USD stabilizes ahead of very busy week ahead

Summary

-

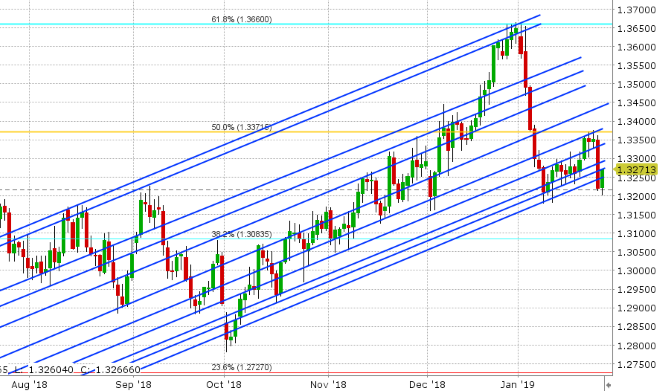

USDCAD: Dollar/CAD is finding a bid this morning as crude oil prices go offered to start the week and the Chinese yuan pulls back from 6 month highs made overnight, but the market is still trading a far cry from Friday’s opening levels. The 1.3270s and 1.3290s (formally support levels on the chart) should now serve as resistance, as traders prepare for a busy week ahead. The highlights will be the FOMC rate decision and US/China trade talks on Wednesday, Canadian GDP on Thursday, and the US non-farm payrolls figures on Friday. The Q4 corporate earnings season also kicks into high gear this week, plus we may get a flood of all the US economic data that was put on hold because the US government shutdown (release schedule hasn’t been announced yet since the government reopened for 3 weeks on Friday), and so it could be a very interesting week to say the least. We think USDCAD continues its bounce higher to test resistance today. There’s market chatter making the rounds this morning that the Fed will be forced to put the brakes on its balance sheet normalization process this week (this also seems to be the narrative that’s being used to explain Friday’s swift USD sell off).

-

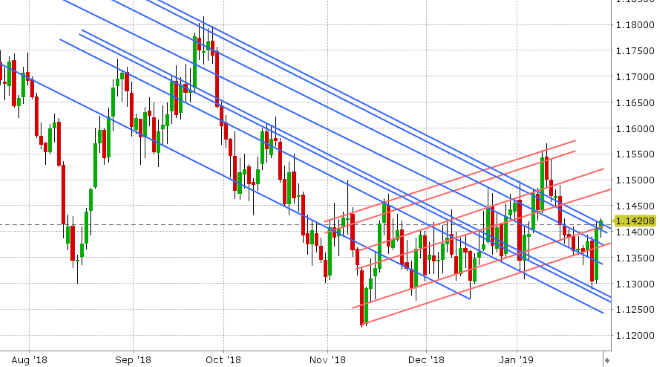

EURUSD: It’s been a choppy start to the week for Euro/dollar, after Friday’s explosive rally couldn’t breach the 1.1410-20 level on the charts. A bounce in USDCNH during European trade this morning and some option expiries around the 1.1400-1.1415 level (1.4blnEUR+) don’t appear to be helping at this hour, but we think the market’s ability snap back above the 1.1400 mark (after dipping below it earlier) does bode well for upward momentum here. ECB President Mario Draghi will be making a couple remarks at EU Parliament hearings this morning (at 9amET and 11amET). The rest of the week will feature German CPI and an Italian 10yr bond auction on Wednesday; Italian GDP, Eurozone GDP and German Retail Sales/Employment data on Thursday, followed by the pan-European Markit Manufacturing PMIs on Friday. We think EURUSD could catapult higher towards the 1.1500 level this week should chart resistance give way.

-

GBPUSD: Sterling is pulling back this morning, and while this may seem a bit counterintuitive given the weekend’s news about Theresa May privately ruling out a “no-deal” Brexit, we think this simply validates the recent market rally and so we think we’re seeing a bit of “buy the rumor/sell the fact” here. Odds are this is also a bit of trader position-squaring ahead of tomorrow’s Parliamentary vote on Brexit Plan B and the Cooper amendment. More here. The market now sits below horizontal resistance in the 1.3170s, but above support in the 1.3150s. We think the market coasts here going into tomorrow unless EURUSD bursts out to the upside. The Bank of England’s Mark Carney will be speaking at 9:30amET.

-

AUDUSD: The Aussie is pulling back this morning with global equities and the Chinese yuan, after Friday's explosive rally. Chart resistance at the 0.7200 level capped prices in overnight trade, and support in the 0.7150-75s is being put to the test now. This week’s Australian economic calendar features the NAB survey tonight (7:30pmET) and Q4 2018 CPI tomorrow. The Reserve Bank of Australia meets next to decide interest rates on February 5th.

-

USDJPY: Dollar/yen is off to a slow start this week after the 109.50-80 support zone gave way in Friday’s trade. The S&Ps are trading down 16pts so far today, and while we think this is not helping the tone here, we’d note the futures have not broken below the 2640s yet. Therefore, we think any bounce here will help USDJPY regain the 109.50s. Japan reports its December Retail Trade figures tonight at 6:50pmET. Wednesday night brings the December Industrials Production numbers. Finally on Thursday, we’ll get the December employment report out of Japan.

Tune in @EBCTradeDesk for more real-time market coverage.

Market Analysis Charts

USD/CAD Daily Chart

USD/CAD Hourly Chart

March Crude Oil Daily Chart

EUR/USD Daily Chart

EUR/USD Hourly Chart

USD/CNH Daily Chart

GBP/USD Daily Chart

GBP/USD Hourly Chart

EUR/GBP Daily Chart

AUD/USD Daily Chart

AUD/USD Hourly Chart

March Copper Daily Chart

USD/JPY Daily Chart

USD/JPY Hourly Chart

March S&P 500 Daily

Charts: TWS Workspace

About the Author

Currency Exchange International (CXI) is a leading provider of foreign currency exchange services in North America for financial institutions, corporations, and travelers. Products and services for international travelers include access to buy and sell more than 80 foreign currencies, gold bullion coins and bars. For financial institutions, our services include the exchange of foreign currencies, international wire transfers, purchase and sale of foreign bank drafts, international traveler’s cheques, and foreign cheque clearing through the use of CXI’s innovative CEIFX web-based FX software www.ceifx.com