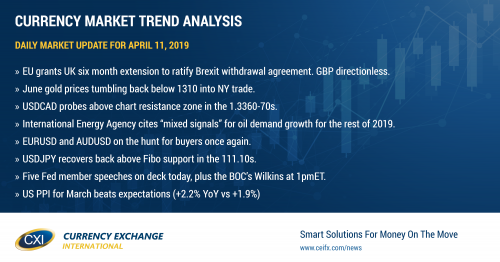

Brexit day extended to Oct 31. Swift move lower in gold prices driving broad USD strength into NY trade

Summary

-

USDCAD: Dollar/CAD indeed extended its early morning gains into chart resistance at the 1.3360-70s yesterday, but this move fizzed out rather quickly after intra-day EURUSD shorts covered their positions post ECB and after crude oil traders focused on a bullish draw of gasoline inventories in the weekly EIA inventory report. The International Energy Agency came out today with its monthly oil market report (usually comes out the day after OPEC’s monthly report), and it too reported a drop in production (-550k bpd) and supply (-340k bpd). While on the surface this sounds like bullish news for oil prices, we’d argue that a lot of this is already priced into the market. Plus, while the agency kept its demand forecast unchanged at 1.4M bpd for 2019, it cited “mixed signals about the health of the global economy” and that “the risks are currently to the downside” with regard to this forecast. May crude oil prices are now backing off yesterday’s highs, and this is allowing USDCAD to drift back up to the 1.3360-70s resistance zone again in our opinion. The US PPI figures for March were just released and they beat expectations on the headline (+2.2% YoY vs +1.9%), but simply met consensus on the core, ex food an energy, measure (+2.4% YoY). Five Fed officials will be making speeches today (Williams, Bowman, Clarida, Bullard, and Kashkari), plus the Bank of Canada’s Wilkins is expected to deliver a speech at the World Bank at 1pmET. We think USDCAD continues to probe the upside today as gold prices take a tumble here. Yesterday’s FOMC Minutes provided little additional information for market participants. The majority of Fed members saw rates to remain on hold through 2019.

-

EURUSD: Euro/dollar is pulling back a tad as NY trading gets underway today as traders continue to struggle with horizontal chart resistance that formed in the 1.1280s yesterday. We think gold prices and USDCNH are the drivers of price action today as the former moves swiftly back below 1310 on the June futures contract this morning, and the latter bounces strongly off chart support in the 6.7170s. Germany’s CPI figures for March were reported in-line with expectations earlier today (+0.4% MoM and +1.3% YoY), but market participants seemed to ignore this. We think EURUSD will continue its search for buyers here. Chart support today comes in at the 1.1250s, then the 1.1230s.

-

GBPUSD: It’s official -- Brexit day has formally been extended to October 31st. The EU has granted the UK an additional 6 months to sort things out at home, with a review to occur at the EU summit on June 20-21. The UK will be able to leave prior to October should the Withdrawal Agreement be ratified, but in the meantime the nation must respect its obligations to the EU. More here from the Financial Times. Sterling traders seem confused this morning on what all this means for the market outlook going forward. While there seems to now be unanimous consent to prevent the UK from crashing out of the EU, there continues to be very little progress when it comes to negotiations between the UK political parties (Tory, Labour and DUP) and we’re growing skeptical now that giving them more time will achieve anything. The UK has been let off the hook yet again with its indecision, and what’s to say we can’t be in this exact same scenario six months from now? GBPUSD is hugging chart support in the 1.3070s at this hour. The EURGBP cross is looking directionless between support at 0.8600 and resistance at 0.8650. There are far less speculative fund shorts in the marketplace now compared to six months ago.

-

AUDUSD: The Australian dollar is seeing some sell pressure this morning as well, as it looks like everybody is watching gold prices fall at this hour. Trend-line chart resistance in the 0.7170s capped prices late yesterday, and we’ve now just seen the market give up yesterday’s pivot in the 0.7150s. May copper prices are trading lower once again today (-0.7%). China released its March CPI figures last night and they came in slightly below expectations (+2.3% YoY vs +2.4%). We think AUDUSD will remain pressured so long as we stay below the 0.7150s. The next major support level lies at the 0.7100 mark in our opinion. Australia will release its bi-annual Financial Stability Review tonight at 8:30pmET.

-

USDJPY: The dollar/yen longs are fighting back this morning, and we think the gold selloff/USDCNH rally (currently underway) is leading it. The S&P futures are trading flat. US 10yr yields look like they might want to get back above 2.50% today. USDJPY has reclaimed Fibo support in the 111.10s this morning, which we think helps to repair the charts a little bit. We think the market could settle into a higher range to close out the week (111.20-111.50).

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

May Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

May Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

June Gold Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com