UK lawmakers pass Withdrawal Agreement Bill, but shoot down government's rushed Brexit time-table

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

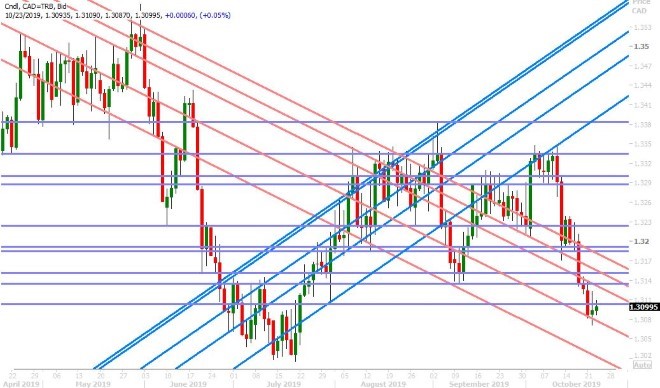

USDCAD

The downward momentum in USDCAD stalled during afternoon trade yesterday after the UK parliament voted down Boris Johnson’s proposed fast-track timetable for implementing his new Withdrawal Agreement Bill (which passed the House of Commons just a few minutes earlier). The selling in sterling that ensued led the USD broadly higher into Asian trade overnight, but cooler heads seem to be prevailing this morning as the markets still expect the EU to grant an Article 50 extension to Britain. USDCAD has slipped back below the key 1.3100 level as GBPUSD tries to take out today’s London highs. Canada reported a much weaker than expected Wholesale Trade number for the month of August this morning (-1.2% MoM vs +0.3%), but this tends to be a volatile data series and so we’re not too surprised to see traders ignoring it. Today’s NY session will feature the weekly EIA oil inventory report at 10:30amET, where traders are expecting a build of 2.23M barrels. Last night’s API report printed another larger than expected build (+4.45M barrels vs +2.2M). December crude oil prices are trading back on the defensive this morning after Russian energy minister Novak said he had no information on yesterday’s Reuters piece that quoted OPEC+ sources talking about a deeper production cut for December’s OPEC meeting.

USDCAD DAILY

USDCAD HOURLY

DEC CRUDE OIL DAILY

EURUSD

Euro/dollar slipped below the lower bound of the 1.1130-50 trend-line support channel yesterday afternoon when GBPUSD abruptly sold off, and it’s been following sterling ever since. Germany reports its October flash Manufacturing PMI tomorrow morning at 4:30amET, and then traders will focus on the European Central Bank's policy meeting at 7:45amET. We still believe Mario Draghi’s hasty re-launch of QE will force Christine Lagarde’s ECB to stand pat/re-validate what was said last month.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

So Boris Johnson got his Withdrawal Agreement Bill past the UK House of Commons yesterday afternoon by a vote of 329-299, but the house voted 322-308 to shoot down his “program motion” or his rushed timetable for approving the details of the legislation. GBPUSD teased traders with break above chart resistance at the 1.2980s after the first vote passed, but then it collapsed to chart support in the 1.2870 after the second vote failed. The EU’s Donald Tusk said late yesterday that he’s going to now recommend that the EU27 leaders accept the UK’s request for a Brexit extension. Domestically, it looks like the UK is now inevitably headed for an election and/or 2nd Brexit referendum in the event the EU grants the extension and Boris Johnson can’t succeed with a second attempt at getting his program motion passed. Will this Brexit drama ever end?

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian dollar is sitting quietly above chart support in the 0.6830s this morning after yesterday afternoon’s sell off in GBPUSD dragged the market further off its recent highs. The RBA’s assistant governor Christopher Kent didn’t say anything monetary policy related when speaking at the ISDA Annual Australia Conference last night.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen traders had some Bloomberg and WSJ articles about the Bank of Japan to digest in the overnight session. The BOJ is considering lowering its forecasts for economic growth and inflation this year in a quarterly outlook report to be released at the end of its next policy meeting on Oct 31, according to Bloomberg sources. However, WSJ sources say policy makers see “little merit in an interest rate cut” this month, believing the ammunition should be saved for worse economic conditions. The market’s swift move lower to the 108.20s was a bit of a head scratcher to us but USDJPY has since recovered back above yesterday’s chart support in the 108.40s. US 10yr bond yields are trying to bounce this morning after yesterday’s failed Brexit program motion vote smacked the market back below 1.77% (a pivotal price level of late).

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com