Bank of Canada keeps rates on hold, but signals nothing with regard to rate cuts

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

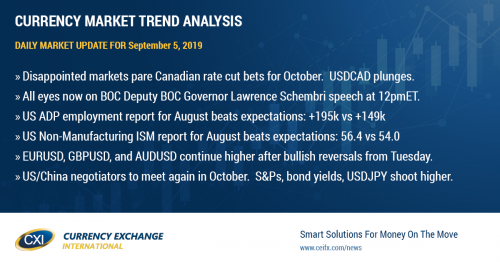

The Bank of Canada killed rate cut speculation yesterday, and it did so by largely saying nothing with regard to forward guidance in the press release following its expected hold to interest rates. After six weeks of not hearing anything from the Canadian central bank (six weeks that had everything from escalating US/China trade tensions to increased global growth fears manifesting itself in global bond markets), traders were expected them to sound more concerned about these global developments, especially considering this has all led to the Canadian yield curve inverting by 20bp since July (which signals recession). Instead, all we got was “the current degree of monetary policy stimulus remains appropriate” and the “Governing Council will pay particular attention to global developments and their impact on the outlook for Canadian growth and inflation. This was a shocking, head-in-the-sand type, press release for the markets in our opinion, and largely explains the violent reaction we saw in the OIS and USDCAD markets afterwards. October rate cuts odds collapsed from 70+% pre-meeting and now stand at just 44% while USDCAD plunged all the way down to the 1.3200 figure. All eyes will now be on Deputy BOC Governor Lawrence Schembri, who will be giving a speech titled “Economic Progress Report” at the Canadian Museum of Immigration at 12pmET. We think the market’s recent uptrend (which really found it legs after the less dovish than expected Fed rate cut at the end of July) is now completely shot. Odds are we see a new trading range develop between 1.31 and 1.33, but it’s still a bit early to tell. Near term, we think traders will be focused on whether or not the market can climb back above the 1.3215-25 level. The US just reported its ADP employment report for the month of August and the numbers beat expectations (+195k vs +149k). The US Non-Manufacturing ISM report for August also just came out above consensus (56.4 vs 54.0). The EIA will report its weekly oil inventory report at 11amET, with traders expecting a 1-2mln barrel build after last night’s surprise build from the weekly API report. October crude oil prices are on the verge of a technical breakout to the upside, should traders rally the market above the 56.60s.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

EURUSD

Yesterday’s barrage of Fedspeak and the Fed’s Beige Book report turned out to be non-events for the markets, with EURUSD traders seeming more content to ride the wave higher in GBPUSD. This pattern largely continues today, with buyers evident on the dip to 1.1010s chart support in the European AM. There’s also an air of “risk-on” to markets this morning following news last night that the US and China will hold another round of talks in October, and this is lifting global bond yields broadly. The German bund yield has rallied back up to the -0.61% level this morning and we’d argue this is supportive for EURUSD right now as well. We got more bad economic news out of Germany today (Factory Orders -2.7% MoM in July vs -1.5% expected) but traders seem to be shrugging this off for now. We think EURUSD simmers down a bit here after the beat on the US Non-Manufacturing ISM.

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling continues to rock it this morning as traders continue to price out “no-deal” Brexit risks. Lawmakers in the UK House of Commons voted late yesterday to outlaw a “no-deal” Brexit (the same thing they did to Theresa May back in March) and to, make matters worse for Boris Johnson, they voted down his motion for a snap election on Oct 15. So what does Boris Johnson do now? He’s either going to leave the prospect of asking the EU for another Brexit extension to last minute and see if Brussels flinches in our opinion, or he’s going to try to find some other way to call for new elections (so his rivals can do it). A truly horrible position to be in. GBPUSD now trades solidly above chart resistance in the 1.2290s and it continues to find buyers at 1.2320 (the next resistance level that was surpassed overnight and now becomes support). One could argue nothing has changed over the last few days seeing as the EU has still not expressed any willingness to renegotiate, therefore the default legal result would still be “no-deal” on Oct 31, no matter how much senseless “it can’t happen” formality UK lawmakers try to create around the issue, but it’s hard to argue with the market’s desire to take some negative chips off the table here. Tuesday’s bullish hammer reversal pattern and a crowded fund short position just added fuel to fire in our opinion. We think GBPUSD could extend all the way back to the 1.2400 if NY trade holds prices above the 1.2320s.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie continues its rip roaring rally, with today’s burst of buying coming from last night’s positive US/China trade headlines. We think the funds, who continued to be positioned net short AUDUSD, might start to freak out should the market close NY trade above the 0.6820s. My oh my what a difference Tuesday’s bullish outside reversal has made for AUDUSD.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen is breaking higher this morning and today’s “risk-on” mood to global markets is providing the catalysts. Everything is moving higher (stocks, bond yields, US 10s2s yield curve now firmly back above zero) and while you could argue last night’s headlines, about US and China trade negotiators meeting again in October, could be another false positive for markets that have been through this trade war song and dance before, the trading algorithms are being and it’s a tough wave to fight at this hour. We think the 107.00 level will now be pivotal for USDJPY heading into the US jobs report tomorrow. This morning's strong Non-Manufacturing ISM figures have seen the market shoot past this level and we think a NY close above here could open up the door for some panic buying from the funds (who remain net short USDJPY) should tomorrow's numbers surprise to the upside.

USDJPY DAILY

USDJPY HOURLY

US 10YR YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com