US/China "phase one" deal signing passes without much fanfare

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Equity markets rally but the bond traders are not believing it.

- US yields continued lower in overnight trade, dragging USD broadly lower.

- Better Retail Sales + stellar Philly Fed numbers out of US now sees yields/USD bounce.

- Bearish upside breakout failures now being noted on the EURUSD and AUDUSD daily charts.

- GBPUSD back to 1.3040s support. Traders now awaiting comments from BOE’s Haldane.

- Large option expiry helping to keep USDJPY afloat. The 110.10s keep capping however.

- UK Retail Sales, US Housing Starts, Industrial Production, Michigan Sentiment all out tomorrow

ANALYSIS

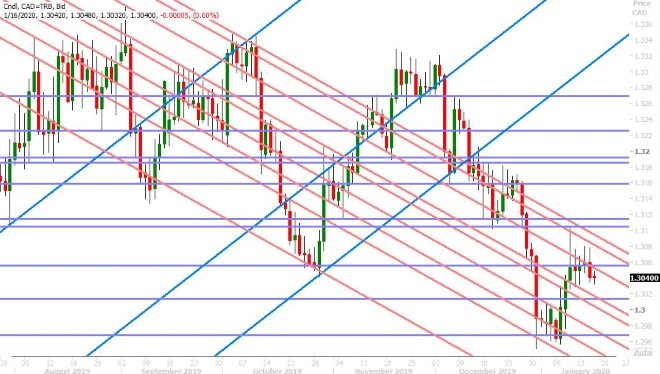

USDCAD

Dollar/CAD is trading lower with the broader USD this morning as traders digest the signing of the US/China “phase one” trade deal and what it will mean for global markets. Some are arguing that yesterday’s ceremony was step in the right direction towards a broader US/China trade deal; and this is why global equities, the Chinese yuan, and commodity currencies are trading higher today while the USD trades broadly lower (in other words…classic “risk” on). We’re a bit more skeptical about what has transpired and would point to the bond market’s reaction as proof of that. If this “phase one” deal is so great, why aren’t US yields shooting higher? If China is actually going to buy 32blnUSD in agricultural products from the US over the next two years, why aren’t soybean and corn futures trading higher? We feel yesterday’s signing was indeed a whole lot of “pomp and circumstance” without much substance, and we feel we have a bond market that is now starting to fret a little bit about “phase two”. If we start looking at what's in "phase one", we notice that a number of US tariffs are still in place. The benefits of the deal feels very lop-sided towards the US (what does China get out of this?) and it allows for a “Complaining Party” to easily back out with written notice to the other party. The FX devaluation section is a re-hash of G20 and IMF rules, which is sort of laughable. What is more, China has reiterated over and over again that the key talking point of this deal (the $200bln in US purchases across manufactured goods, agriculture, energy, and services over 2 years) will be based on “market conditions”, ie. supply and demand, prices, etc. In other words, there’s very little clarity on the enforcement mechanism for these ambitious purchase targets. They simply appear to be goals and rely heavily on China’s goodwill in our opinion. Long story short, we think the move lower in the broader USD since yesterday morning has been more US yield driven than "risk-on" driven.

This decline is US yields is taking a breather now however after the US reported some decent Retail Sales data and a stellar Philly Fed survey. Retail Sales were reported +0.3% MoM for December (in-line with expectations), but the ex-Autos number beat expectations (+0.7% MoM vs +0.5%) and we got a +0.1% upward revision to November’s headline figure. The Philly Fed business outlook survey blew away expectations of 3.8, coming in instead at 17.0. This included higher numbers for all sub-categories of the survey as well, ie. Capex, employment, prices paid and new orders. All this is now seeing the US 10yr yield bounce back up to 1.80%, hence causing the small USD buying wave we’re seeing now.

What does all of this mean for USDCAD heading into the end of the week? Frustratingly, very little in our opinion. Despite yesterday’s negative USD influences and this morning’s relatively more positive USD influences, broad market FX volatility has been very low. We’re still confined in the 1.3110-30 to 1.3190 range we presented last Friday, and we don't really see that changing yet. We didn’t get the pronounced “buy the rumor…sell the fact” type of broad market reaction that we were hoping for…instead we got a quiet chuckle from everybody we follow and talk to. What is more, we don’t have anything major on the Canadian economic data docket until the CPI numbers next Wednesday morning, ahead of the Bank of Canada rate decision.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar continued its upside pressure on the 1.1150s during the overnight session (largely because of weaker US yields in our opinion), and while we saw the inklings of an upside breakout attempt at the start of NY trade today, this has now been squashed due to the better than expected US data that was just released. We think a NY close today, below the 1.1150s, would be technically bearish for EURUSD heading into next week’s ECB meeting. The ECB's Christine Lagarde will be speaking at an event in Frankfurt at 3pmET today.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling continues moderately higher today as it rides on the coat-tails of some soft US inflation data this week and a “phase one” US/China trade deal that has been greeted with a bit of skepticism from the US bond market. This morning’s strong US economic data is the reason for the market’s pullback to chart support in the 1.3040s in our opinion. We think traders will now definitely focus on comments from Bank of England member Andy Haldane, who is expected to speak at 1pmET at an event in London, especially given all the dovish talk coming out of other BOE members since last week. Rate cuts odds for Jan 30th have slipped back to 56% in the OIS market today. The UK reports its December Retail Sales data at 4:30amET tomorrow, with traders expecting +0.5% MoM.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Australian rallied with most currencies into the NY close yesterday as US yields and the broader USD traded lower. This upward momentum carried over into the overnight session, with AUDUSD trading briefly above chart resistance in the 0.6920s. The market has since given up this upside break-out attempt on the heels of this morning’s better than expected US Retail Sales/Philly Fed numbers…and dare we say it, we think we see a bearish “head & shoulders” pattern developing on the daily AUDUSD chart. Tomorrow’s very large option expiry at the 0.6925 strike could ultimately delay or even thwart this negative chart pattern from coming to fruition, but it’s hard not to notice it this morning.

If we look at Chinese yuan price action today, it has broken down back below the pivotal 6.8850 we talked about earlier this week. While one could argue this was mildly bullish for commodity currencies like CAD and AUD during the overnight session, those currencies are now focusing on better US economic data and a bounce in US yields. With the US/China “phase one” deal now also technically out of the way, we think USDCNH could follow the broader USD as opposed to lead it.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

This morning’s large 1.8blnUSD option expiry at the 110 strike, and some better US economic data, appears to be the reason why USDJPY is holding up rather well this morning. Chart resistance in the 110.10s is still stubbornly capping prices however, and we wonder if this could now be an ominous sign for the market heading into week’s end.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com