USD trading mixed ahead of FOMC meeting

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Interested in creating a custom foreign exchange trading plan? Contact us or call EBC's trading desk directly at 1-888-729-9716.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up to currency insider here.

SUMMARY

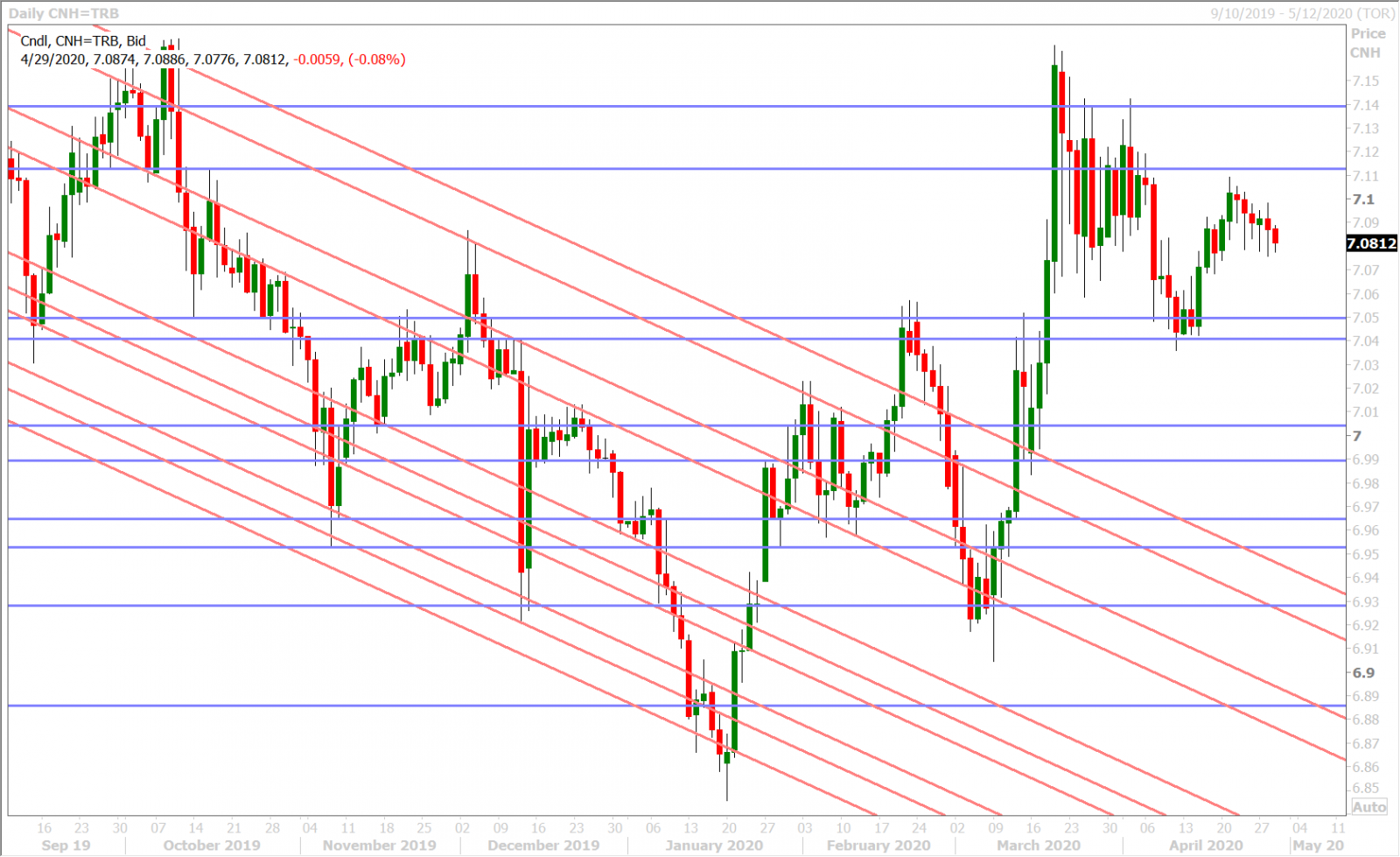

- Asia buys risk with month-end USD sales, oil bid, Aussie CPI beat, shrugged off Italy downgrade helping.

- Europe re-buys USD ahead of US GDP release. GBP underperforms on month-end EURGBP demand.

- US Q1 Advance GDP misses expectations, -4.8% vs -4.0% expected. Markets don’t react much.

- Gilead says its Remdesivir trial has “met its primary endpoint”. S&Ps pop 40pts, dragging USD lower again.

- Fed press release at 2pmET. Powell to speak at 2:30pmET. FX option markets pricing in a non-event.

- China April Manufacturing PMI at 9pmET. ECB statement at 7:45amET tomorrow. Lagarde speaks at 8:30amET.

ANALYSIS

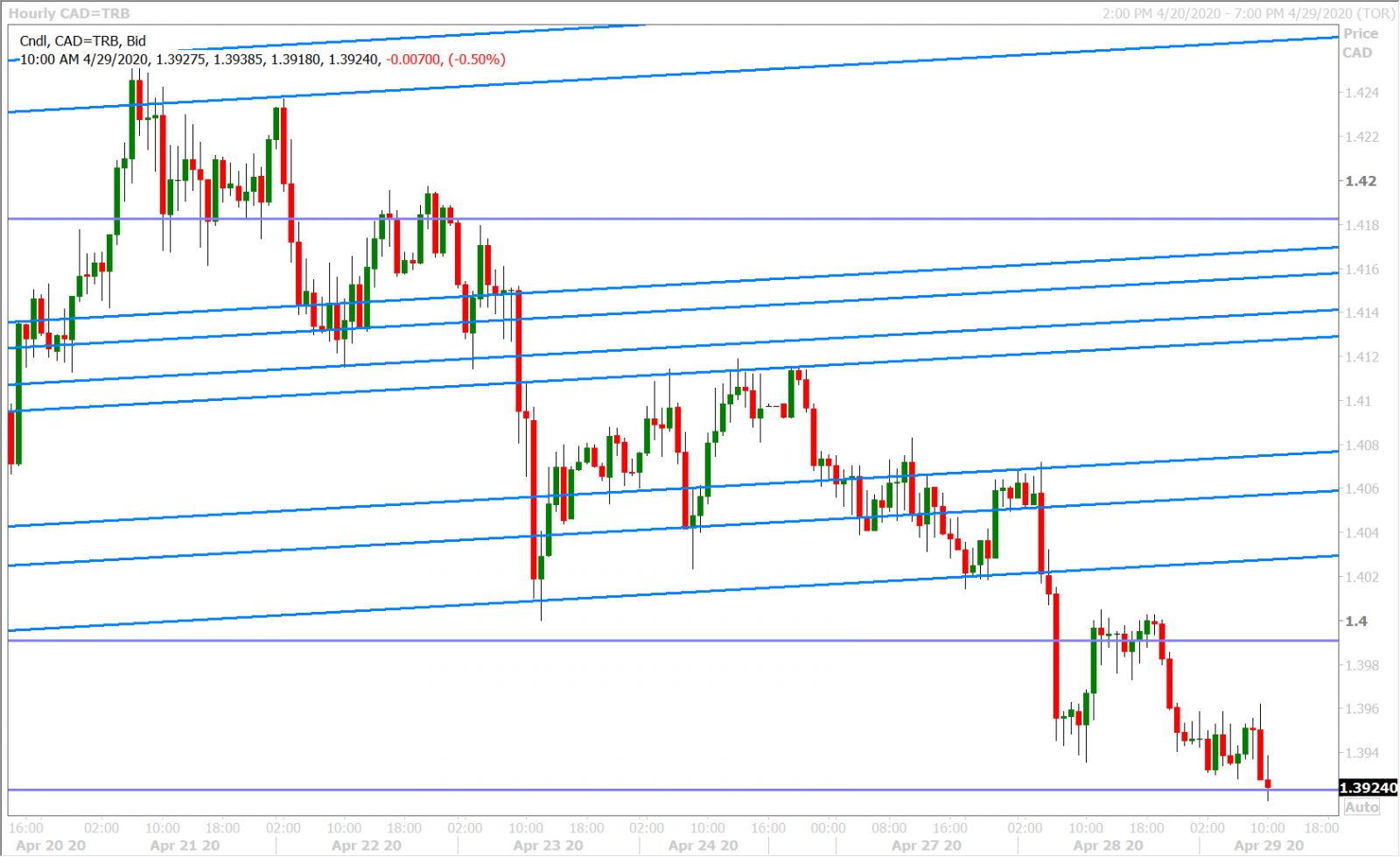

USDCAD

The USD traded lower during Asian/early European trade today as some of yesterday’s talking points were repeated (month-end USD selling and stabilizing oil prices). Broader risk sentiment also appeared to get a boost from Alphabet’s better than expected Q1 earnings report last night, EURUSD’s shrugging off of Fitch’s downgrade to Italian debt, and AUDUSD’s push back above the 0.6500 level on higher than expected Australian Q1 CPI.

All these flows started to reverse around 3-5amET this morning though and, while we can’t find an obvious news catalyst for this, we would note a number of analysts talking about the typical month-end demand for EURGBP from the German Bundesbank (to cover the UK’s monthly contributions to the EU budget). This saw GBPUSD reverse sharply lower off chart resistance in the 1.2480s and we wonder if casual FX observers mistook these flows for broad, risk-off type, USD demand. There was a case to be made for taking some risk off the table though ahead of the much anticipated release of US Q1 Advance GDP at 8:30amET, which was just reported at -4.8% vs -4.0% expected…which now marks the sharpest quarterly contraction in US economic growth since the 2008 Global Financial Crisis.

Traders are largely ignoring the GDP headline though as Gilead steals the limelight with its Remdesivir trial results having “met its primary endpoint”. Recall this is the pharmaceutical company whose Remdesivir drug was alleged to have worked on a small group of severe COVID-19 patients a few weeks ago. The S&P futures have spiked 40pts higher as a result, which is in turn bringing back some broad, risk-on, USD sales.

Today is FOMC Day of course, which could very likely put global markets into a lull ahead of this afternoon’s announcement. The Fed will release its statement at 2pmET and chairman Jerome Powell will speak to reporters at 2:30pmET. No changes are expected when it comes to interest rates or the avalanche of new asset purchase/loan programs that were announced by the Fed over the last month, and we think market participants are very much expecting to Fed to reiterate its commitment to do whatever it takes. The FX options market is pricing in a rather tame reaction to the Fed today, as overnight at-the-money straddles trade at approximately just 50pts for EURUSD, USDJPY and AUDUSD. Dollar/CAD is now re-testing the bottom end of its recent range (1.3850-1.3920).

USDCAD DAILY

USDCAD HOURLY

JUNE CRUDE OIL DAILY

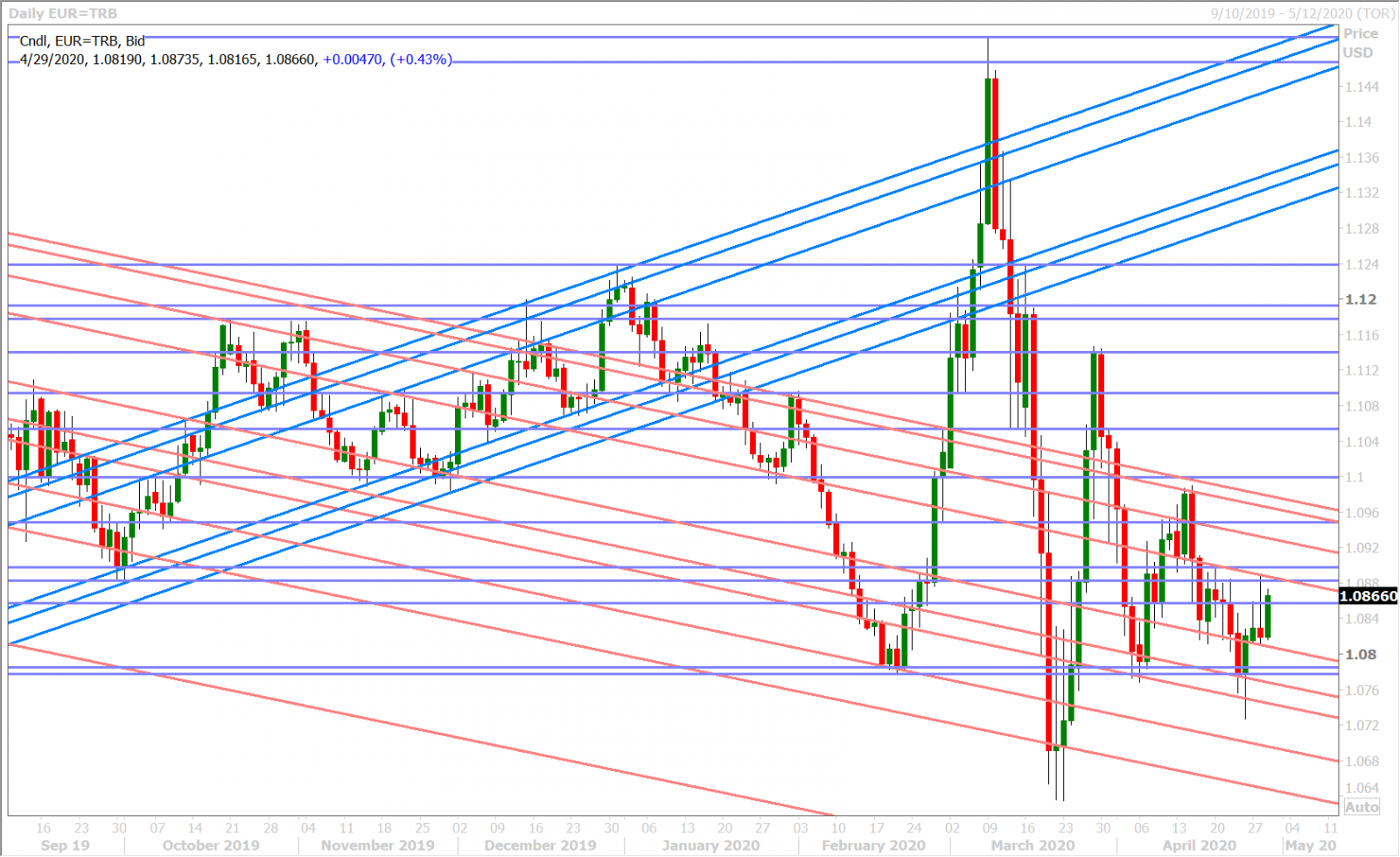

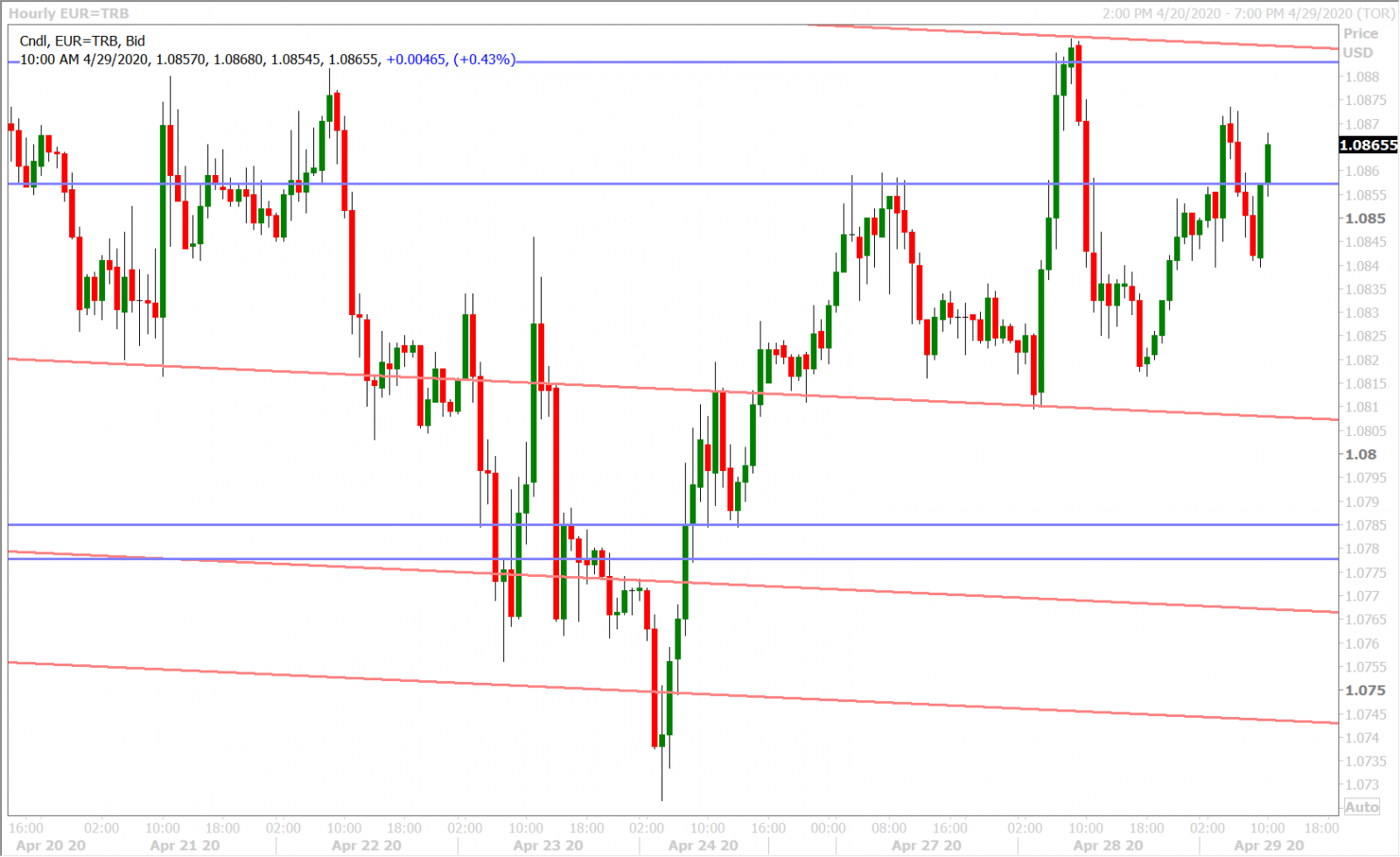

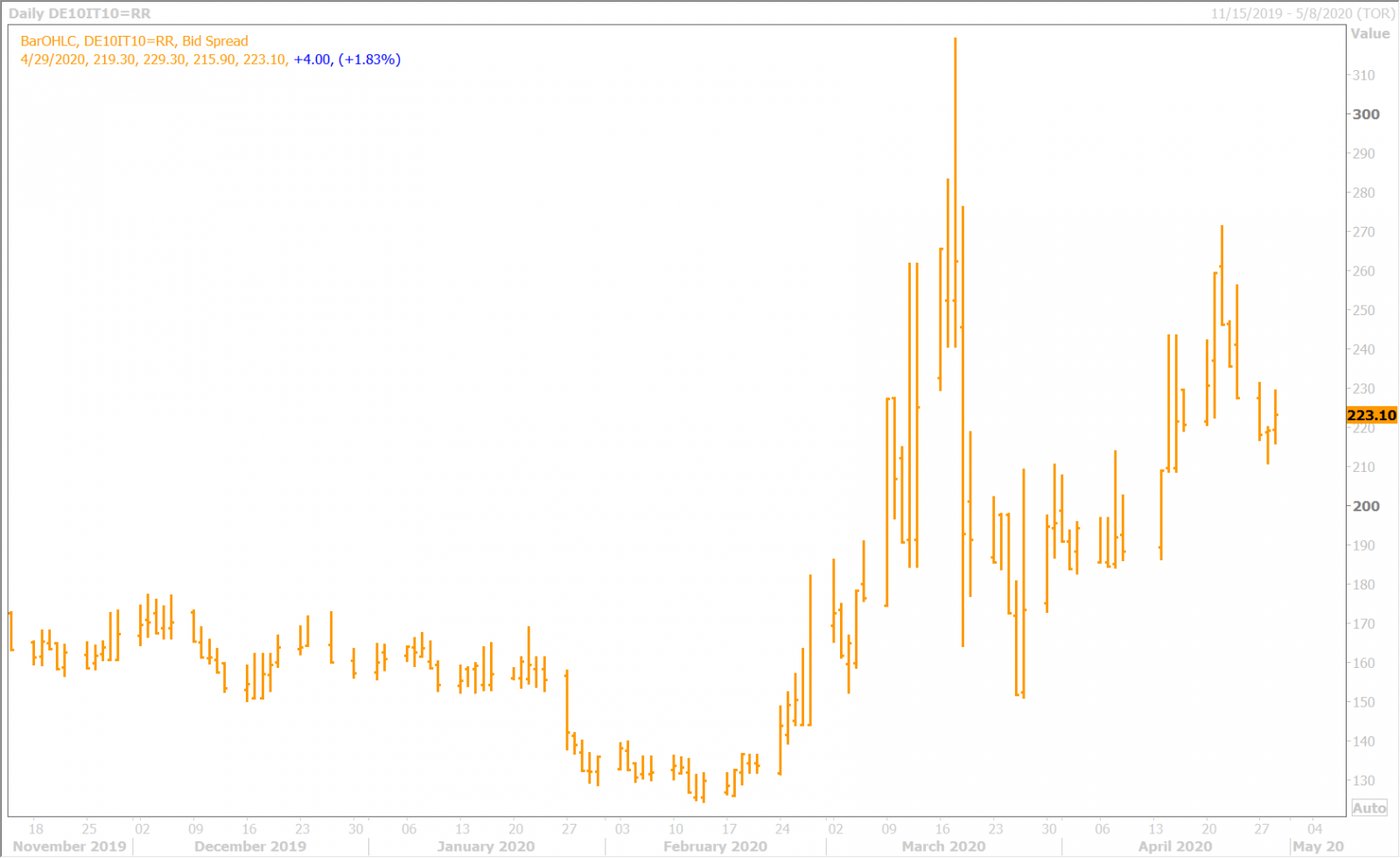

EURUSD

Euro/dollar has been a volatile mess over the last 24hrs and it doesn’t look like the market’s technical structure is going to get any clearer over the next 24hrs. Yesterday’s early risk-on move higher was ultimately met by EURUSD sellers at chart resistance in the 1.0880s. The NY close back below the 1.0850s was technically negative, but the market’s ability to shrug off an Italian debt downgrade from Fitch seemed to bring about some short covering. This morning’s brief push back above the 1.0850s in EURUSD felt EURGBP flow driven, and we think the subsequent fall back below proves that point.

EURUSD DAILY

EURUSD HOURLY

BTP/BUND SPREAD DAILY

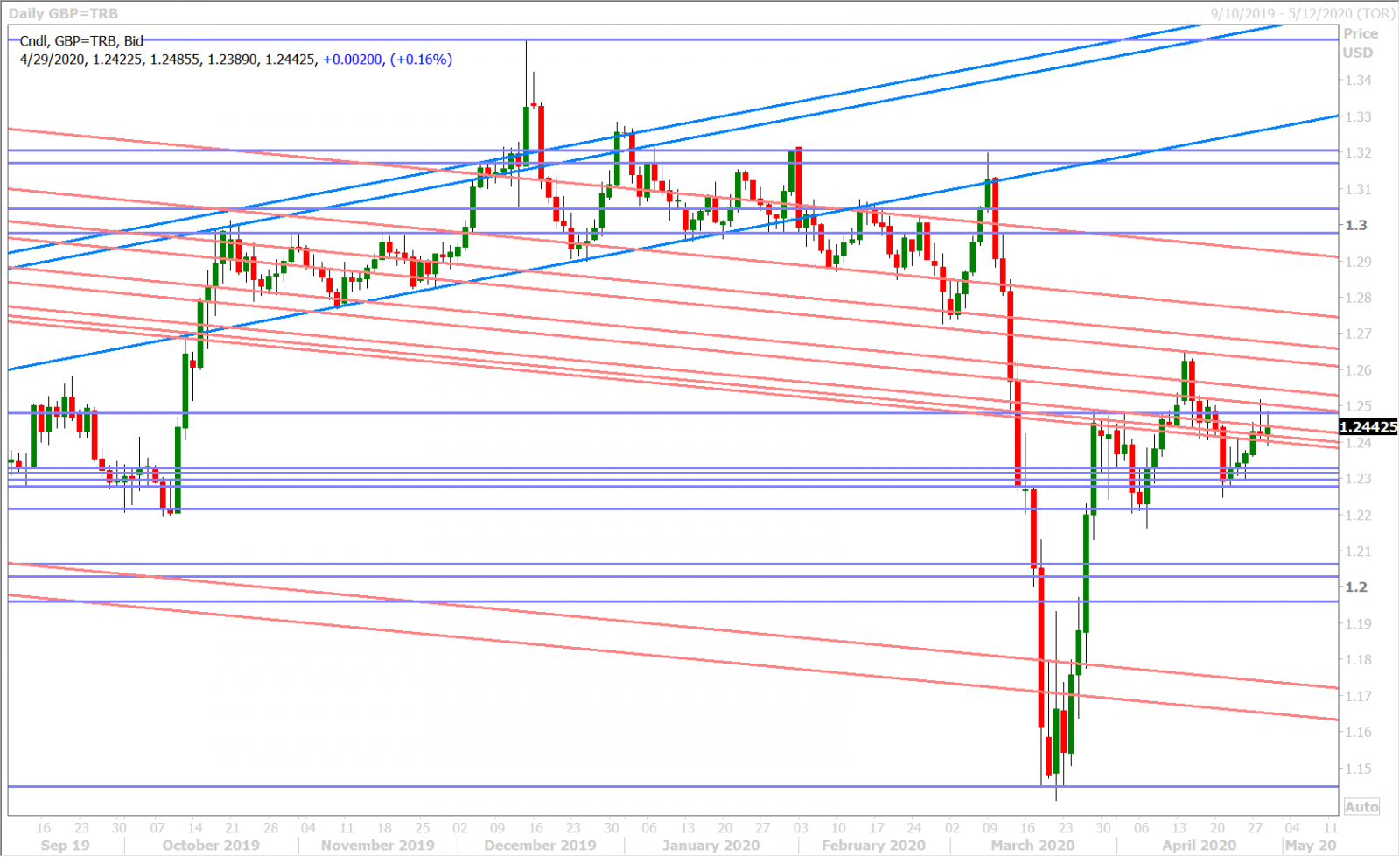

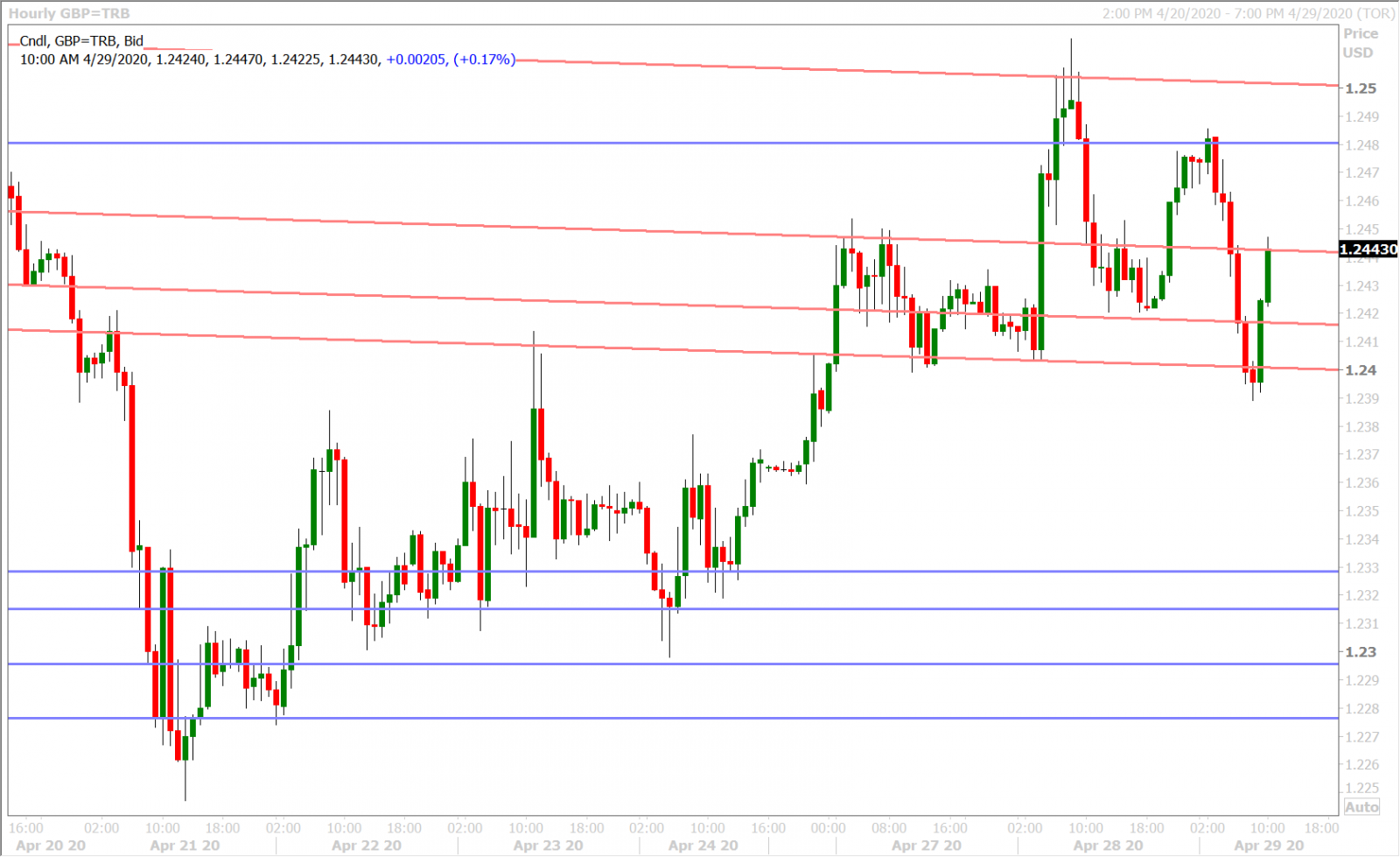

GBPUSD

Sterling got sold across the board this morning as talk of month-end EURGBP buying made the rounds. GBPUSD’s sharp reversal off the 1.2480s chart resistance level is a rather consequential development though, as we’re starting to see signs of a bearish head & shoulders pattern developing on the daily chart. The day is young though and we would need to see this pattern clearly visible into the NY close before confirming. The Gilead headlines are helping the market recover a little bit now and of course we’ll have the Fed meeting later this afternoon.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

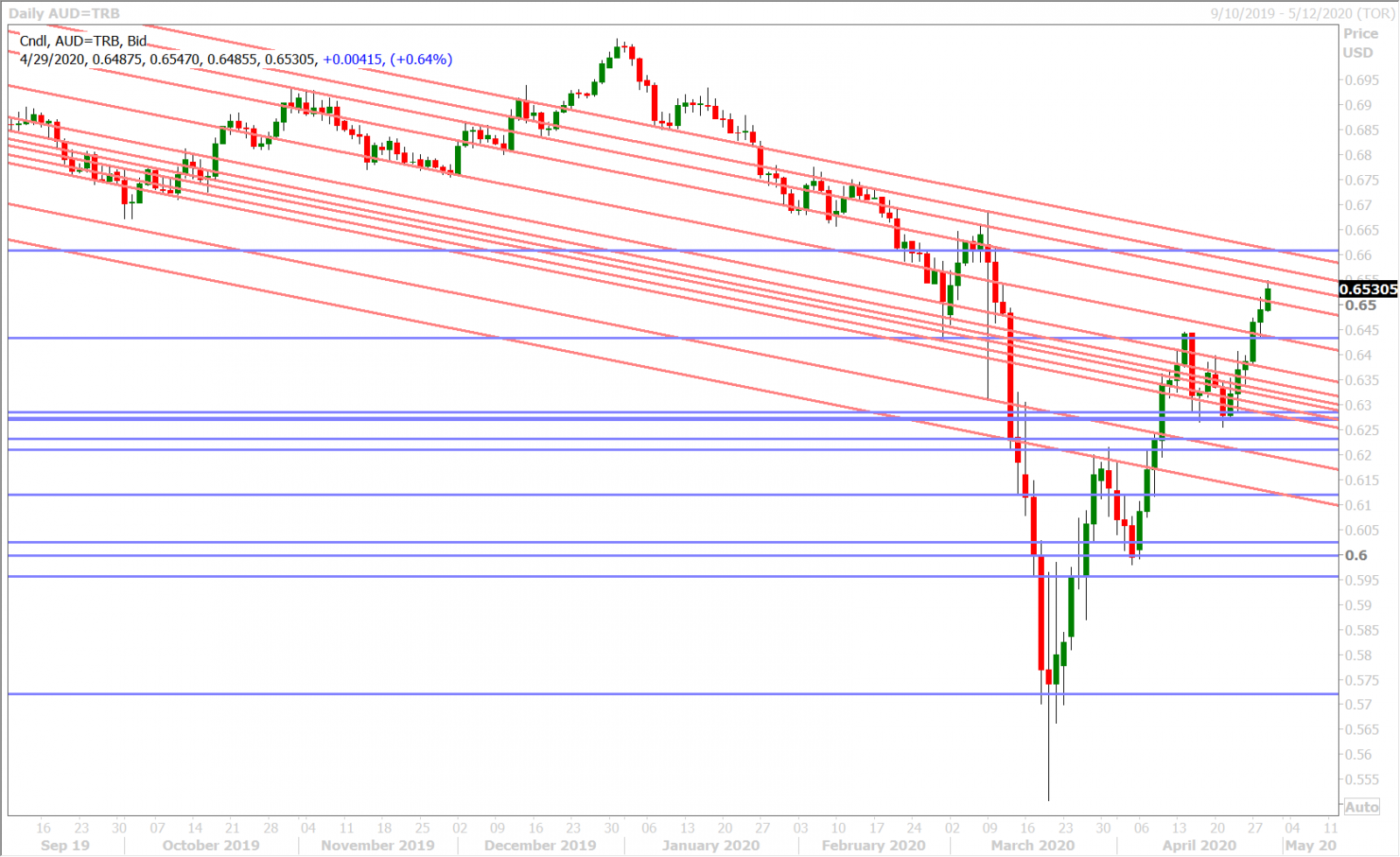

AUDUSD

The bulls remain in control of the Australian dollar today and this was aided by last night’s move back above the 0.6505 resistance level in AUDUSD. Australia reported a better than expected Q1 CPI result shortly after this technical development was achieved and, while one could argue that this inflation data is old now (pre COVID-19), we’d argue that traders are looking past the expected Q2 CPI decline already too. We think the Aussie continues to have legs here so long as the Australian re-opening efforts continues as indicated by government officials and so long as the funds remain stubborn with their bearish theses.

The next 24hrs could be very pivotal for AUDUSD however as we'll have a ton of outside, non-Australia specific developments. We have the Fed meeting (2-2:30pmET today), the official April Manufacturing PMI out of China (9pmET tonight), the ECB meeting (7:45-8:30amET tomorrow) and a massive option expiry at the 0.6570 strike (10amET tomorrow). All of these developments could force an interesting test of the 0.6570-0.6610s resistance zone, which is arguably the last key chart resistance zone left on the charts (above which we think AUDUSD could move to a new uptrend).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

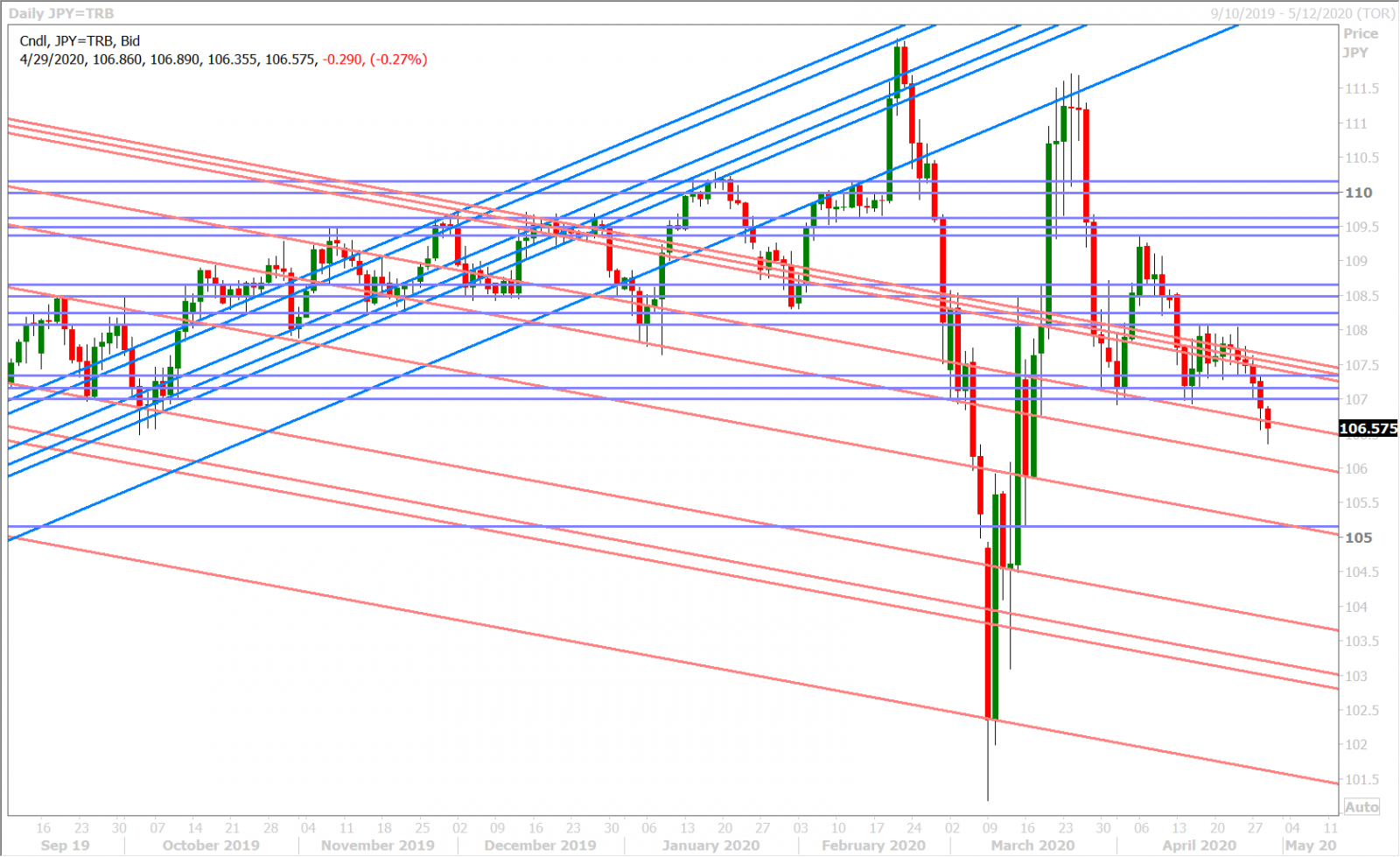

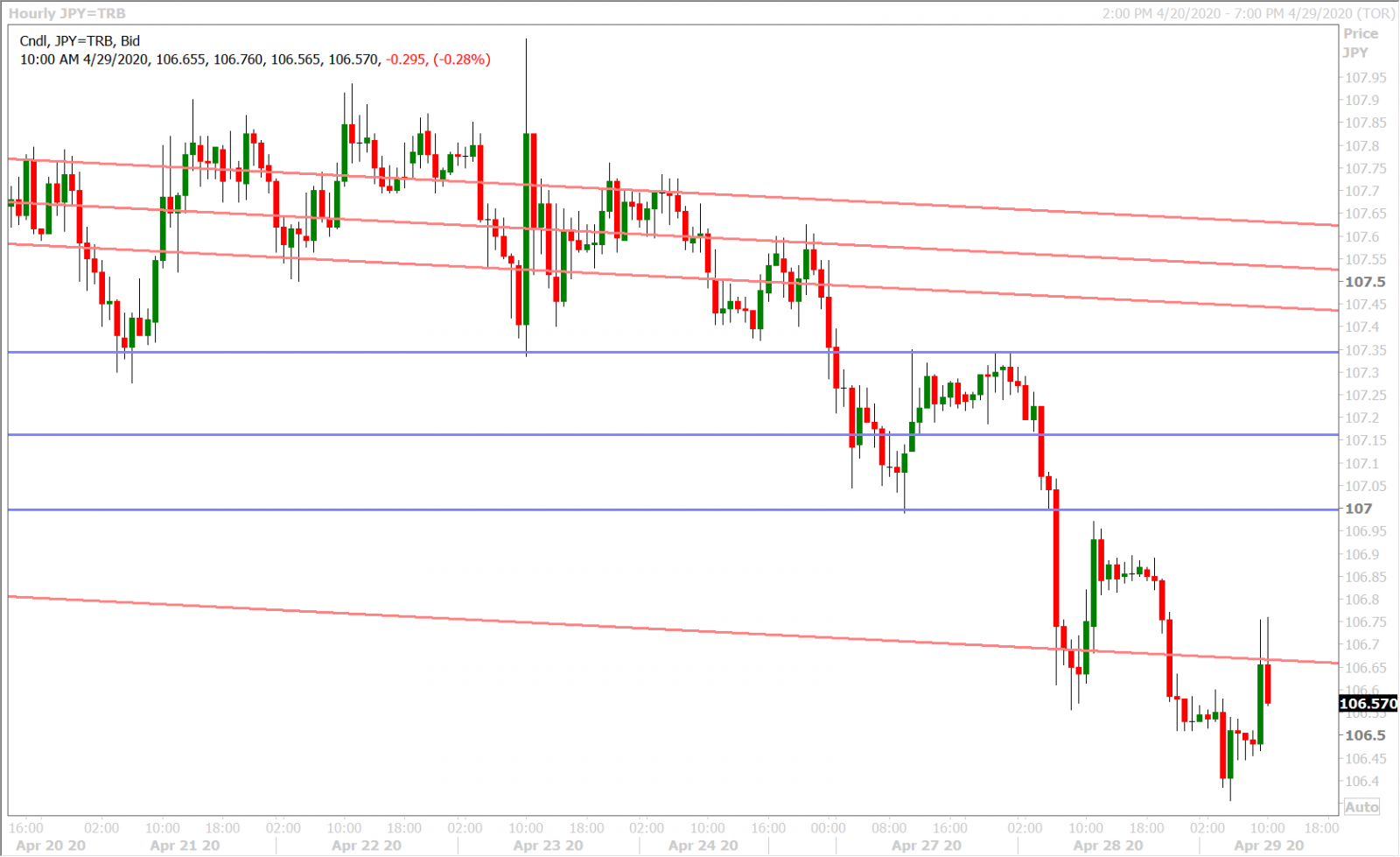

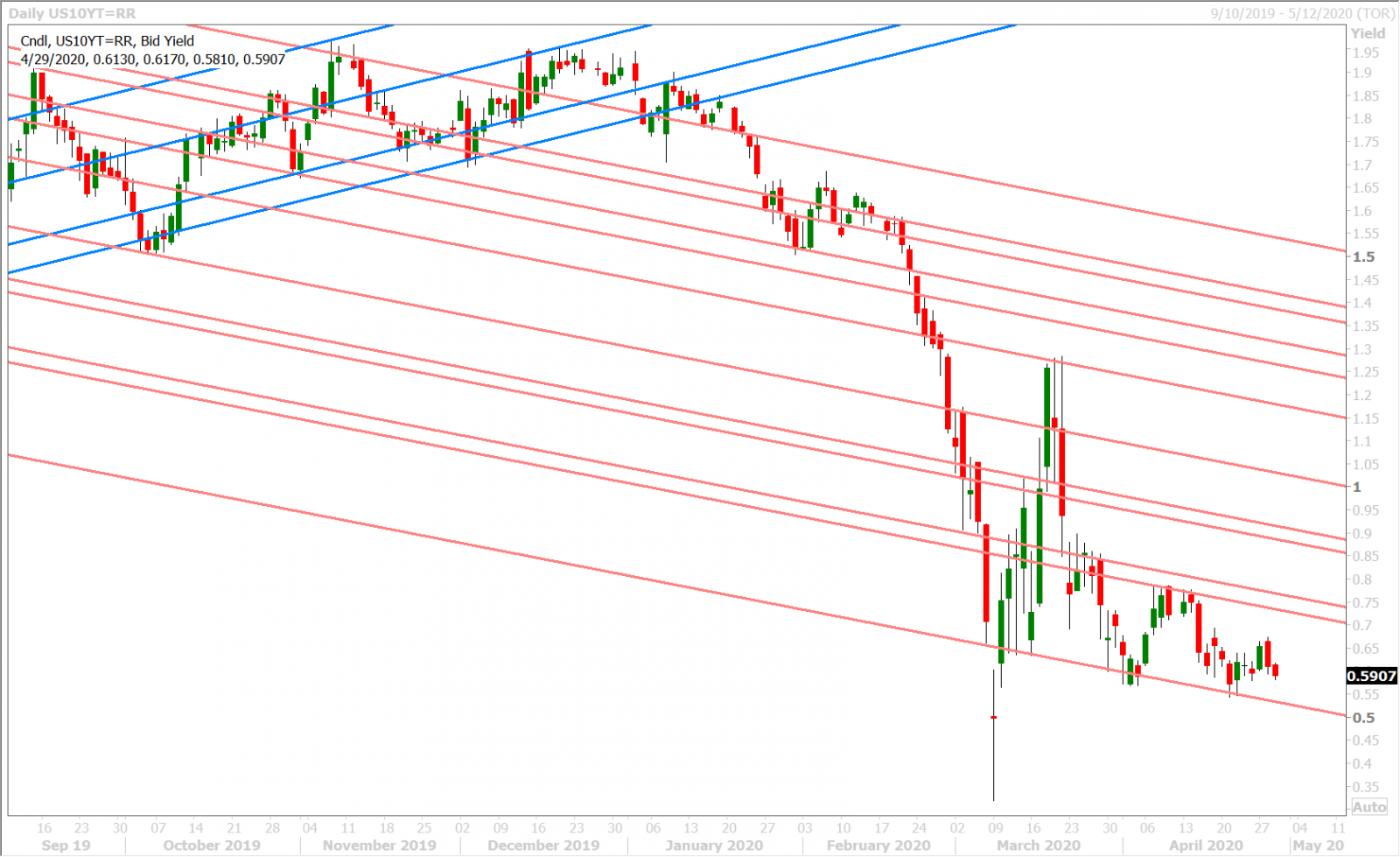

Japanese markets were closed for Showa Day today, the first of four holidays which constitute the Golden Week holiday in Japan every spring. Markets will re-open this Thursday and Friday but will be closed again next Monday through Wednesday for Greenery Day, Children’s Day and Constitution Memorial Day. Local market USDJPY liquidity is rather thin now as a result and we think this is one of the reasons why the market gave up 106.60s support level so easily last night. Yen volatility has increased moderately as well but we’re still not seeing USDJPY option traders rush to protect against the downside.

Dollar/yen seemed to benefit from this morning’s Gilead headlines, which is a slight deviation from its recent inverse correlation to broader risk sentiment. The market is struggling to regain the 106.60s however, which should give the leveraged funds (who remain net short USDJPY) some added comfort. Next up is the Fed, but the mere 53pt premium for the overnight ATM USDJPY straddle suggests that it will be a non-event.

USDJPY DAILY

USDJPY HOURLY

USDJPY 1-MONTH RISK REVERSAL DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com