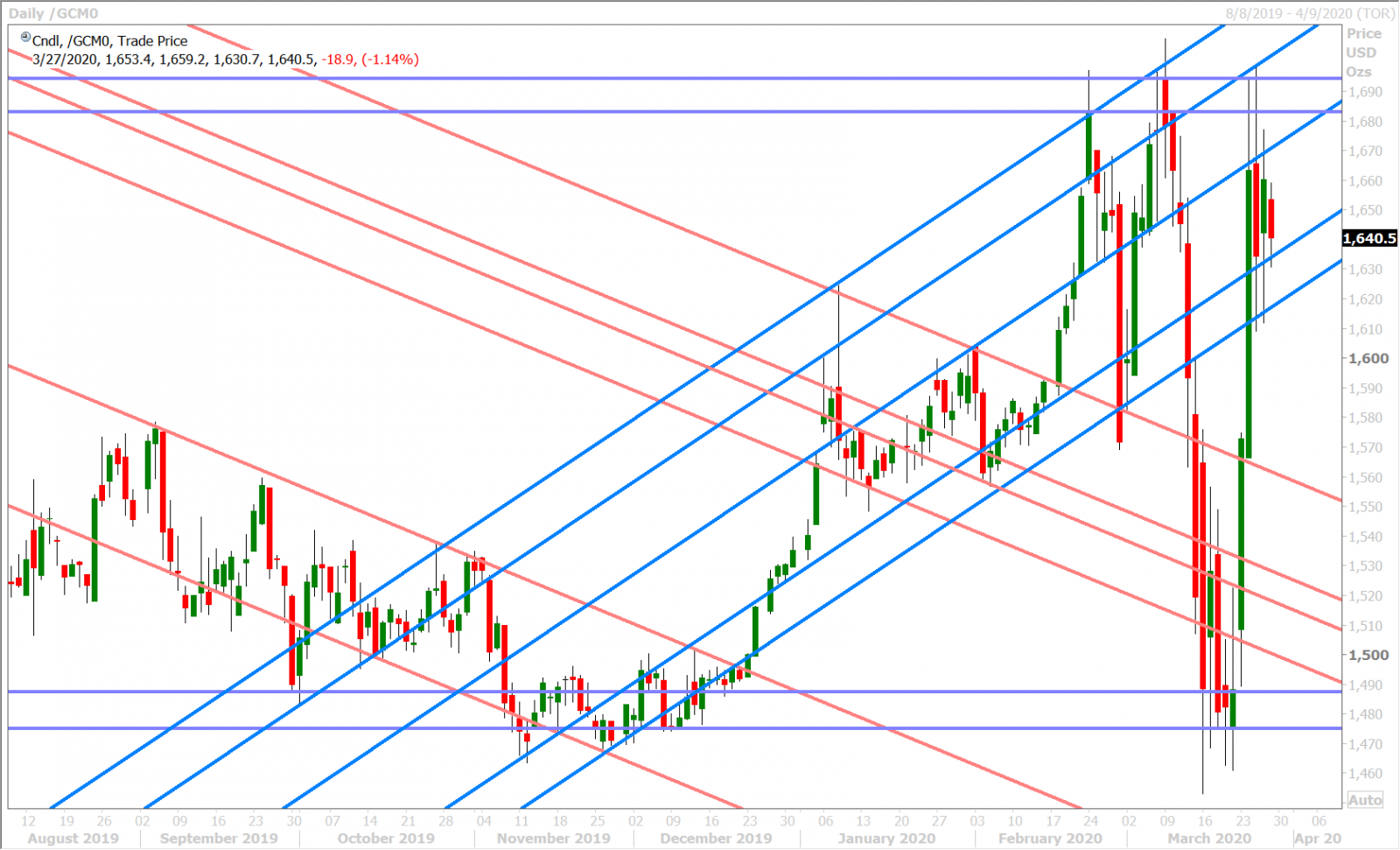

The widely followed 3-month EURUSD cross currency basis swaps remains steady around +19bp this morning, which indicates no trouble right now for broad dollar funding capacity. The S&P futures are slipping 3% lower, which is fitting given yesterday’s non-sensical rally off the worst US jobless claims print in history. Finally, May crude oil prices continue to dribble 0.6% lower as the fundamental outlook looks increasingly bearish.

USDCAD DAILY

USDCAD HOURLY

MAY CRUDE OIL DAILY

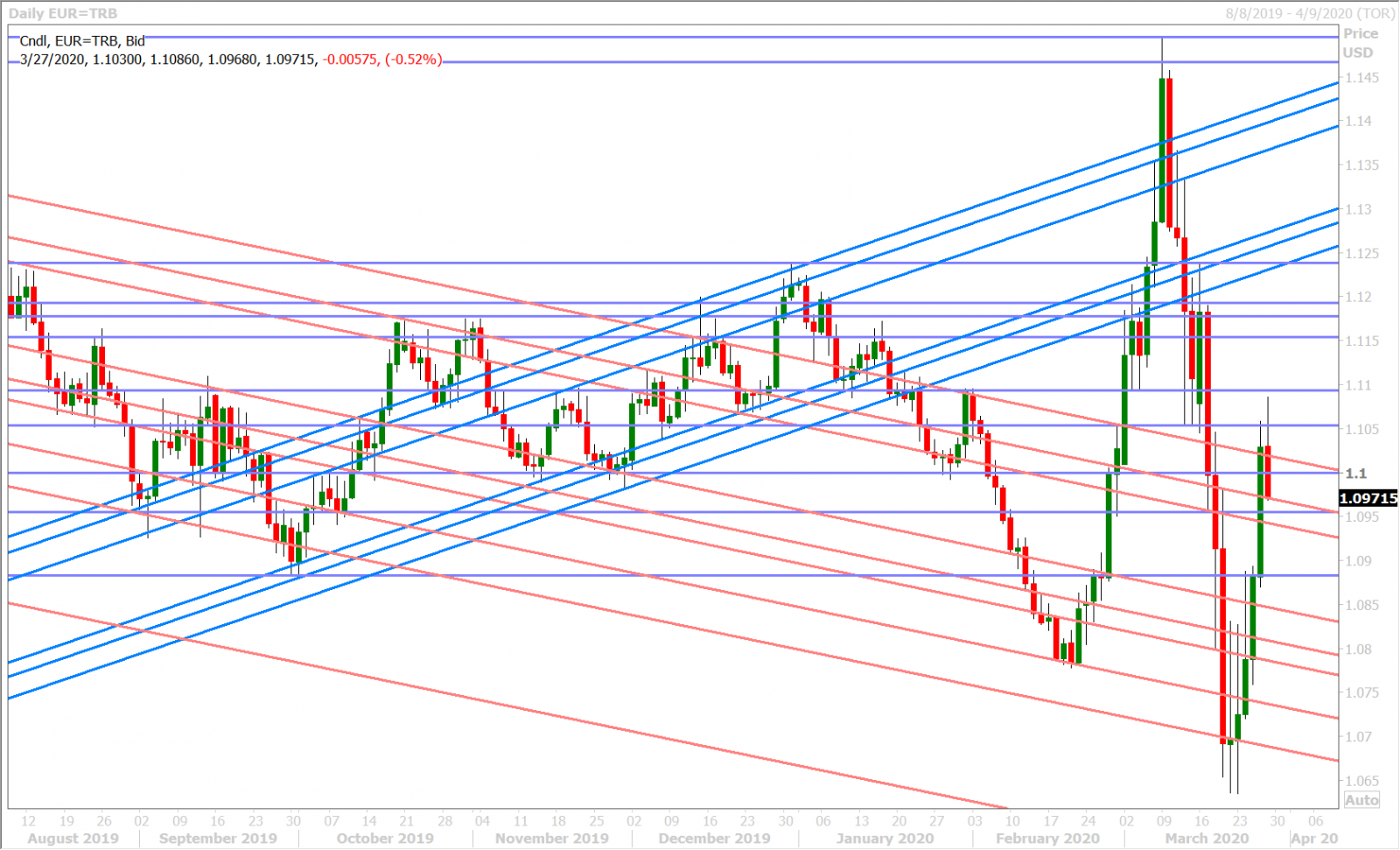

EURUSD

Euro/dollar put in an absolutely stellar performance yesterday. It not only shattered its recent downtrend with an overnight move back above the 1.0820-80s, but it wasted no time and surged to a very positive NY close above the key 1.1000 level. This led to even further buying in Asian trade today, and now we’re seeing broad month-end USD demand (and likely some EUR option hedging flows too) pull the market back to some large 10amET expiries around the 1.1000 strike.

EURUSD DAILY

EURUSD HOURLY

JUNE GOLD DAILY

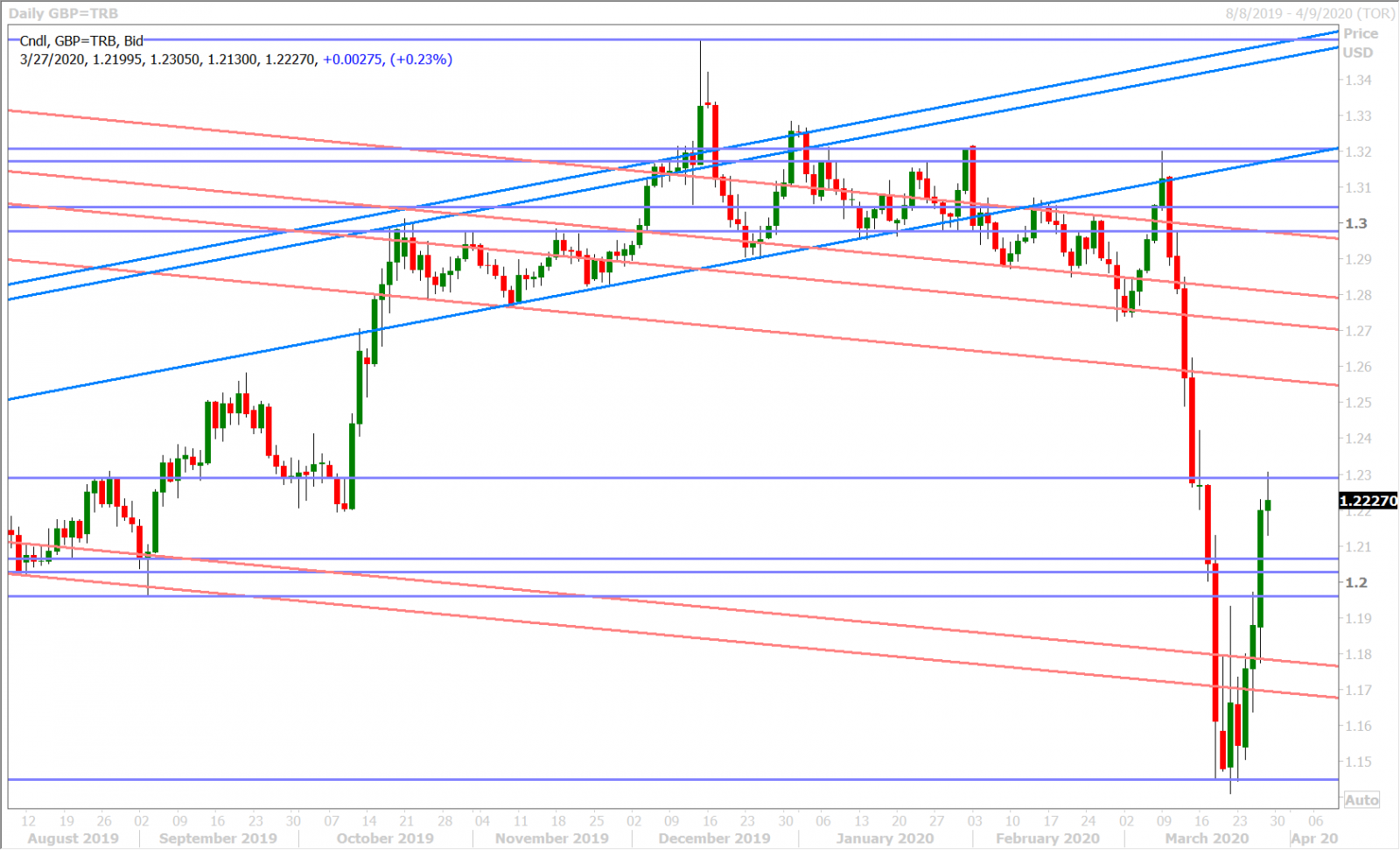

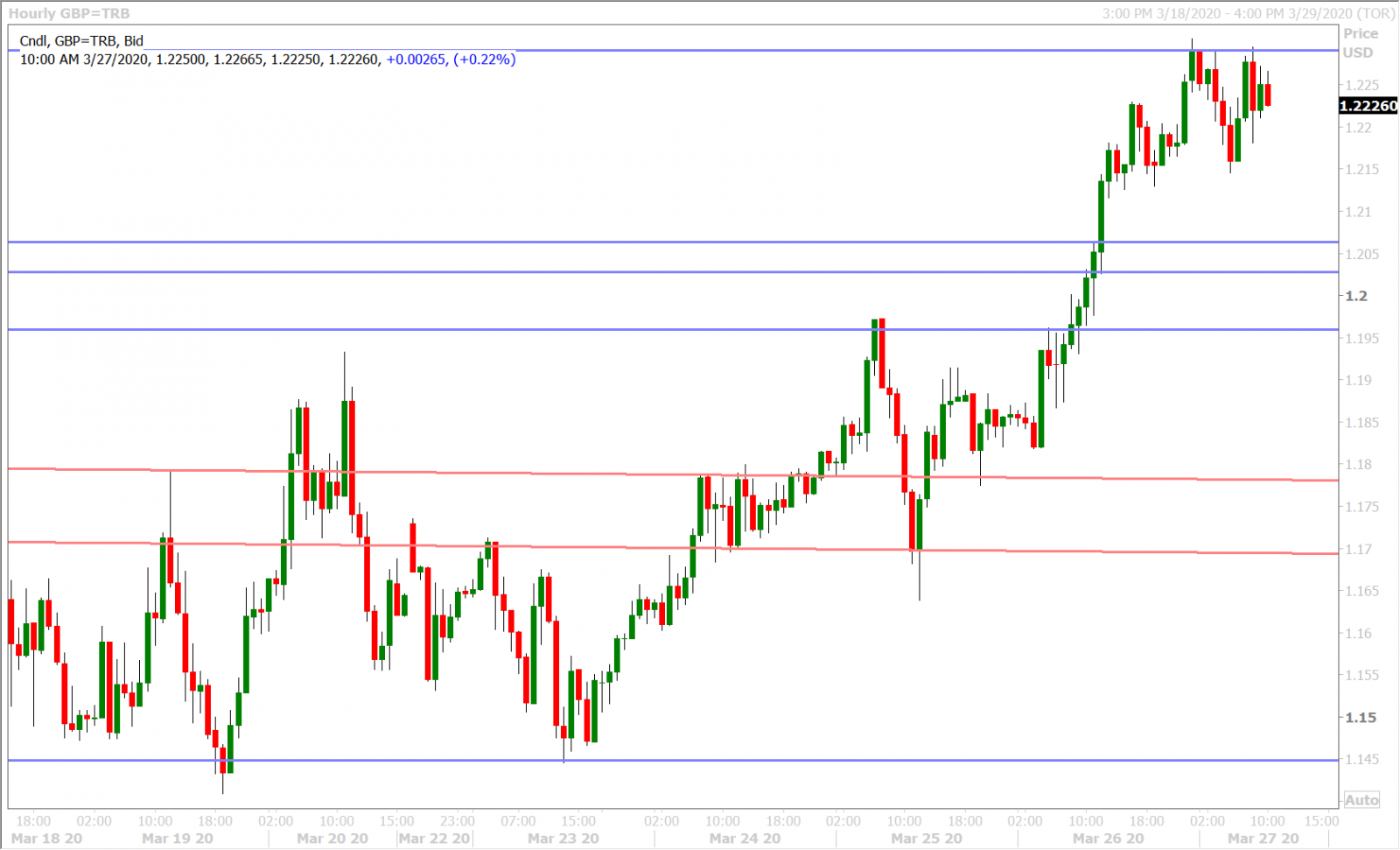

GBPUSD

Sterling bulls didn’t waste any time yesterday either. It was up, up, and away as soon as soon chart resistance in the 1.1950-70s fell in early NY trade. While we saw some mild buyer hesitation at 1.2020-50 heading into the London close, that level quickly gave way too after US stocks continued their “hey…the US jobless claims weren’t as bad as we feared” rally. GBPUSD is now trading just shy of its next major chart resistance level in the 1.2290s and we’ve seen some selling come in on the back of news that the UK Prime Minister Boris Johnson tested positive for the conoravirus.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

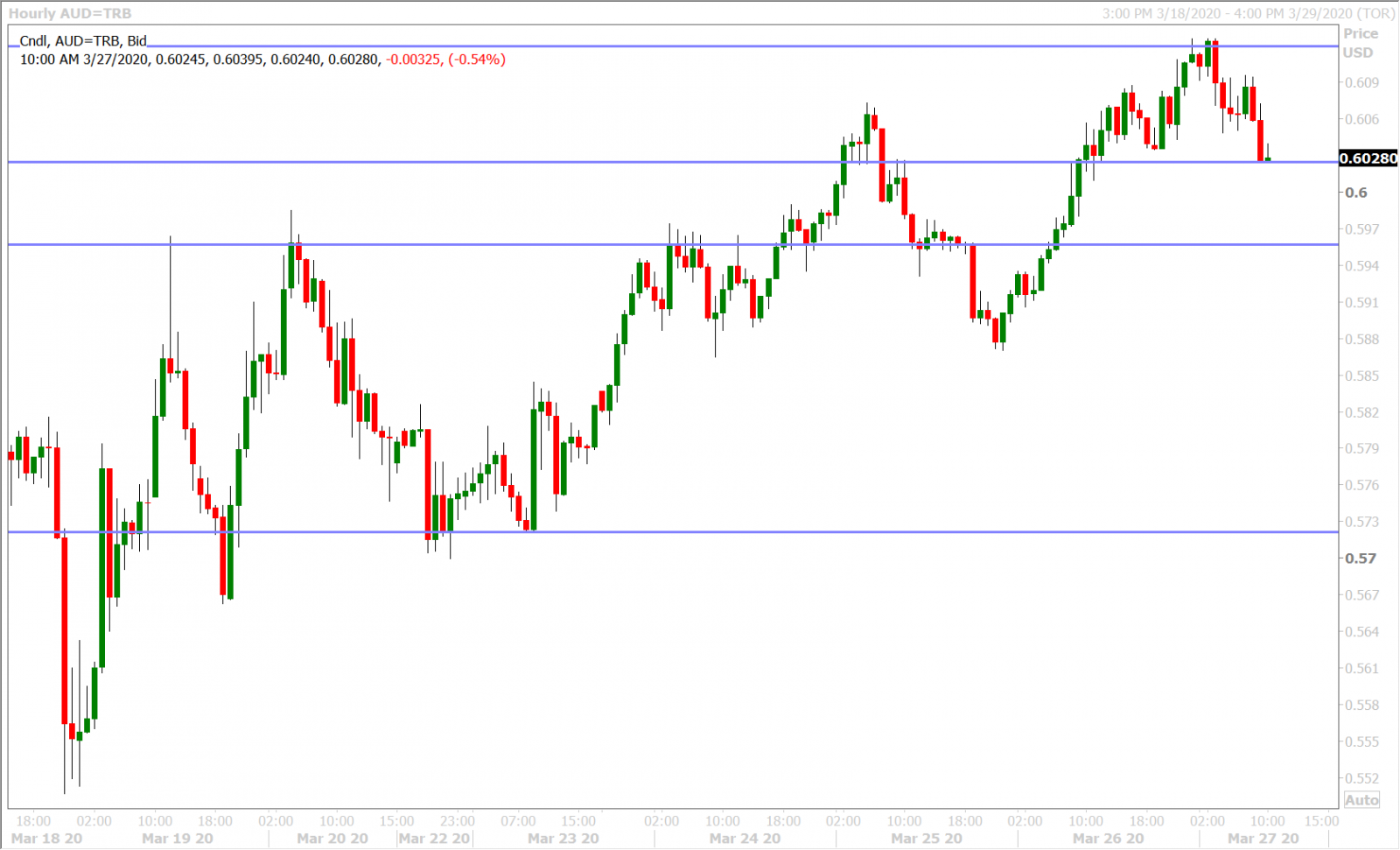

AUDUSD

The Australian dollar continues to lag its G7 peers over the last 48hrs; perhaps because of its poorer relative chart structure vis a vis the other USD majors and perhaps also because of the open-ended nature of the RBA’s new quantitative easing program. We think this dynamic is all very new for Aussie traders and will lead its government bond yields to perhaps fall further than their US counterparts in the near term. AUDUSD closed above the 0.6020s yesterday (which was positive technically) but it has since fallen too easily back off its next major resistance level in the 0.6110s (which is not good).

AUDUSD DAILY

AUDUSD HOURLY

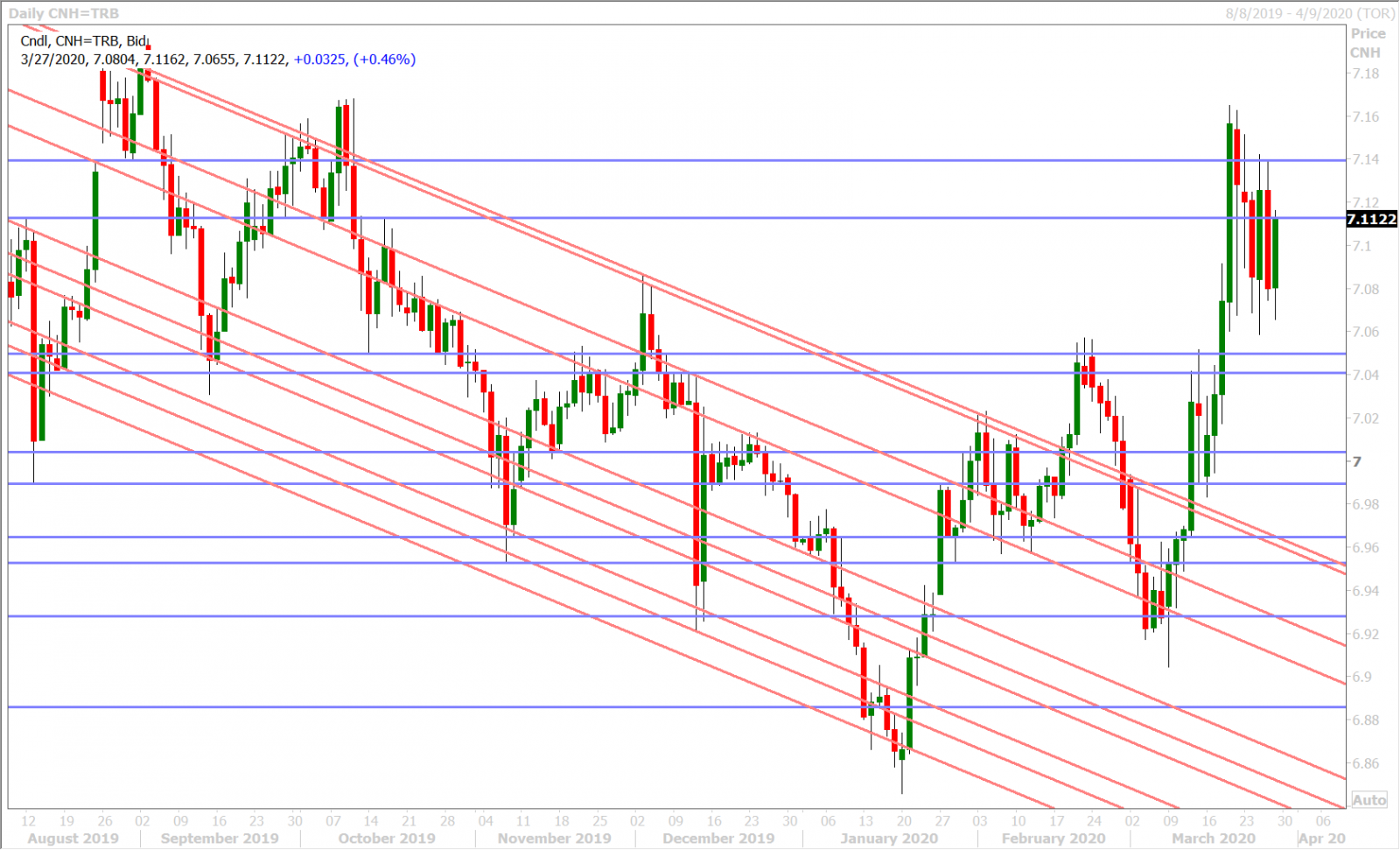

USDCNH DAILY

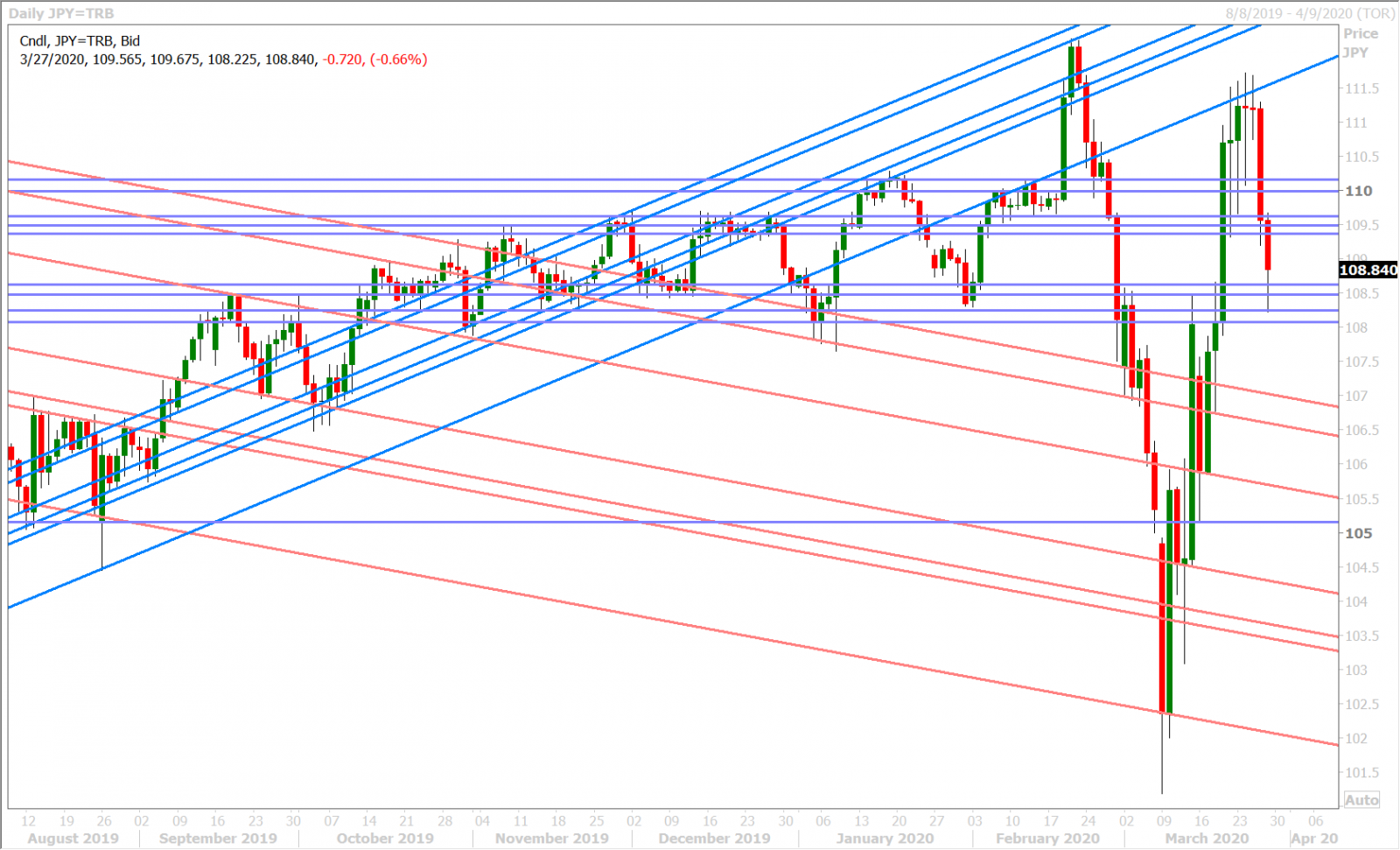

USDJPY

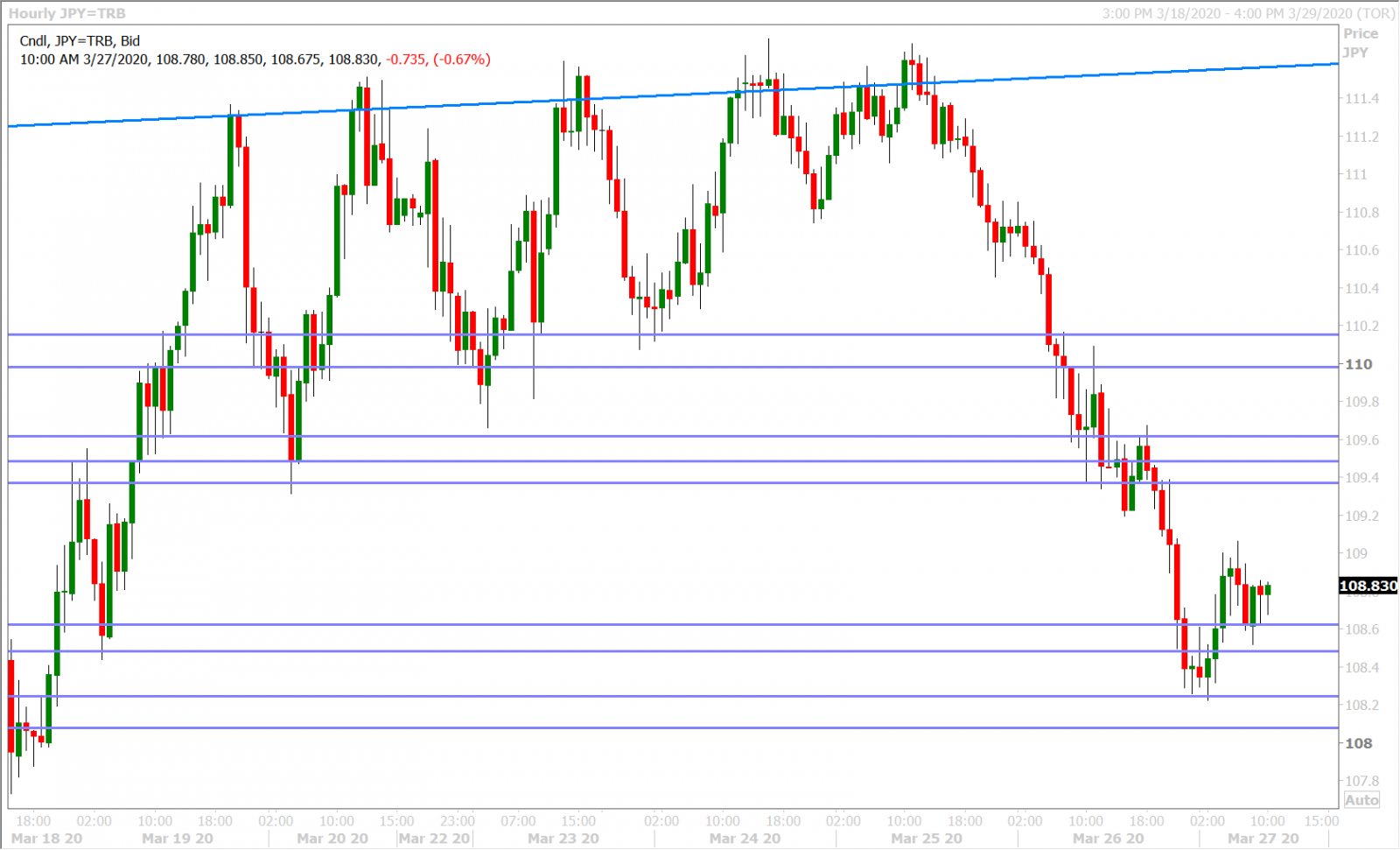

Dollar/yen continued its tumble overnight after the 109.40-60s support zone gave way. We hear dealers blaming it on Japanese fiscal year end (repatriation) demand for JPY ahead of this morning’s London fix. This all makes sense. However, we’re also hearing about broad month-end demand for USD, which complicates things and perhaps explains USDJPY’s bounce off 108.20s support in early London trade. These flows are highly very difficult to predict with any accuracy, but it makes month end FX price movement sort of unpredictable and exciting at the same time. There are no major USDJPY option expiries near current levels heading into the 10amET NY cut.

USDJPY DAILY

USDJPY HOURLY

JUNE S&P 500 DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com

Disclaimer: All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This publication has been prepared by Currency Exchange International for informational and marketing purposes only. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable, but no representation or warranty, express or implied, is made as to their accuracy or completeness and neither the information nor the forecast shall be taken as a representation for which Currency Exchange International, its affiliates or any of their employees incur any responsibility. Neither Currency Exchange International nor its affiliates accept any liability whatsoever for any loss arising from any use of this information. This publication is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any of the currencies referred to herein, nor shall this publication be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The general transaction, financial, educational and market information contained herein is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a "call to action" or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. You should note that the manner in which you implement any of the strategies set out in this publication may expose you to significant risk and you should carefully consider your ability to bear such risks through consultation with your own independent financial, legal, accounting, tax and other professional advisors. All Currency Exchange International products and services are subject to the terms of applicable agreements and local regulations. This publication and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced in whole or in part, or referred to in any manner whatsoever nor may the information, opinions and conclusions contained in it be referred to without the prior express written consent of Currency Exchange International.