Countries taking matters into their own hands after soft WHO emergency declaration

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

- WHO declares public health emergency of international concern regarding coronavirus.

- The un-binding decree however stops short of recommending travel restrictions.

- Italy, Singapore, US and Japan take further steps to curtail travel to and from China.

- Overnight risk-off flows re-emerge, hitting commodity currencies (AUD and CAD) once again.

- Safe-havens in demand, with bonds, yen and gold all trading higher. EURUSD benefitting.

- GBPUSD set for bullish weekly reversal as UK leaves EU. Month-end USD selling flows helping.

- AUDUSD re-tests 2019 lows in 0.6670s, with this level now acting as near-term support.

- USDCAD buyers putting in a fight at 1.3220s this morning despite negative data influences.

- Canada reports slightly better than expected GDP for November, +0.1% MoM vs flat.

- US Chicago PMI for January misses expectations by a long shot, 42.9 vs 48.8

ANALYSIS

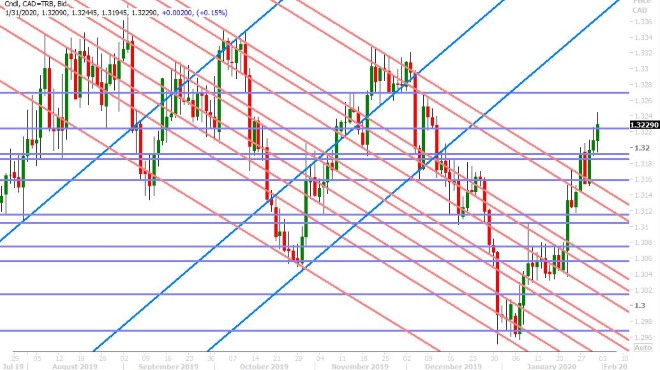

USDCAD

Dollar/CAD buyers defended the market’s new uptrend by holding prices above the 1.3190s into the NY close yesterday. This came despite a “risk-on” wave that swept across markets when the WHO declared a rather soft public health emergency of international concern that lacked a recommendation for travel restrictions. Market chatter suggested that the declaration was politically influenced by China, and before we knew it Italy had already decided to take matters into its own hands by halting all flights to and from China. This, in turn, helped USDCAD recover.

This theme, of countries taking matters into their own hands, picked up steam in the overnight session with Singapore closing its border with China, Japan baring entry for infected persons, and Italy declaring a state of emergency for 6 months! The US declared a Level 4 (Do Not Travel) advisory for China. More than 43 airlines worldwide have cancelled flights to the mainland. Thailand confirmed its first human-to-human transmission of the coronavirus today and raised its total number of cases to 19, the highest for any jurisdiction outside China. The UK confirmed its first two coronavirus cases. The official case count in China is now 9,720, with 213 fatalities.

These negative overnight headlines has very much seen “risk-off” flows take charge again. Global equities, crude oil prices and commodity currencies have slumped lower while bonds, gold, the yen attract traditional safe-haven buying. USDCAD has broken above yesterday’s chart resistance in the 1.3220s and while Canada just reported a slightly better than expected GDP figure for November (+0.1% MoM vs flat), this price level continues to hold. We think the 1.3220s will definitely be today’s pivot for price momentum heading into the weekend.

USDCAD DAILY

USDCAD HOURLY

MAR CRUDE OIL DAILY

EURUSD

There’s been a lot of negative economic news out of Europe today, but EUR traders seem to be once again focusing on rising gold prices instead. German Retail Sales for December missed expectations big time (-3.3% MoM vs -0.5%); Italy reported an unexpected contraction of GDP growth in Q4 2019 (-0.3% QoQ vs +0.1%); and even France unexpectedly retrenched during the final quarter of 2019 (-0.1% QoQ vs +0.2%).

However, “risk-off” driven demand for gold appears to be a more dominant driver for EURUSD price action today. We think yesterday’s positive NY close above the 1.1020s chart pivot helped reinforce a “buy the dip” mentality for today’s trade, and we think this morning’s very weak January Chicago PMI number is adding fuel to the fire now.

EURUSD’s downward momentum, which really picked up steam following the creation of a bearish & shoulders pattern in mid-January, has now formally been halted in our opinion. We wouldn’t be surprised to see EURUSD form a new 1.1060-1.1080 price range heading into next week.

EURUSD HOURLY

APRIL GOLD DAILY

GBPUSD

Brexit day is finally here, with Britain set to leave the European Union at 6pmET tonight. Sterling is rallying quickly to the 1.3130-40s resistance level we talked about yesterday (above which the market could gain sustainable upside momentum). While we feel today’s strength has been more EURUSD-led and month end flow driven, we’re beginning to wonder now if all the pessimism surrounding the 1-year Brexit transition period (which begins next week) has become a bit overblown. GBPUSD’s chart structure has dramatically improved in just 24hrs and we think a NY close above the aforementioned 1.3130-40s resistance level could portend some positive UK narratives to come.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

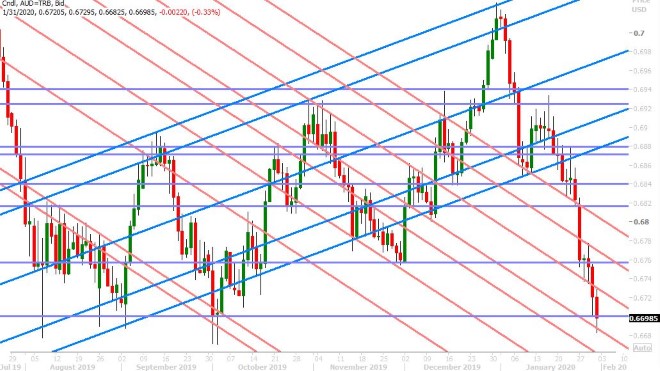

AUDUSD

The Australian dollar bled lower again overnight when today’s risk-off conoravirus headlines reached a fever pitch around the European open, and AUDUSD has very quickly re-tested the late September/early October 2019 lows in the 0.6670s. This level is now acting as near term support for the market as traders think about how they want to be positioned going into another potentially scary weekend of coronavirus headlines. Will we see another fade of risk-off sentiment (like we’ve seen in NY trading every session this week) or will we see traders reduce risk even further? (like they did last Friday).

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

The WHO’s half-hearted emergency declaration yesterday is being long forgotten by traders this morning as various countries take matters into their own hands to try and stem the worsening coronavirus outbreak. An overnight session of more negative news now sees the US 10yr yields back below chart support at the 1.56%, which is in turn pressuring USDJPY back below the 109 handle. Chinese capital markets are set to re-open formally from the Lunar New Year holidays on Monday, but 14 provinces (which account for over two-thirds of Chinese GDP) will remain shut for another week.

Off-shore dollar/yuan (USDCNH) looks set to once again threaten the psychological 7.0000 level. We think traders need to be on guard for a scary open for Chinese stocks on Sunday night and perhaps some interventionist measures from the PBOC should it get really bad.

USDJPY DAILY

USDJPY HOURLY

GERMAN 10YR BUND YIELD DAILY

Charts: Reuters Eikon

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com