Canada reports dismal Retail Sales report for October

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

A horrible Canadian Retail Sales report for the month of October is wreaking havoc on the USDCAD fund shorts this morning. The headline number was reported a whopping -1.2% MoM vs +0.5% expected, and the ex-autos number missed consensus by 0.8% (-0.5% vs +0.3%), making October the worst month for Retail Sales since November of last year. Ouch! This news has naturally led to a sharp move higher in USDCAD, but it could also now destroy the market’s ability to form a new downtrend (our thesis from earlier this week).

We think “all bets are off” with a NY close today above the 1.3150-60s. Such a close (if it happens) will stall the market’s downward momentum heading into the holidays in our opinion, and bring about more of range trade that could see prices drift higher initially.

USDCAD DAILY

USDCAD HOURLY

FEB CRUDE OIL DAILY

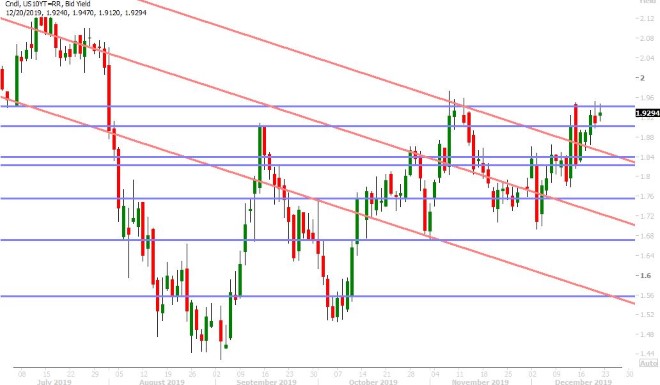

EURUSD

Euro/dollar is feeling the pressure once again this morning as the US 10yr yield continues to hover near the top end of its most recent range. Yesterday’s lackluster NY close (smack in the middle of defined chart support at the 1.1080s and resistance and at the 1.1150s…with negative momentum coming into it) didn’t help matters in our opinion. The market now sits just above the 1.1080s as traders prepare for “quad witching”. While this quarterly expiration of stock options, stock index options, stock index futures and single stock futures is normally just an equity market phenomenon, we think FX traders need to be on guard here from some un-explainable moves today. Today’s London fix (11amET) is also the last before many traders head out for holidays. We wouldn’t be surprised to see EURUSD bounce at some point today, for no particular reason.

EURUSD DAILY

EURUSD HOURLY

FEB GOLD DAILY

GBPUSD

Sterling is seeing a bounce off the 1.2990s this morning as over 2blnGBP in options expire between the 1.3000 and 1.3050 strikes at 10amET. The UK reported slightly better than expected GDP numbers earlier today (+0.4 QoQ vs +0.3%), which is a mildly positive backdrop. Traders are also awaiting confirmation that Boris Johnson’s new Brexit Withdrawal Bill finally passes UK parliament with flying colours today, given the massive Tory majority achieved in last week’s general election. More here from the WSJ.

In other news, Andrew Bailey has been appointed as the next governor of the Bank of England, and will take over for Mark Carney on March 16, 2020. More here from the BBC.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

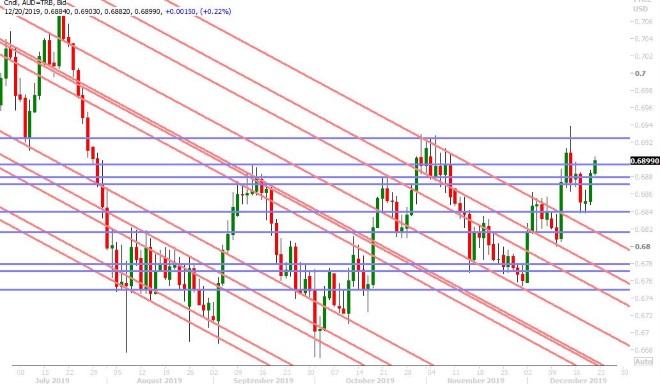

AUDUSD

There’s another odd bid to the Australian dollar this morning and we just realized that this is 2nd time this week we’ve been forced to say this. The broader USD is doing fairly well today, but not against the Aussie. Some are chalking this up to residual optimism from yesterday’s strong Australian jobs report (which we can understand), but to us this feels like broad “risk-on” sentiment from the equity market today. The S&P futures are going nuts at the start of US cash open; trading up 12pts to another new record high. We think a NY close for AUDUSD above the 0.6895 level could lead to some reluctant short covering from the funds heading into the holidays next week.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

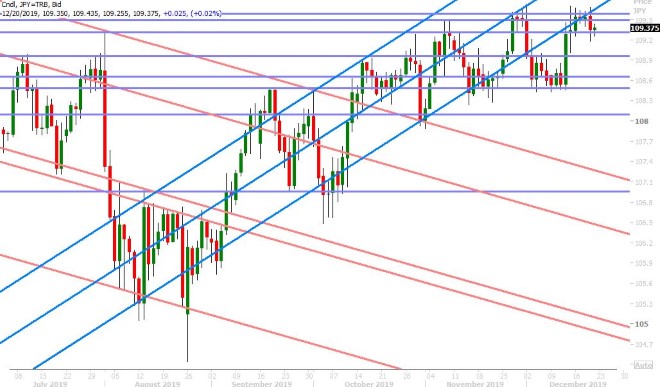

USDJPY

The dollar/yen chart suffered a bearish outside reversal pattern at the close of NY trade yesterday, and while this usually invites more selling, we’re seeing some competing factors today that have stalled the downward momentum for the moment. The broader USD is trading higher, led by EURUSD weakness. The US 10yr yield still has a stubborn “everything is ok on US/China” sort of bid to it. Plus, we have over 3blnUSD in options expiring in USDJPY at the 109.45 to 109.50 strikes this morning (slightly above the market here). We’ll be watching US and German 10yr yields today to see if they “give up” once again on this week’s upside break-out attempt, as this would be negative for USDJPY.

USDJPY DAILY

USDJPY HOURLY

US 10YR BOND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com