Trump de-escalates. Carney goes dovish. Australia calls for more evacuations.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

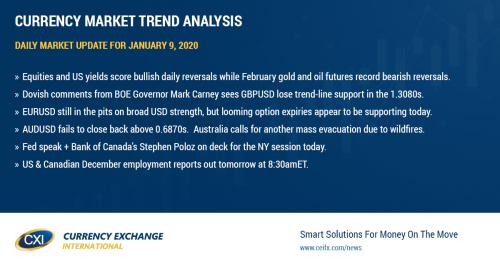

- Equities and US yields score bullish daily reversals while February gold and oil futures record bearish reversals.

- Dovish comments from BOE Governor Mark Carney sees GBPUSD lose trend-line support in the 1.3080s.

- EURUSD still in the pits on broad USD strength, but looming option expiries appear to be supporting today.

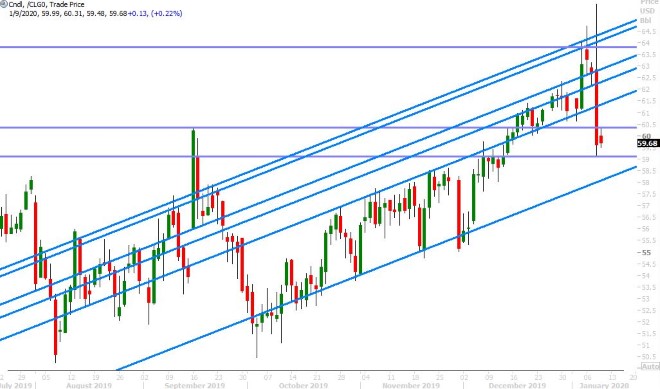

- AUDUSD fails to close back above 0.6870s. Australia calls for another mass evacuation due to wildfires.

- Fed speak + Bank of Canada’s Stephen Poloz on deck for the NY session today.

- US & Canadian December employment reports out tomorrow at 8:30amET.

ANALYSIS

USDCAD

Dollar/CAD is seeing some follow-through technical buying this morning after the market closed NY trade yesterday above 1.3020-30. We characterized yesterday’s price action (post-Trump) as a tug of war but the bulls ultimately won out in the end with a NY close that has now halted the market’s downward momentum since early December. There’s been a slight paring back of yesterday’s massive US/Iran de-escalation moves across global markets on the back of a revolutionary guard comment saying Iran would take “harsher revenge” soon, but traders seem to be taking this headline in stride. Both equities and US 10yr yields scored bullish reversals on their daily charts yesterday, while February gold and oil futures recorded bearish reversals.

The broader USD continues to trade higher amidst all this US/Iran driven volatility, but we’d argue other factors are contributing to its strength this week, ie. sudden re-pricing for an RBA rate cut, good US data (ISM services and ADP jobs), angst around 2020 Brexit transition talks + a now more dovish BOE governor (see GBPUSD below). If we combine this with deteriorating chart technicals for all the major currencies against the USD, we think traders need to start thinking about what narratives could propel the broader USD higher into next week. Perhaps a better than expected US Non-Farm payroll report tomorrow? Perhaps US/China sentiment sours in and around the phase one deal signing? Perhaps even higher US 10yr yields because this week’s start of a new downtrend below 1.80% was swiftly reversed yesterday?

We think the USDCAD fund shorts need to be on guard here. The trend has been their friend for over a month now, but we can see how the broader USD wants to turn higher now. Canada just reported weaker than expected Building Permit data for the month of November (-2.4% vs +1.0%), which is now causing the market to hit new session highs above the 1.3050s. The rest of today’s calendar features central bank speak for the most part (Fed’s Williams at 11:30amET, Evans at 1:20pmET and Bullard at 2pmET). We’ll also be hearing from Bank of Canada governor Stephen Poloz in a “fireside chat” at the Vancouver Board of Trade at 2pmET.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

Euro/dollar recorded a miserable NY close yesterday below the 1.1110s yesterday, and we think the continuation of the US yield rally post-Trump contributed to that, but it seems today’s looming option expiries between 1.1090 and 1.1125 are providing some support. The overnight selling stopped at the 1.1090s and the market now looks like it wants to get back above the 1.1110s and target 1.1125 before the 10amET NY cut. We wouldn’t be surprised to see EURUSD crawl higher today and consolidate, ahead of tomorrow’s US Non-Farm Payrolls report for December.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Who decided today was the day to unleash a downbeat Mark Carney, and why? The Bank of England governor has been all over the wires this morning with rather dovish comments about UK monetary policy, and the pound doesn’t like it one bit. Speaking at a conference, Mark Carney said: “This rebound is not, of course, assured. The economy has been sluggish, slack has been growing, and inflation is below target. Much hinges on the speed with which domestic confidence returns. As is entirely appropriate, there is a debate at the MPC over the relative merits of near term stimulus to reinforce the expected recovery in UK growth and inflation”. Did he just say near-term stimulus?

What is more, the BOE governor said there could be a “relatively prompt response” from the bank “if evidence builds that the weakness is activity could persist”. He even bragged about all the firepower that the BOE could still use: “There is sufficient headroom to at least double the August 2016 package of 60 billion pounds of asset purchases, a number that will increase with further Gilt issuance”. “BOE has equivalent of 250 basis points of policy space - QE, forward guidance, rate cuts all parts of tools.”

Our view is…why now? What does he know? Why is Mark Carney saying all this when he’s literally on his way out the door in March? Should we even be listening? Interest rate traders are paying attention for the time being though as they push Jan 30th rate cut odds up to 15%, according to the OIS market. GBPUSD has now broken down below trend-line chart support in the 1.3080s, which will be a significant negative development for the market’s technical structure should it close NY trade below it.

GBPUSD DAILY

GBPUSD 30-MINUTE

EURGBP DAILY

AUDUSD

The Australian dollar can’t catch a break. We didn’t get a bounce in EURUSD yesterday and so AUDUSD couldn’t close NY trade above the 0.6870s. We continue to see the USD trade broadly higher on the back of even stronger US yields post Trump. What is more, there are calls for even more mass evacuations in Australia due to the worsening wildfire situation. The OIS (overnight interest rate swap) market has is now pretty much assured (97%) that the Reserve Bank of Australia will cut rates 25bp when it meets next month on February 4th. Australia will report its November Retail Sales report at 7:30pmET tonight, with +0.4% MoM expected. We think a weaker than expected report will keep AUDUSD under pressure here.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

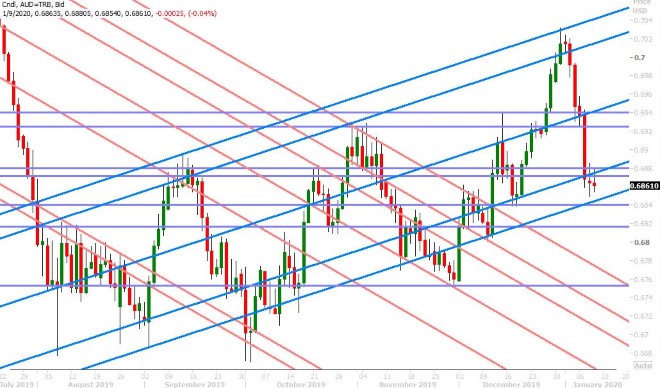

USDJPY

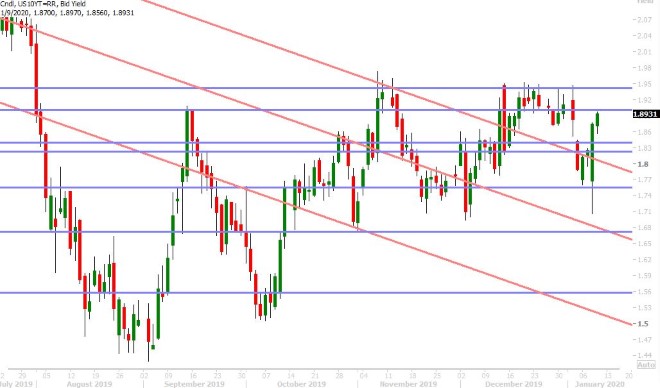

President Trump indeed de-escalated tensions with Iran during his speech yesterday morning. He said “Iran appears to be standing down”. He said “America’s economic strength is the best deterrent and that he doesn’t want to use military might”. What is more, Trump said he is “ready to embrace peace with all who seek peace”. This was enough for US 10yr yields and USDJPY to resume their massive recovery from their Tuesday night lows, and we ending up closing NY trade with very bullish outside day patterns for both markets. This positive momentum has now carried over into today’s trade; so much so that we see US 10s threatening 1.90% and USDJPY back near its December highs.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com