Dazed and confused.

Take control of your international payments with CXI FX Now.

• Zero transfer fees & great rates

• Fast international payments

• Safety and security

• Unparalleled customer service

• Consultative approach

Learn more about CXI's international payment services for businesses or call our trading desk directly at 1-833-572-8933.

Get real-time market coverage on twitter at @EBCTradeDesk or sign up here.

SUMMARY

ANALYSIS

USDCAD

Dollar/CAD is trading with amazingly subdued volatility to start the week as global markets digest a litany of US/China trade headlines from over the weekend. First, we got Trump’s announcement that he’ll be raising planned Sep 1st tariffs on $300bln of Chinese goods from 10% to 15% and raising existing tariffs on another $250bln of Chinese goods from 25% to 30% on Oct 1st (this came out late Friday and was in response to China’s tariff retaliation on Friday). Then we got some odd and confusing dialing back of tension early Sunday where Trump responded “yeah sure, why not?” and “might as well” to a reporter’s question about if he had second thoughts about his latest escalation (which the White House later clarified as “Trump regrets not raising tariffs further”). Treasury secretary Mnuchin later said China’s President Xi was still Trump’s friend, and this came after Trump referred to Xi as an “enemy” on Friday during a tweet storm against the Fed. Global markets had enough negative to go on however at the Sunday open and went into full risk-off mode to start trade Asian trade. Stock futures, the Chinese yuan and oil prices gapped lower while bonds, gold, the USD and JPY gapped higher. China’s top trade negotiator, Vice Premier Liu He, then used a public appearance to call for calm by saying “we are willing to solve the problem through consultation and cooperation with a calm attitude”. President Trump affirmed this in early European trade by saying “China wants to make a deal” and that US officials have “received two very productive calls from the Chinese”, and with that the entire “risk-off” move has reversed heading into NY trade today. Forget the fact that the Chinese are now denying these two phone calls even occurred or that Trump won’t answer questions from reporters when pressed about the nature of these calls. Market participants appear to be sifting through this “noise” and seem to be hopeful the US and China come to some sort of truce before both nations slap new tariffs on one another this weekend. USDCAD, in particular, is not showing strong conviction either way this morning to break out of its recent range (let’s call it 1.3270-80s to 1.3330s) and we think the market stays this way for the time being unfortunately as the economic calendar is pretty light this week until Thursday (US Q2 GDP) and Friday (Canadian Q2 and June GDP). The US just reported its Durable Goods figures for the month of July and they came in mixed (+2.1% MoM vs +1.2% expected on the headline, and -0.4% vs 0.0% expected on the core measure). October crude oil prices are now ripping higher back towards the $55 level as global markets calm down. The leveraged funds trimmed short USDCAD positions for the 2nd week in a row during the week ending August 20, but still hold a net short market position for 8 weeks running now.

USDCAD DAILY

USDCAD HOURLY

OCT CRUDE OIL DAILY

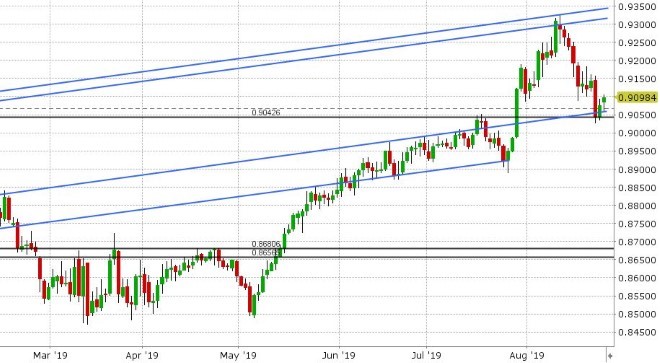

EURUSD

Euro/dollar had an explosive move higher on Friday and we think this was largely because Powell did not overtly disappoint markets when delivering a speech to the annual Jackson Hole symposium. The text of his speech was released in advance and we think traders focused on the following excerpt: “we have seen further evidence of a global slowdown” and the lack of any reference to the “mid-cycle adjustment” language used at the last Fed meeting. One could make the argument that this was a somewhat dovish (at least not hawkish) development for markets and so traders put their “Fed rate cut” trades back on in our opinion (which means sell USD). Trend-line chart resistance in the 1.1160s capped EURUSD however in the flurry of gold buying that followed yesterday’s panicky Sunday open, and we’re now seeing the market retrace with gold as everything goes green on Trump’s “two productive phone calls” comment. Germany reported another dismal IFO survey this morning (this time for the month of August), and this is not helping EUR sentiment either today we would argue. All three readings (Expectations, Business Climate, and Current Assessment) came in below expectations and this further reinforces the idea that a recession is coming in Germany. The leveraged funds continue to cover EURUSD short positions however, if we look at the latest CFTC COT report showing speculative positioning as of August 20, and we think this is largely because of the market’s volatility over the last month and the market’s inability to break below the 1.1000 level. This week’s European calendar features the following:

EURUSD DAILY

EURUSD HOURLY

DEC GOLD DAILY

GBPUSD

Sterling continues to hold up rather well despite recent comments from Boris Johnson that have tried to play down Angela Merkel’s hopes of a quick Brexit deal. The Sunday/Asia open was rather uneventful for GBPUSD (with UK markets closed for a banking holiday) and if anything we’ve seen the market follow EURUSD lower since the European open. The leveraged funds covered short positions for the 2nd week in a row during the week ending August 20. This is not at all surprising given the bullish closing pattern we saw on that day and we’d surmise the fund net short position is reduced even further now following the Angela Merkel breakout higher on Aug 22nd. This morning’s slip back below chart support in the 1.2250s is a bit concerning, technically speaking, as it allows for a full retrace of Thursday and Friday’s price action from last week. There are no major UK economic data scheduled for release this week.

GBPUSD DAILY

GBPUSD HOURLY

EURGBP DAILY

AUDUSD

The Aussie has gone on a roller-coaster ride since the Sunday open last night; plunging lower initially on the “risk-off” move that saw the Chinese yuan plunge to its lowest in 11 years, and then rallying strongly after Chinese Vice Premier Liu He and Trump try to install a sense of calm for global markets. Trend-line support in the 0.6720s has been reclaimed, the S&P futures are now trading +15 after being down 40 at the Sunday open, and even the Chinese yuan is coming back here (albeit more slowly than other commodity currencies). It appears Friday’s trend-line resistance in the 0.6760s (the highs post Jackson Hole) will become the pivot for price action again in NY trade today. Today’s reversal-type price action in AUDUSD has all the hall-marks of another bottoming pattern for the market, but we’d like to see a strong NY close above the 0.6780s to confirm that. The funds left their net short AUDUSD position largely unchanged at a 1-month high during the week ending August 20.

AUDUSD DAILY

AUDUSD HOURLY

USDCNH DAILY

USDJPY

Dollar/yen has seen some tumultuous trade since Friday morning. A triple whammy of China retaliatory tariffs, dovish Powell at Jackson Hole, and an order to American companies from Trump to “start looking for alternatives to China” saw the market completely fall apart on Friday, and the weekend’s escalation to the US/China trade war added insult to injury on the Sunday open. USDJPY plunged to its Jan 3rd flash crash lows below 104.50 but it’s now attempting to roar all the way back to Friday’s opening range as comments from Lui He and Trump seem to calm markets more broadly. The funds were busy liquidating long positions during the week ending August 20, leaving their new net short position at a 3 week high. We’re on bullish reversal-watch for USDJPY too today, should the market close NY back towards the 106.50-70s resistance range from last week.

USDJPY DAILY

USDJPY HOURLY

SEP S&P 500 DAILY

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com