Month / quarter / half-year end flows in focus

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

- USD bid on “risk-off” through Europe, but now falling into NY options cut / London fix.

- Two large topside option expiries in play for EURUSD (1.1240s) and AUDUSD (0.6900).

- Dollar demand noted at yesterday’s London fix. Flows into 11amET could be erratic.

- Lots of Fed-speak on deck afterward, but no surprises expected. Powell at 12:30pmET.

- Chicago PMI for June misses consensus estimate, 36.6 vs 45.0 vs 32.3 previously.

- Canadian GDP -11.6% in April. Canadian markets closed for Canada Day tomorrow.

ANALYSIS

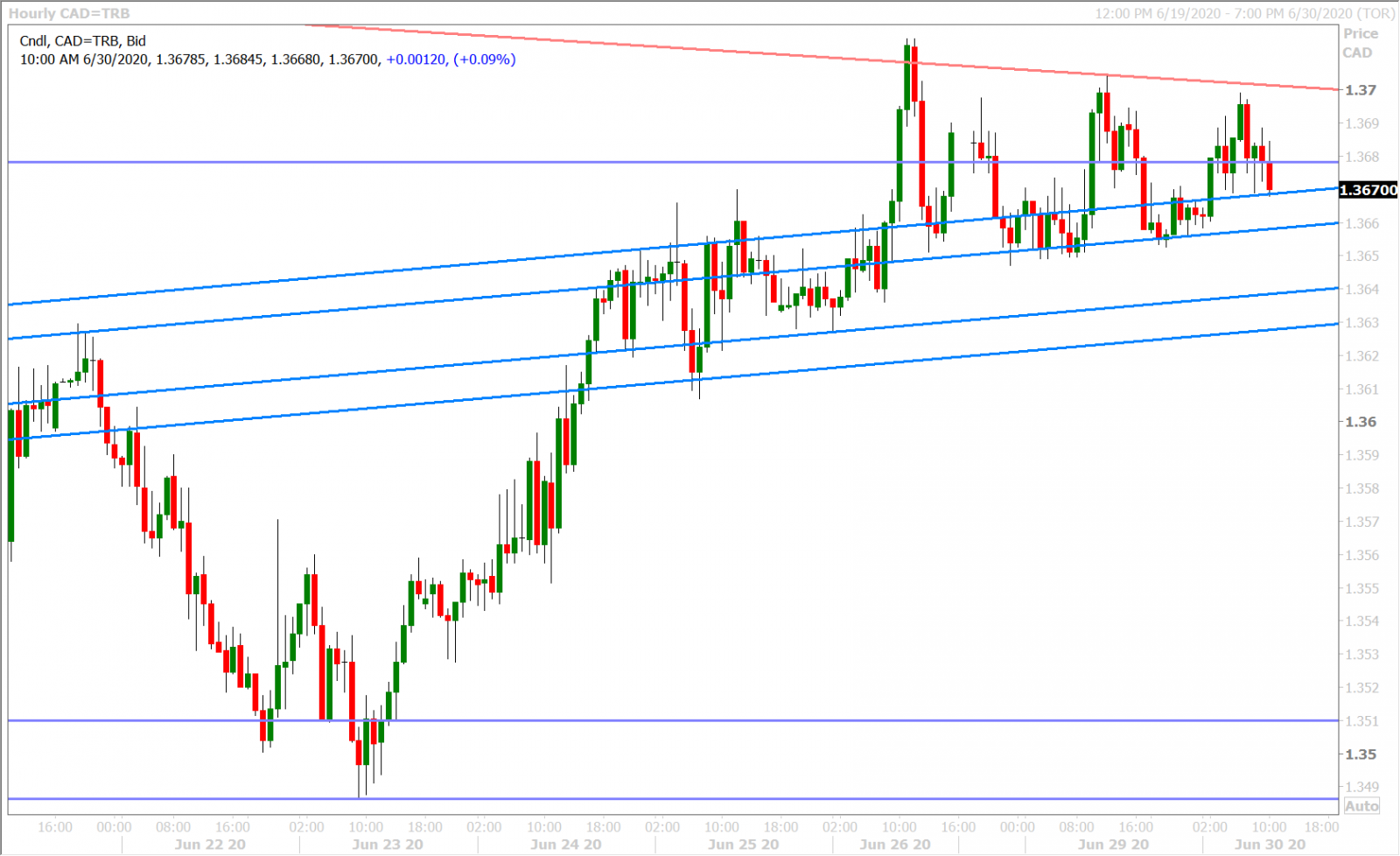

USDCAD

While global risk sentiment miraculously recovered into the NY close again yesterday, it’s looking shaky again this morning as traders digest news of fresh lockdowns for parts of the UK and Australia (Leicester and Melbourne) and headlines about global opposition to China’s official passage of its new Hong Kong security law. This morning’s safe-haven dollar bid also seems to be getting support from EURUSD selling heading into a large 1.1185 option expiry at 10amET and talk of month/quarter/half-year-end USD buying at the London fix (11amET). Dollar/CAD is still struggling to break above its daily downtrend line just above the 1.37 mark, but we’d note a bullish triangular consolidation developing on the hourly chart should the 1.3660s hold.

Canada just reported a slightly less worse than expected contraction to GDP for April (-11.6% vs -13.0%), but datasets like these continue to be backward looking, which explains this morning’s trader apathy to the headline. Canadian markets will be closed tomorrow for the Canada Day holiday.

USDCAD DAILY

USDCAD HOURLY

AUGUST CRUDE OIL DAILY

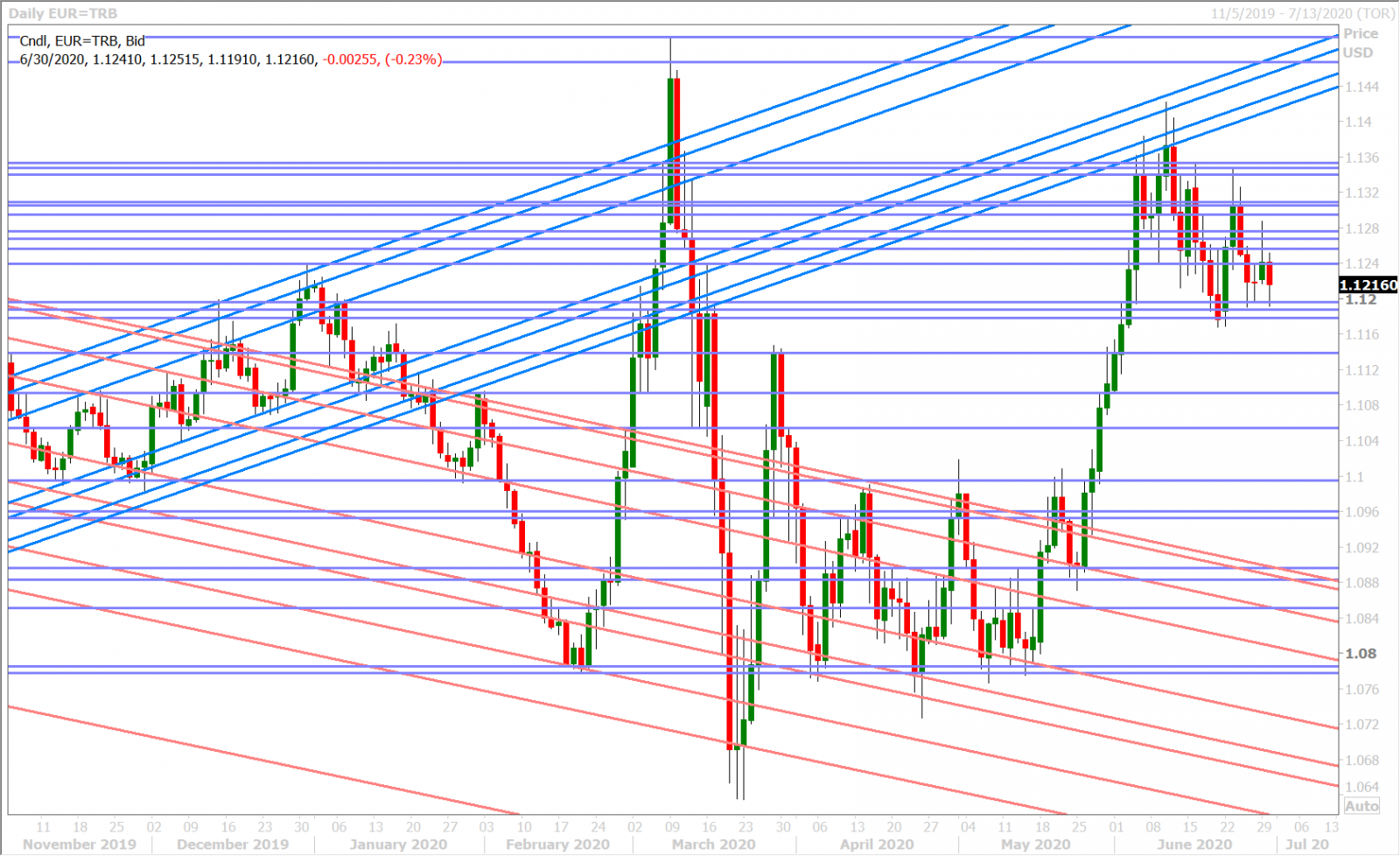

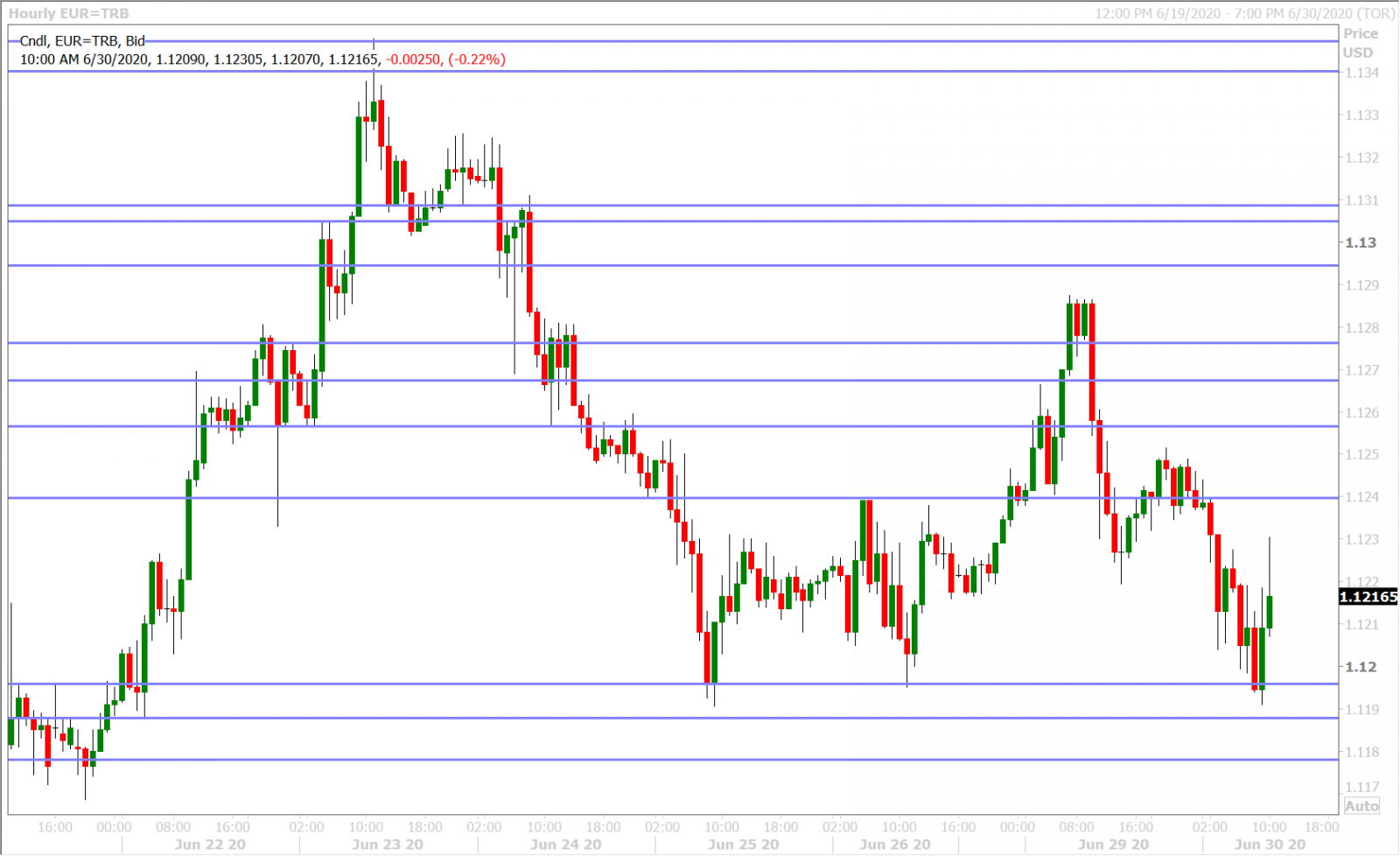

EURUSD

Euro/dollar gave up all its gains after the NY options cut yesterday, which was quite appropriate in our opinion given the risk-off flows/month-end USD demand type flows we saw heading into the London close. The market’s NY close back above 1.1240 stabilized prices during the Asian session last night, but the negative headlines during the European morning saw this level give way once again. Hedging ahead of two large option expiries at 10amET (1.6blnEUR at 1.1185 and 2.4blnEUR at 1.1240-50) and month/quarter/half-year-end rebalancing flows ahead of the 11amET London fix should dominate trader attention this morning, after which we’ll hear from four Fed speakers (Williams at 11amET, Powell at 12:30pmET, Bostic and Kashkari at 2pmET). No surprises are expected from the Fed chairman, after Powell reiterated the “extraordinarily uncertain” economic outlook in his prepared remarks, which were released late yesterday. See here.

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

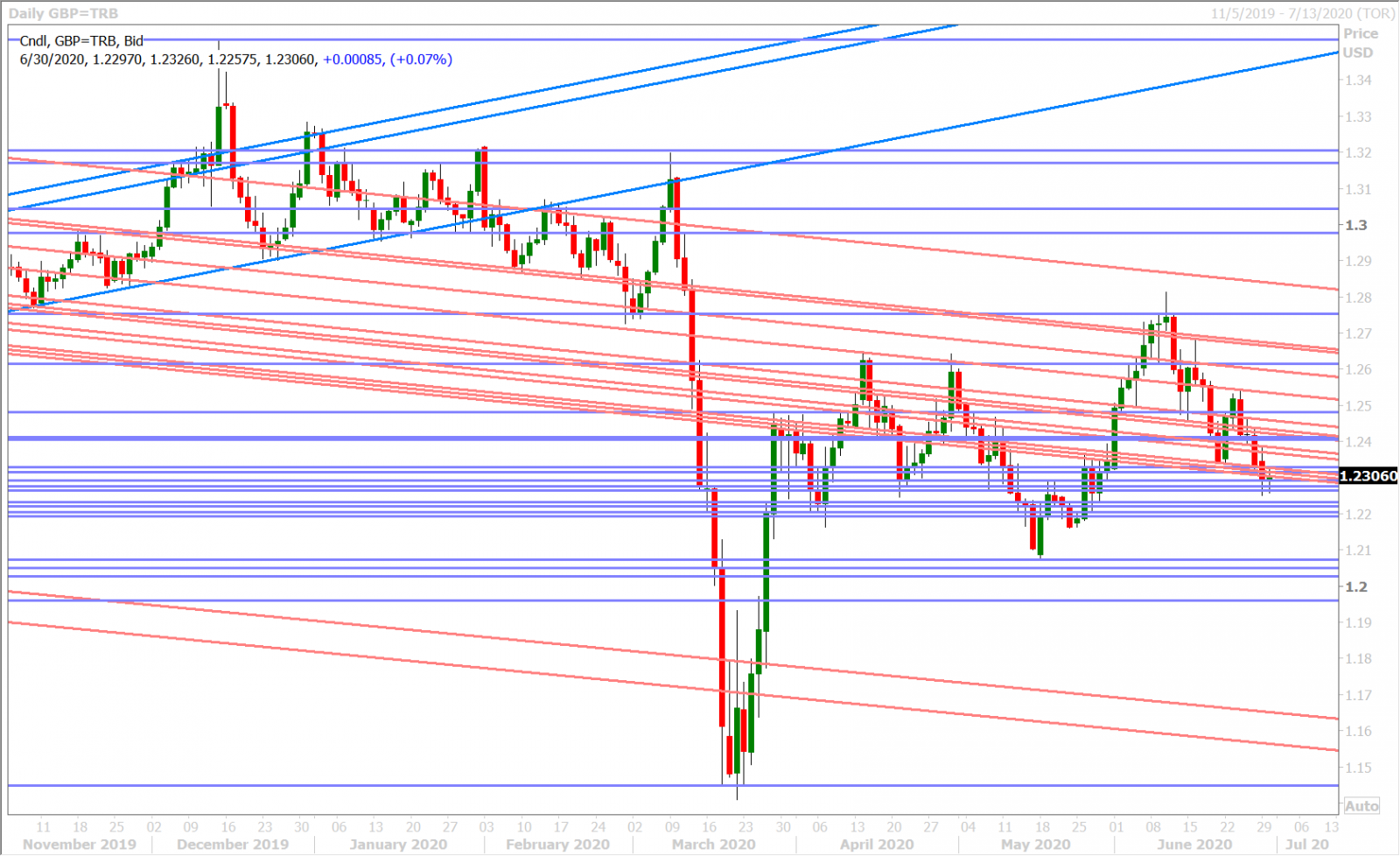

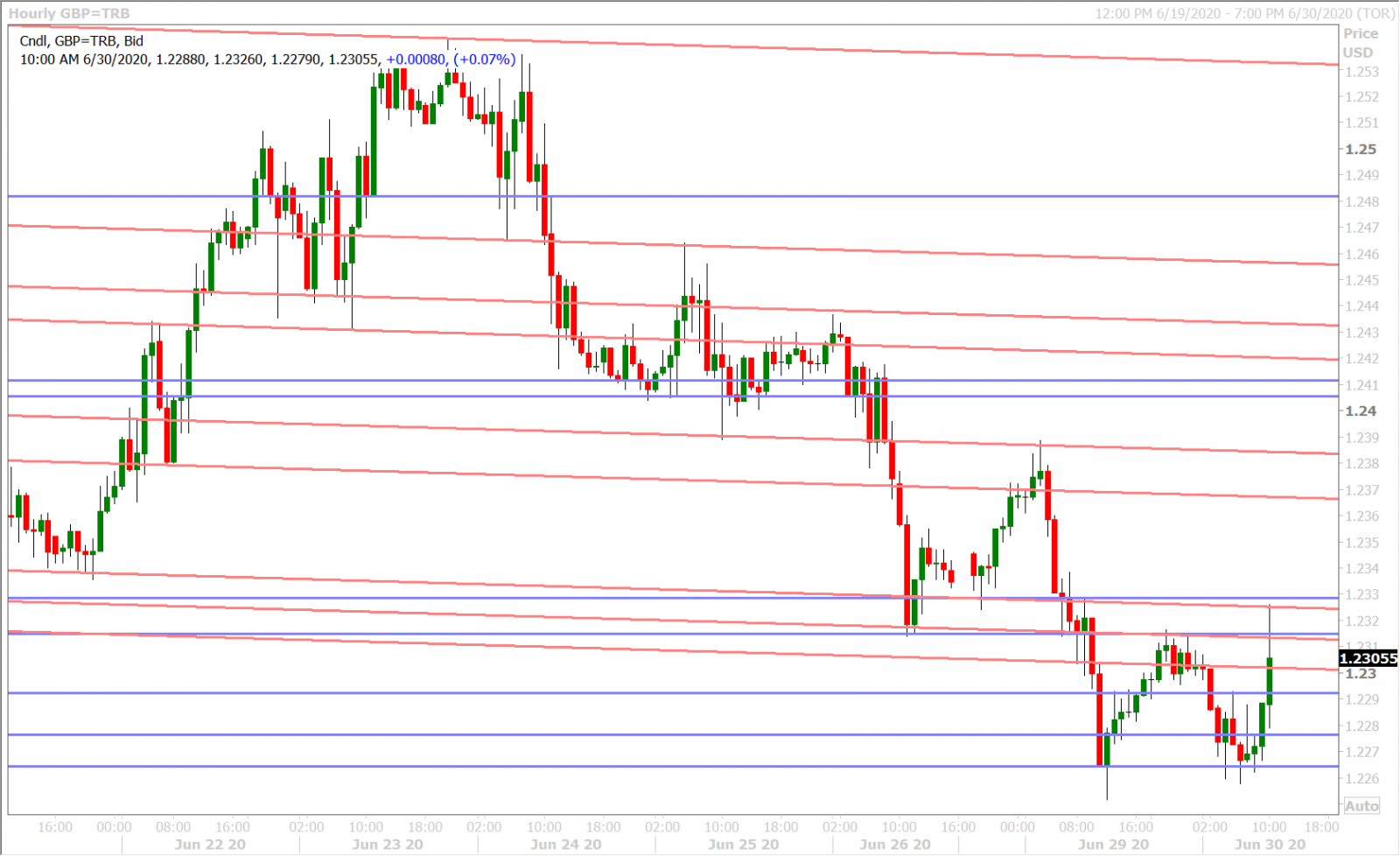

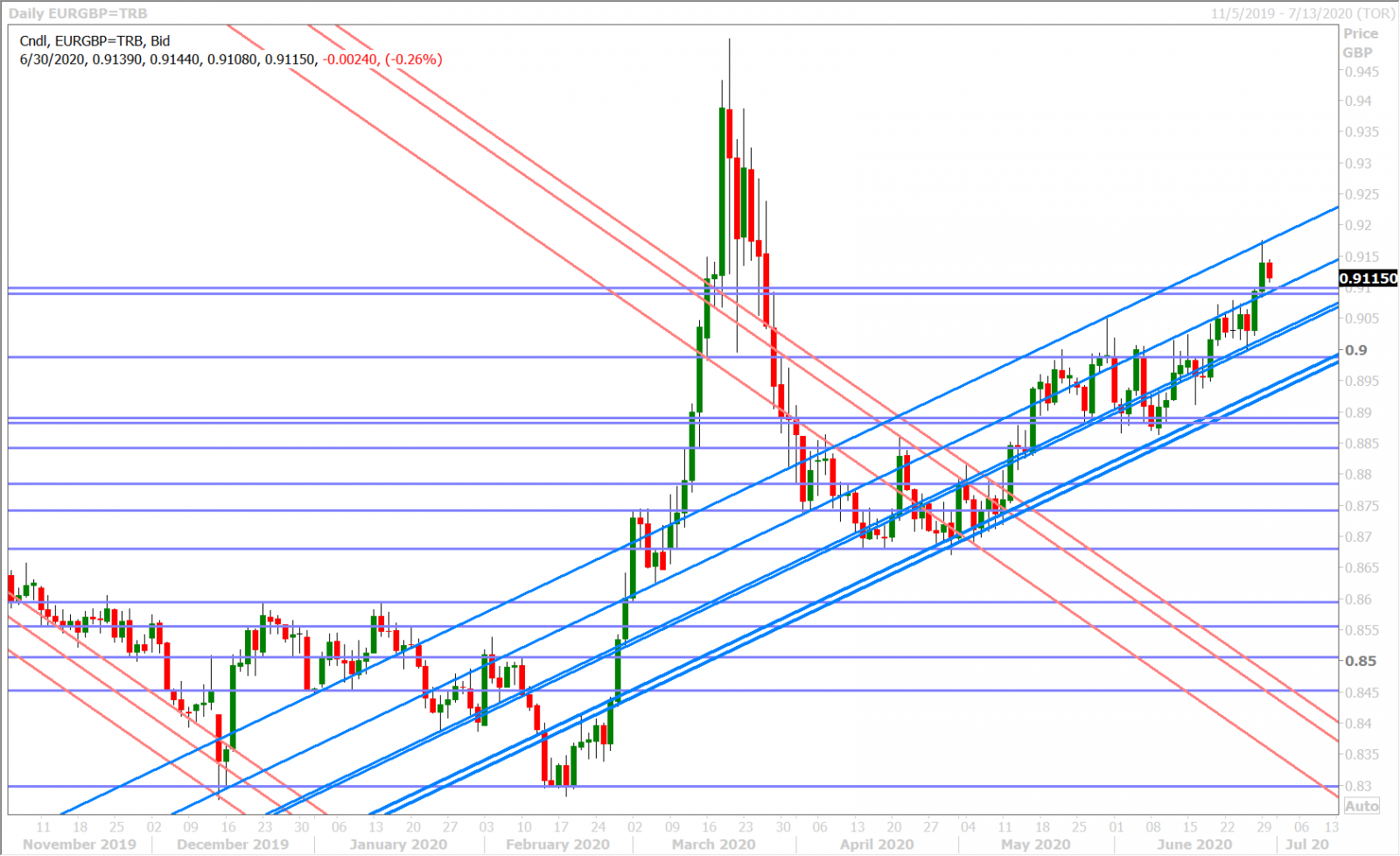

GBPUSD

The UK reported its worst quarterly contraction in 40 years this morning (-2.2% vs -2.0% expected for Q1) and, while we saw sterling trade lower around the 2amET release time, we felt the GBPUSD drop was more driven by the fresh lockdown headlines coming out of Melbourne, Australia. The market is now bouncing strongly as focus turns to flows around two large EURUSD option expiries and month/quarter/half-year-end. The completion of month-end EURGBP demand and some trend-line extension resistance at the 0.9170s has seen the cross top out for the time being, which is mildly GBP supportive as well.

The BOE’s Andy Haldane said “so far so V” when referring to state of the UK’s economic recovery this morning. More here from Reuters. Deputy Bank of England Governor Jon Cunliffe will be speaking at 10amET.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

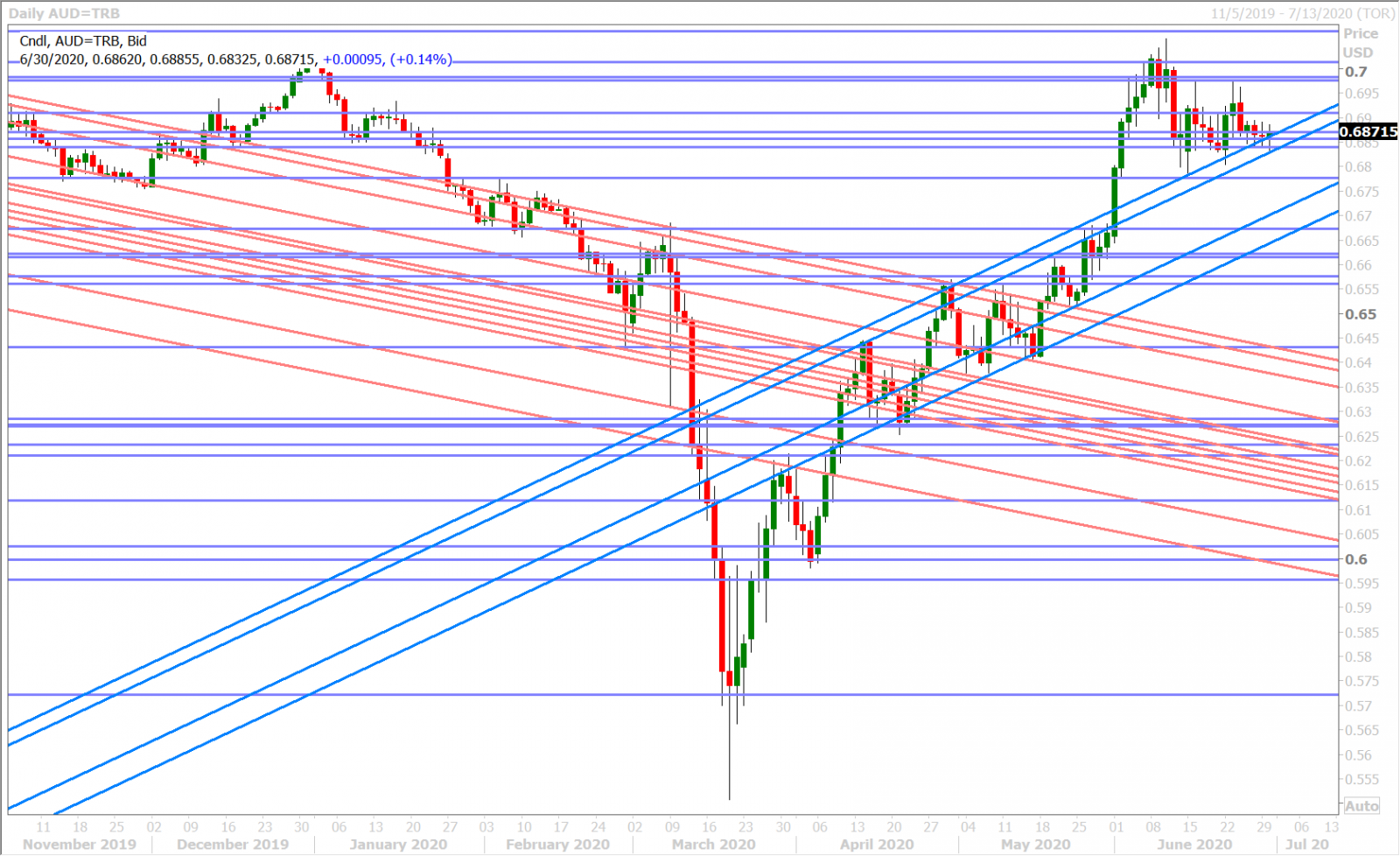

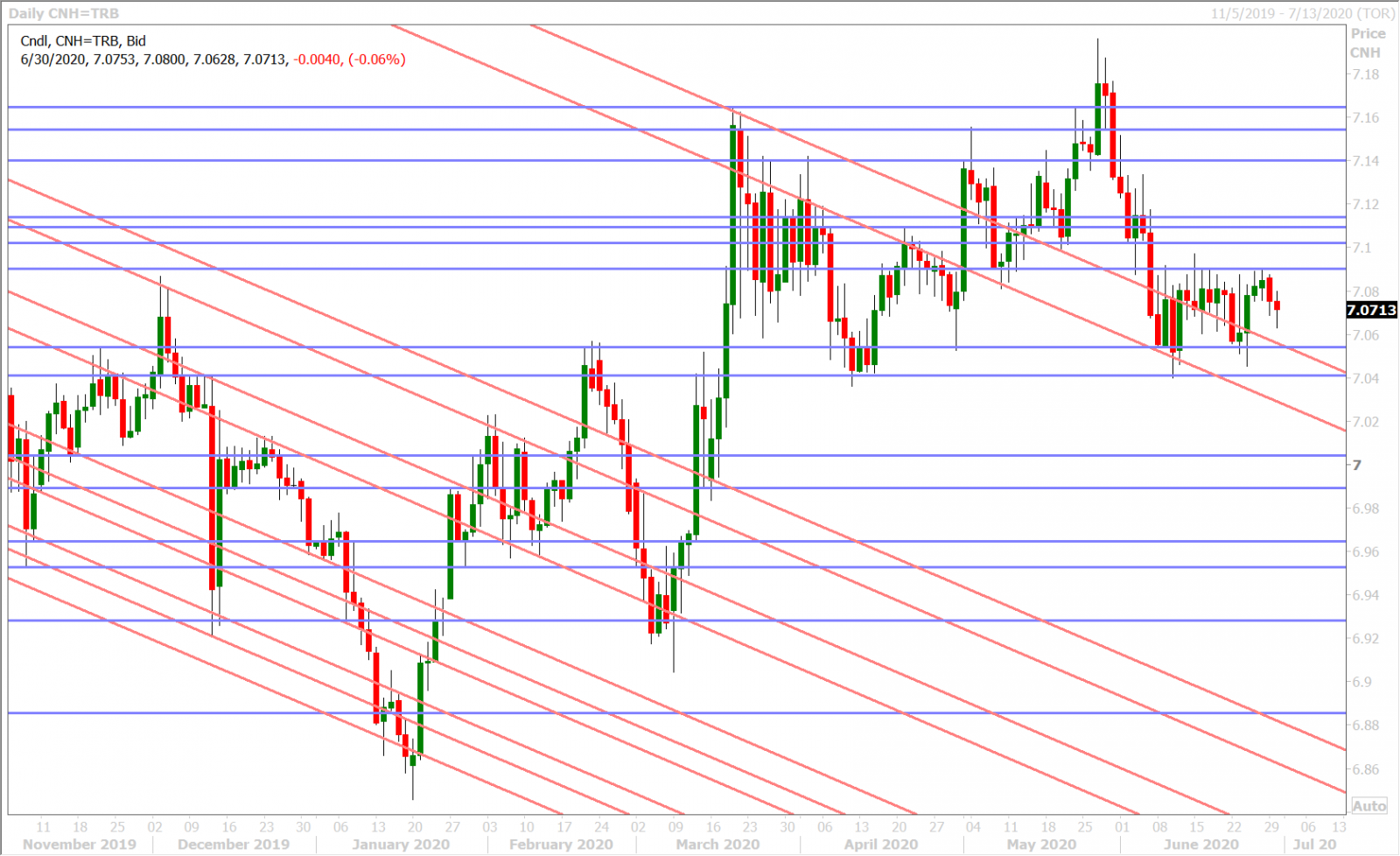

AUDUSD

Can this morning’s large topside option expiries for EURUSD (1.1240s) and AUDUSD (0.6900) save the day for the Australian dollar and keep the market’s uptrend intact? So far so good, if we look at the Aussie’s bounce off the top end of the familiar 0.6810-40 support zone this morning. Deputy Governor Guy Debelle didn’t say anything new from a monetary policy perspective last night. More here from Reuters. There was also very little excitement following last night’s mildly better than expected Manufacturing PMI out of China for June (50.9 vs 50.4)

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

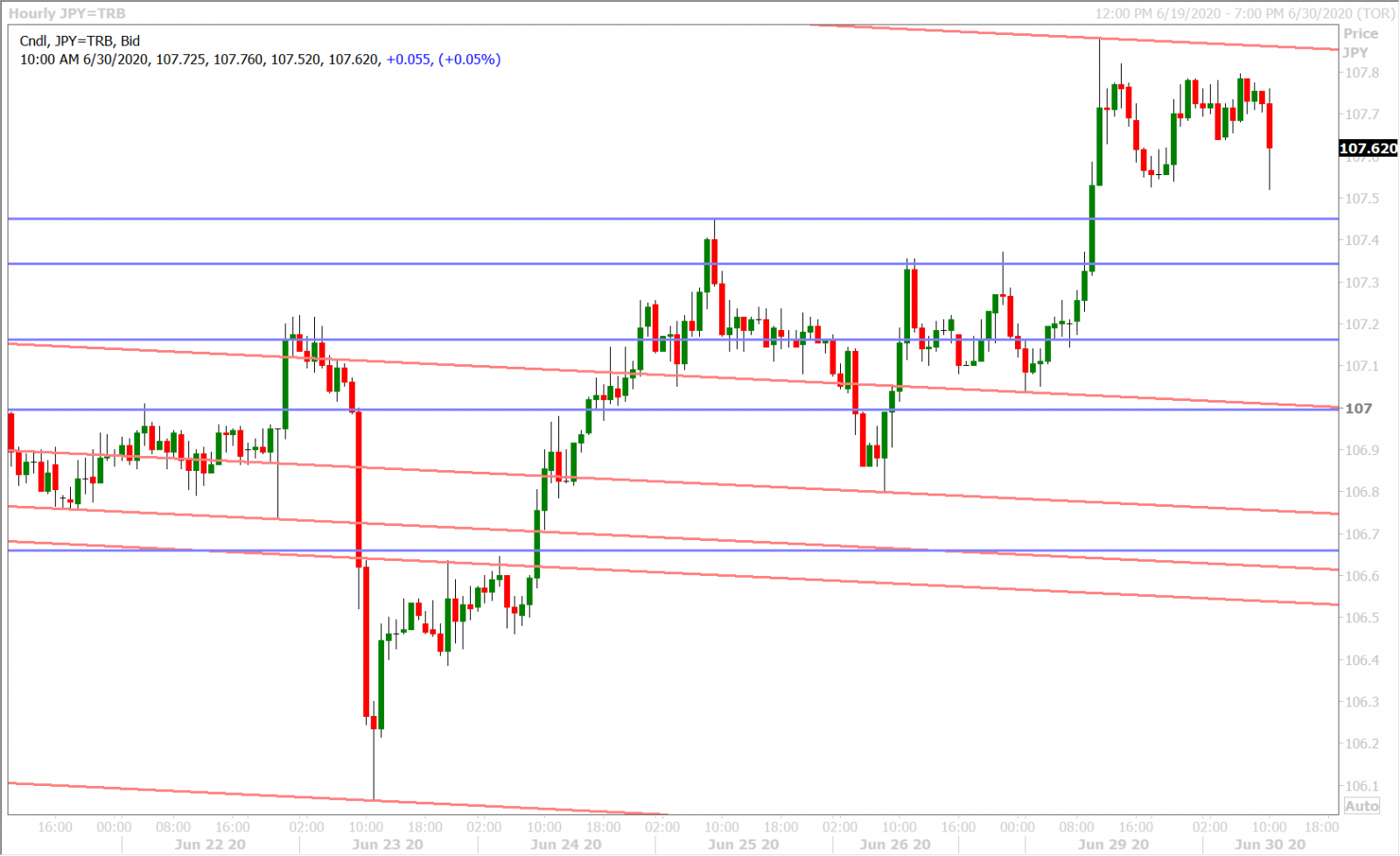

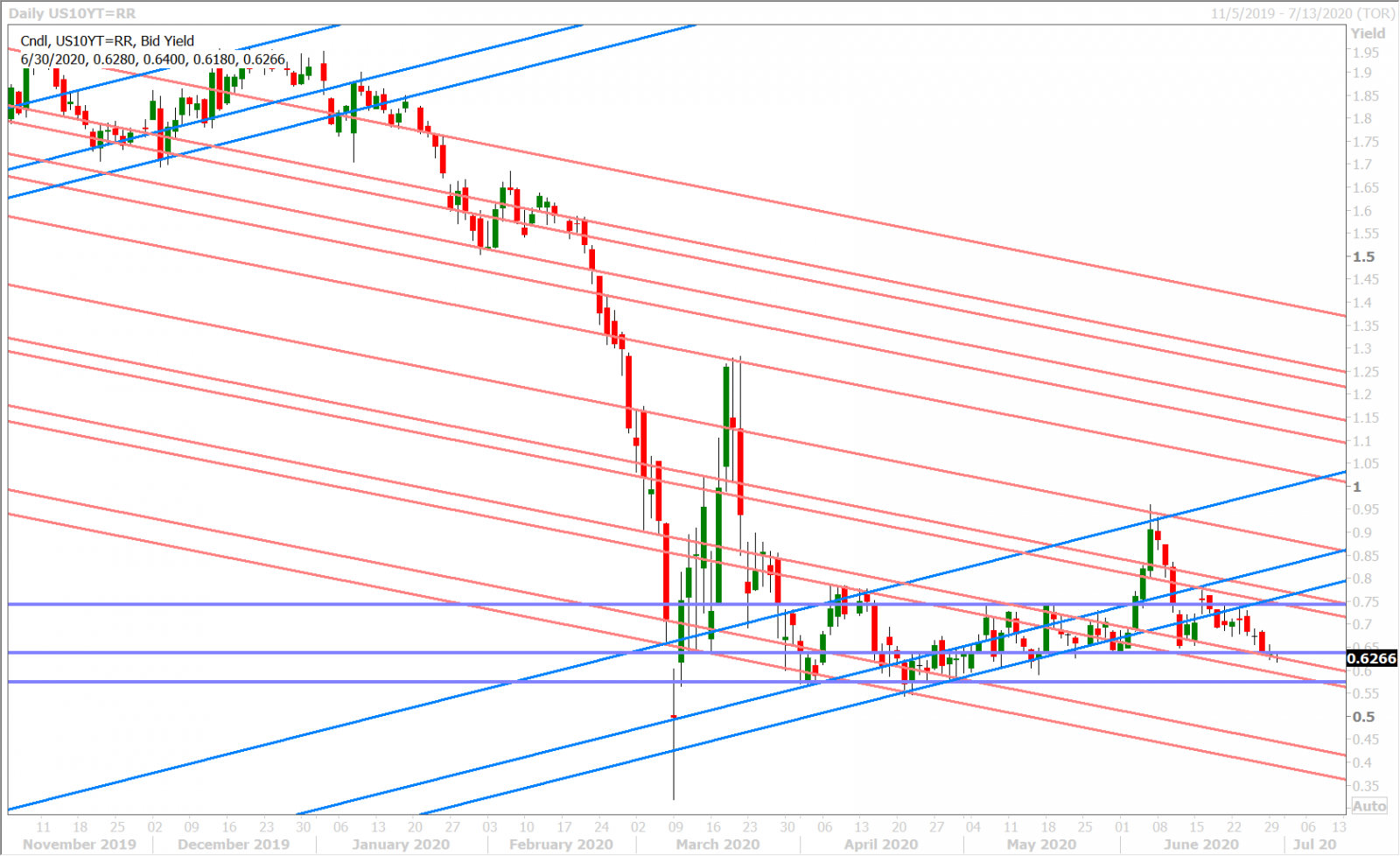

USDJPY

Dollar/yen traders look a little dazed and confused this morning as month/quarter/half-year-end portfolio rebalancing flows dominate the market’s attention. Yesterday’s rally capped out at trend-line chart resistance in the 107.80s and we see the 107.30-40s now acting as support. US yields are under pressure again today as some more negative interest rate bets get placed on the middle of the 2021 Fed Funds and Eurodollar curves. We don’t think FX traders are really paying attention to this yet, but this could become a broad USD-negative if bond markets continue to pressure Powell here.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com