US COVID case counts back in focus

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Record breaking 36k rise in new US cases ignites “risk-off” flows yesterday.

- Relatively less worse California stats this morning sees risk sentiment bounce.

- US Jobless Claims increase more than expected for the 2nd week in a row.

- Fitch takes away Canada’s AAA credit rating with sovereign debt downgrade.

- USDCAD testing upper end of recent price range. EURUSD loses 1.1240s.

- USDJPY de-couples from US yields. GBPUSD loses 1.2440-60 support zone

ANALYSIS

USDCAD

Another bad day of US coronavirus statistics, including a record breaking 36k jump in new daily infections, drove broad risk sentiment lower and the USD higher yesterday. Dollar/CAD’s rally had an extra tailwind behind it following Fitch’s downgrade of Canada’s sovereign debt rating to AA+, citing a deterioration in the country’s public finances resulting from the coronavirus pandemic. Full commentary here. While holiday thinned Asian markets and the ECB’s announcement of a new repo facility for central banks seemingly helped the risk recover overnight, the mood turned sour once again into the NY open as traders prepared for some US economic data and today’s virus case counts out of Texas, Florida and California.

This morning’s US data dump was a mixed bag (see below), but FX traders are now focusing on some "less bad" COVID stats tricking out for California (just 5349 new cases today vs +7149 yesterday) and are selling the USD as result.

US MAY DURABLES ORDERS +15.8 PCT (CONSENSUS +10.9 PCT) VS APRIL -18.1 PCT (PREV -17.7 PCT)

US JOBLESS CLAIMS FELL TO 1,480,000 JUN 20 WEEK (CONSENSUS 1,300,000) FROM 1,540,000 PRIOR WEEK (PREVIOUS 1,508,000)

US FINAL Q1 GDP -5.0 PCT (CONSENSUS -5.0 PCT), PREV -5.0 PCT; FINAL SALES -3.5 PCT, PREV -3.7 PCT

USDCAD DAILY

USDCAD HOURLY

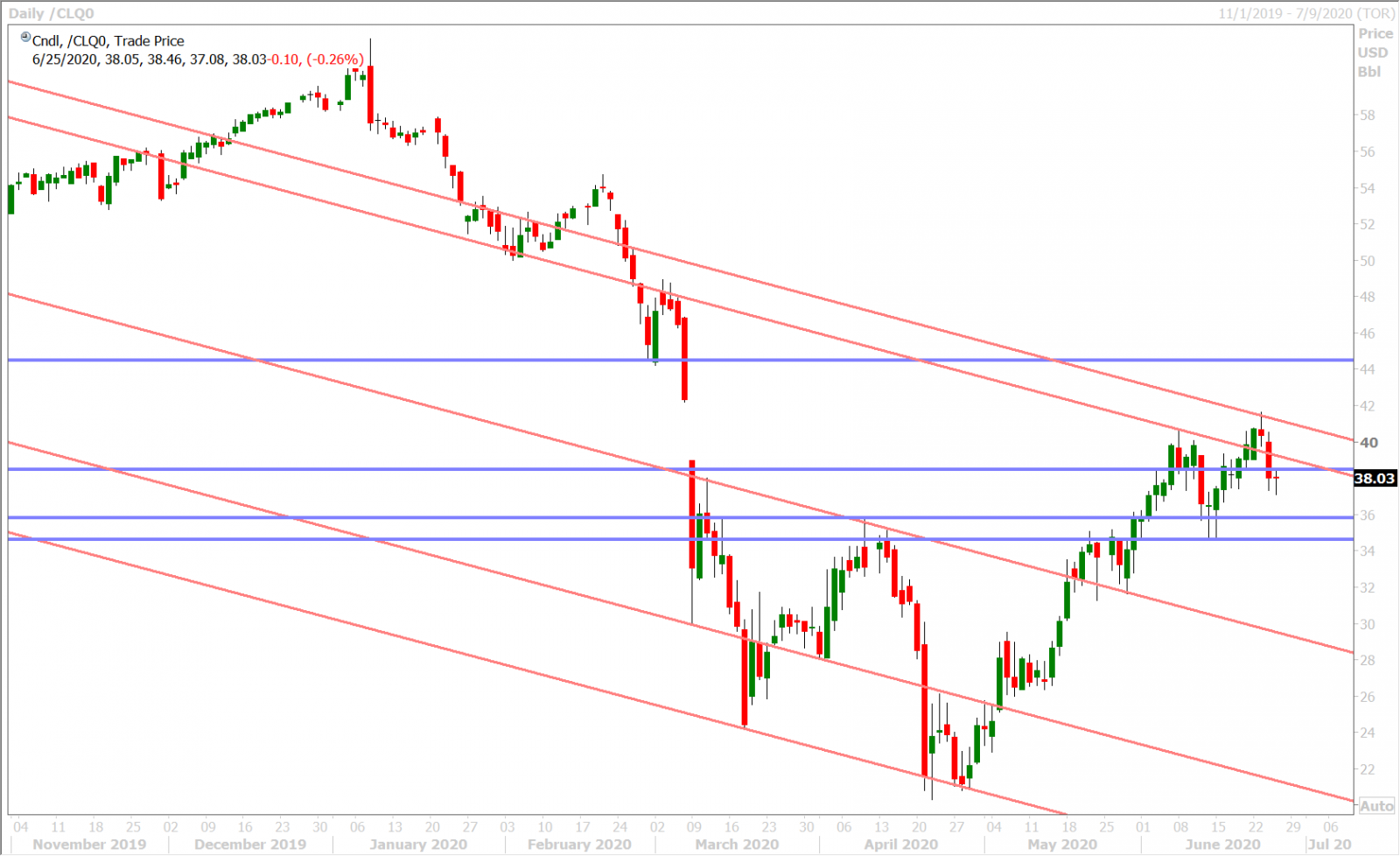

AUGUST CRUDE OIL DAILY

EURUSD

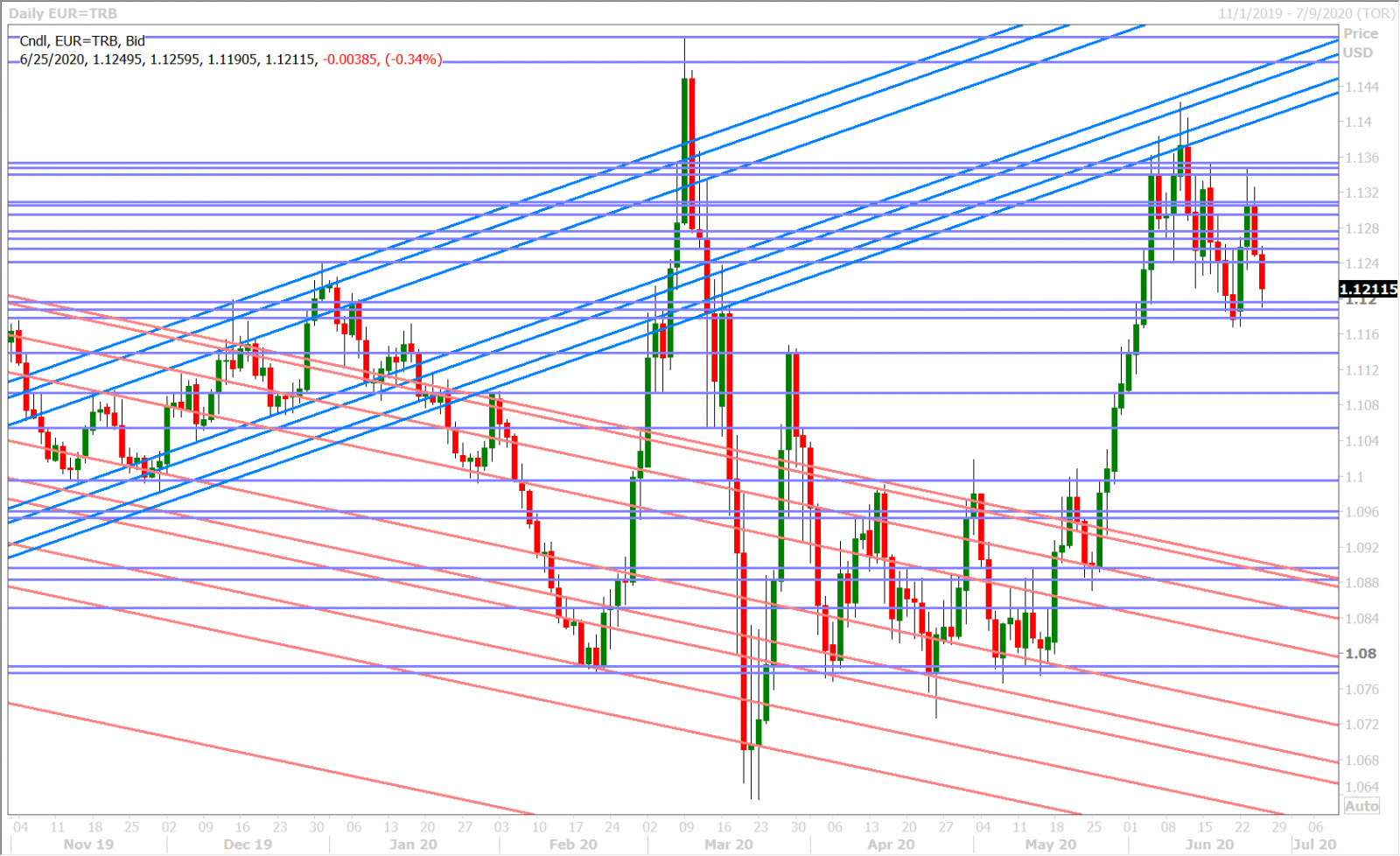

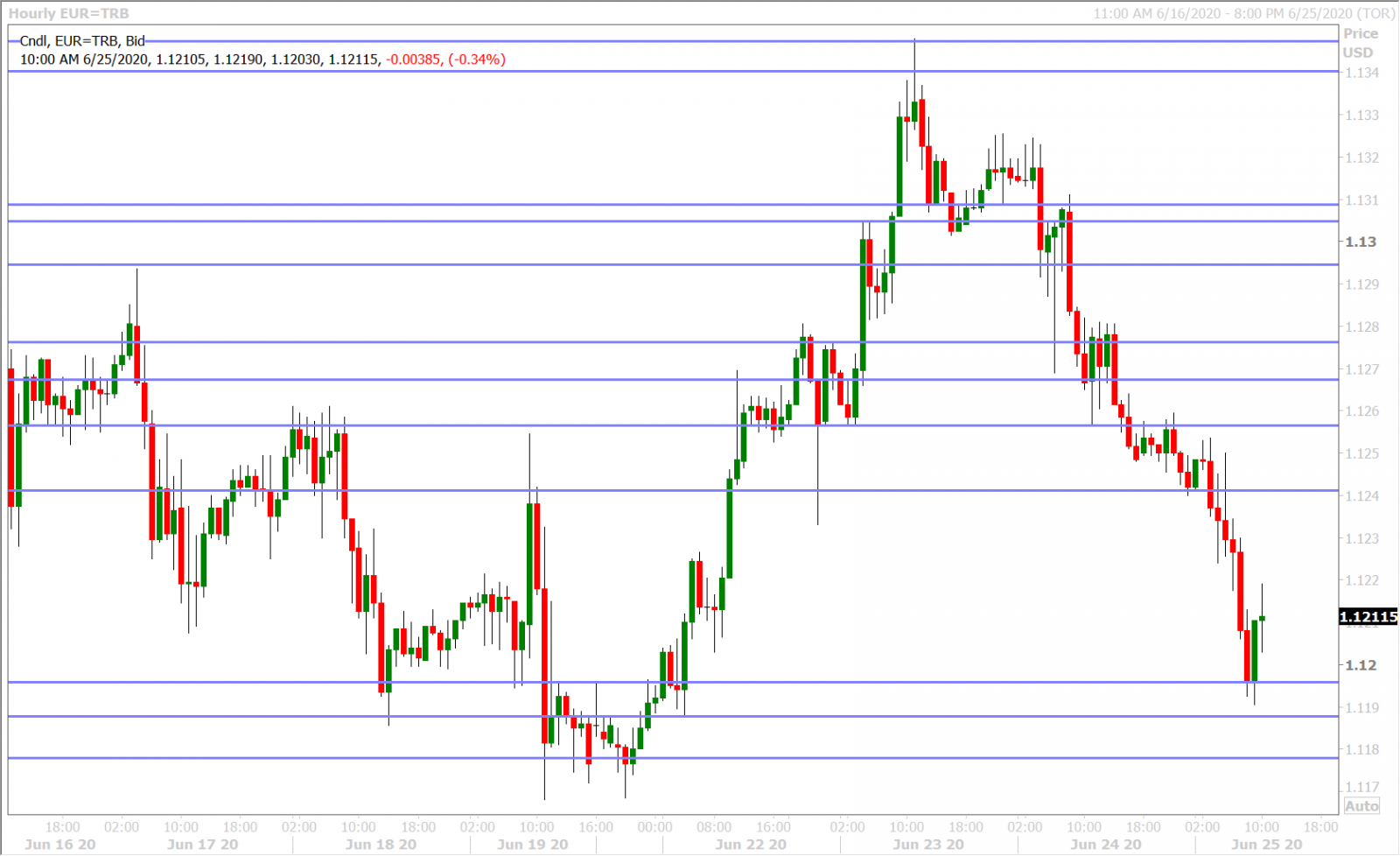

Euro/dollar recorded a miserable NY close below the 1.1250s yesterday as rising COVID-19 fears unleashed broad demand for the safe-haven USD. Buyers failed with their recovery attempt to regain this level in Asia and while the break below the 1.1240s underwent some false starts this morning, the sellers ultimately triumphed and pushed EURUSD down to its next support level in the 1.1190s. We reckon that this morning’s large 1.6blnEUR expiry at the 1.1200 strike could be playing a part in this morning’s EUR weakness as well. The market is not paying attention to the ECB’s precautionary new EUREP facility. Full press release here.

EURUSD DAILY

EURUSD HOURLY

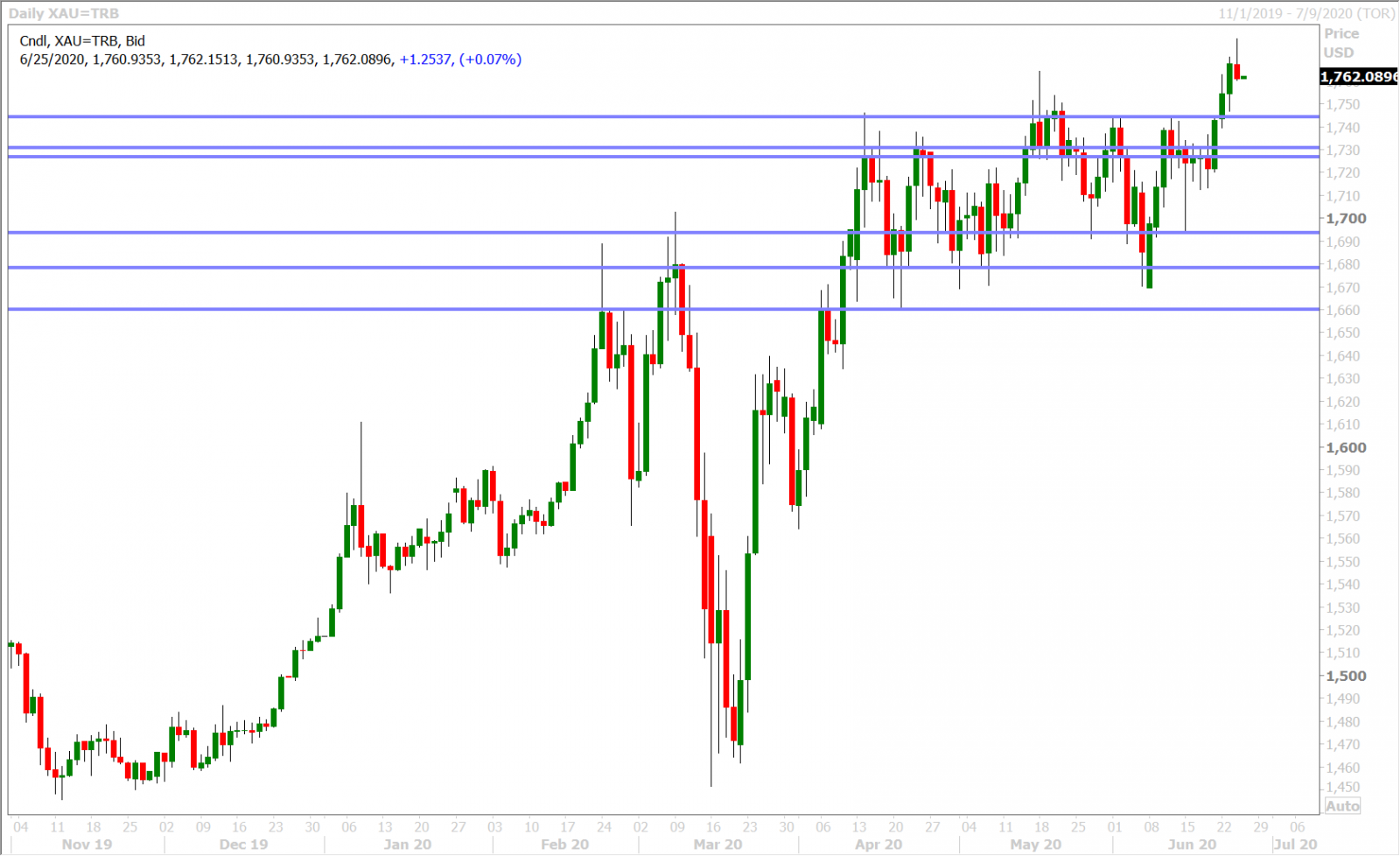

SPOT GOLD DAILY

GBPUSD

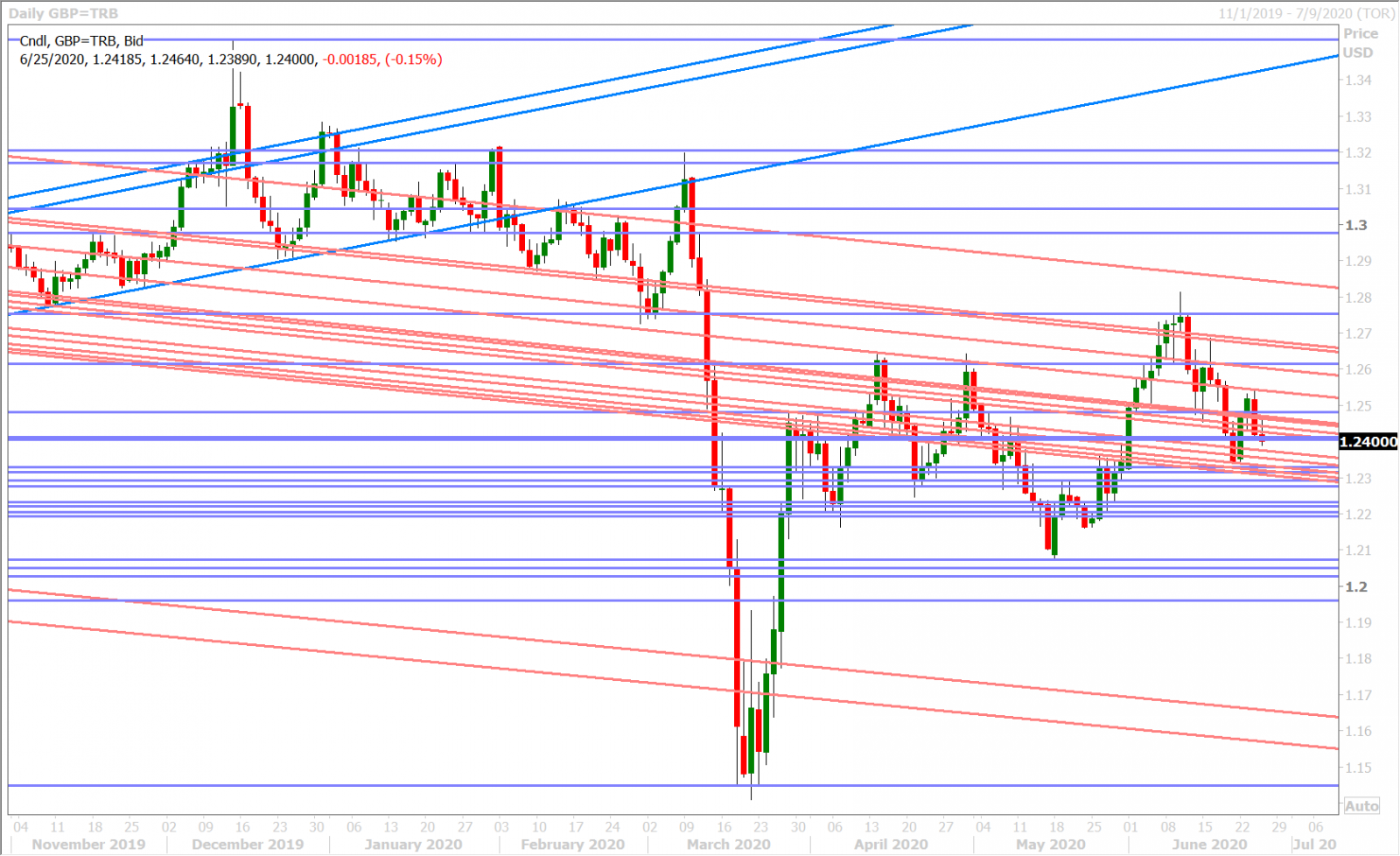

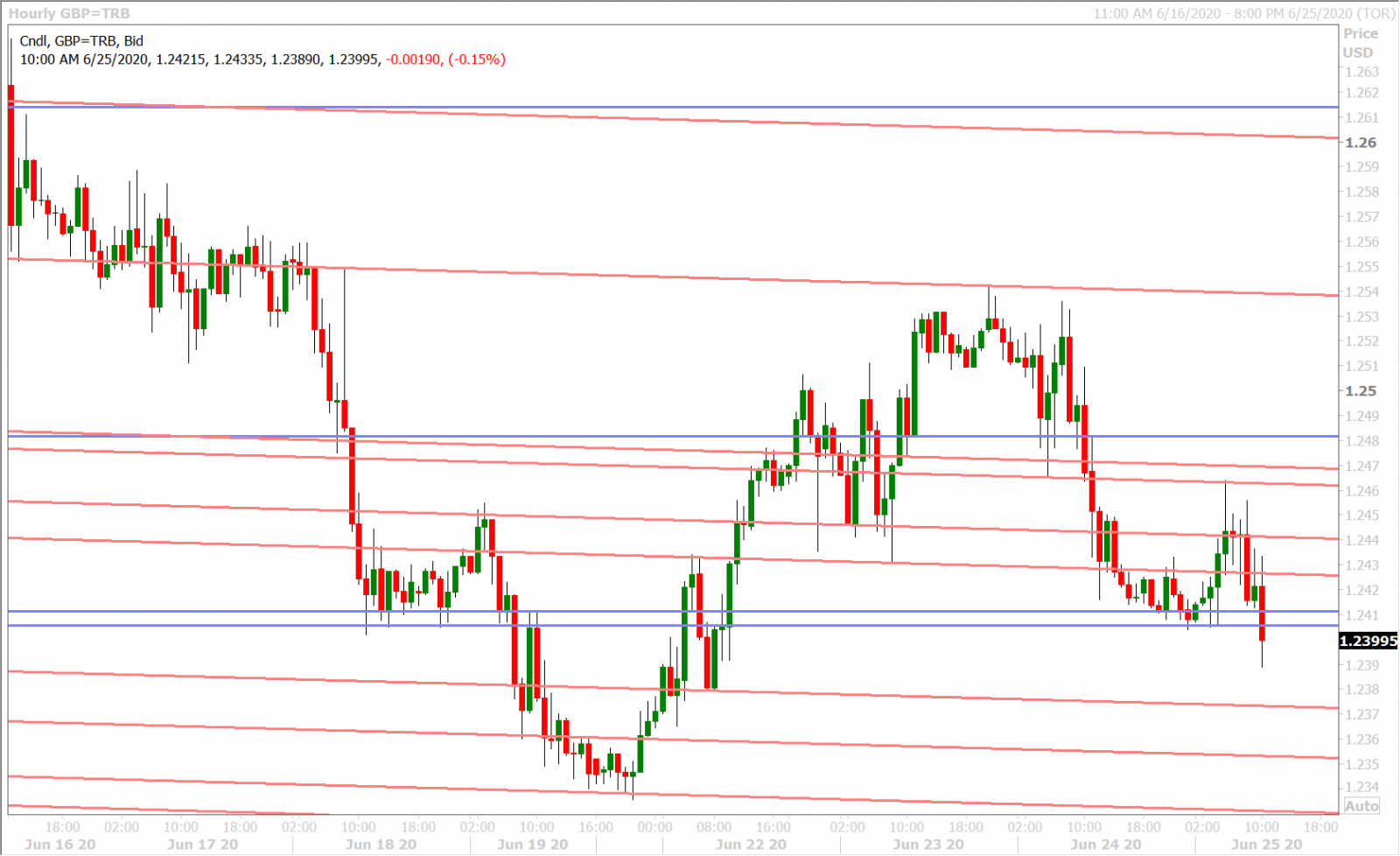

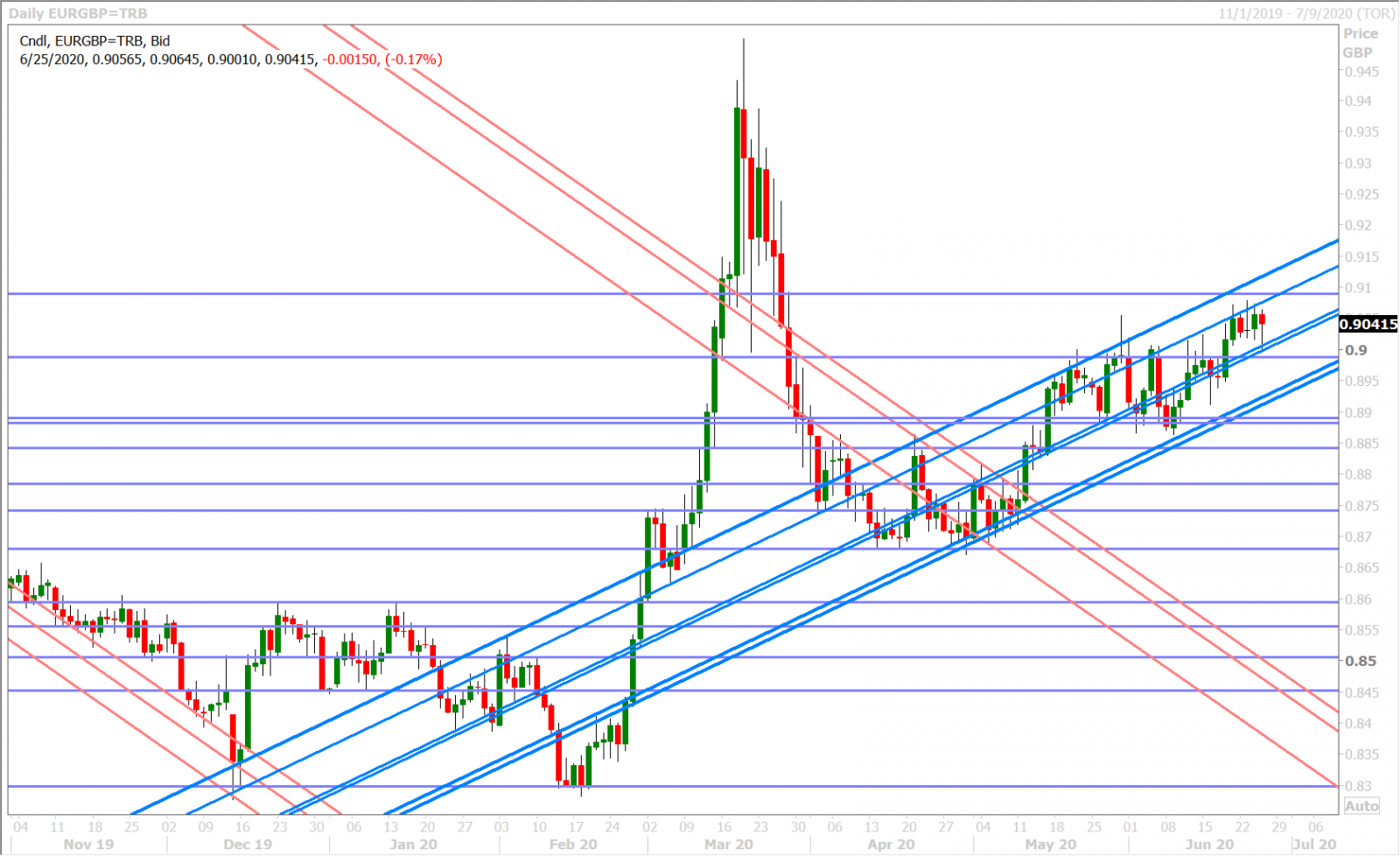

The 1.2440-60 support level ultimately gave way yesterday, which has shifted the momentum negative once again for sterling. We saw this reinforced in European trade this morning when buyers failed to regain this level and we’d be on the lookout for the typical month-end EURGBP demand over the next few days as another short term potential weight for GBPUSD.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

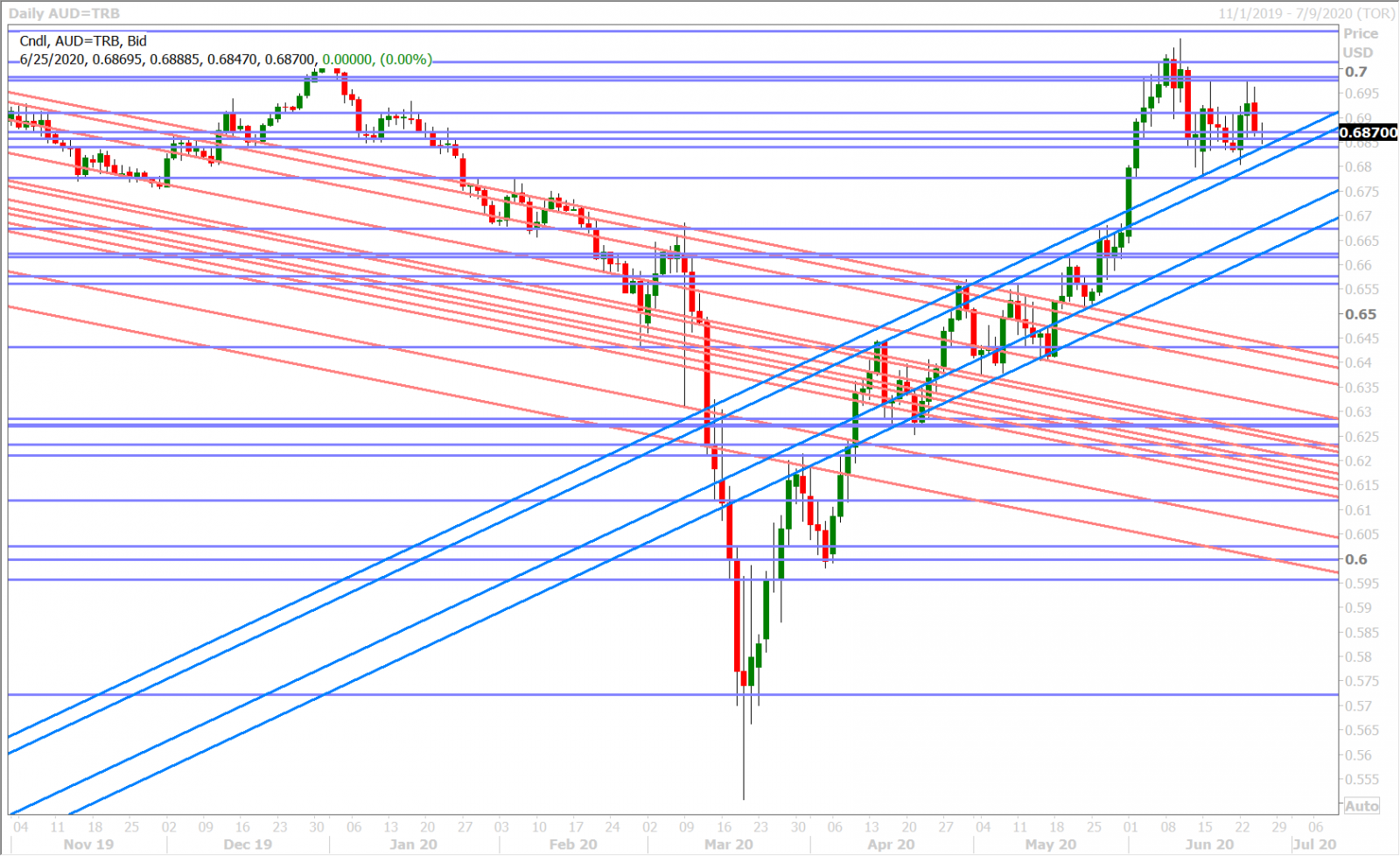

AUDUSD

The Aussie sellers are fighting to maintain the market’s downward momentum this morning as some relatively less worse COVID stats out of California (just released) compete with a technically weak NY close below the 0.6910s yesterday. Expect the virus headlines out of the other US hot-spots to set the tone for risk sentiment again today, with the 0.6850-70s being the near-term pivot for price action.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

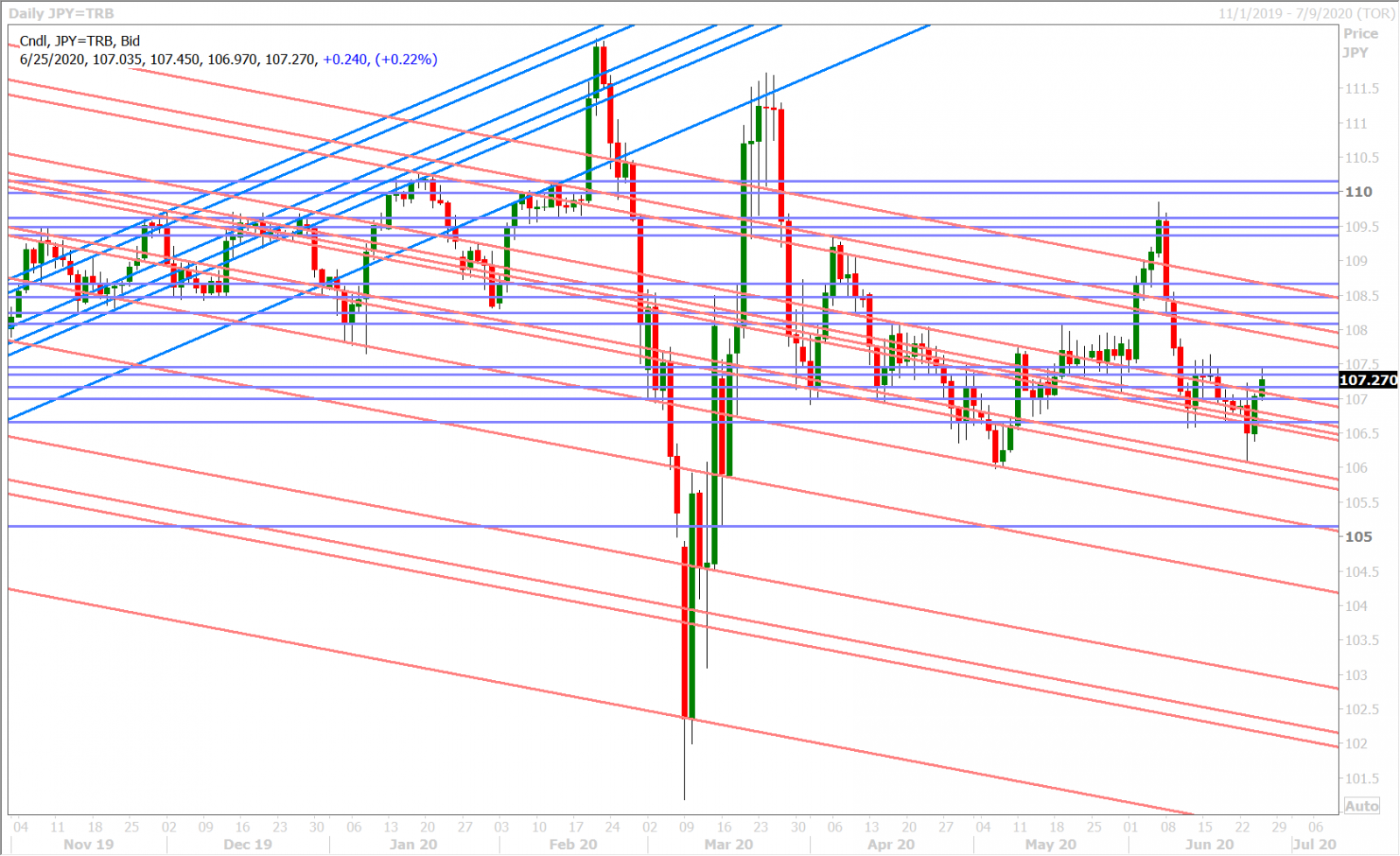

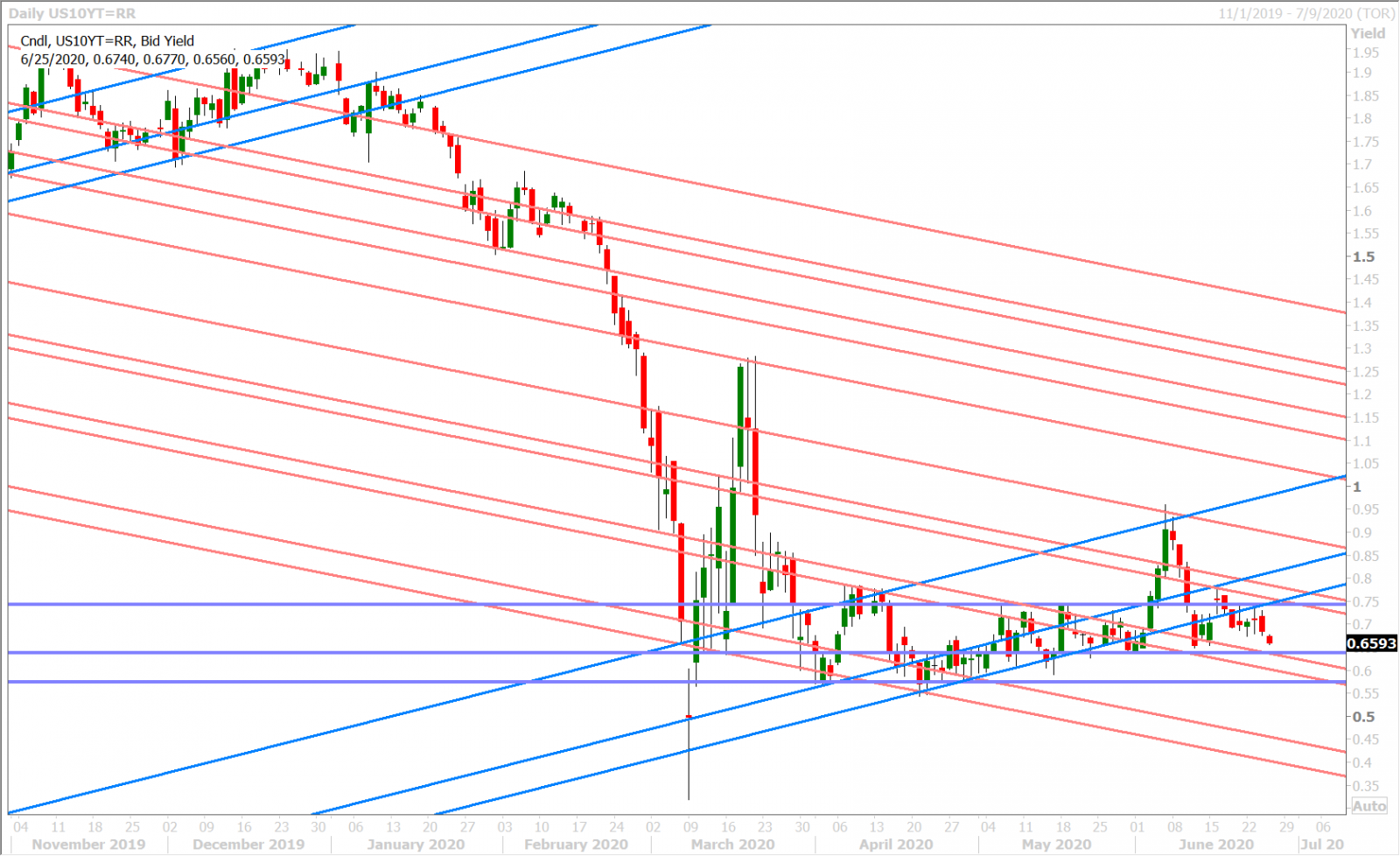

USDJPY

Dollar/yen broke its positive correlation with US yields yesterday as market chatter circulated about Japan being vulnerable to a “second wave” of the coronavirus. To be fair, we're seeing clusters of new cases re-emerge in Germany, Australia, China and even Japan now (daily new cases in Tokyo climbed to 55 yesterday, which was the highest tally in 6 weeks).

We could also simply be seeing a reversion to the market’s familiar range in the low 107s after the hugely disruptive flows from Tuesday. Reuters reported today that a hedge fund was rumored to have initiated a new $2bln short position in USDJPY during Tuesday morning’s 100pt drop. Over $1.1bln in options will be expiring between the 107.00 and 107.40 strikes at 10amET this morning.

USDJPY DAILY

USDJPY HOURLY

US 10-YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com