Rising US oil inventories save USDCAD. Markets in risk-off mode again today

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

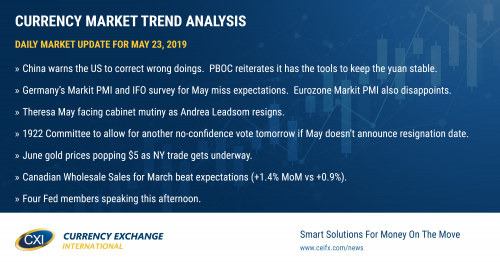

- China warns the US to correct wrong doings. PBOC reiterates it has the tools to keep the yuan stable.

- Germany’s Markit PMI and IFO survey for May miss expectations. Eurozone Markit PMI also disappoints.

- Theresa May facing cabinet mutiny as Andrea Leadsom resigns.

- 1922 Committee to allow for another no-confidence vote tomorrow if May doesn’t announce resignation date.

- June gold prices popping $5 as NY trade gets underway.

- Canadian Wholesale Sales for March beat expectations (+1.4% MoM vs +0.9%).

- Four Fed members speaking this afternoon.

ANALYSIS

USDCAD

Another weekly build in US oil inventories came to the rescue for USDCAD yesterday. Canada’s March Retail Sales figures surprised to the upside and while this saw the market fall precariously below Fibonacci chart support in the 1.3370s in the early goings, the bearish weekly EIA inventory report and the ensuing 3% decline in oil prices helped USDCAD dramatically recover. This upward momentum has continued in overnight trading as global markets go “risk-off” again. China warned today that the United States needs to correct its wrong doing first before trade negotiations can continue, and that it hopes the US behaves rationally on the Huawei situation. The Markit Manufacturing PMI for Germany and the Eurozone both missed expectations for the month of May (44.3 vs 44.8 for the former and 47.7 vs 48.1 for the latter). Germany’s widely followed IFO business survey for May also missed expectations, coming in at 97.9 vs 99.1 (which marks a new 4-year low). What is more, things have gone from bad to worse in the UK as 1922 Committee treasurer Clifton-Brown said he would allow a new no-confidence vote against Theresa May if the prime minister does not announce her resignation date tomorrow. Global equities are a sea of red this morning, and traders are flocking to the traditional safe havens (USD, JPY, US and German bonds). July crude oil prices are slumping another 1.6% lower at this hour and USDCAD has touched familiar trend-line resistance in the 1.3470s as NY trade gets underway. Canada just reported its Wholesale Sales figures for the month of March and the numbers beat expectations (+1.4% MoM vs +0.9%). Fed members Kaplan, Daly, Bostic and Barkin will all be speaking early this afternoon. We think USDCAD’s chart structure has improved significantly in the last 24hrs and we think another serious bout of risk-off could see the market finally break higher into the 1.35s with strong momentum.

USDCAD DAILY

USDCAD HOURLY

JUN CRUDE OIL DAILY

EURUSD

So it turns out euro/dollar chart support in the 1.1160s didn’t hold as we headed into the NY close yesterday. We think this gave the funds a sigh of relief as there was no fundamental reason for EURUSD to be trading higher earlier yesterday (other than the large 1.1180 option expiry in our opinion). Today’s weaker than expected data out of Germany (Markit PMI and IFO survey) is icing on the cake for these funds, who remain net short EURUSD, however we haven’t yet seen USDCNH seriously threaten an upside break of the 6.95 level so far this week. Part of this could be related to overnight comments from the PBOC’s Liu Guoqiang, who said China’s central bank has ample policy tools to cope with exchange rate fluctuations and to keep the yuan stable. June gold prices have just surged $5 higher above trend-line chart resistance at the 1278 level. We think EURUSD could be vulnerable to some short covering here if the market rises back above the 1.1140s and traders decide to follow gold prices (like they did a week and half ago).

EURUSD DAILY

EURUSD HOURLY

USDCNH DAILY

GBPUSD

Sterling took out some sell stops below the 1.2635-25 level this morning after prominent Brexit supporter and cabinet member, Andrea Leadsom, resigned in protest over Theresa May’s latest Brexit gambit. Talk is swirling that more cabinet resignations could be on the way, and as we mentioned above, it looks like the nine lives of Theresa May could finally be coming to an end. GBPUSD has managed to reclaim the 1.2625-35 level however as NY trade gets underway today, and so we think this mild, technical positive, will halt the rampant GBP selling we’ve been seeing over the last 10 days.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar continues to consolidate toward the lower bound of the 0.6860-0.6920 range we talked about yesterday. While we’re seeing risk-off flows hit global equities once again, it appears AUD traders are taking solace from the fact that dollar/yuan has not broken higher yet. We think AUDUSD could drift higher should EURUSD and GBPUSD rebound, but all bets would be off if the 0.6860s give way to the downside.

AUDUSD DAILY

AUDUSD HOURLY

JUL COPPER DAILY

USDJPY

The buyers are not yet stepping back into USDJPY as the S&P futures break back below the 2850s in overnight trade. We think they’ll take another stab at it though, provided USDJPY chart support in the 109.85-95 level holds today. Japan reports it April CPI figures tonight at 7:30pmET and the market expectation is for +0.4% YoY.

USDJPY DAILY

USDJPY HOURLY

S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com