Oil markets spike 15-20% higher after weekend attack on Saudi Arabia shuts down 50% of production

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

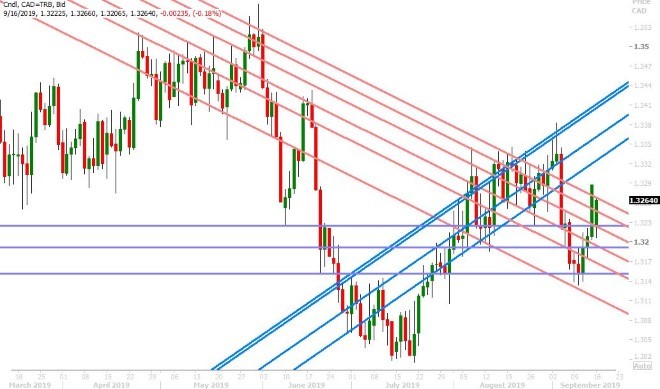

USDCAD

Crude oil prices rallied the most on record last night after an alleged drone attack knocked out 50% of Saudi Arabia’s oil production on Saturday. The US Secretary of State Mike Pompeo was quick to blame Iran despite Yemeni Houthi rebels claiming responsibility. President Trump said the US is “locked on loaded depending on verification” of who the culprits were. Iran is slamming the US accusations as “irresponsible” and now says it has no plans for its leader Rouhani to meet Trump at the next UN meeting. Brent crude oil futures for October delivery shot up 20% at the 6pmET open, WTI traded 15% higher, and we saw the oil sensitive CAD gap higher along with the safe-haven JPY. Since the open however we’ve seen the oil markets calm down a bit and these FX moves retrace partially, largely because we think global markets don’t want to rush to conclusions in a region that has seen false flag terrorism before. We still don’t know who coordinated the attack, the Saudi’s have been quiet so far with regard to assigning blame, and we have to wonder what Iran would have to gain be provoking the US and its largest buyer of crude oil -- China. Officials from China and Russia have condemned the rush to pin the blame on Iran. OPEC doesn’t see the need to call an emergency meeting. What is more, the Saudis, while admitting it’s now going to take them longer than expected to restore production, continued to export crude this weekend to Asian buyers without a hitch because of their massive stockpiles. WTI crude oil for October delivery is now trading up just 10% on the day and USDCAD sits between support at the 1.3240s and resistance in the 1.3260s (having filled most of its Sunday opening gap). There’s still so much to talk about for this week (Fed meeting on Wednesday, Canadian CPI and Retail Sales data), but USDCAD traders appear preoccupied right now with the oil market and how it will react to this developing story in Saudi Arabia. We think USDCAD could challenge the 1.3300 level again should oil markets calm down some more. The funds increased their net short USDCAD position for the 1st time in over a month during the week ending Sep 10.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Euro/dollar started the week on a quiet note, despite gold’s 1% pop higher at the 6pmET futures open last night, and we’re now seeing some technical selling come in after Friday’s disappointing NY close (no real follow-though from Thursday’s bullish outside day reversal). It’s also about that time where EURUSD traders start positioning themselves for this week’s highly anticipated Fed interest rate decision on Wednesday and we get the sense they’re bracing for a less dovish than expected 25bp cut from Jerome Powell (maybe this is the last cut?). Germany will report its September ZEW survey tomorrow morning at 5amET. EURUSD is now trading within Thursday’s very wide price range, which we think could make it vulnerable to a decline all the back to the 1.1000 level. The ECB’s chief economist Lane is currently speaking, but we have yet to hear anything market moving. The ECB’s Lautenschlager will be speaking at 12pmET today.

- ECB'S CHIEF ECONOMIST LANE - NATURAL THAT DEBATE OVER POLICY MEASURES AT ECB TAKING PLACE

- ECB'S CHIEF ECONOMIST LANE - FUTURE GOVERNING COUNCILS CAN REVISIT THIS POLICY DECISION, BUT FOR NOW DECISION IS MADE

- ECB'S CHIEF ECONOMIST LANE - HIGH DEGREE OF CONSENSUS ABOUT NEEDING TO ACT, THE MOST IMPORTANT MESSAGE IS THAT THE CURRENT SITUATION IS NOT SATISFACTORY

- ECB'S CHIEF ECONOMIST LANE - WOULD NOT SAY WE ARE NORMALIZING THE BOND PURCHASE PROGRAMME, FAR FROM A NORMAL ENVIRONMENT RIGHT NOW

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling is pulling back after Friday’s explosive move higher on Brexit deal optimism, and the market appears to be taking its cue this morning from weakness in the EURUSD and some disappointing news on the Brexit front. UK Prime Minister Boris Johnson met with the EU’s Jean Claude Juncker in Luxembourg today, but it looks like the UK has yet to come forward with a solution to replace the Irish backstop, so says the European Commission. More here from the BBC. We think GBPUSD traders have reason to take pause here (UK CPI for August out Wednesday along with the Fed meeting + Bank of England meeting on Thursday), but we’re still watching for a potential breakout close above the 1.2500 level (which could reverse the market’s long-term downtrend). The funds increased their net short GBPUSD position for the 1st time in over a month during the week ending Sep 10.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is slumping back with the general “risk-off” mood to markets following the attacks on Saudi Arabia over the weekend (S&Ps -0.4%, Copper -1.5%), and we’re now testing the lower bound of the 0.6855-0.6875 price pivot channel we talked about on Friday. We think we might also be seeing a delayed reaction to more weak data out of China on the weekend (August Industrial Production +4.4% YoY vs +5.2% expected & August Retail Sales +7.5% vs +7.9% expected). We continue to believe the 0.6855-0.6875 price channel will be pivotal for near term AUDUSD price action heading into this Wednesday’s Fed decision. Australia will report it August Employment Report on Wednesday night at 9:30pmET. There’s market talk this morning of a massive 2.5blnAUD option expiry at the 0.6895-0.6900 strike for Wednesday morning’s NY cut (10amET). The leveraged funds at CME reduced their net short position to the tune of 6k contracts during the week ending Sep 10.

AUDUSD DAILY

AUDUSD HOURLY

DEC COPPER DAILY

USDJPY

The safe-haven yen went immediately bid at the Sunday open last night following the events in Saudi Arabia over the weekend, but the overnight move is reversing now as a sense of calm returns to global markets (S&Ps/bond yields bounce while oil prices retreat from their session highs). What remains left of dollar/yen’s opening gap (107.95-108.05) is now begging to be filled in our opinion. Sellers are putting up a tough fight though at the 107.80s for the time being. It was encouraging to see buyers step in so quickly as the 107.50s in early Asia, despite Japanese markets being closed for a holiday. We think the leveraged funds, who continue to remain net short the market as of Sep 10, are looking increasingly vulnerable to positive risk developments. The Bank of Japan will announce its latest decision on monetary policy this Wednesday night after the Fed meeting.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com