Trump helps USD bid continue after Powell kills negative rate speculation

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Powell removes dollar-negative yesterday; markets quickly refocused on escalating US/China tension.

- President Trump adding to USD bid this morning with very critical comments towards China.

- TRUMP SAYS WE COULD CUT OFF WHOLE RELATIONSHIP WITH CHINA (Fox News).

- S&Ps -1%. US 10s near 1-week lows. USD bid with downside EURUSD expiries supporting.

- Australian Employment Report shows larger than expected job losses in April.

- BOE’s Bailey says negative rates not contemplated, but “it's always wise not to rule anything out forever”.

- ECB’s Lane to speak at 10amET. Poloz at 10:30amET. Three Fed member speak later this afternoon

ANALYSIS

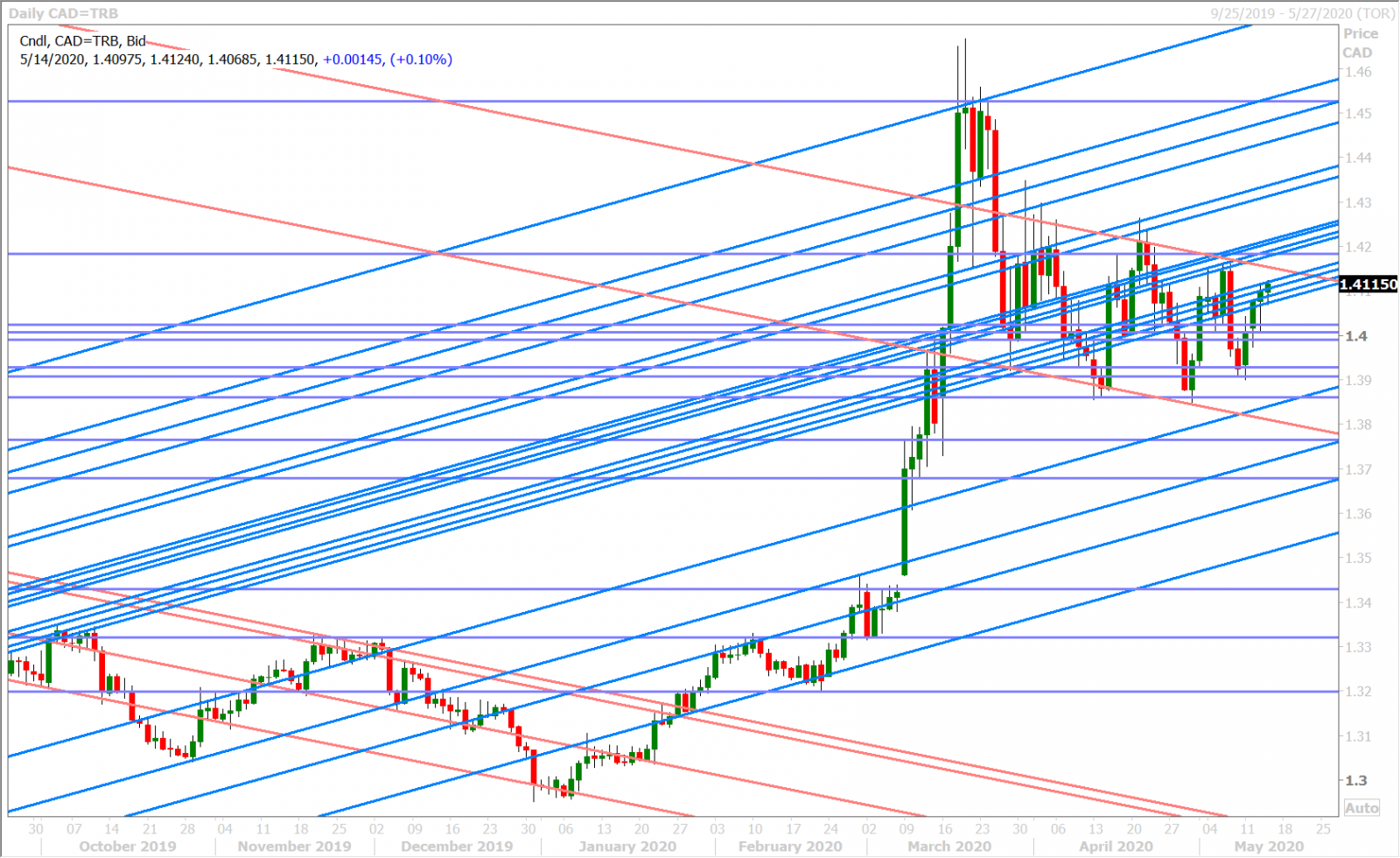

USDCAD

Dollar/CAD is re-challenging familiar chart resistance in the 1.4110-20s as President Trump said “It's a great time to have a strong dollar. Everybody wants to be in the dollar because we kept it strong. I kept it strong." These are convenient headlines to explain this morning’s USD bid, but they don’t make sense in light of the President’s comments late yesterday about strongly wanting negative rates. You can’t have it both ways Mr. Trump. We think FX traders are seeing through this banter and are instead quickly refocusing on the prospects for growing US/China tensions after Fed chairman Powell formally killed negative rate speculation yesterday. A big dollar-negative has been removed (at least for now) and there’s frankly a lot things for traders to start worrying about once again, which could manifest itself in the form of “risk-off” USD buying. Huge downside option expiries in EURUSD, also appear to helping the dollar as we approach the 10amET NY cut, and these were well telegraphed heading into today’s trade.

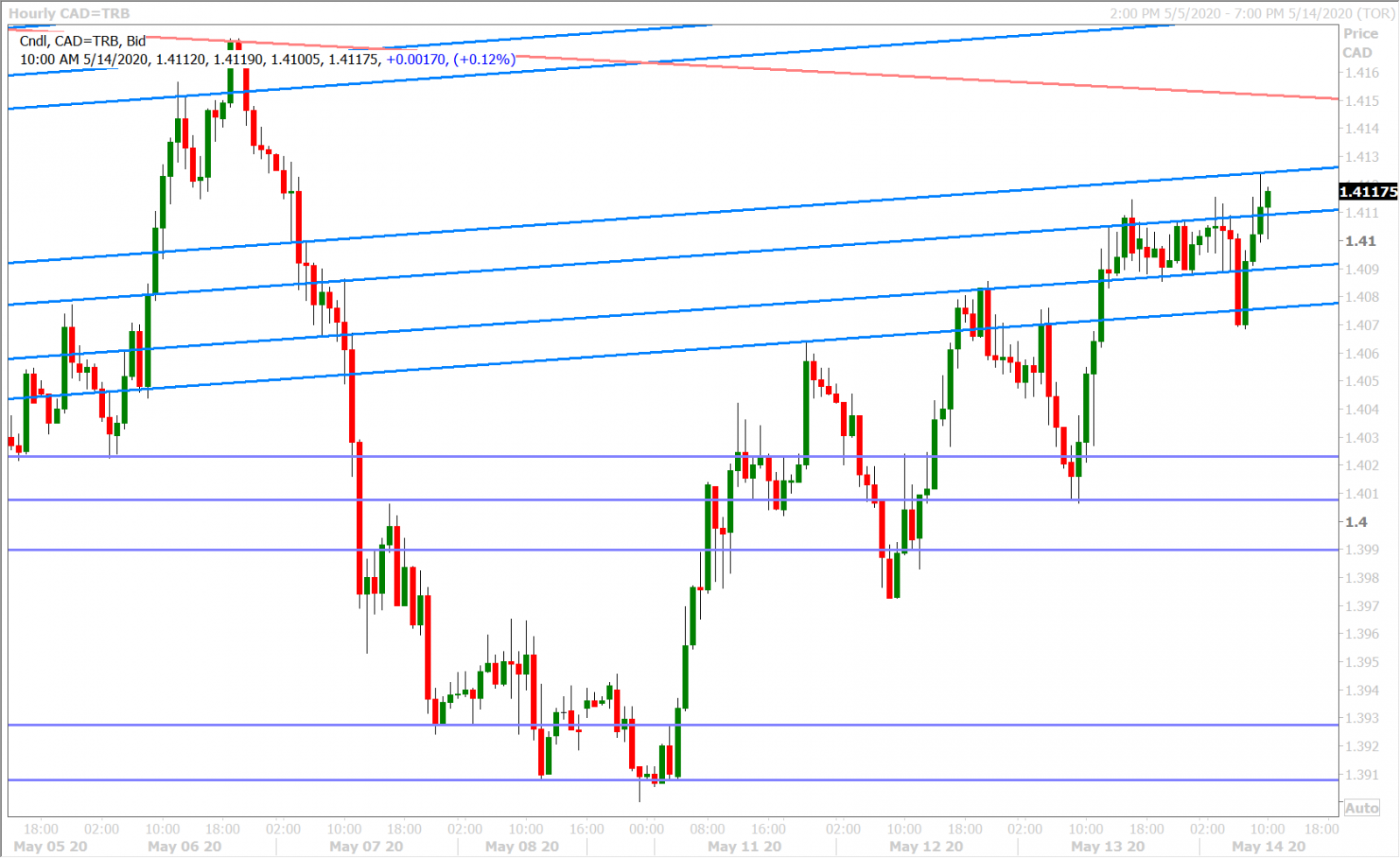

The US just reported +2.981M more jobless claims for the week ending May 9th, versus expectations of +2.5M. While the week-over-week increase in the number of new claims declined for the sixth week in a row, it appears FX traders are focusing on the headline miss and are bidding up the USD a little more here. We also think Trump's very critical comments on China this morning are adding some fuel to the fire. As we mentioned on Twitter yesterday, we continue to watch USDCAD for a potential NY close above the 1.4120s as we think this could create enough positive momentum for traders to re-challenge the topside of the trading range we’ve been talking about since late March. A breakout above the 1.4220s, in turn, would invite a new uptrend in our opinion.

Bank of Canada Governor Stephen Poloz will be holding a press conference at 10:30amET this morning to discuss the contents of its annual Financial System Review. This is not expected to be a market-mover. We’ll also hear from three Fed members later today (Kashkari at 1pmET, Bostic at 3pmET, and Kaplan at 6pmET).

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

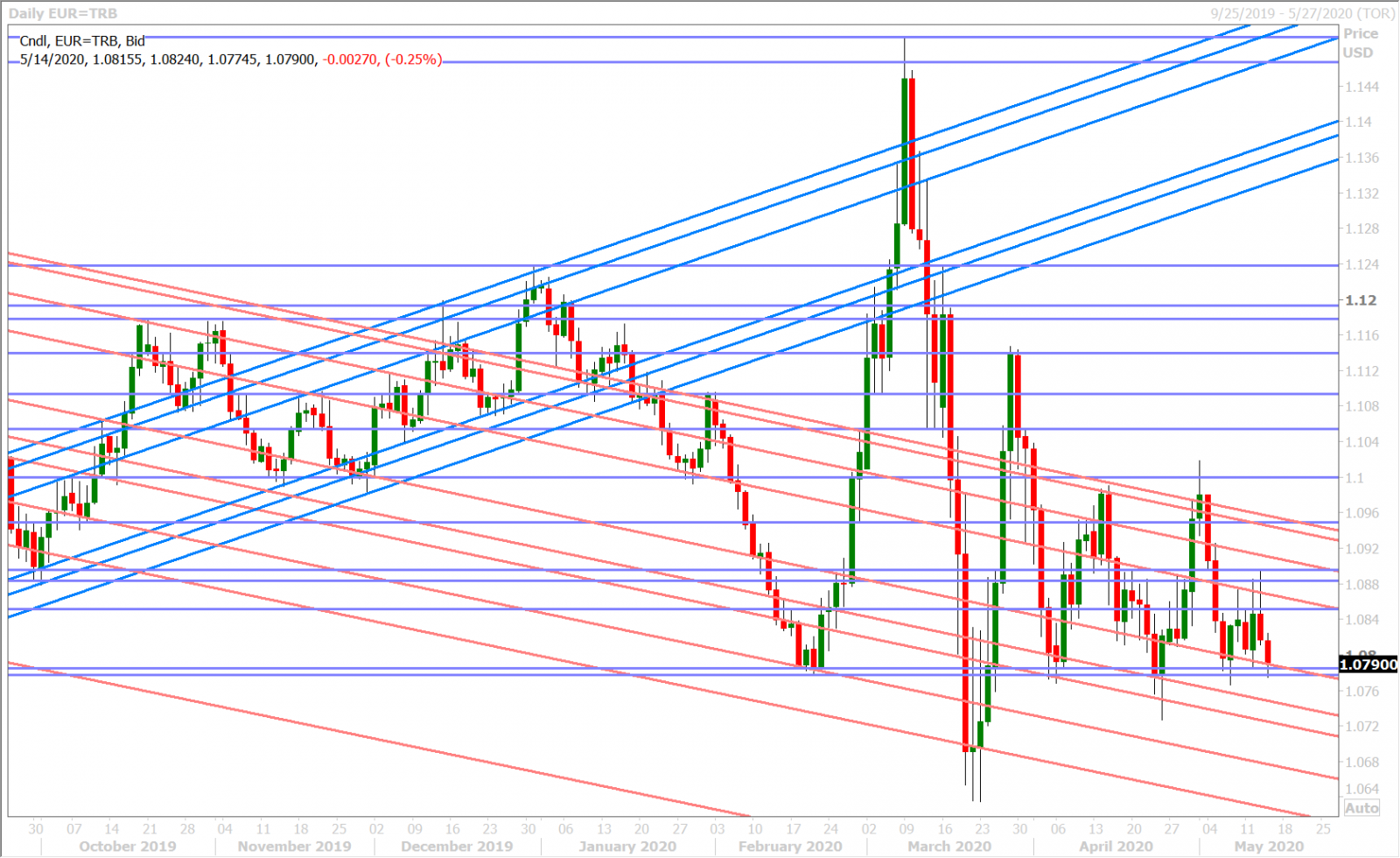

EURUSD

Euro/dollar traders are putting downside pressure on chart support in the 1.0770-80s this morning as they digest more headlines from President Trump, which have quickly shifted from support for a strong dollar to more disdain for China. See below. Over 3.2blnEUR in options will be expiring between the 1.0750 and 1.0800 strikes at 10amET this morning. The ECB’s Philip Lane is expected to speak about the “euro area outlook” in a speech around that time as well.

TRUMP SAYS CORONAVIRUS OUTBREAK SHOWS THAT ERA OF GLOBALIZATION IS OVER

TRUMP, ASKED ABOUT TRADE AND SUPPLY CHAINS, SAYS HE COULD TAX COMPANIESTHAT MAKE PRODUCTS OUTSIDE OF U.S

TRUMP SAYS HE'S VERY DISAPPOINTED IN CHINA

TRUMP SAYS HE IS NOT GOING TO RENEGOTIATE CHINA TRADE DEAL

TRUMP: THE INFORMATION WE HAVE ON CHINA AND VIRUS IS 'NOT GOOD'

TRUMP WONDERS WHAT WOULD HAPPEN IF U.S. CUTS TIES WITH CHINA

TRUMP SAYS HE AND XI HAVE GOOD RELATIONSHIP BUT 'RIGHT NOW, I JUST DON'T WANT TO SPEAK TO HIM

TRUMP SAYS WE COULD CUT OFF WHOLE RELATIONSHIP WITH CHINA

TRUMP ADMINISTRATION IS SAID TO BE MULLING AVENUES TO POSSIBLY PUNISH OR SEEK FINANCIAL COMPENSATION FROM CHINA FOR WHAT IT SEES AS WITHHOLDING INFORMATION ABOUT THE VIRUS

EURUSD DAILY

EURUSD HOURLY

SPOT GOLD DAILY

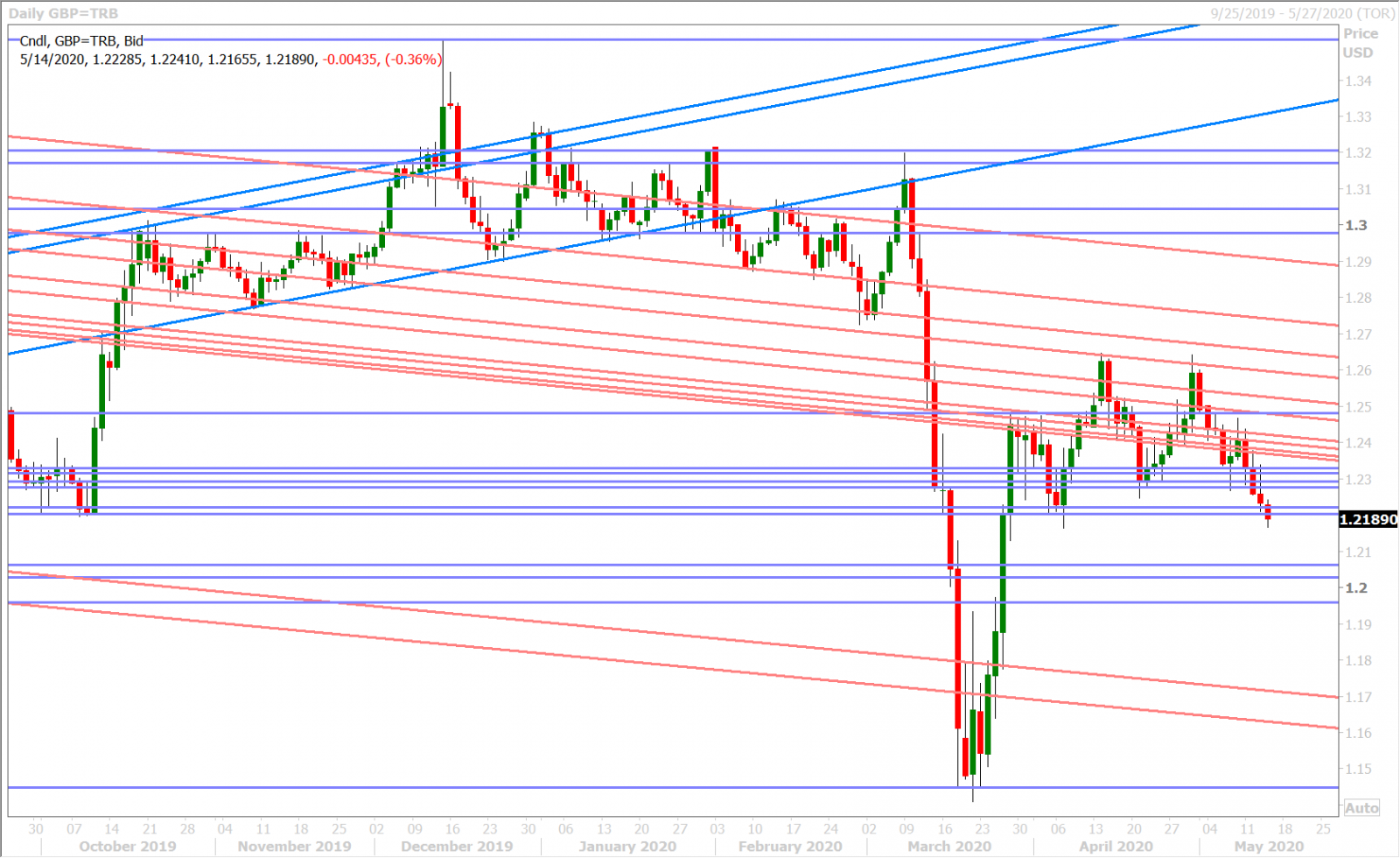

GBPUSD

Sterling saw a brief bounce during the London AM this morning as BOE Governor Bailey reaffirmed that negative rates are “not something we’re contemplating”, but he obviously left the door open when he said “it's always wise not to rule anything out forever”. We think this part-in-parcel explains GBPUSD’s slump back down to its session lows below 1.2200.

The bearish head & shoulders pattern on the daily GBPUSD chart, which got confirmed with last Wednesday’s NY close, now continues to ominously play out. We feel that a NY close below the 1.2200 level could invite a tide of further selling that sees GBPUSD fall quickly down to the 1.20 handle.

GBPUSD DAILY

GBPUSD HOURLY

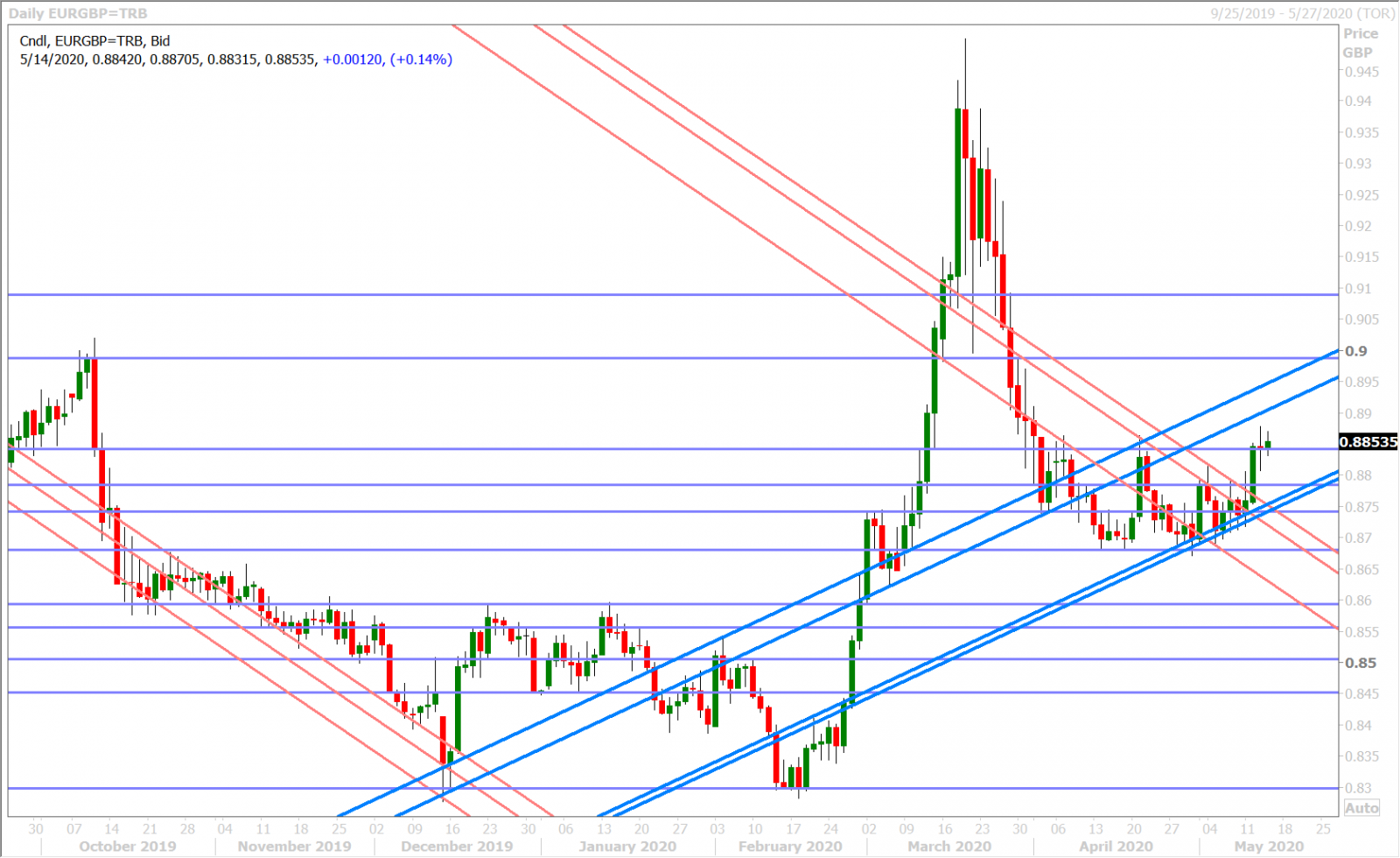

EURGBP DAILY

AUDUSD

The Australian dollar quickly fell apart yesterday after Jerome Powell confirmed that the Fed’s view on negative rates had not changed and that it was not something they were looking at. The buyers gave up the 0.6500 handle once again and they then made no attempt to halt the sellers at chart support in the 0.6470s. The loss of this level in turn led to more selling, which left AUDUSD in a miserable spot, technically speaking, heading into the NY close.

Last’s night’s worse than expected Australian Employment Report for April (details below) then brought about another selling wave which saw the 0.6430s support level get re-challenged. Some buyers appeared in London when GBPUSD bounced, but this level has now fallen too as FX traders continue to reposition for escalating US/China tension. We see some chart support at the 0.6400 level. Over 1.7blnAUD in options expire at the 0.6350 strike this morning at 10amET.

AU APR Employment, -594.3k, -575k f'cast, 5.9k prev

AU APR unemployment rate, 6.2%, 8.3% f'cast, 5.2% prev

AU APR participation rate, 63.5%, 65.2% f'cast, 66% prev

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

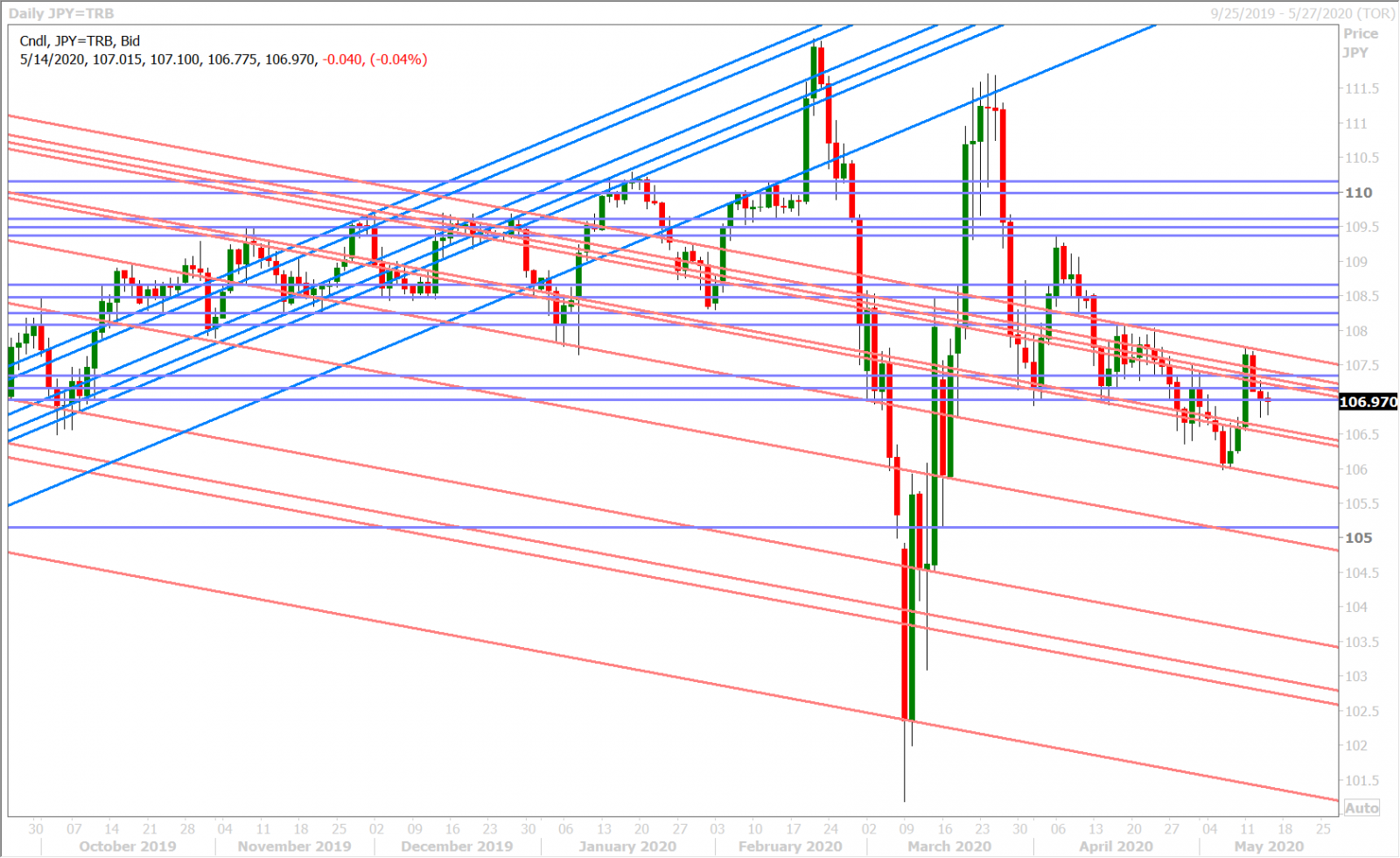

Dollar/yen is hugging the 107.00 strike once again this morning as another 1.2blnUSD in options are set to expire there at 10amET. We think this is fitting considering the market’s continued struggle to determine which currency is a better safe-haven (USD or JPY). This morning’s broad USD bid, which helped USDJPY earlier, is looking like it might stall during NY trade today (perhaps after the 10amET option expiry), but we’re not sure quite frankly how USDJPY wants to trade today relative to the broader risk tone, which just so happens to be deteriorating (S&Ps -1% and US 10yr yields back near 1-week lows). If we combine the market’s increasingly cloudy fundamental drivers with a mixed chart structure, we think traders will be content to sit on the sidelines for the time being.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com