Iran attacks US airbases in Iraq, but no US casualties reported

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

It’s been an eventful overnight session for global markets and it all started with an Iranian missile attack on the US Iraqi airbase in Taji at the start of Asian trade. It was difficult at first to confirm if the reports were true or not and so markets didn’t react all that much, but crude and gold prices started spiking higher as soon as reports started flooding in about missiles hitting the US’s airbases in Erbil and Al Asad. Gold and oil futures then both quickly spiked over 4% higher, with Iran’s Revolutionary Guard claiming responsibility for the attacks. Iran then made threats of mass escalation…”To attack more bases in Iraq. To unleash Hezbollah. To unleash shiite militias in Iraq. To attack Israel and Dubai. Making it clear it is ready for a wide-spead campaign if this escalates further with a US response”, according to Richard Engel from NBC News. USDJPY plunged alongside US yields and the S&P futures, and USDCAD (which looked a little confused throughout all of this) finally started to succumb to the weight of the rallying oil price by falling below 1.2990s chart support.

Then we saw a relatively more positive turn of events unfold...first with Iran’s foreign minister Javid Zarif saying “we do not seek escalation or war”. All eyes then turned to the US casualty count, of which surprisingly there weren’t any. Iran said that “if there is no retaliation from America for these latest attacks then they will stop attacking.”, according to Ali Arouzi from NBC News. President Trump allowed us to finally go to bed by tweeting: “All is well! Missiles launched from Iran at two military bases located in Iraq. Assessment of casualties & damages taking place now. So far, so good! We have the most powerful and well equipped military anywhere in the world, by far! I will be making a statement tomorrow morning.”

The entire “risk-off” move started reversing towards the end of Asian trade and the positive momentum has now carried itself through European trade and into the start of NY trade today. The February gold and oil futures daily charts are showing sizable bearish reversals in the making. US yields, the S&P futures, and USDJPY are now trading higher on the session. USDCAD, in particular, has regained the 1.2990s on the collapse in oil prices and is now testing yesterday’s trend-line resistance in the 1.3020s.

Traders will now be focused on the expected statement from President Trump at 11amET this morning. It almost feels like what Iran did last night was a “face-saving” exercise. They needed to formally show their population that they were avenging the death of Qasem Soleimani. They needed to use big words in the process, saying that the attacks were a “crushing response” and that the US was delivered a “slap in the face”, but they know full well that they cannot afford a full blown war with the US. A US official told Bloomberg this morning it was if “Iran appeared to be shooting to miss”. We think President Trump now has an absolutely perfect opportunity to de-escalate tensions further.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

EURUSD

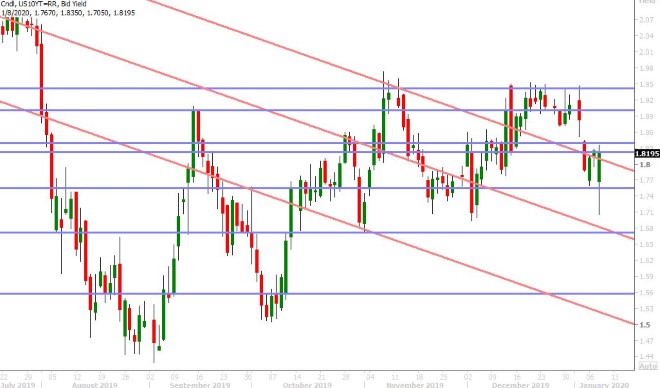

Yesterday’s stronger than expected Non-Manufacturing ISM report out of the US (55.0 vs 54.5) made the 1.1200 level a distant memory for EURUSD prices. The market continued lower after the numbers were released, and while a post-London bounce off the 1.1130s and the Iranian missile strikes helped it recover somewhat, the subsequent 4% fall in gold prices has put EURUSD right back under pressure again. The US has just reported its ADP employment report for the month of December, and the figures beat expectations (+202k vs 160k). November’s numbers were also revised higher to +124k from +67k. US yields are now rallying above 1.82% in response, and we think this is going to make life even more difficult for EURUSD heading into Friday’s Non-Farm Payrolls report. Chart support today checks in at the 1.1110s (where nearly 2.2blnEUR in options are about to expire as well). Over 3blnEUR in options expire tomorrow between 1.1090 (the next major support level) and 1.1125.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling is following the broader USD tone from the overnight session; higher initially on the back of the Iranian missile attack but lower now with the broad USD strength that is coming from the recovery in US yields. We think some comments from new European Commission President, Ursula von der Leyen, aren’t helping the market today either, as she warned of “tough” talks ahead for the UK and the EU over the course of 2020 and that a comprehensive trade deal by the end of the year would be “impossible”. More here from the BBC. GBPUSD is now trading right between support in the 1.3070s and resistance in the 1.3110s, as traders await details from Boris Johnson’s meeting with the new EC chief in London.

GBPUSD DAILY

GBPUSD 30-MINUTE

EURGBP DAILY

AUDUSD

The Aussie looks battered and bruised from yesterday’s plunge lower, so much so that the market barely reacted to the events of the overnight session. Some further selling transpired on the back of last night’s Iranian missile strike, but it was rather mild; and the subsequent bounce (on the back of improved risk sentiment) lacked vigor as well. Australia reported better than expected Building Permit data for the month of November (+11.8% vs +2.0%), but this news seemed to be largely ignored. One could argue that today’s US-yield driven USD strength is part in parcel to blame for the Aussie’s inability to bounce. However, we think ever worsening chart technicals and re-positioning for an RBA rate cut has taken over the narrative for the Australian dollar since the start of the new year. That being said, we think a bounce in EURUSD here could help AUDUSD close above the 0.6870s, which would halt the market’s downward momentum temporarily.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

It was look real scary for USDJPY at the start of Asian trade last night. The prospects of WWIII appeared to be back on when Iran launched retaliatory missile attacks on three US airbases in Iraq. Gold prices surged above $1,600 and the US 10yr yield plunged to 1.70%, leaving USDJPY on a precarious course to collapse below its January 5th lows in the 107.70s. But “all is well” according to President Trump in a tweet late last night, and there are still no confirmed reports of US casualties! This act from Iran, which seems to have been delicately orchestrated to “save face” without tipping things into a conflict that neither side wants, appears to working for the time being. Let’s see how President Trump describes the situation when he speaks at 11amET. If he decides to de-escalate tensions further, we think markets could be in store for a major “risk-on” reversal here that could propel USDJPY back up to the 109s.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com