Powell screwed it up

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Risk sentiment initially pops after FOMC’s press release. USD longs puke against risk currencies.

- Fed to increase QE/repo, rates on hold until 2022, SEP showed “V” recovery in 2021.

- Powell then downplays SEP, last week’s NFP report, cites many risks to labor market.

- Risk sentiment reverses lower and doesn’t look back. Bond and JPY traders laughing.

- Short-term USD bottoms now in the works vs risk sensitive currencies CAD, AUD and GBP.

- JPY outperforms on continued US yield weakness. EUR’s funding status sees it hang in there.

- US Jobless Claims beat expectations for the week ending June 6, +1.542M vs +1.55M.

ANALYSIS

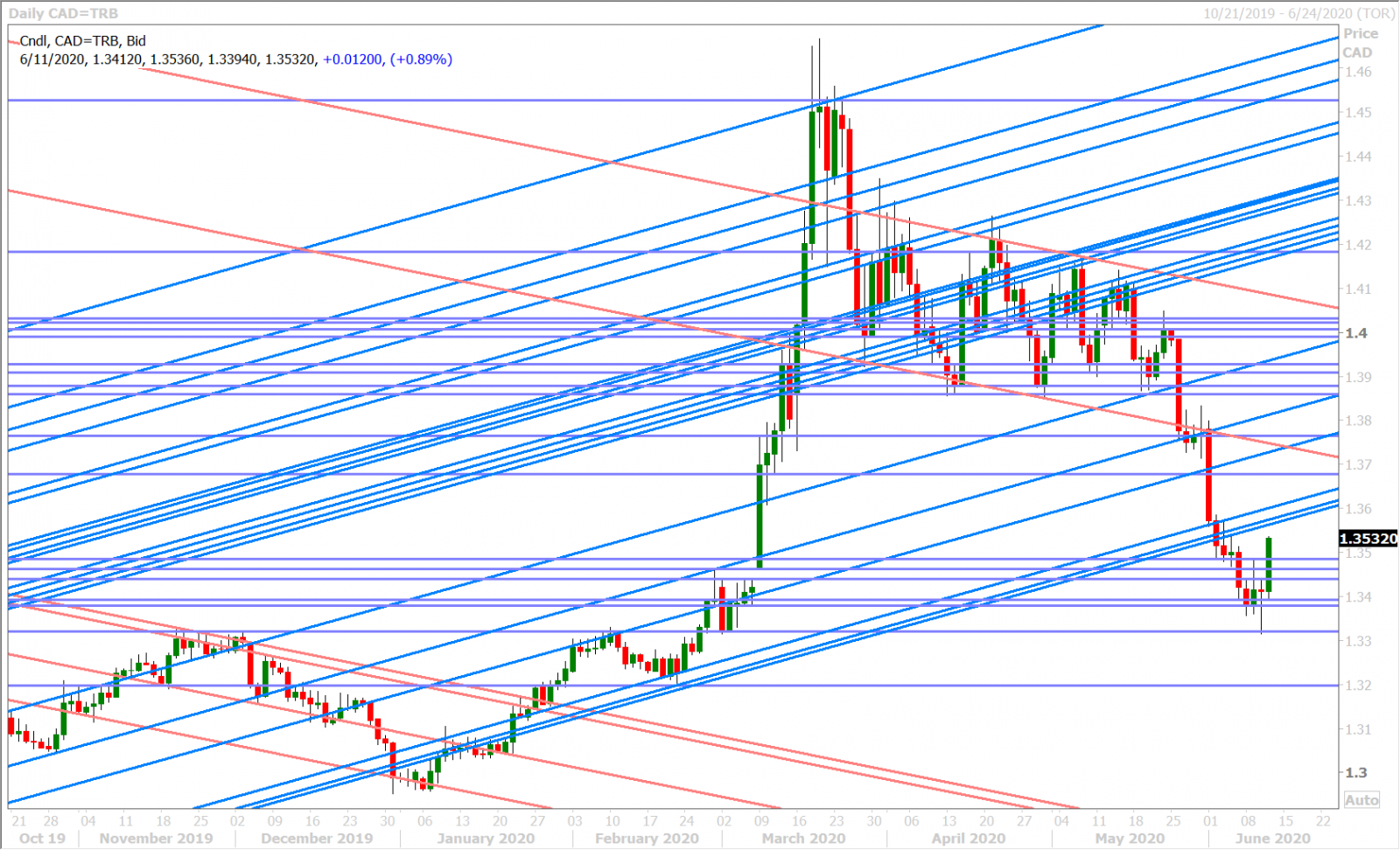

USDCAD

The initial market reaction after the FOMC’s press release yesterday was to “buy risk” and sell the USD. While the statement and economic projections didn’t read as overtly more optimistic when compared to the Fed’s prior assessment, traders seemed to focus on the Fed’s expected “V” shaped recovery to GDP for 2021, the fact that the Fed would increase and continue its QE/repo operations, and the Fed’s dot plot…which showed interest rates remaining at low levels until at least 2022. You could then almost hear the screaming from the leveraged fund community as they bailed out of losing long USD positions against the CAD, AUD, and GBP. Recall the “pain trade” we talked about in USDCAD on June 1st and again this past Monday…this ultimately saw USDCAD quickly plunge lower to its next chart support level in the 1.3320s.

Jerome Powell then started speaking in his post-meeting video conference and screwed it all up in our opinion. While the Fed chairman kicked the can down the road on “yield curve control” by referring to its effectiveness as a “open question” (mild yield and USD positive), we felt this was completely overshadowed by his total lack of confidence in the recovery view. Powell referred to last week’s unbelievably positive NFP report as a reflection of ongoing uncertainty; he noted uncertainties with the Fed’s own Summary of Economic Projections (which showed the “V” coming in 2021); and what is more…he kept referring to a whole bunch of risks with regard to the labor market and the pandemic. Notwithstanding the fact that Powell dodged the questions about wealth inequality and perpetuating asset bubbles…this was not a confidence inspiring performance overall and we think the markets were given another wake-up call. How bad must things really be and/or how powerless must the Fed really be if Powell has to keep doing more of this?

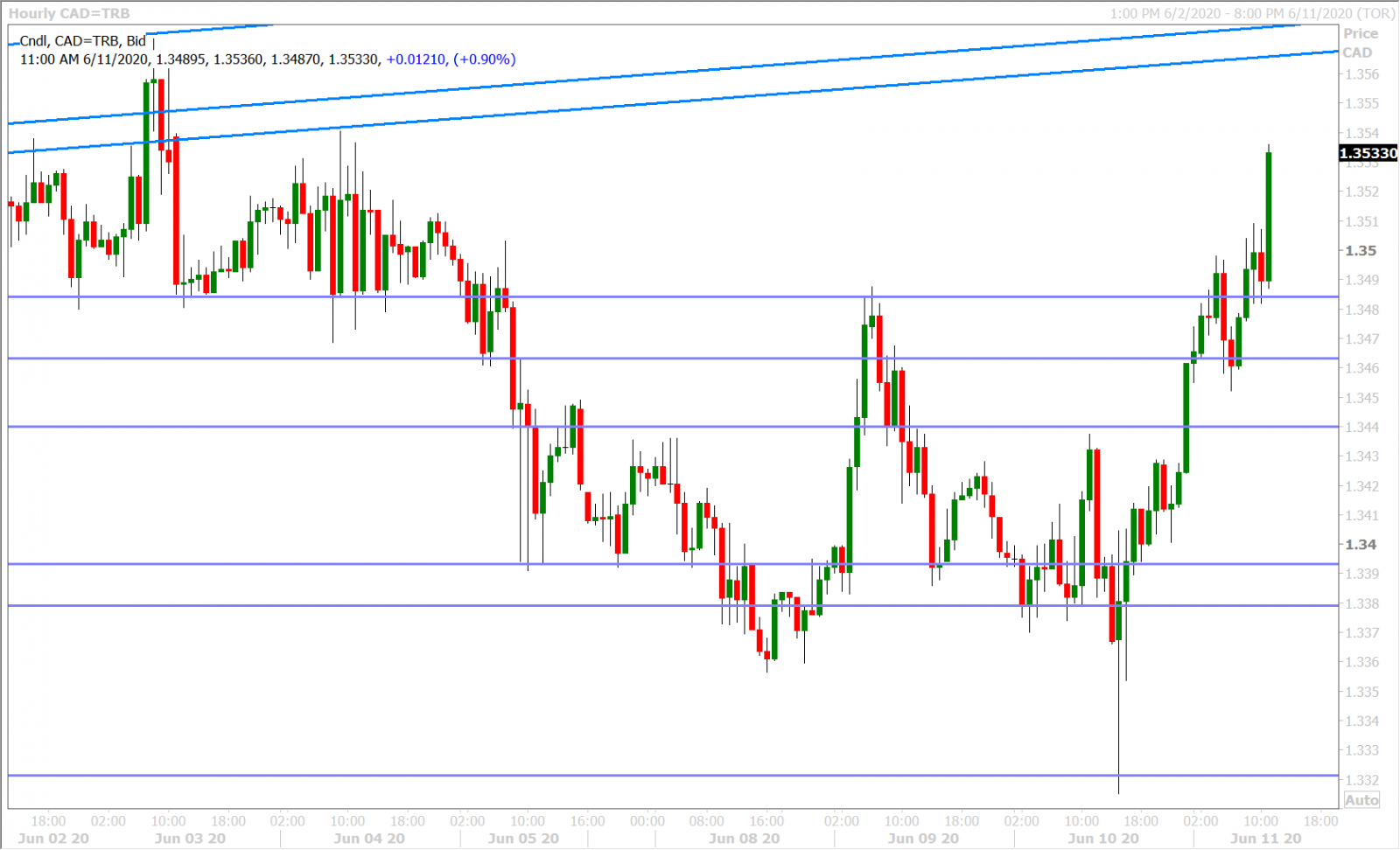

Risk sentiment then quickly started to reverse lower towards the 3pmET hour and it has continued to deteriorate ever since. The broader USD swiftly reversed higher as a result and is now recording significant daily gains against the high-beta risk currencies (CAD, AUD and GBP). Dollar/CAD, in particular, has blown through five resistance levels in the 1.34s and is now trying to make headway into the 1.35s. Bond traders have been told not to focus on yield curve control for now, but their pre-FOMC positioning has been rewarded nonetheless by a Fed that doesn’t even trust its own economic projections.

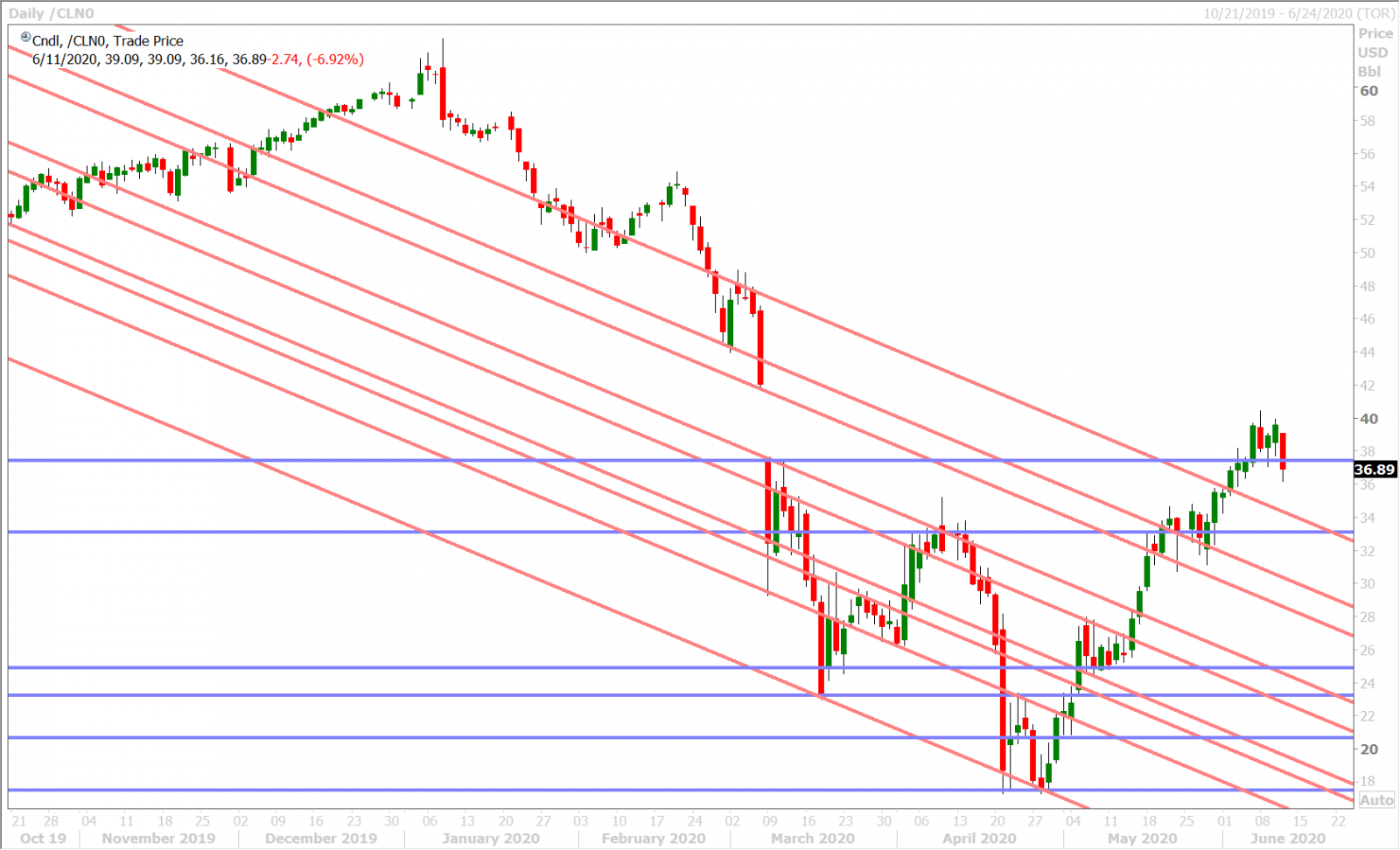

We think yesterday’s Fed meeting has begun to sow the seeds for a short-term bottom for the broader USD dollar against the high beta risk currencies. We’ll need bullish NY closes for USDCAD above 1.3480s, AUDUSD below 0.6980s, and GBPUSD below 1.2700 in order to confirm this. The S&P futures are trading -2.5% and July WTI is cratering 7% lower.

USDCAD DAILY

USDCAD HOURLY

JULY CRUDE OIL DAILY

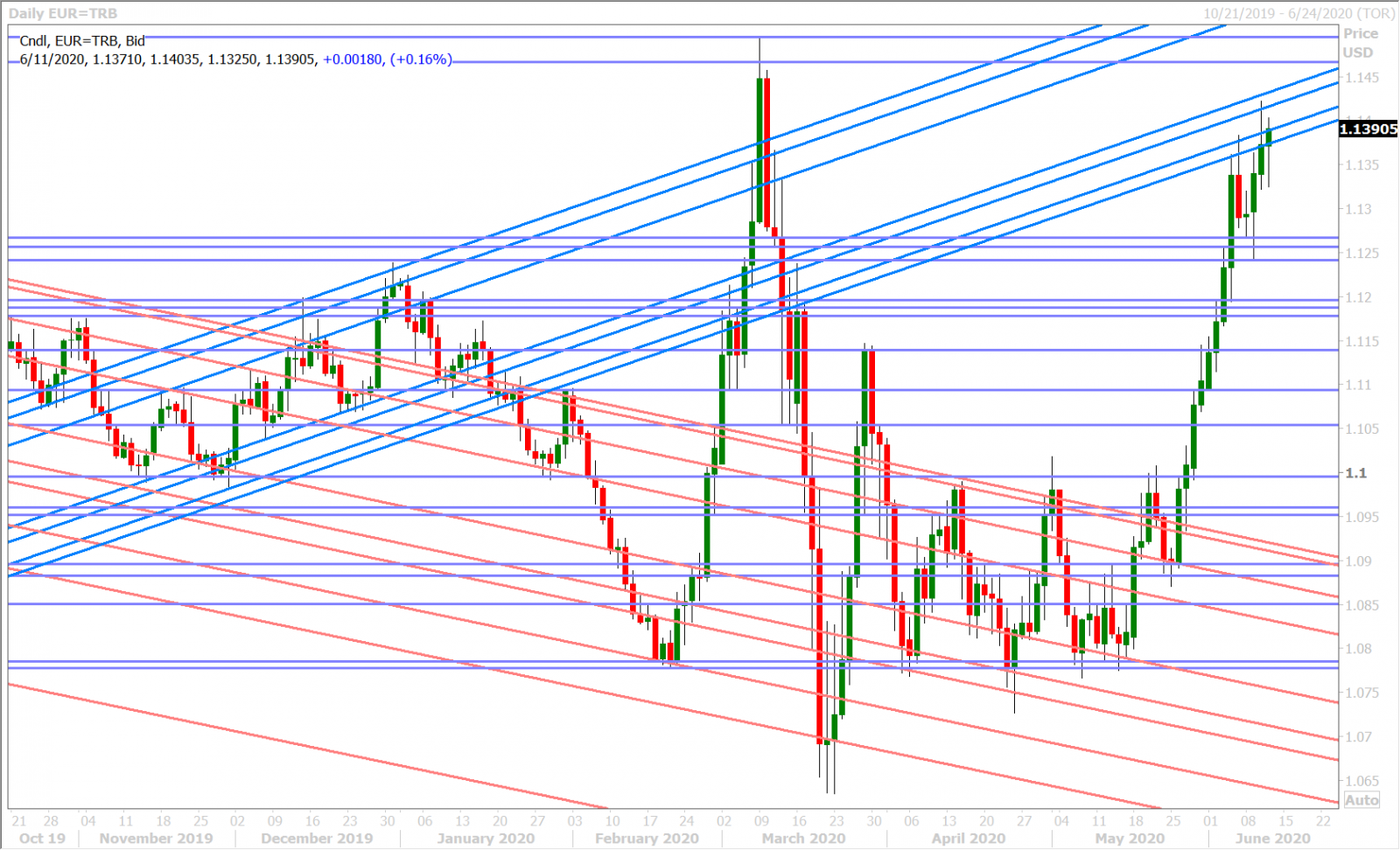

EURUSD

Euro/dollar has had a more muted response to the Fed meeting; and we saw this by way of a reserved spike higher following the press release and a less technically damaging move lower following the press conference. This shouldn’t come as a surprise to market participants though given the euro’s relegated status as a funding currency (less desirable risk-proxy compared to the market’s favorites like AUD and CAD).

With near-term Fed policy updates now out of the way for the market, we wonder if traders will begin refocusing on the ratification of the European Commission’s proposed 750blnEUR recovery fund…which will likely be very difficult. EURUSD is still technically in an upward trend, since breaking above the 1.0990s on May 27th, but the market has shown over the last 24hrs that it’s now having trouble at trend-line resistance levels in the 1.1410s and the 1.1390s.

EURUSD DAILY

EURUSD HOURLY

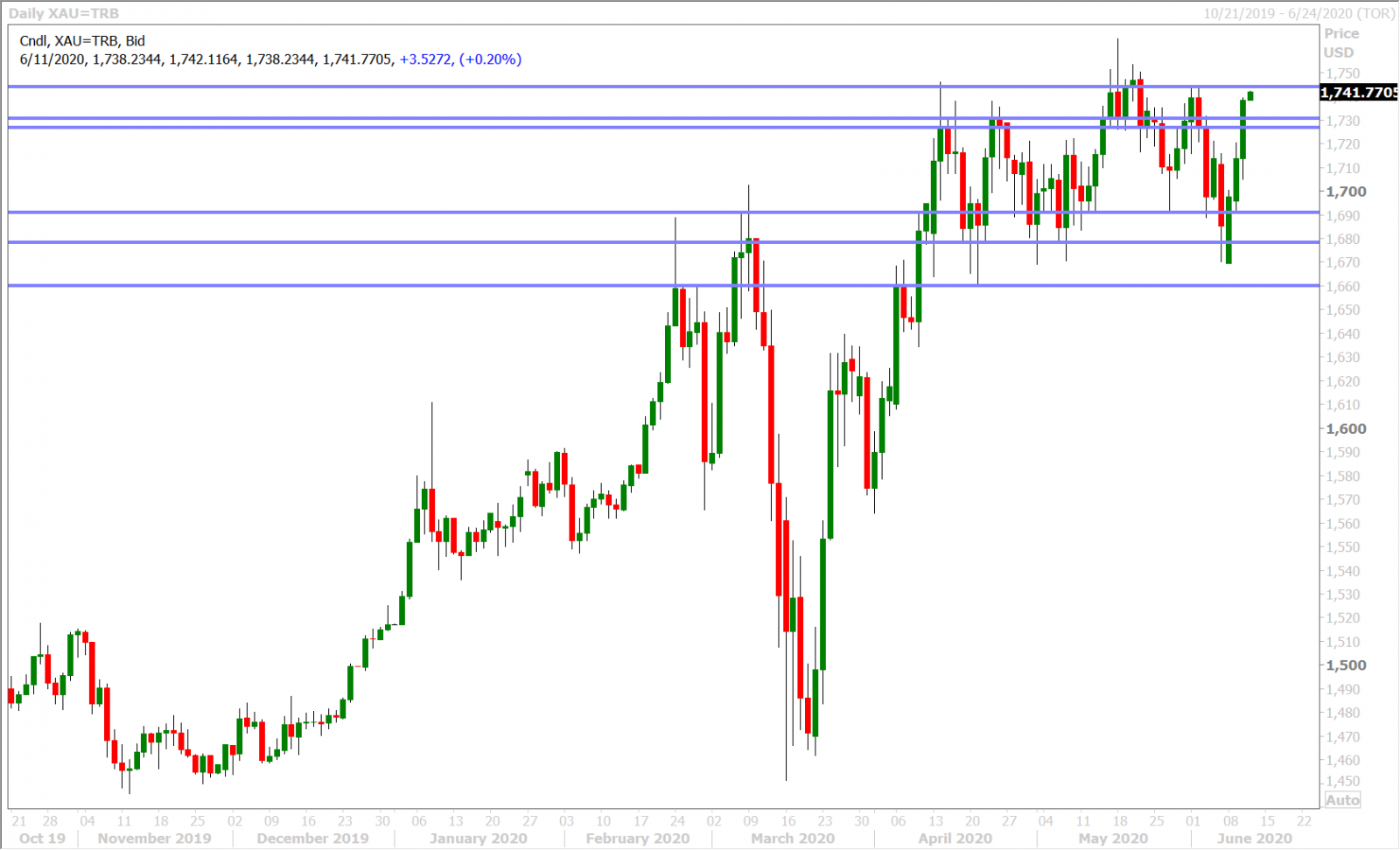

SPOT GOLD DAILY

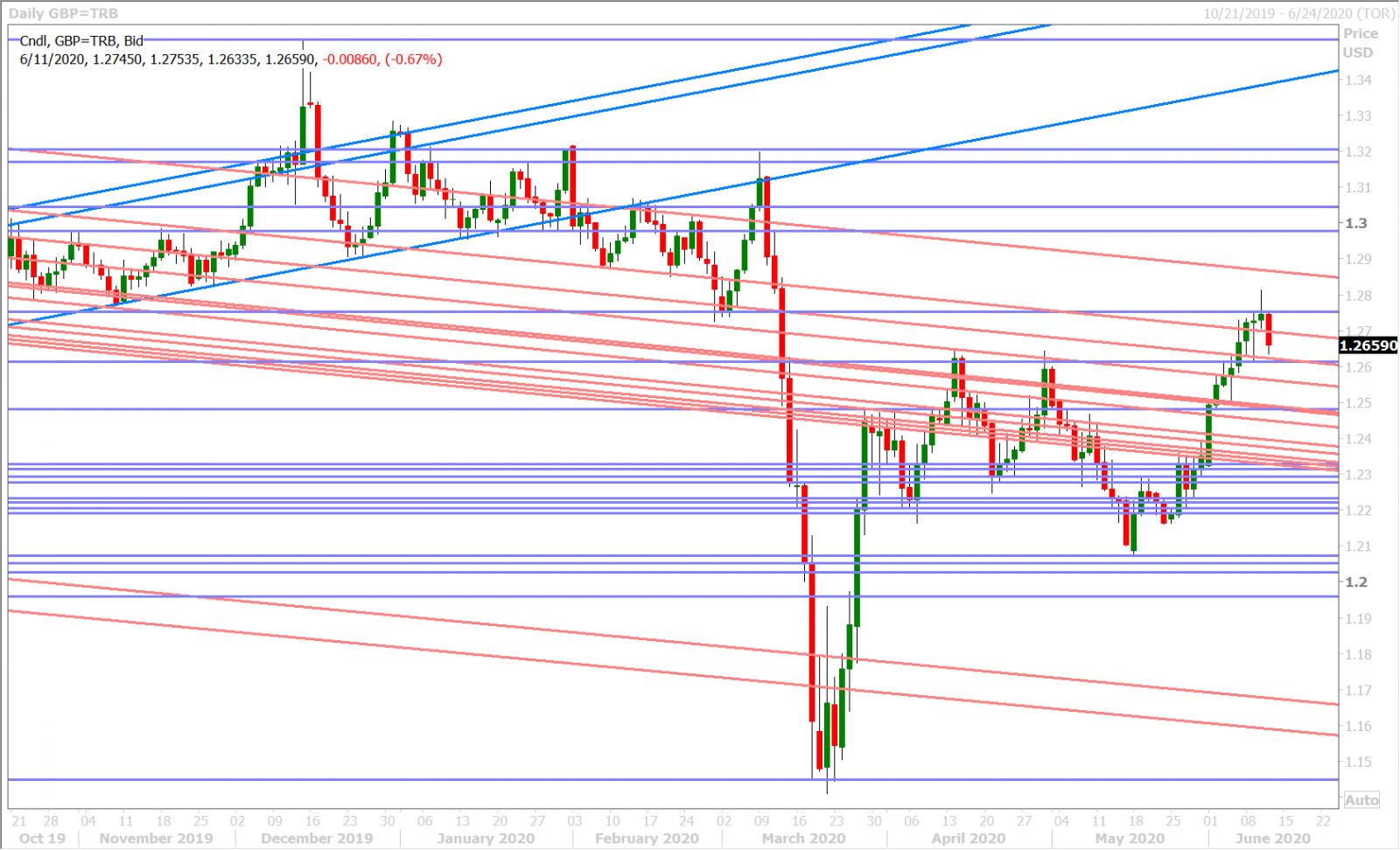

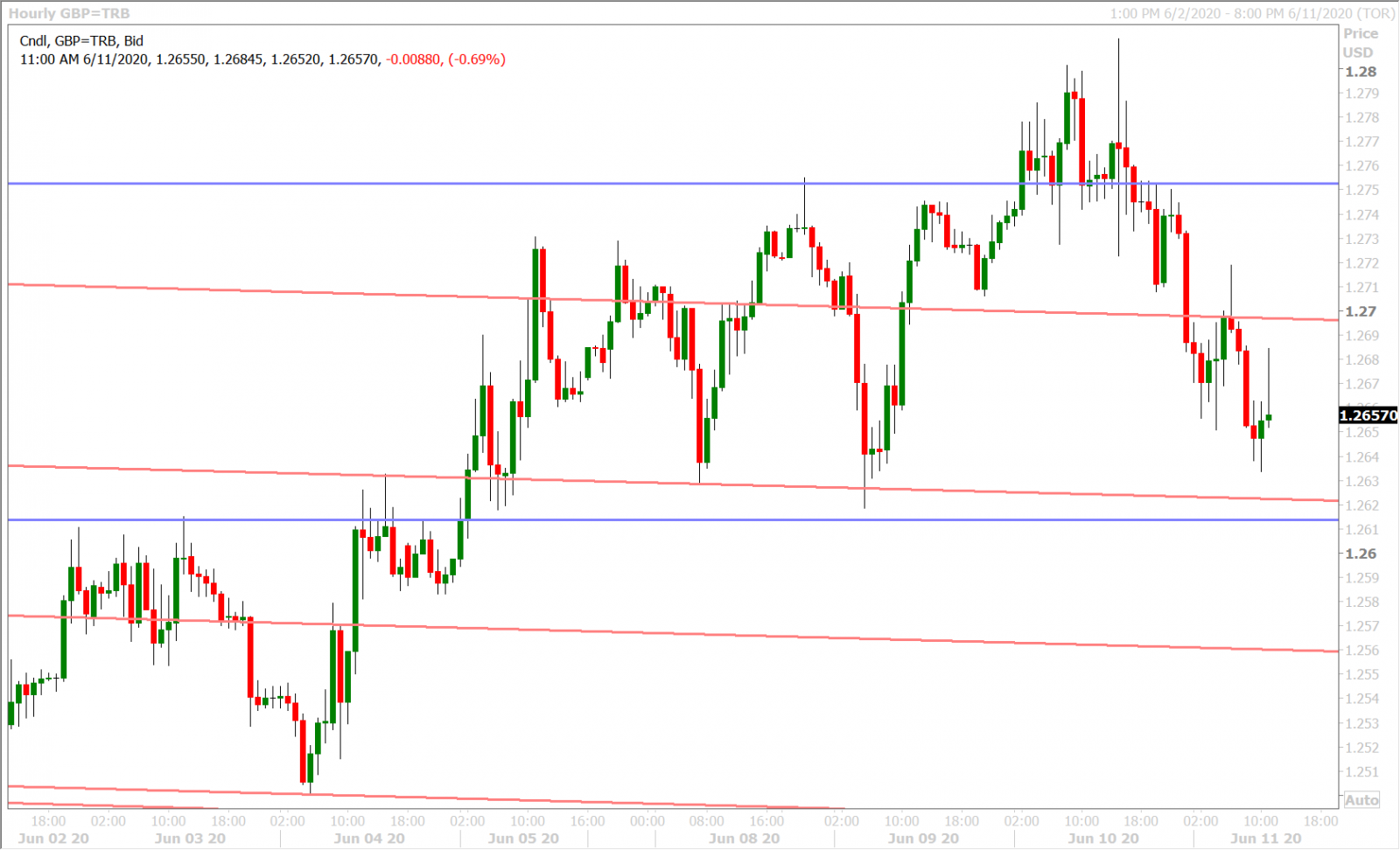

GBPUSD

The entrenched sterling shorts must be breathing a sigh of relief this morning as yesterday’s Fed press conference ultimately derailed the market’s multiple forays above GBPUSD chart resistance in the 1.2750s. The NY close below this level was negative, technically speaking, and European traders therefore felt comfortable smacking the sell key this morning after Asian traders made no attempt to regain this level last night. Trend-line support at the 1.2690s then gave way, and the sellers came back in again when an attempt to regain this level failed spectacularly. These technical developments don’t bode well for GBPUSD during the NY session today and could very well be sowing the seeds for a short-term top.

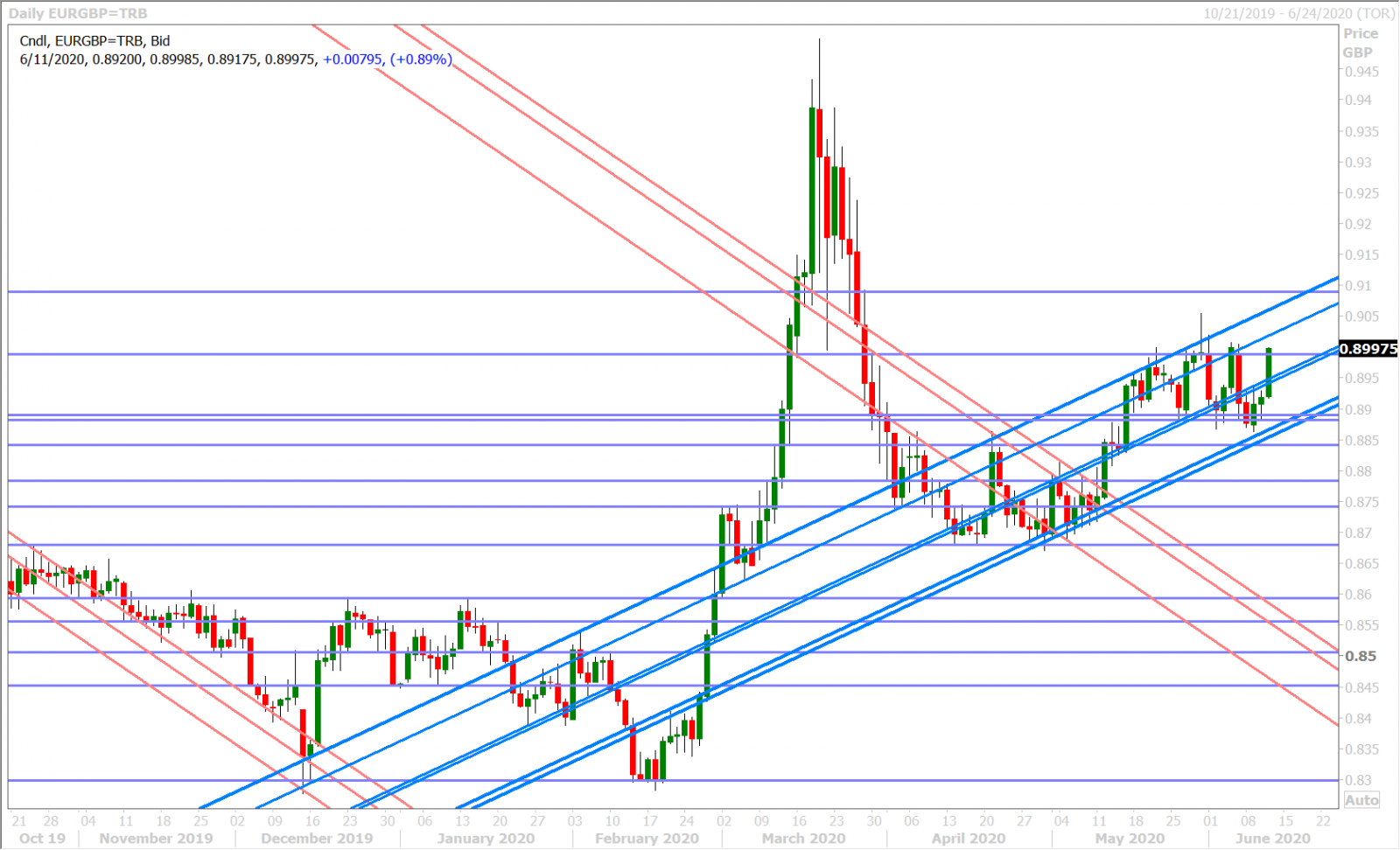

The EURGBP cross surged back above the 0.8940-50 resistance level this morning, but we think this has more to do with GBP’s higher sensitivity to broad risk sentiment vis a vis EUR (which has turned negative) as opposed to some of the negative Brexit headlines making the rounds (“French lawmakers want hard-line in Brexit fishing talks”).

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

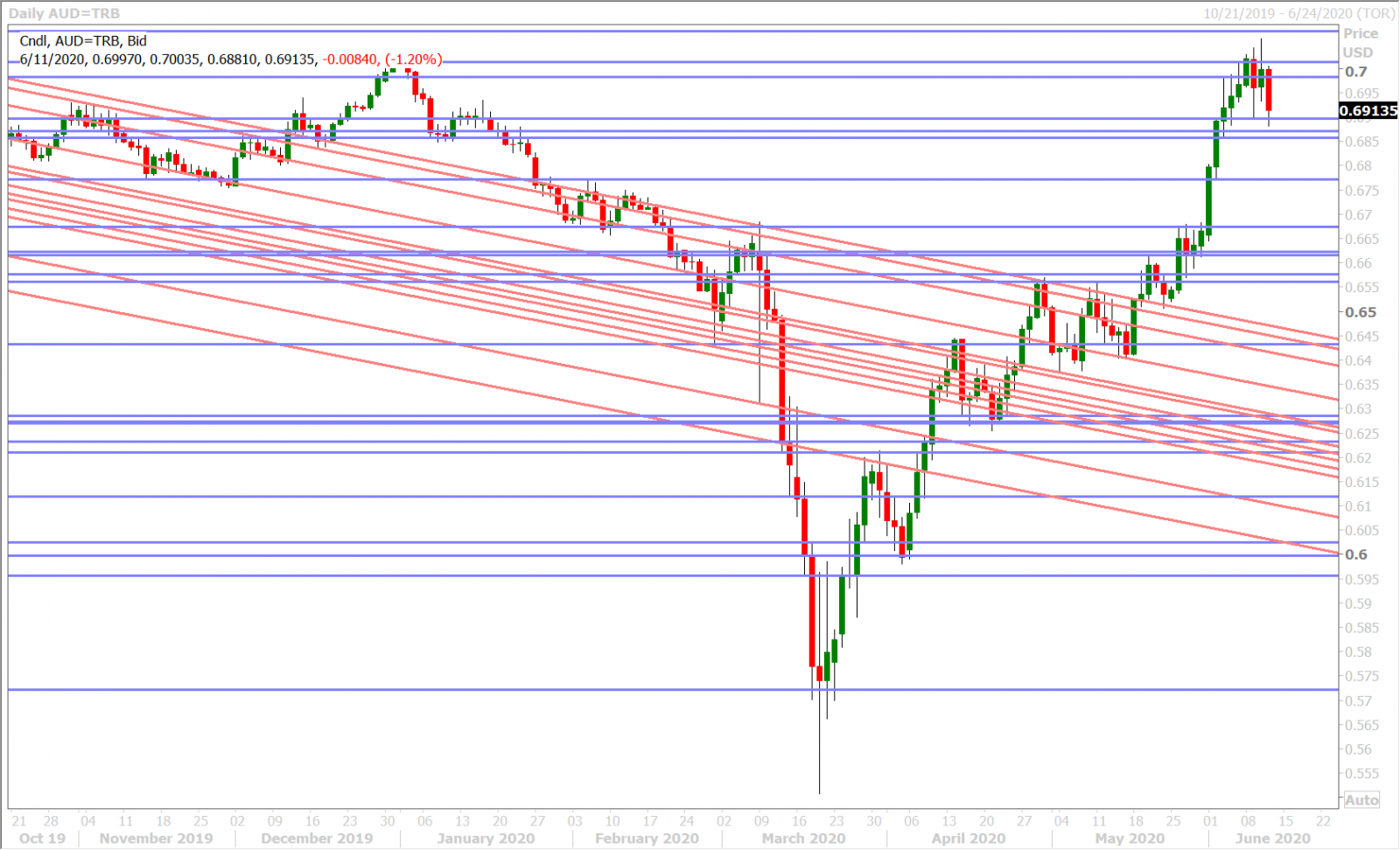

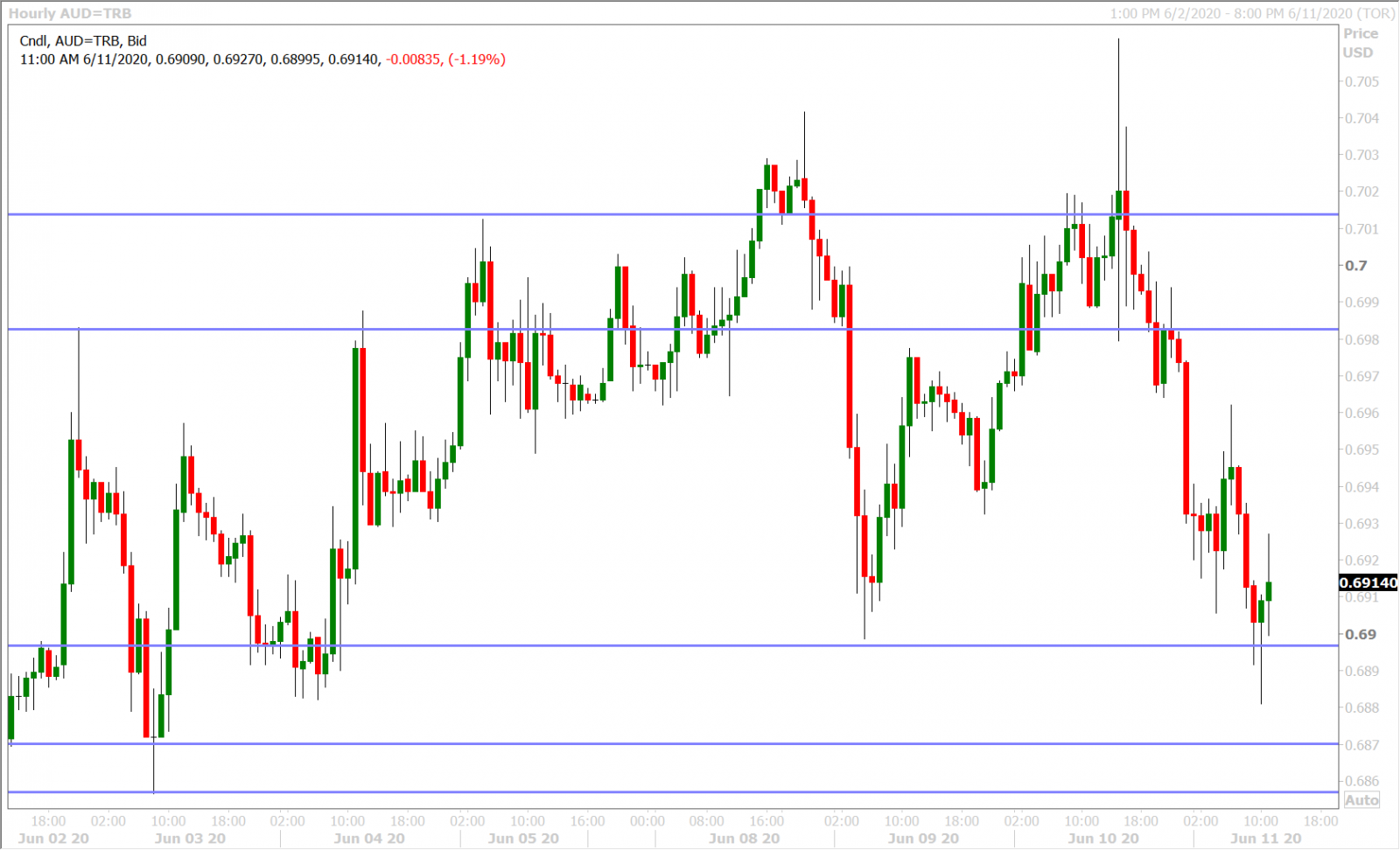

Traders are knocking the Aussie lower today as they quickly adjust to a Fed chairman that was more cautious that the FOMC’s statement led markets to believe. The Australian dollar is also one of the market’s favorite risk-proxies (ways to play the swings in broader risk sentiment)...and commands a higher relative option volatility vis a vis other G7 currencies because of it...therefore it’s not surprising to see the AUDUSD decline lead the USD higher today.

While we think some of the entrenched AUDUSD shorts threw in the towel following the FOMC’s press release, we think plenty more were relieved to see the market ultimately fail above the 0.7010s yesterday and subsequently fall lower. We believe a short-term top could be in the works here for AUDUSD as well, but we’ll need to see today’s USD strength persist and keep the market focused on 0.6890s support as opposed to the 0.6980-0.7010s resistance zone.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

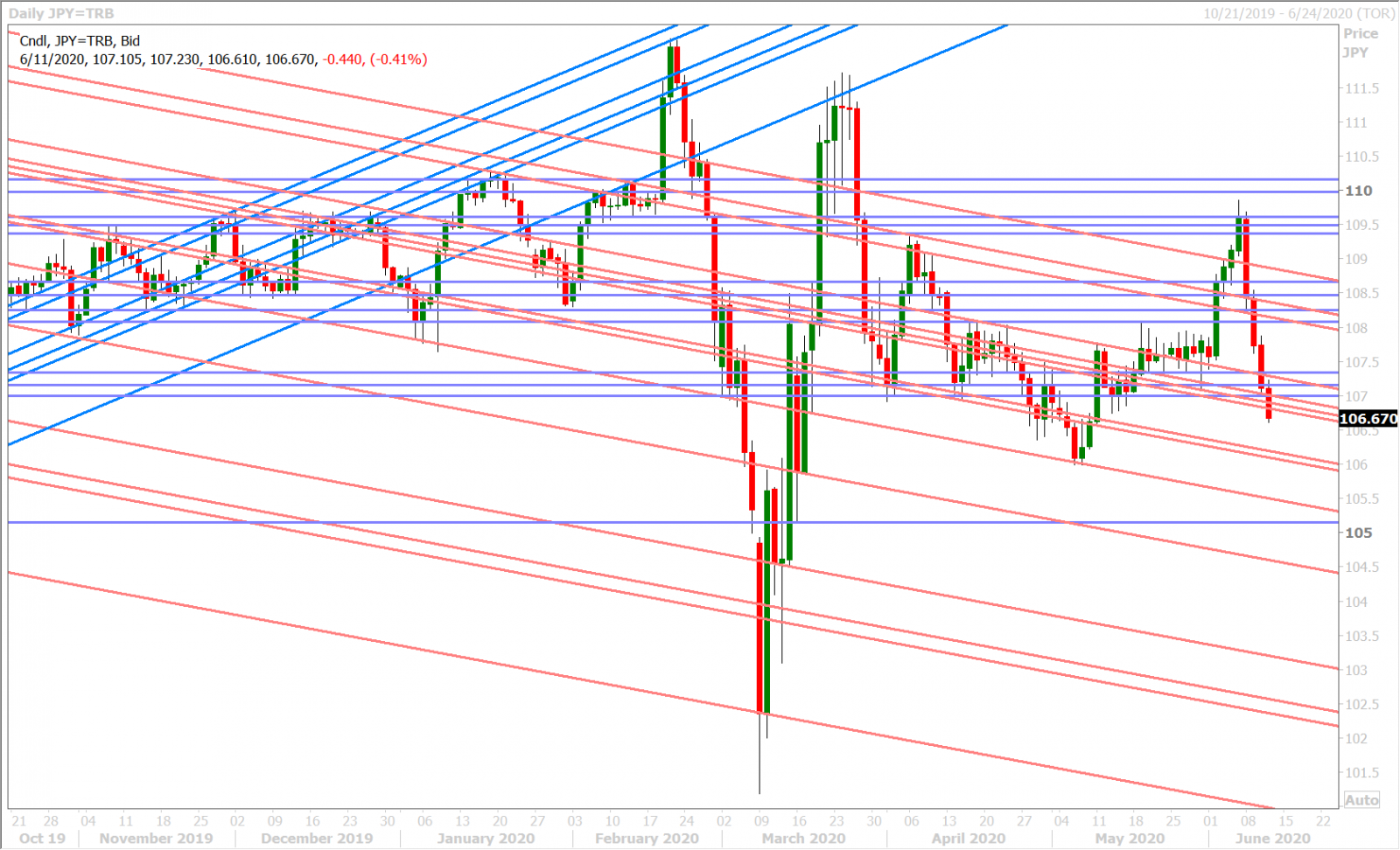

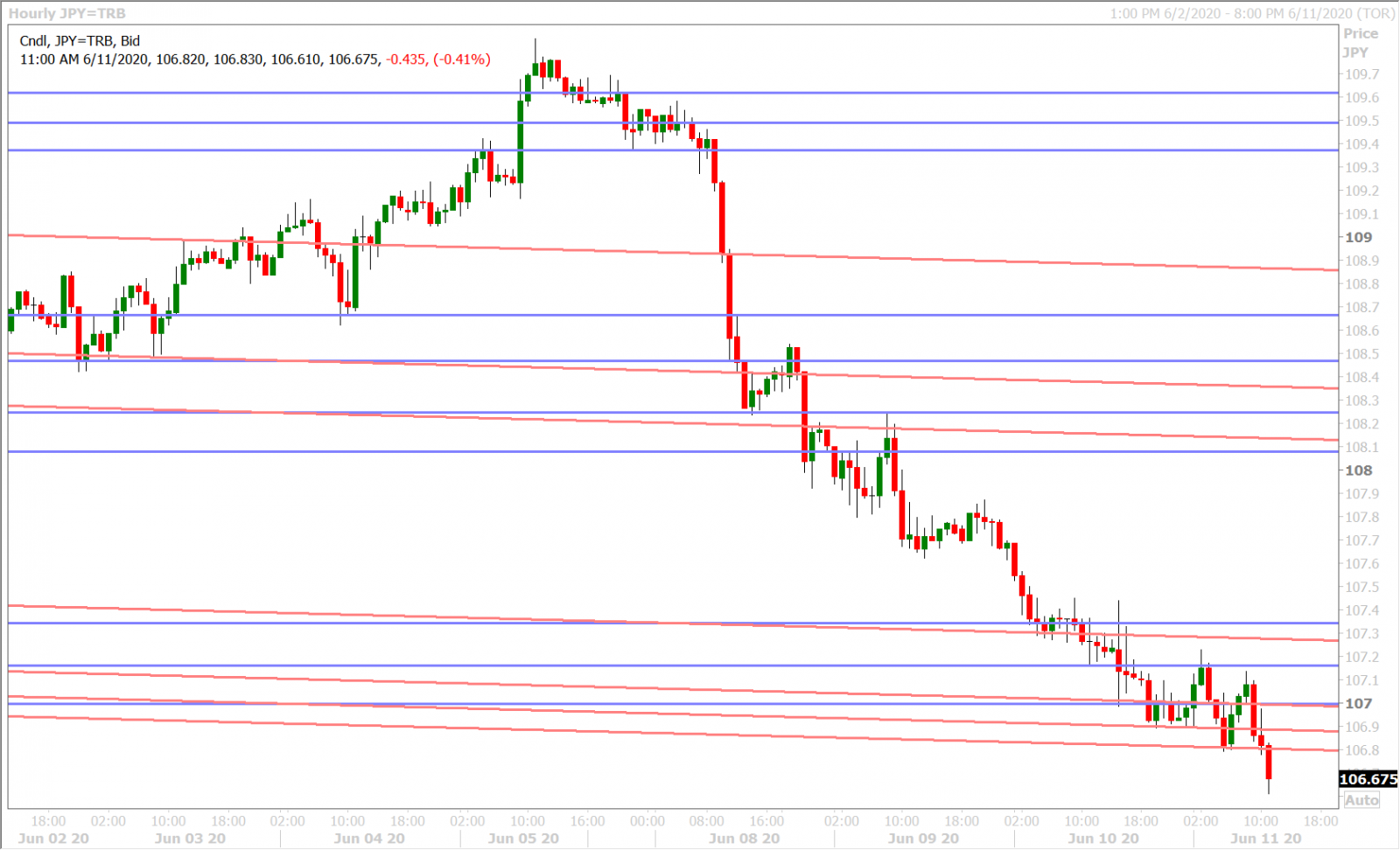

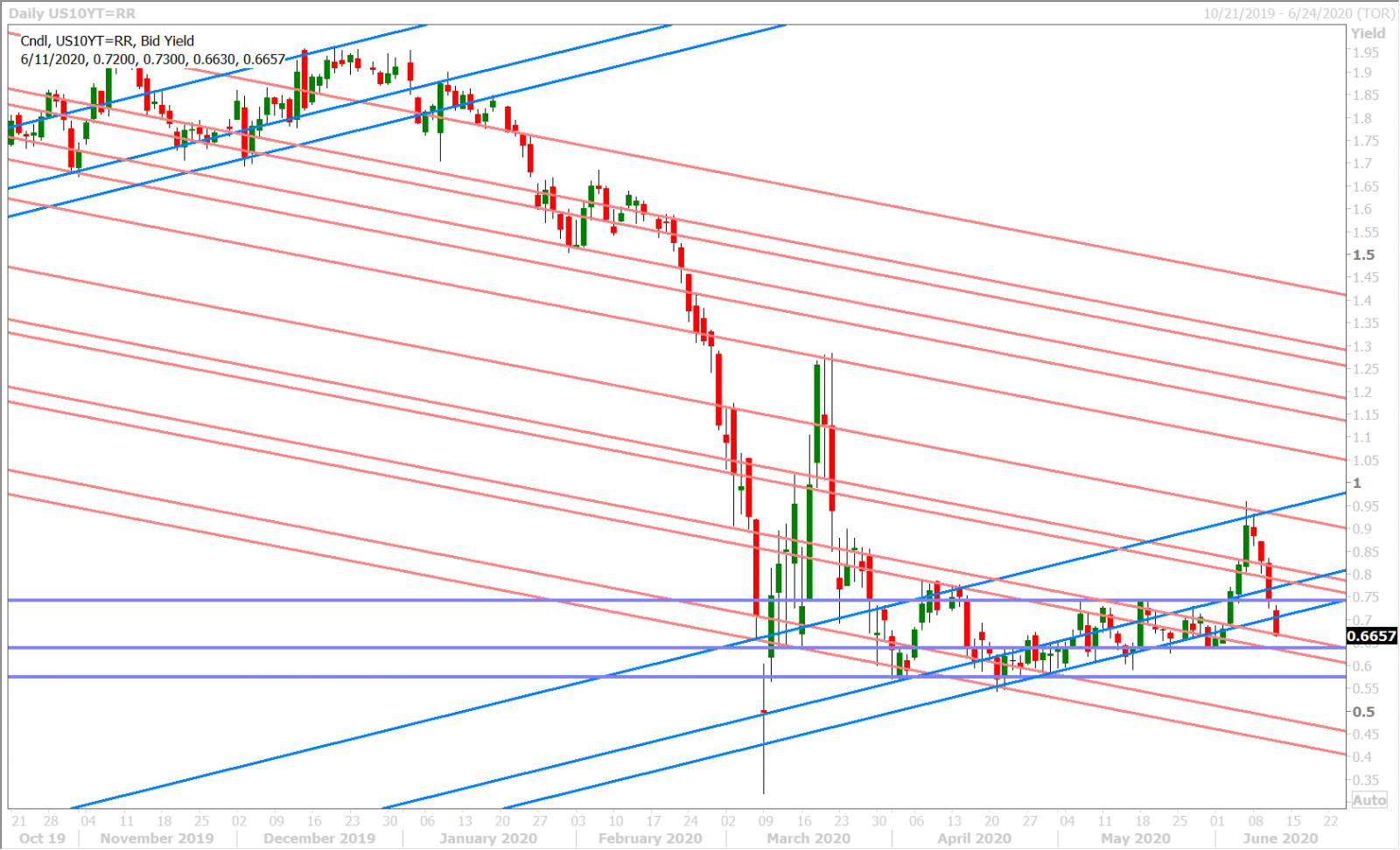

If the dollar/yen shorts were whistling yesterday, they must be laughing today as the market continues to follow US yields lower. The bond market called it right all along, as it usual does. The pre-Fed meeting angst about yield curve control was misplaced in retrospect, but bond traders seemed perfectly positioned for the both the FOMC statement and the press conference. The US 10yr yield barely bounced during the initial “risk-on” reaction to the Fed’s statement and the economic projections (in retrospect, this was a warning), and it completely fell apart with Jerome Powell’s confidence as the press conference wore on. US yields have now totally reversed their three-day spike higher from last week and this has seen USDJPY cascade lower for the fourth session in a row.

Dollar/yen’s positive correlation with US 10yr yields is clearly alive and well. Expect the market to dive to the low 106s if bond traders decide to target 0.63-0.64% in US 10s (the June 1st lows).

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com