More positive headlines out of China propel risk sentiment higher again

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Daily increase in new coronavirus cases outside Hubei province declines again in China.

- Beijing considering cash infusions and mergers for airline industry + LPR rate cut tomorrow.

- US PPI for January comes in much hotter than expected, +0.5% MoM vs +0.1%.

- Headline Canadian for January CPI beats consensus, but core and common measures fail to impress.

- UK CPI for January beats YoY on the headline, but MoM and core measures miss.

- USD broadly in demand going into NY open. EURUSD still under pressure. USDJPY explodes higher.

- Japan could become the largest hotspot for coronavirus infections outside of China (Bloomberg).

ANALYSIS

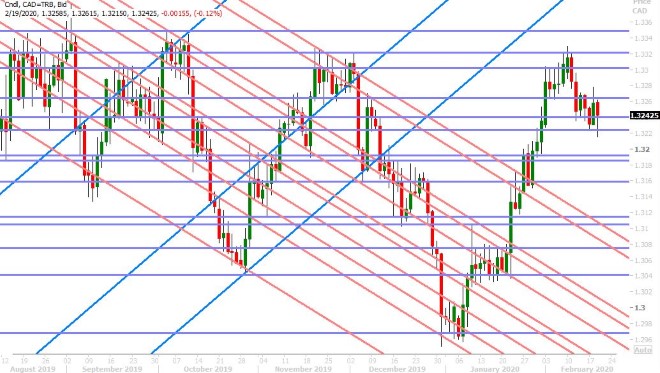

USDCAD

Dollar/CAD traders couldn’t muster a NY close above the 1.3260s resistance level yesterday despite a weaker than expected Canadian Manufacturing Sales print for December and a stronger than expected NY Fed Manufacturing Survey for February. After a brief “risk-off” fit that saw gold prices surge above the $1,600 mark, global markets eventually shook off coronavirus concerns yet again and nowhere was this more apparent than in the sharp recovery in March crude oil prices. This saw USDCAD lose the 1.3260s after trading above it in early NY trade and set the market up for an offered tone going into Asian trade.

This offered tone picked up pace after China’s National Health Commission reported just 56 new coronavirus cases outside of Hubei province for February 19th, which is now the lowest daily rise in new cases since January 29. Bloomberg reported that the Beijing was considering cash infusions and mergers to bail out the Chinese airline industry. More here. Market chatter also suggested that China will cut its benchmark loan prime rate (LPR) at the PBOC’s monthly fixing tomorrow. All this contributed to a modest risk-on vibe which saw USDCAD slip below the 1.3240s support level heading into London trade.

This technical weakness ushered in yet more USDCAD selling, but this has come to a halt following the release of Canada’s latest CPI report and the US’ most recent read for producer price inflation. The headline inflation figures for Canada mildly beat expectations in January (+0.3% MoM and +2.4% YoY vs +0.2% and +2.3% respectively), but the core YoY measure simply met expectations of +1.8% YoY and the Common CPI measure actually missed consensus by two tenths (+1.8% YoY vs +2.0%). US PPI, on the other hand, beat expectations by a big margin on the headline and core measures (+0.5% MoM vs +0.1% for both).

We’d argue that this morning’s economic data is net positive for USDCAD and explains the strong bounce we're now seeing.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

Euro/dollar is grasping for straws again this morning after a couple waves of risk-on over the last 24hrs cancelled out yesterday morning’s gold-driven bounce. It’s hard to find any sort of fundamental narrative to stop the selling in euro right now and so we defer to the chart technicals and trader willingness to push the market below the key 1.0790 support level today. A NY close below here would be another bearish development for EURUSD and would open up more selling down 1.0550-1.0600 level in our opinion.

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

The UK reported better than expected YoY reads for both headline and core inflation for the month of January this morning, but the MoM figures missed on the headline and just met expectations on the core measure. Sterling traders seemed unimpressed and decided to keep selling GBPUSD after yesterday’s notable buyer failure at 1.3040s chart resistance.

This morning’s hotter than expected US PPI data for January now seems to be driving some broad USD strength, that has in turn pressured GBPUSD back below the 1.2980s. Chart support in the 1.2940-50s is the next stop in our opinion, and we think the market technicals would get decidedly more bearish with a NY close below there.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

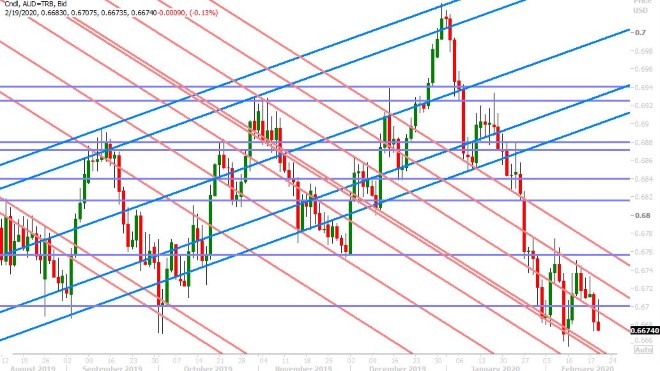

AUDUSD

The Australian dollar benefited from last night’s mild risk-on move in Asia, but all this is now unraveling as traders focus on upbeat US PPI data and broad USD buying flows, which have really picked up steam. Last night’s +0.5% QoQ in-line read for Australia’s Q4 Wage Price Index was a non-event for markets, and it appears this morning’s sizable option expiries around the 0.6700 strike are not getting much attention either.

The Aussie looks more focused on making new lows here but we might need a weaker than expected employment report out of Australia tonight before that can happen. The market consensus is looking for +10k jobs created in January and 5.2% for the unemployment rate. The OIS market is pricing in just a 4% chance that the RBA cuts interest rates on March 3rd.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

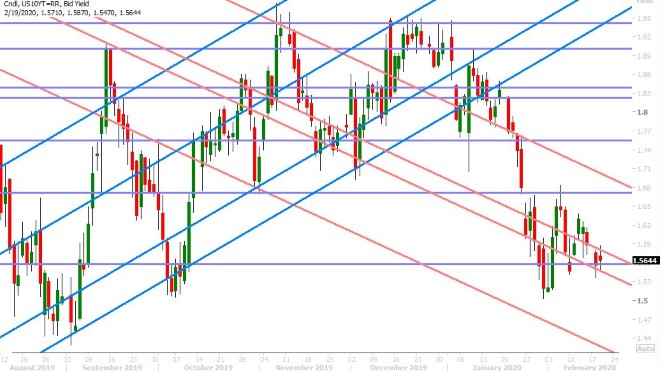

USDJPY

The yen is completely falling apart today, and while we think it’s safe to say some of the early moves today were risk-on driven, we’d argue there’s some “sell everything Japan” vibes in the marketplace today following a Bloomberg report that said Japan could become the largest hotspot for coronavirus infections outside of China. More here.

Dollar/yen has surged higher through chart resistance in the 110.10s while US 10yr yields trade just modestly higher. Traders are now eyeing the 111 handle as there’s not much chart resistance on the charts at all around current levels. We wouldn’t fight this upward move in USDJPY until we see clear signs of buyer failure and we might not get this until the mid-111s.

USDJPY HOURLY

US 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com