Bank of England's Tenreyro going dovish too. US & Canadian employment reports up next.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- BOE’s Tenreyro “edging towards a cut in rates if downside risks emerge”. GBPUSD still below 1.3080s.

- Traders expecting +164k jobs created in the US in December, +25k for Canada.

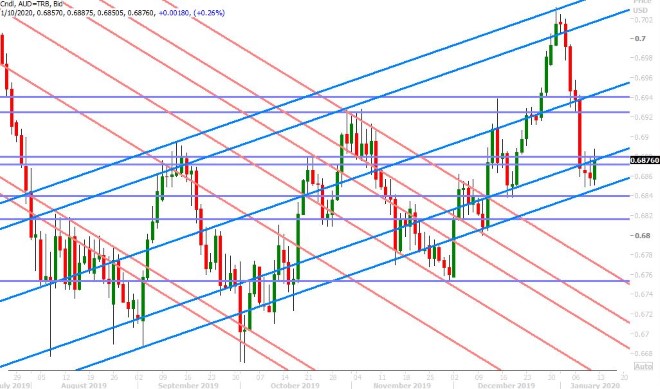

- AUDUSD bounces off better than expected Australian Retail Sales number, but still cannot clear 0.6870s.

- EURUSD holding yesterday’s chart support in the 1.1090s. Large option expiry at 1.1140-50 today.

- USDCAD momentum neutral after oil bounce/Poloz comments pull market off 1.3090s resistance.

- USDJPY threatening upside breakout above weekly resistance in 109.60s, but US 10yr yields not confirming yet.

ANALYSIS

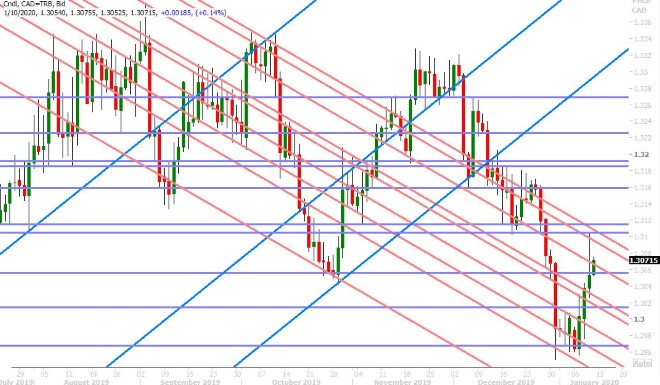

USDCAD

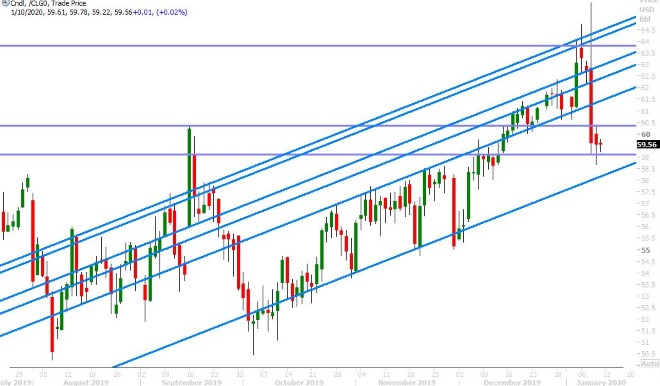

It’s been a relatively quiet overnight session today as traders await the December employment reports out of the US and Canada at 8:30amET. Dollar/CAD pulled back off chart resistance in the 1.3090s when February crude oil prices bounced back above 59.20 yesterday, and some rather upbeat comments from Stephen Poloz helped extend the decline into the NY close. Chart support in the 1.3050s kept prices from falling much further though as the Asian session got started and the market hasn’t done much of anything since then. Traders are expecting +164k jobs created, +0.3% MoM and +3.1% YoY on wage growth, and 3.5% on the unemployment rate for the US Non-Farm Payrolls report. For Canada, they’re expecting +25k jobs created (after the awful -71.2k print for November) and 5.8% on the unemployment rate. Canadian wage growth was +4.36% MoM for November.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar is displaying much the same holding pattern so far today as traders await the US NFP numbers. Yesterday’s chart support level in the 1.1090s has been tested once again and is holding for now. Over 1blnEUR in options expire at the 1.1140-50 strikes this morning at 10amET, which could act as a magnet for spot EURUSD prices should the numbers disappoint.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

The Bank of England’s Tenreyro has been on the wires this morning saying that more stimulus may be needed if growth does not recover. This comes after Governor Mark Carney’s dovish comments from yesterday and makes us wonder now if UK monetary policy is truly starting to shift to a more accommodative stance. We already know that two MPC members (Saunders & Haskel) wanted to cut interest rates at the last BOE meeting. Now it appears we have a third member, in Silvana Tenreyro. More here from Bloomberg.

The OIS market is now pricing in 23% chance that the Bank of England cuts rates on Jan 30th and an over 50% chance they cut by the May 7th meeting. Sterling appears to be taking today’s BOE dovishness in stride, but we think the lack of follow-through selling has more to do with traders not wanting to put on new short positions ahead of the US NFP report out any minute now. Yesterday’s NY close below the 1.3080s wasn’t a positive technical development for the market, but we think GBPUSD could erase this pattern rather easily with a weak US employment number.

GBPUSD DAILY

GBPUSD 30-MINUTE

EURGBP DAILY

AUDUSD

The Australian dollar finally caught a bit of a break last night when the Australian Retail Sales report for November was reported at +0.9% MoM vs expectations of +0.4%. This better than expected economic number appeared to trigger some short covering which inspired a “buy the dip” mentality in European trade today, but we’re noticing here that the market is once again struggling to clear chart resistance in the 0.6870s. We’d argue that the lull in market activity, that we normally see pre-NFPs, is not helping. We think a weaker than expected US employment report will help AUDUSD recover here somewhat, whereas a better than expected report will encourage the recent downtrend to continue to the mid to lower 68 handle.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

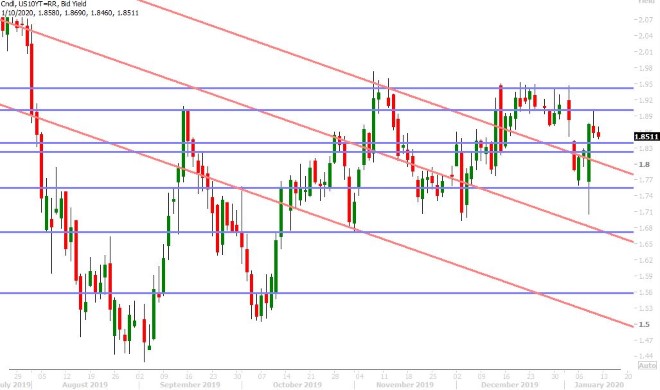

What a week it’s been for USDJPY! As one of the most popular currency pairs through which traders express broad “risk-on, risk-off” sentiment, it has bourn the brunt of the US/Iran tension from earlier this week, and it has reaped the most reward from the de-escalation we’ve witnessed over the last 48hs. With the market now teasing a break above weekly chart resistance in the 109.60s, some are speculating that a strong NFP number today could see USDJPY surge higher into the 110s. The only thing that concerns us about this USDJPY excitement this morning is the US 10yr yield’s inability to close NY trade above 1.90% yesterday. Perhaps this due to yesterday’s solid US 30yr bond auction, which saw 16blnUSD of new government paper get bought up by the marketplace. Given the tight correlation between US yields and USDJPY, we’d like to see US 10s clear 1.90% to the upside before getting more confident about a new upside breakout in dollar/yen.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com