ECB leaves rates and forward guidance unchanged as expected. Press conference now underway.

Summary

-

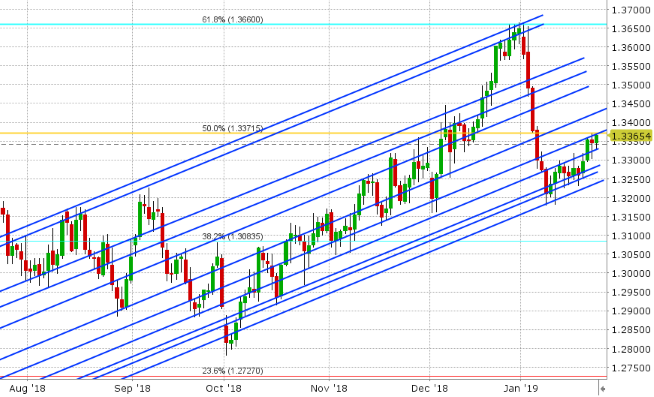

USDCAD: Dollar/CAD is drifting higher this morning as some broad USD buying sweeps over markets. Weakness in AUDUSD led the way in Asian trading overnight, and we’re now seeing EURUSD come off hard ahead of the ECB meeting this morning. The market is trading just shy of chart resistance in the 1.3360-70s, which capped prices yesterday following a rally on weaker than expected Canadian Retail Sales figures. Today’s calendar will be dominated by the ECB’s press conference early on (starts at 8:30amET), and so we’ll be focused on some key EURCAD levels (1.5110 to the downside and 1.5190 to the upside) to see if movement through these price points exerts influence on USDCAD. After the ECB, we’ll get the weekly EIA oil inventory data at 11amET where traders are expecting a mere 4.2k barrel draw. March crude oil prices have been slipping lower ever since buyers failed to keep prices above the $54 mark. We think USDCAD will wrestle with the 1.3360-70 resistance level again today. A break and close could spur further buying into the 1.34s, whereas another failure to surpass it could invite the sellers back in.

-

EURUSD: Euro/dollar is slumping lower this morning after the January Markit PMIs out of Germany, France and the Eurozone largely disappointed to the downside. This news, and the fact that we’ve now completely reversed yesterday’s GBP driven bounce, is not helping market sentiment and the chart structure ahead of the ECB meeting this morning. The European Central Bank has just announced that they will continue to keep interest rates unchanged “through the summer 2019”, which is a copy/paste of their last announcement, and so EURUSD has barely budged. The focus will now turn to Mario Draghi’s press conference, which begins at 8:30amET. Can he say something to turn this market around? Over 1.2blnEUR in options expire at the 1.1400 strike at 10amET.

-

GBPUSD: Sterling is dialing back some of its gains this morning, with GBPUSD price action largely mirroring EURUSD to the downside. Yesterday’s continued rally, on the increasing likelihood that a “no-deal” Brexit will be avoided, ran out of steam at trend-line resistance in the 1.3070s. Support today comes in just above the 1.3000 level. UK headlines today suggest Theresa May is continuing to fight the Cooper amendment, and other attempts by parliament to delay Brexit. We think the market follows the broader tone to the EUR today.

-

AUDUSD: The Aussie is taking a significant step back this morning, as the daily chart starts forming a bearish outside day pattern. The better than expected employment figures out of Australia last night were the driver for gains into chart resistance at 0.7160-70, but then a surprise hike in mortgage rates from National Australia Bank (NAB) sent the market into a bit of a tailspin, which then broke chart support at the 0.7110s in the process. NAB cited increased funding pressure for the need to hike rates to customers, and when we combine this news with the already softening housing market down under, it doesn’t bode well for any chance of hawkish guidance from the RBA this year. The Reserve Bank of Australia (RBA) meets next to decide interest rates on February 5th. We think AUDUSD needs to regain the 0.7110s quickly, or else we could be looking at a test of the 0.7000 level (post AUDJPY flash-crash levels).

-

USDJPY: Dollar/yen is inching higher this morning after US equity traders regained their composure going into the NY close yesterday. The S&Ps recovered to trade back above a key trend-line level in the 2630s. USDJPY regained the 109.60 level that we’ve been talking about for a few days. While we think some option expiries at the 109.40-50 level could make things choppy early on, we think USDJPY still has legs here if US stocks can remain bid.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

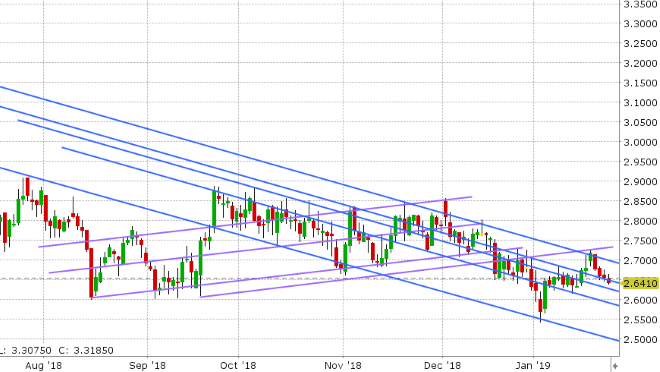

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com