USD trading mixed amid competing headlines on a holiday Monday

Take control of your international payments with CXI FX Now.

• Low transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- Volumes and volatility subdued as US traders out for Memorial Day. S&P futures +1%.

- UK markets also closed for Spring Bank holiday. GBPUSD pivoting around 1.2190s.

- Weekend features barrage of negative US/China headlines, but risk sentiment holding.

- German IFO beats expectations. Japan lifts 7-week state of emergency. USDCNH steady.

- Recent USDCAD longs & AUDUSD shorts looking a tad vulnerable. Need more negative news.

- Bank of Canada’s Stephen Poloz to deliver lecture at 1:30pmET. Powell speaks on Friday.

ANALYSIS

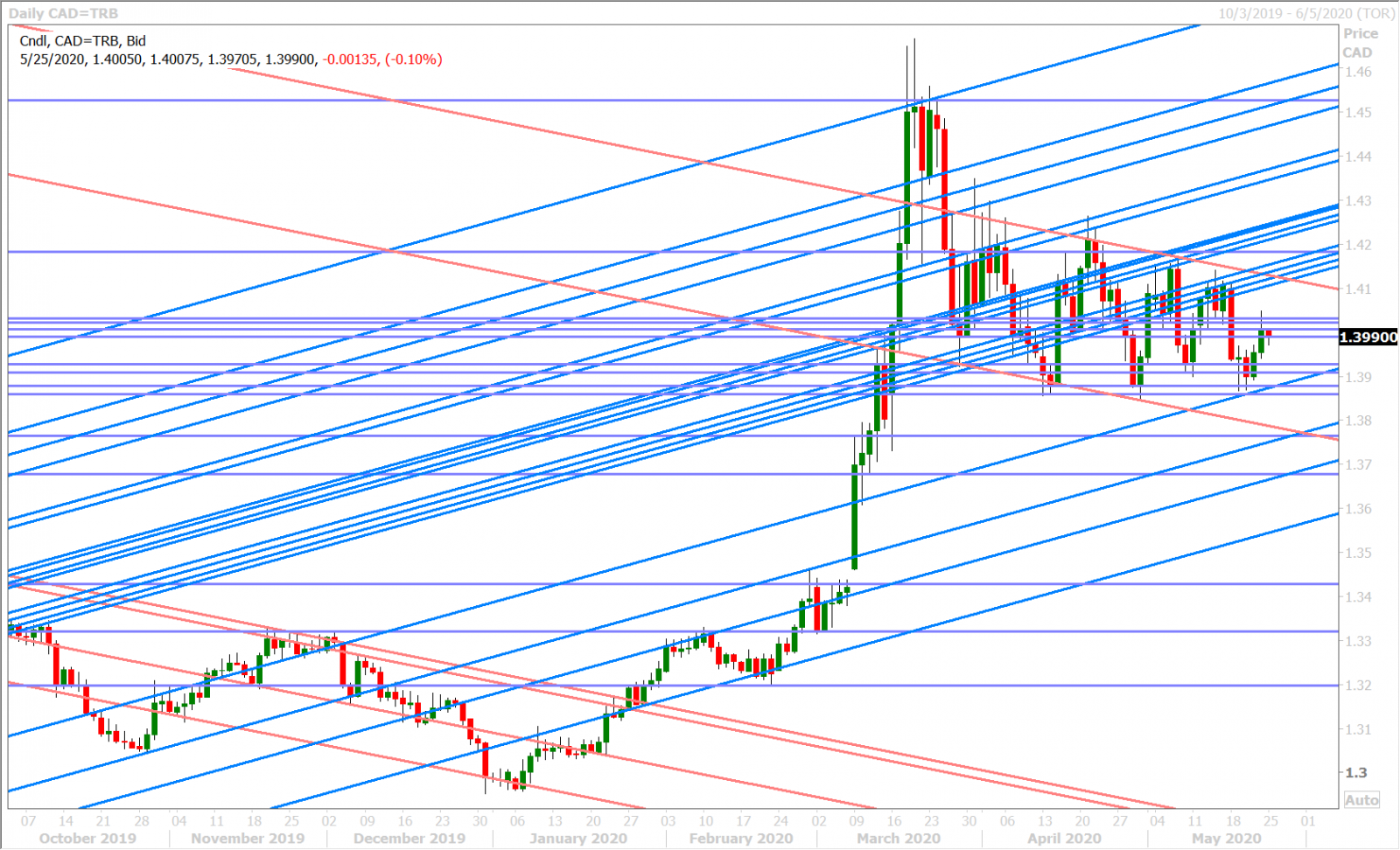

USDCAD

The broader USD is trading with a mixed tone today as escalating US/China tensions compete with news of Japan lifting its state of emergency and Germany reporting a better than expected IFO survey for the month of May. All these headlines had the potential to create volatility to start the week, but traders aren’t really stepping up to the plate in either direction this morning because the US markets are closed for Memorial Day. Dollar/CAD sits just below chart support in the 1.3990s as the S&P futures trade almost 1% higher, with the only scheduled headline risk on tap being Stephen Poloz’s 1:30pmET lecture at the University of Alberta titled “Monetary Policy in Unknowable Times”.

The latest Commitment of Traders Report released by the CFTC last Friday showed the leveraged funds extending their net long USDCAD position to a new 9-week high during the week ending May 19. While this not surprising given escalating US/China anxiety, this is the sort of position accumulation you’d like to see after the market has broken out already, not beforehand. Last week’s now questionable Moderna-led “risk-on” rally did some damage to the USDCAD chart unfortunately, and so we think these new funds longs will need to be fed some more negative US/China news soon to keep them motivated.

On the US/China front, we got news late Friday that the US would add 33 Chinese organizations to an economic blacklist; 24 supporting procurement of items for use by the Chinese military, and 9 for “complicit in human rights violations and abuses committed in China’s campaign of repression, mass arbitrary detention, forced labor and high-technology surveillance against Uighurs”. This caused a predictable reaction from the Global Times saying “China won't back down from the US' quickening technology war mongering against Chinese companies, but will honor the phase one trade deal while developing its own countermeasures. China will not be the first to tear up the phase one trade deal amid renewed tensions, but the US must know that China has ample countermeasures”.

White House national security advisor Robert Obrien then hinted on Sunday that the US could revoke Hong Kong’s special status that allows it to function as an international financial hub, should China move ahead with the proposed new security law. China’s foreign commissioner in Hong Kong then claimed that last year’s protests were “terrorist” in nature.

Finally, WSJ reported that the US administration has discussed conducting its first nuclear test since 1992, following accusations that Russia and China are conducting low-yield nuclear tests, and that such a move “could prove useful from a negotiating standpoint”. China’s foreign ministry then said it was very concerned and urged the US to correct its mistake.

USDCAD DAILY

USDCAD HOURLY

JUlY CRUDE OIL DAILY

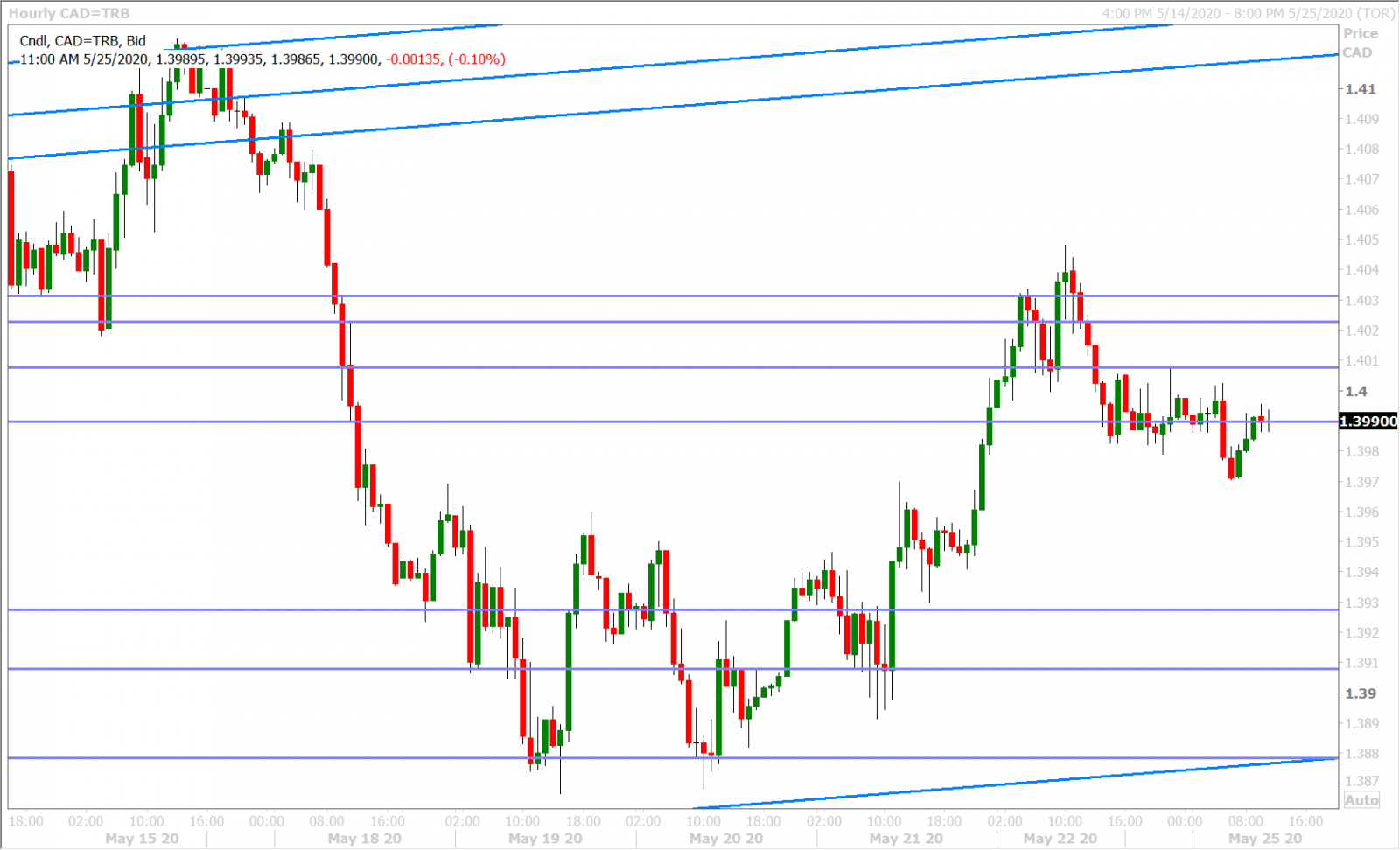

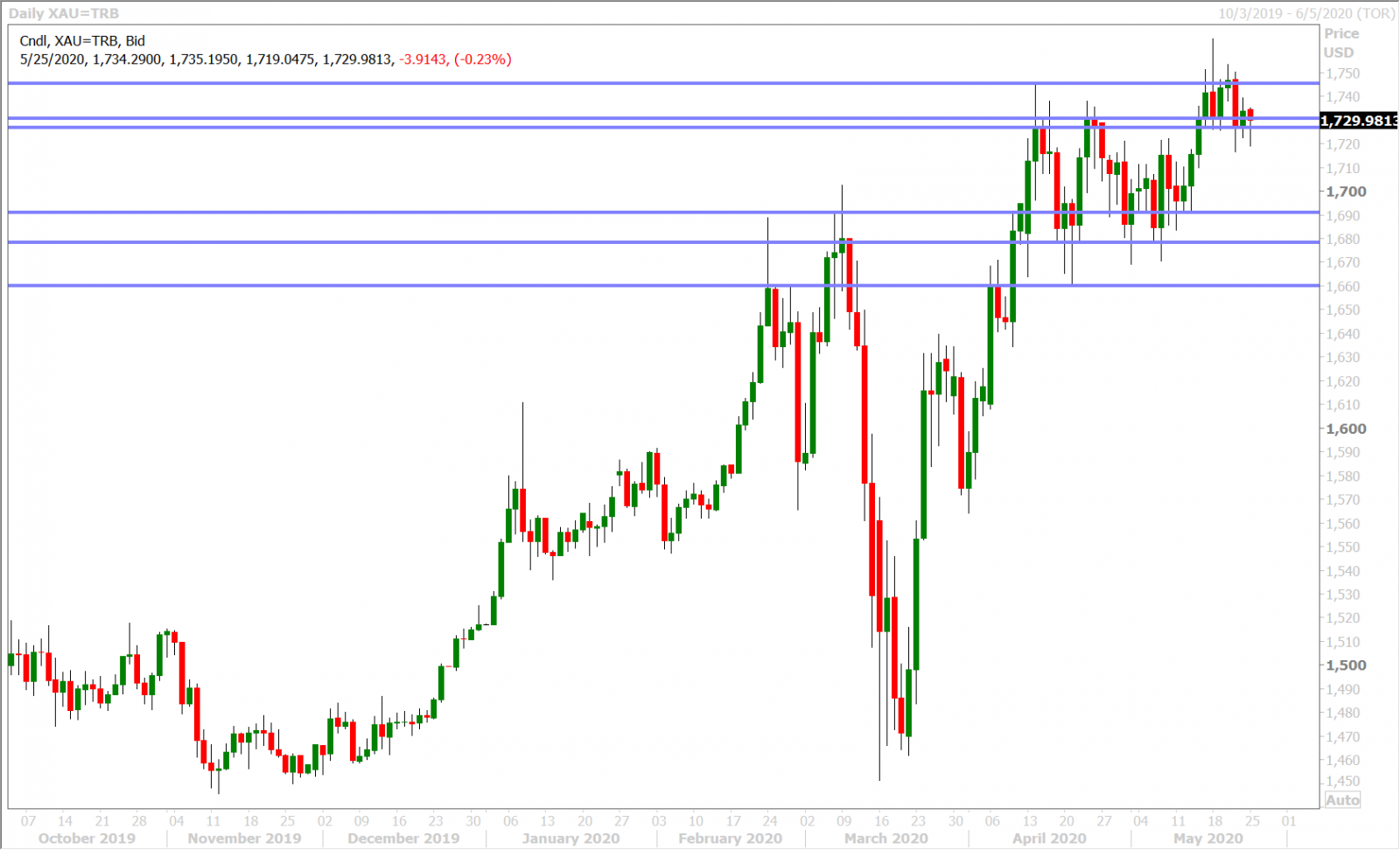

EURUSD

Some better than expected German business sentiment for the month of May is helping euro/dollar bounce this morning, but the absence of traders from London and New York today (liquidity) seems be to hindering the market’s ability to gather upside momentum as it gets back above the 1.0890s. This week’s calendar will be focused on the European Commission, which is expected to release its draft blueprint on the EU’s long-anticipated recovery fund on Wednesday. The leveraged funds trimmed their net long EURUSD position a little bit during the week ending May 19.

German May Ifo Business Climate New, 79.5, 78.3 f'cast, 74.3 prev, 74.2 rvsd

German May Ifo Expectations New, 80.1, 75.0 f'cast, 69.4 prev

German May Ifo Curr Conditions New, 78.9, 80.0 f'cast, 79.5 prev, 79.4

EURUSD DAILY

EURUSD HOURLY

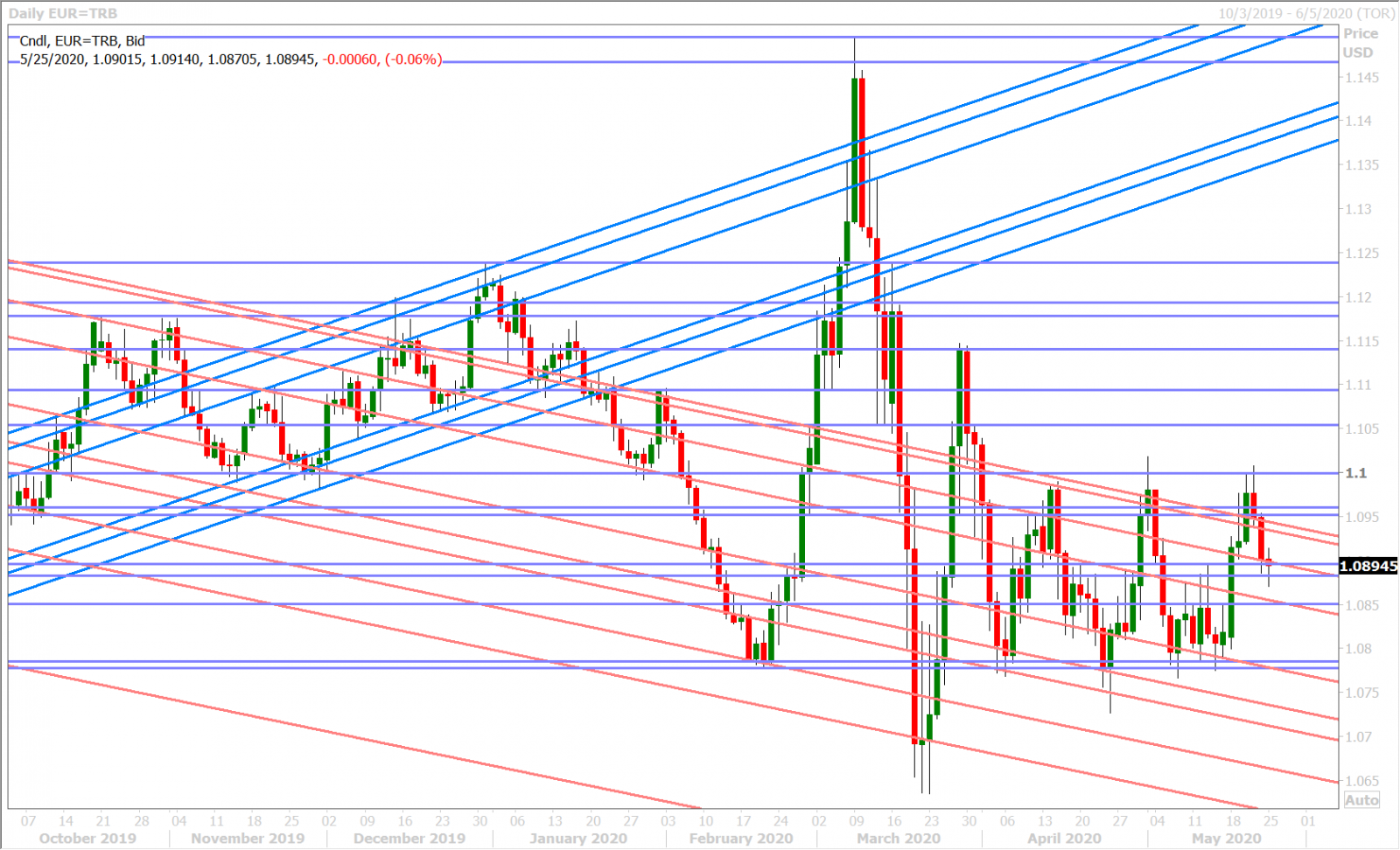

SPOT GOLD DAILY

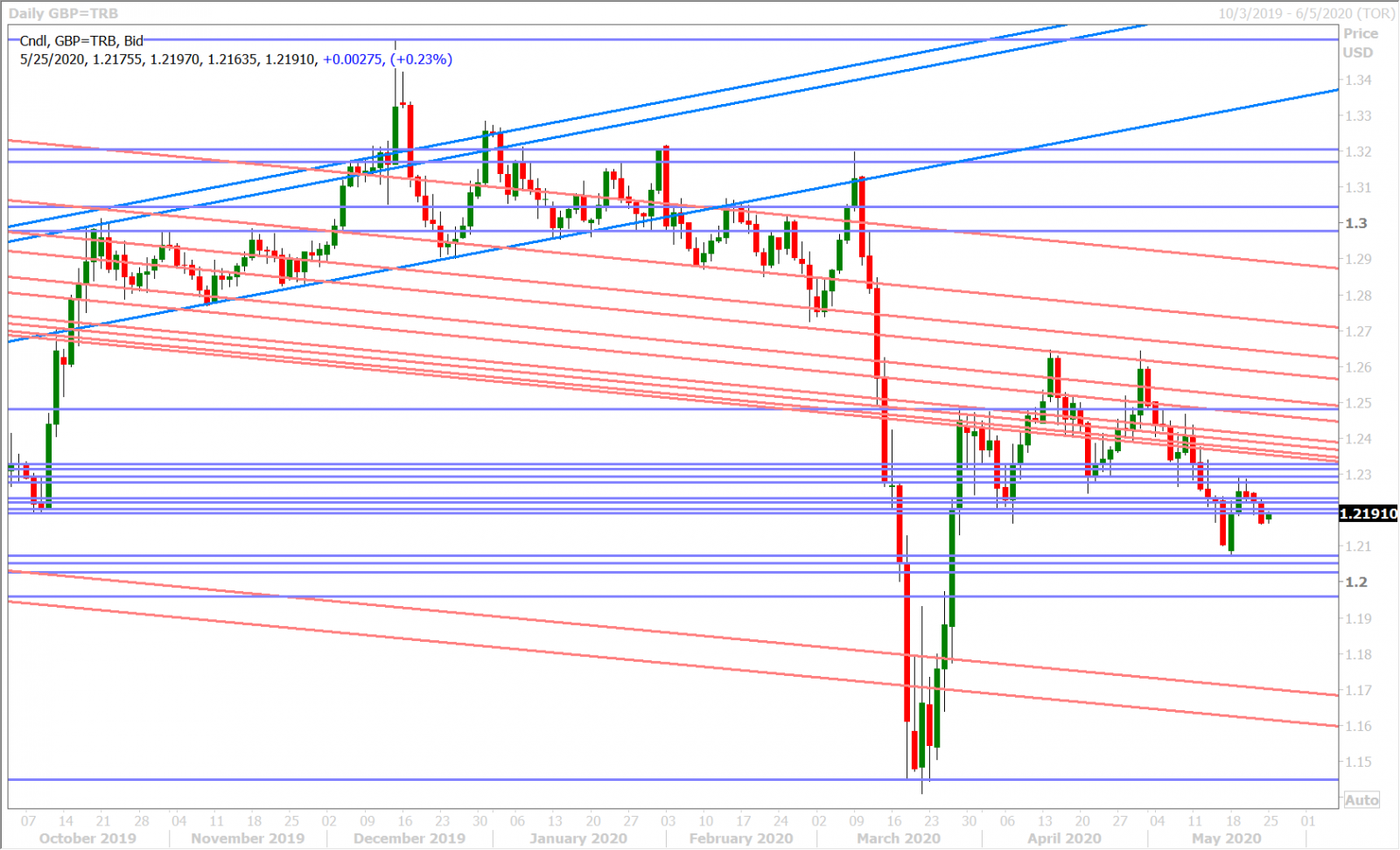

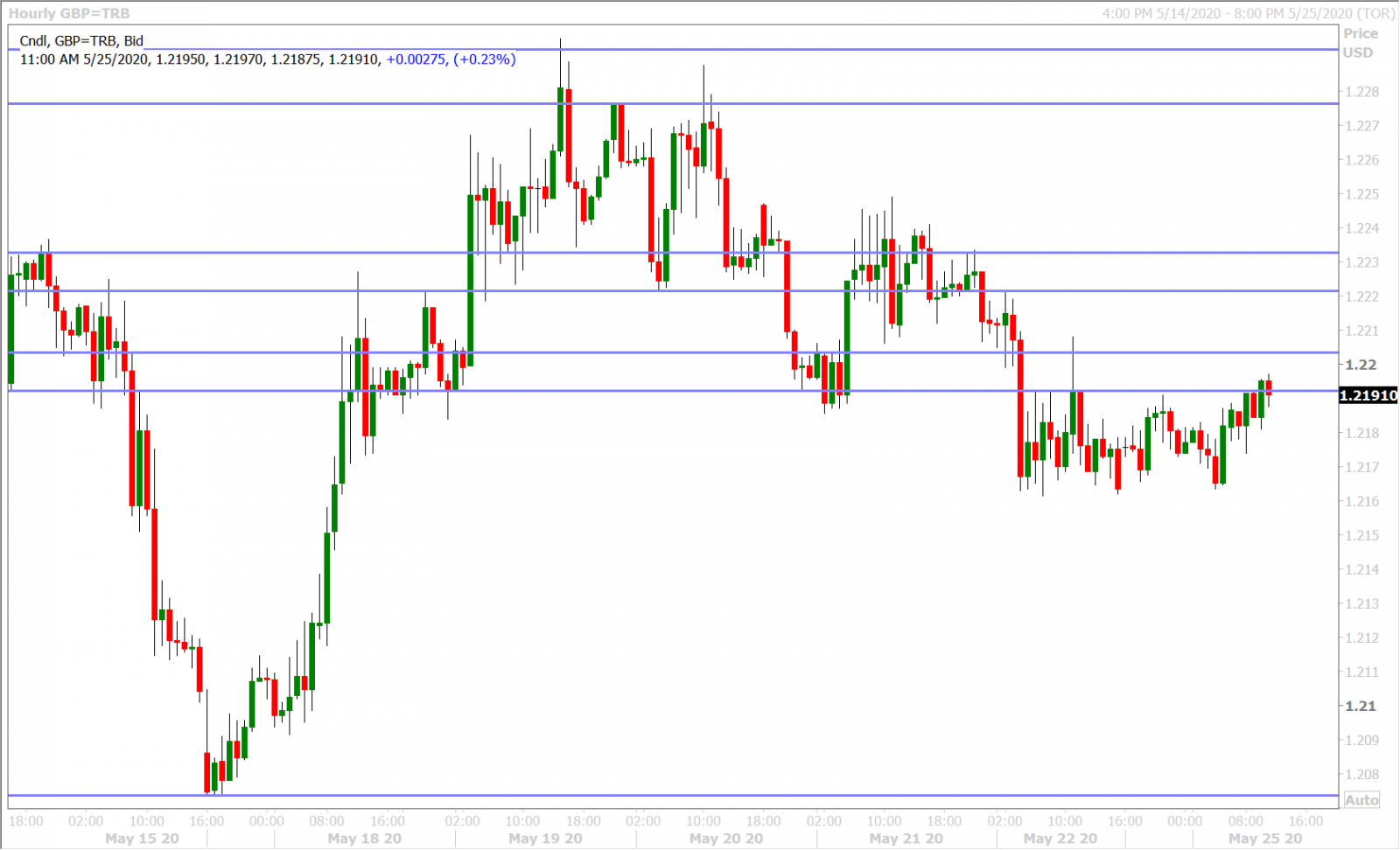

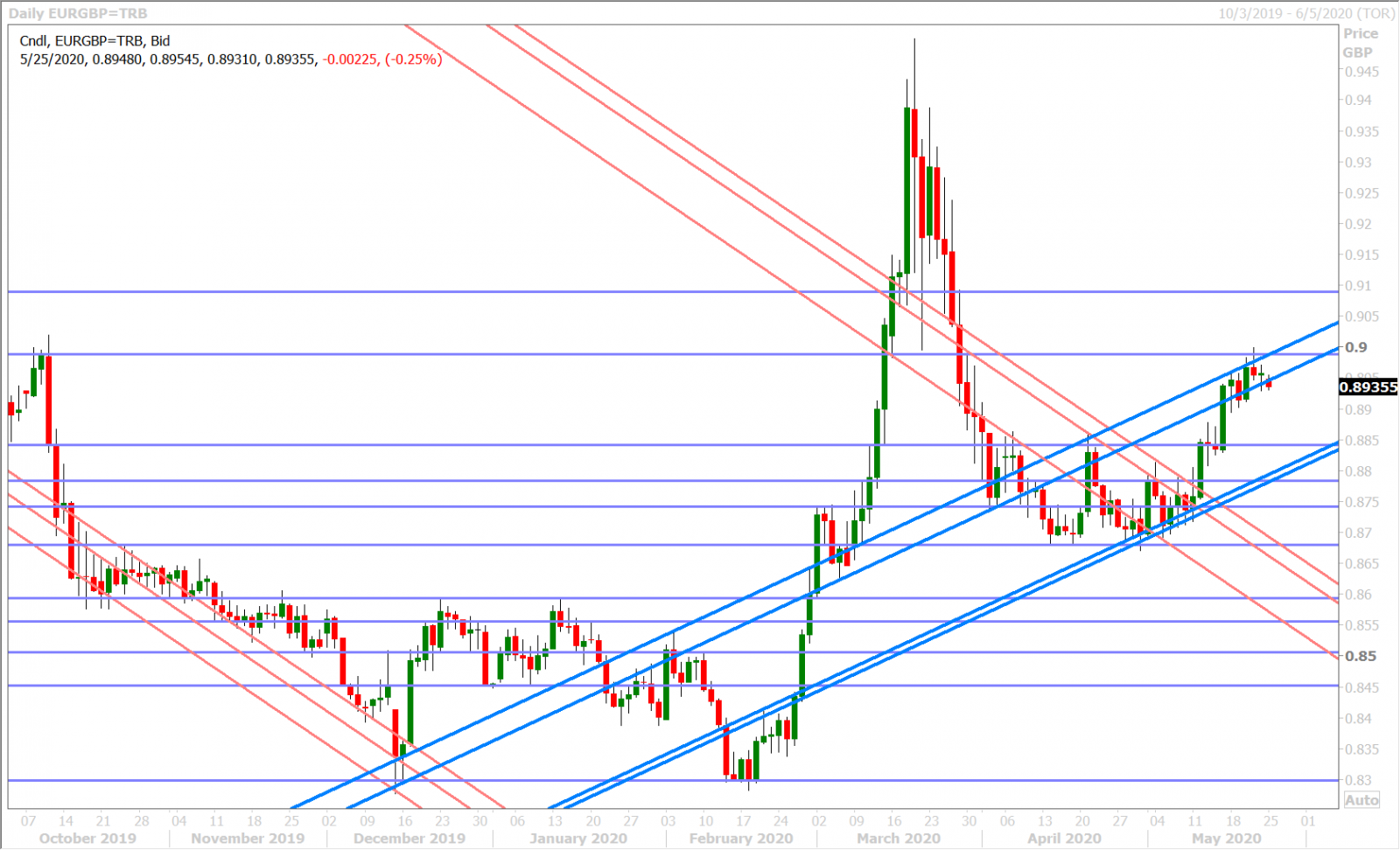

GBPUSD

Sterling is trading very quietly within Friday’s price range this morning as the UK markets are closed for the Spring Bank holiday. The only headlines making the rounds today revolve around UK PM advisor Dominic Cummings; how he reportedly violated coronavirus lockdown restrictions by travelling to see family, and how he’s now being pressured by 18 Tory MPs to resign…but none of this is proving to be market-moving.

The latest Commitment of Traders Report released by the CFTC last Friday showed the leveraged funds extending their new net short GBPUSD position to a 4-week high during the week ending May 19; which is understandable given May 15th’s plunge below the 1.2190s. Last week’s early bout of “risk-on” from Powell and Moderna (however unjustified as it may be), has hurt the market’s downward momentum somewhat, by virtue of taking it back above the 1.2190s on a number of occasions, and so we think the 1.2190-1.2230 corridor will be pivotal for GBPUSD price action this week. Recent shorts will likely feel emboldened the longer we keep trading below it whereas a move back above it (on a closing basis) could squeeze them out of their positions.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

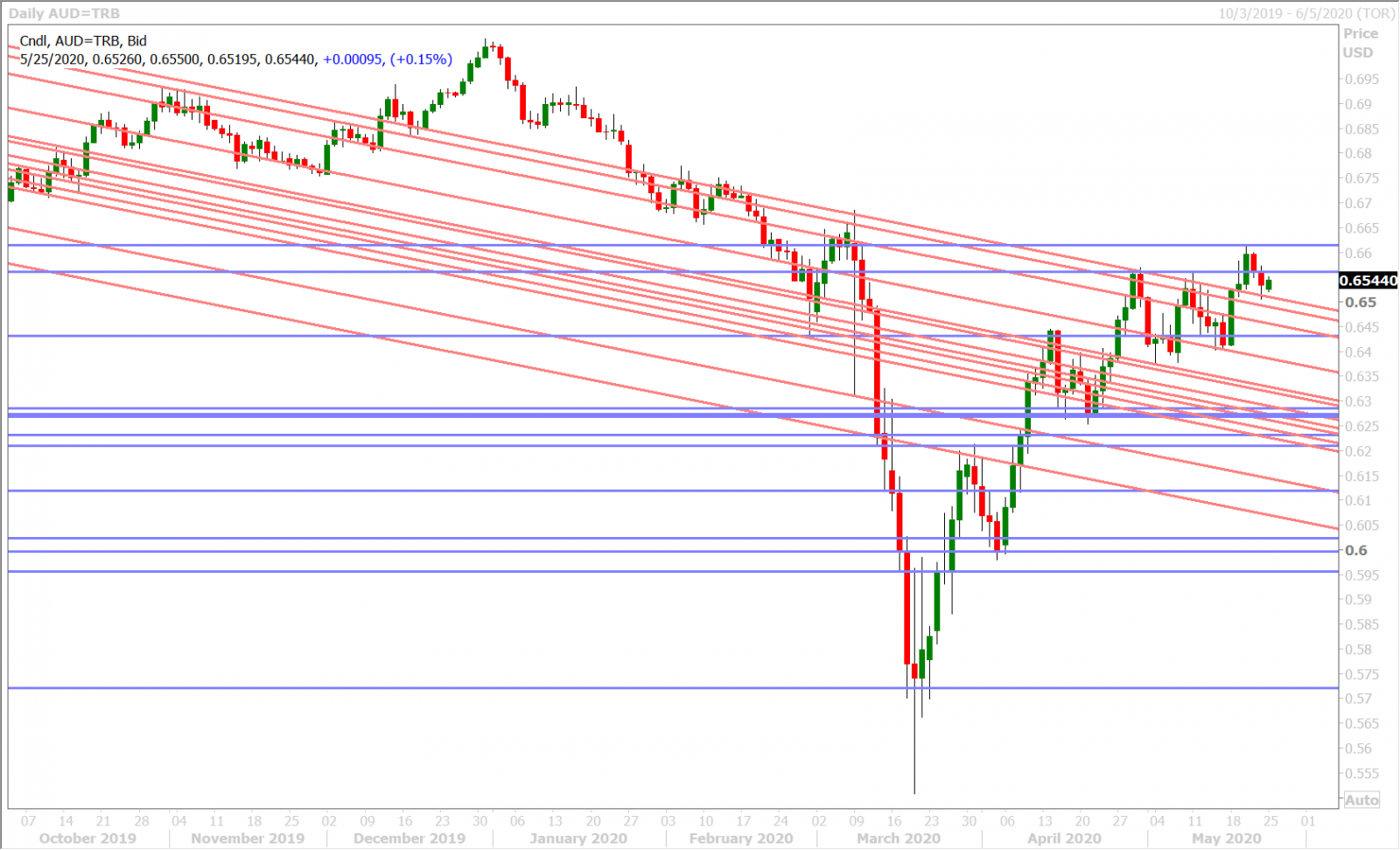

The Australian dollar is trading quietly bid this morning as global markets appear to be giving more credence to positive sounding lockdown-easing headlines vis a vis negative sounding US/China headlines. A good chunk of market participants are also absent today due to the US and UK holidays though, and so we wouldn't put too much stock in any of these price moves for the moment.

The leveraged funds increased their net short AUDUSD position to an 8-week high (40k contracts) during the week ending May 19; which is not a great sign for the Aussie bears as the market has not rewarded these traders whatsoever during this time. However, we think they might be taking some solace now from last week’s failed defense of Wednesday’s upside breakout.

AUDUSD DAILY

AUDUSD HOURLY

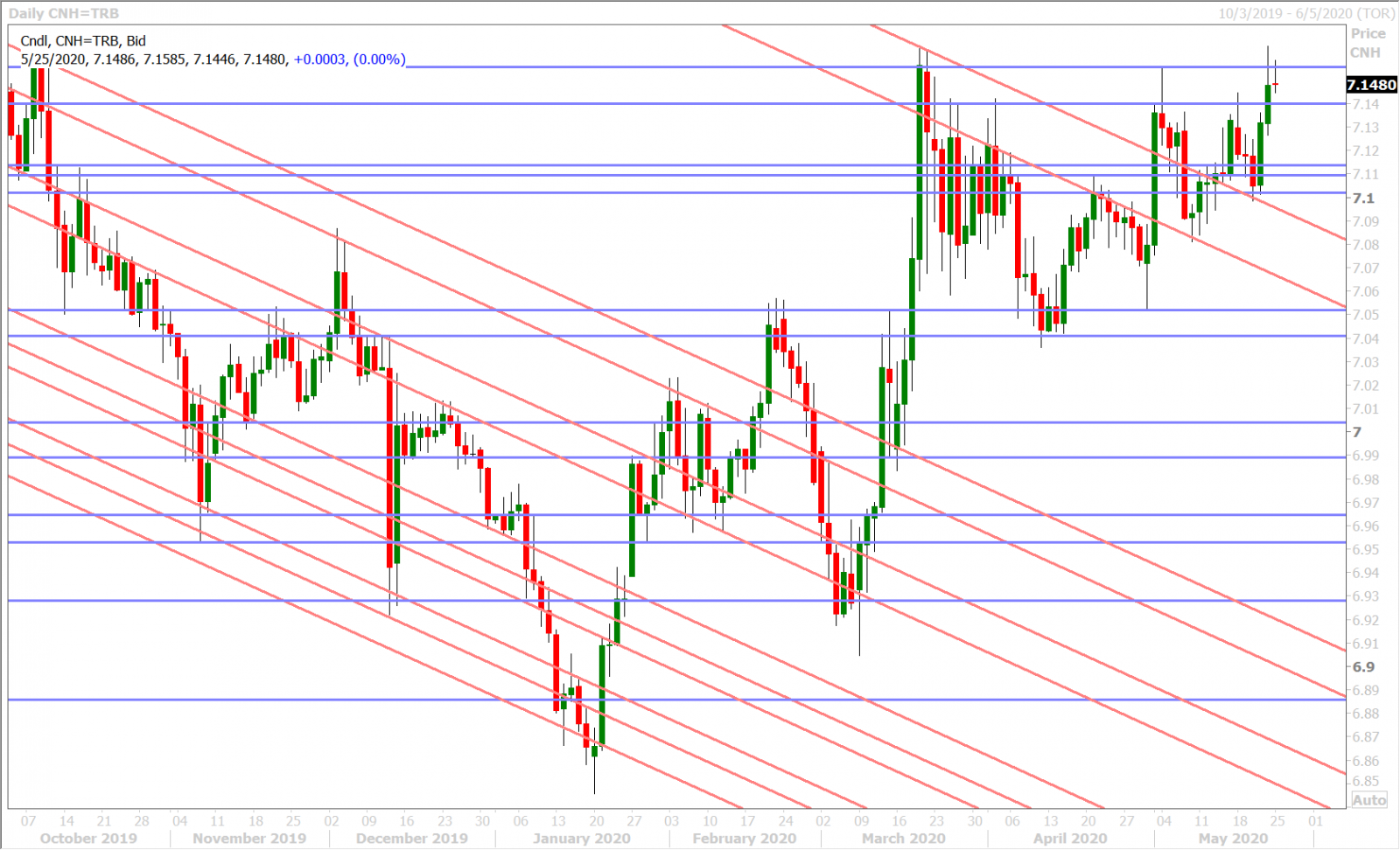

USDCNH DAILY

USDJPY

Dollar/yen saw a brief rise at the Japanese market open last night as the Nikkei traded higher, but it’s been languishing ever since for direction. Expect a whole lot of nothing today as the US celebrates Memorial Day. This week’s US economic calendar is on the lighter/less important side (see below), although we’ll be hearing from Fed chairman Powell at Princeton on Friday. The leveraged funds very much kept their net short USDJPY position at the same level for the third week in a row during the week ending May 19.

Tuesday: US Consumer Confidence (May), Fed’s Kashkari speaks

Wednesday: Fed’s Beige Book + speeches from the Fed’s Bullard and Bostic

Thursday: US Durable Goods (Apr), Jobless Claims (w/e May 23), Q1 GDP (2nd estimate) + speeches from the Fed’s Williams and Harker;

Friday: “A Talk with Jerome Powell” at the Griswold Center for Economic Policy Studies at Princeton

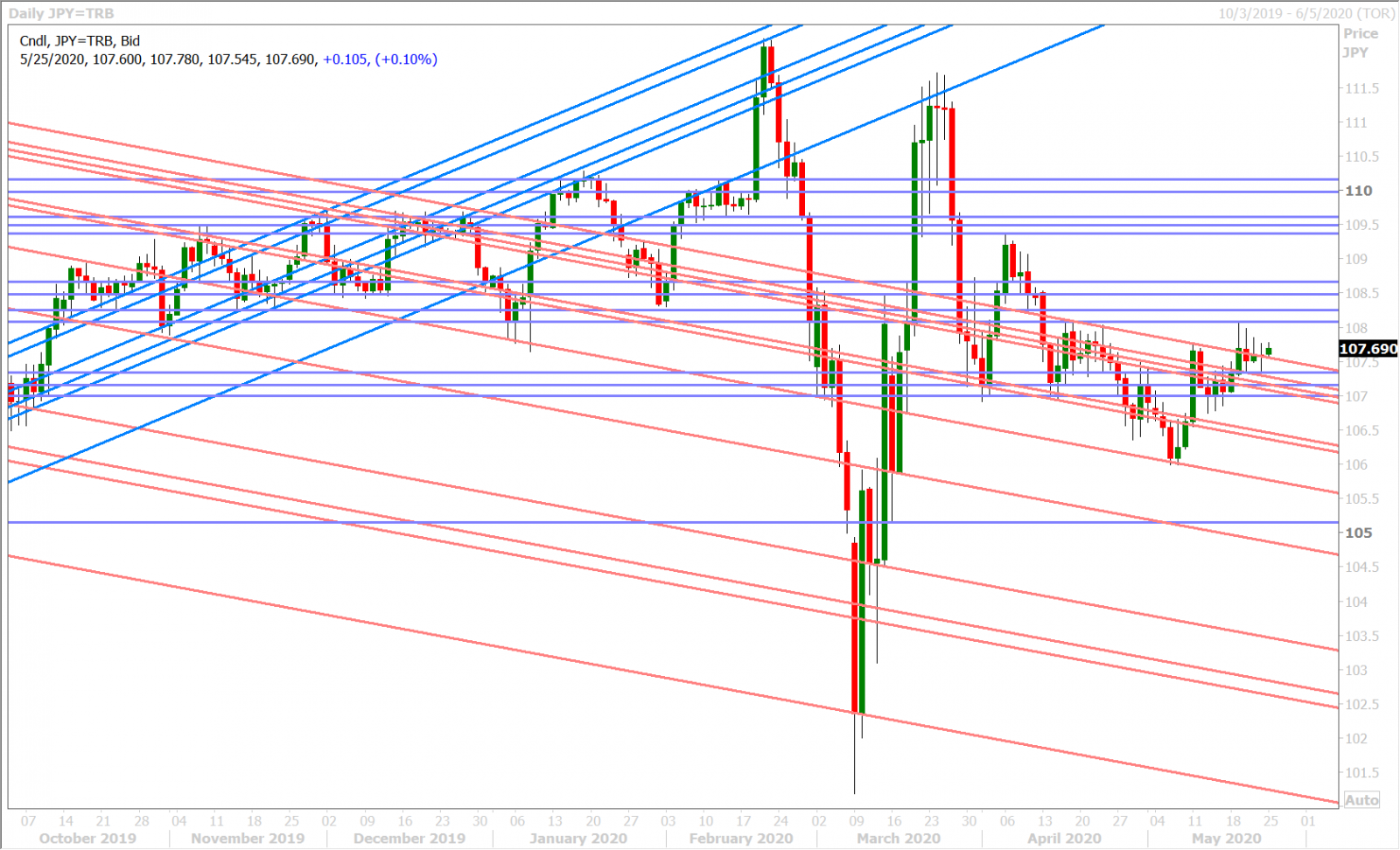

USDJPY DAILY

USDJPY HOURLY

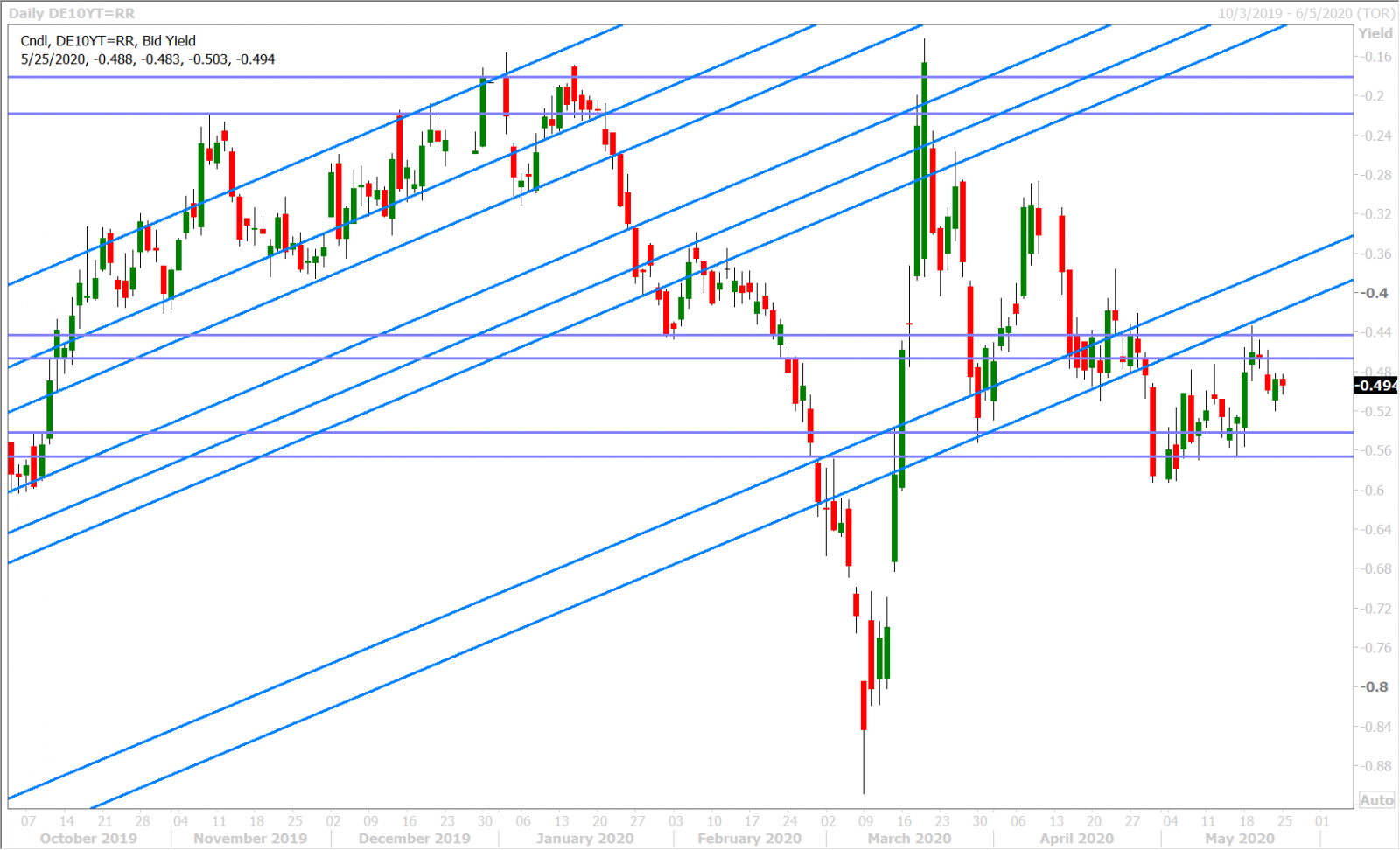

GERMAN 10-YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Erik Bregar - Director, Head of FX Strategy

Erik works with corporations and institutions to help them better navigate the currency markets. His desk provides fast, transparent, and low cost trade execution; up to the minute fundamental and technical market analysis; custom strategy development; and post-trade services -- all in an effort to add value to your firm’s bottom line. Erik has been trading currencies professionally and independently for more than 12 years. Prior to leading the trading desk at EBC, Erik was in charge of managing the foreign exchange risk for one of Canada’s largest independent broker-dealers.

Interested in creating a custom foreign exchange trading plan? Contact us or call CXI's trading desk directly at 1-833-572-8933.

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com