New Zealand central bank surprises markets with dovish turn in monetary policy outlook

Summary

-

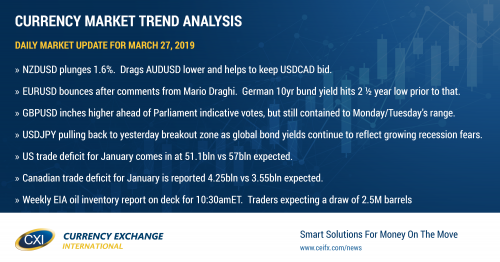

USDCAD: Dollar/CAD continues to waffle above and below the 1.3390s again this morning as the broader USD trades with a mixed tone for the third day running. May crude oil prices are pulling back below $60 after the weekly API inventory report showed a surprise build in oil stocks last night, the global equity market tone is skittish once again as European and US yields continue to trend lower, and the New Zealand dollar is getting crushed following a dovish turn from the RBNZ. All this is helping USDCAD stay bid at the moment, but the market is still very much lacking momentum in one way or the other. The January trade balance figures for both the US and Canada were just released, showing a smaller than expected deficit in the US and a larger than expected deficit in Canada. Next up is the weekly EIA oil inventory report at 10:30amET, where traders are expecting to see a draw of 2.5M barrels. We think USDCAD can retain its upward bias should chart support in the 1.3370-90s continue to hold.

-

EURUSD: Euro/dollar traders are having to digest a plethora of ECB speak this morning, with the most notable comments coming so far from Mario Draghi at the “ECB and its Watchers XX” conference in Frankfurt. While the ECB President said the risks to the outlook remain tilted to the downside, he sounded a touch more confident about reaching the central bank’s inflation target. European traders bought at trend-line support in the 1.1250s as Draghi started speaking, and we’re now trading back into the 1.1270s (or the support level that was lost late yesterday). The German 10yr bund yield is bouncing a touch as well, after printing at a new 2 ½ year low of -0.062% earlier today. USDCNH has broken higher above trend-line resistance in the 6.7270s today. We think this bounce in EURUSD is a relief bounce at most right now, and we think the leveraged short fund position remains in charge. We also continue to watch for a potential breakout higher in USDCNH (weakness in the Chinese yuan) given chart developments today and feel that this would be EUR bearish should it occur.

-

GBPUSD: Sterling continues to trade within Monday’s and Tuesday’s range this morning as traders await what the UK parliament wants to do next regarding Brexit. A series of “indicative votes” are expected to occur later today in an effort to move the process along. More here. GBPUSD continues to find buyers on dips below the 1.3200 level, but these buyers shy away as soon as the market hits chart resistance in the 1.3250s. Pound position liquidation continues to occur at CME, with futures open interest falling 1886 contracts yesterday. We would not be surprised if the leveraged funds, who have been net short the market since last June, have now gone net neutral. We’ll get the next update on this from the CFTC this Friday afternoon.

-

AUDUSD: The Aussie is taking some heat this morning following a 1.6% plunge in the New Zealand dollar today. The Reserve Bank of Zealand kept interest rates on hold last night (as expected), but surprisingly signaled “given the weaker global outlook and reduced momentum in domestic spending, the more likely direction or out next OCR move is down”. The Australian dollar is falling in sympathy, and is now looking poised to re-test Monday’s lows in the 0.7070s.

-

USDJPY: Dollar/yen is doing a little “backing and filling” today after yesterday’s rally above the 110.30s ran out of steam. S&P futures traders are finding it tough to re-challenge chart resistance in the 2830s as US and global bond yields continue to fall. USDJPY buyers have stepped back in at trendline support in the 110.20s this morning however, and we think this is a sign that the market wants to give the upside another go here. There are almost 2blnUSD in options expiring between the 110.50 and 110.75 strikes this morning, which could be having a magnetizing effect on prices as well.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

US 10YR BOND YIELD DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com